Section 195 certificate can be applied for by the Payor or the Payee.

- Section 195 certificate applied by Payor – Section 195(2)

- Payor may make an application to the Assessing Officer, for grant of certificate determining the appropriate portion of such sum, which will be chargeable to tax so that he may apply withholding tax on such portion only

- Such application would be made only when payer considers that whole of such payment to non-resident would not be income chargeable to income-tax

- AO cannot be approached to grant a certificate that no tax is payable on any gross sum payable by the Payor

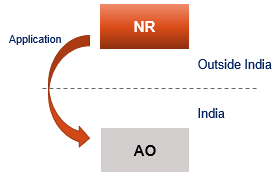

2. Section 195 certificate of Nil withholding tax applied by NR Payee – Section 195(3)

Non-resident payee (non-corporate non-resident or foreign company)

may make an application to the Assessing Officer

for grant of certificate , authorizing him to receive

interest or other sum [on which TDS has to be deducted u/s 195(1)]

without deduction of tax thereunder.

NOTE : –

Where any such certificate is granted, every person responsible for paying such interest or other sum to the person to whom certificate is granted, shall make payment of such interest or other sum without deduction of tax at source under section 195(1), so long as the certificate in force.

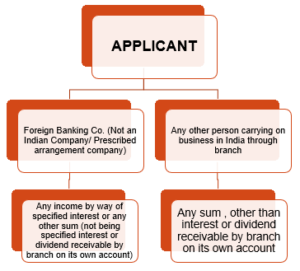

Certificate of Nil withholding tax u/s SECTION 195(3) applied by NR Payee

CONDITIONS TO BE SATISFIED FOR APPLICATION U/S 195(3)

- Applicantis regularly assessed to tax in Indiaand has filed all the returns due before the date of application;

- He is not in default/ Deemed to be in default for any tax, interest or penalty payable under the Income Tax Act

- Additionally, for application made by non banking company, the person should have carried on business in India for a period of 5 yearsimmediately preceding the date of application

- The value of fixed assets in the books of accounts, for the last financial year, should exceed Rs. 50 lakh

- Application in : –

- Form 15C by foreign banking company

- Form 15D by any other person

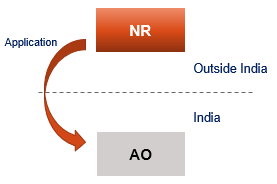

Certificate for deduction of tax at a lower rate – Section 197 applied by NR Payee

- Application for lower deduction or Nil deduction of TDS can be made by non-resident payee in Form No 13 .

- Such application can also be made before commencement of Financial Year

- No certificate for lower deduction or nil deduction shall be issued, if the non-resident payee does not provide PAN .

- Where such certificate is granted by the AO , payor is required to deduct tax as per the rate given in such certificate .

NOTE : –

- Lower withholding tax or Nil withholding tax shall be deducted upto the limit of income specified in such form .

- Where payment to NR exceeds the amount mentioned in certificate , withholding tax shall be deducted as per normal rate on any excess payment.

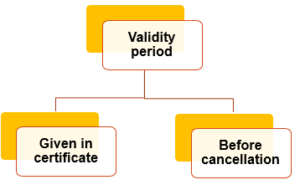

Validity period of certificate for non deduction of wht – section 195(4)

Certificate of non-deduction of WHT issued u/s 195(3) shall remain in force till the –

- Expiry of the period specified therein ; or

- Cancellation of WHT certificate by AO.

Note :-

- Certificate for non-deduction of TDS is given on yearly basis . Thus, there is no auto-renewal of such certificate and payee needs to apply for it again in next year .