Applicability of withholding tax on payment of interest or any other sum to non-resident – section 195(1)

Section 195

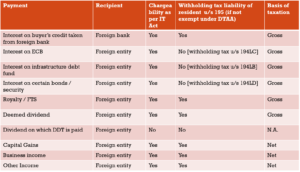

Any person (whether resident or non-resident), responsible for paying interest (other than interest referred to in Section 194LB/194LC/194LD) or any other sum (other than salaries) chargeable to tax, to a non-corporate non-resident or to a foreign company is liable to deduct tax at source at the rates prescribed by the relevant Finance Act.

The following person should be noted in regard to the 195 TDS provisions : –

- Payment may be made by a resident or non-resident, it would be covered u/s 195 ,

- Such sum should be chargeable to tax

- Sum could be payable to either of the following : –

- Non-corporate non-resident or

- Foreign company

- Tax is to be deducted at the rates prescribed by the relevant Finance Act .

- Payment could be of the following nature : –

- Interest , excluding the following interest : –

- Interest on Infrastructure Debt Fund – Withholding tax u/s 194LB @ 5% plus surcharge ;

- Interest on External Commercial Borrowing – Withholding tax u/s 194LC @ 5% plus surcharge ;

- Interest on certain bonds / Government security to FII or QFI – Withholding tax u/s 194LD @ 5% plus surcharge plus cess .

- Interest , excluding the following interest : –

Section 195 TDS provision are not applicable on the above interest payments to non-residents, even when such interest is chargeable to tax in India : –

-

- Any other Sum Chargeable to tax (Other than salary)

Notes :-

- Interest, royalty, Fee for Technical Services and Dividend are taxable on gross basis – Unless Permanent Establishment or a Fixed Base exists

- Payment of salary to non-resident is not covered under Section 195 TDS provision . Such deduction is covered u/s 192 .

- Section 195 excludes dividend on which Dividend Distribution Tax is paid by Indian Company, and which is exempt in the hands of non-resident shareholder . In such a case, the provision of Section 115O would be applicable.

- Certain interest payments to non-residents are also not covered under section 195 , which are discussed above.

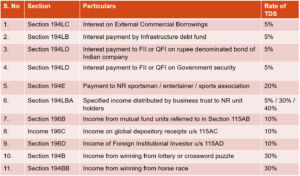

Other payments to non-resident not covered under section 195

In addition to the above, Section 195 TDS provisions do not apply to the following payments made to the norm residents. This is due to the fact, that there are specific provisions dealing with deductions from such payment to non-residents.

Payment covered under Section 195 can be taxable in the hands of the non resident either on a gross basis or on a net basis: – . Let us discuss both of them hereunder : –

- Payments taxable on gross basis (unless PE / Fixed base exist )

- Payment in the nature of Interest, Royalty, Fees for Technical Services and Dividend are taxable on gross basis .i.e., no deduction is allowed for any expenditure and withholding tax rate (10/15%) would be applied on the amount of remittance to be made to non-resident.

- If terms of treaty provide otherwise, they would override the above.

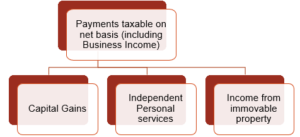

2.Payments taxable on net basis

- Certain types of incomes are taxable on net basis, i.e., withholding tax would be calculated on net income after allowing deduction for expenses as per the IT Act or relevant Treaty. Such income includes business profits, income from immovable property, capital gains, Income from independent professional services.

- If terms of treaty provide otherwise , they would override the above .

Liability to withhold tax u/s 195 ?

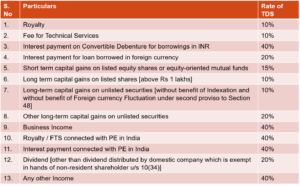

Withholding tax rates under Income tax act for payments to non-resident

Withholding tax rates under Finance act, 2018 for payments to non-resident

Due date for payment of tds deducted from payment to non-resident

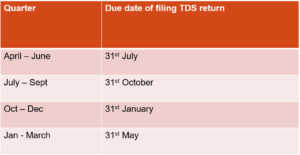

Due date filing of TDS return in form 27Q

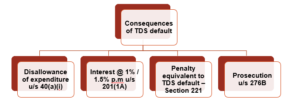

Consequences of TDS default on payment to non-resident