Purpose of Form 15CB

Form 15CB is the Form, in which a Chartered Accountant, is required to certify the tax that should be deducted from specified payments to the non-resident , which is the subject matter of such certificate (Section 195(6)). Such Form 15CB has to be obtained , before paying any sum to non-resident , whether or not the payment is chargeable to tax , and has to be filed online.

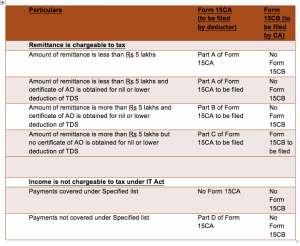

Relevant Factors to be considered in making decision on , which Part of Form 15CB needs to be filed are as under : –

- Whether remittance is chargeable to tax or is not chargeable to tax under Income Tax Act , 1961 ?

- Whether remittance is less than or more than Rs 5 lakhs ?

- Whether certificate of AO is obtained for nil or lower deduction of TDS ?

- Whether payments covered under Specified list ?

Once these items are identified, the Payor would be required to furnish Form 15CA/Form 15CB as per the following table : –

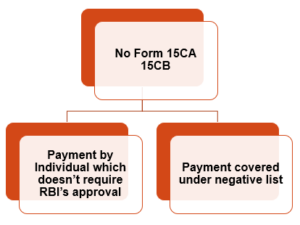

Payments to non-resident for which no form 15CA / Form 15CB to be filed

However, Form 15cb is not required to be obtained in the case of the following specified transactions : –

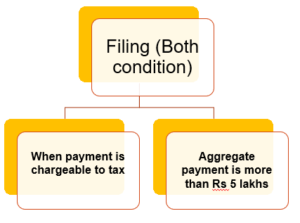

When to file form 15CB ?

1)When payment is chargeable to tax

- Form 15CB should be filed when payment to non-resident is chargeable to tax under the Income Tax Act.

EXAMPLE:- No Form 15CB shall be filed for income exempt u/s 10

- Form 15CB should also be filed when payment to non-resident is chargeable to tax under the Income-Tax Act but it is exempt from tax under DTAA

EXAMPLE:- Form 15CB shall be filed for capital gains which are taxable under the Income Tax Act but exempt from tax under India Singapore DTAA.

2)When aggregate payment is more than Rs 5 lakhs

- Form 15CB shall be filed when single payment does not exceed Rs 5 lakhs but aggregate payment during the FY would exceed Rs 5 lakhs

EXAMPLE :-

ECB interest of Rs 4 lakhs to be paid per quarter during FY 2017-18 . In this case Form 15CB shall be filed as amount of Rs 16 lakhs would be paid in the entire FY 2017-18

- No Form 15CB shall be filed when payment to non-resident does not exceed Rs 5 lakhs and no further payment would be paid to such non-resident during such FY.

Step by Step Procedure to fill form 15CB ?

BASIC DETAILS – FORM 15CB

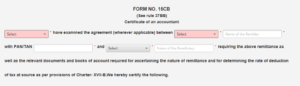

The Chartered Accountant needs to enter the name of payor and non-resident payee along with PAN / TAN of payor in Form 15CB .

NAME AND ADDRESS OF BENEFICIARY-Form 15CB

The Chartered Accountant need to enter the name and address of non-resident beneficiary .

REMITTANCE DETAILS – FORM 15CB

1.Country to which remittance is made :- In this column, Foreign Country to which remittance is made should be entered.

Currency :- In this column type of foreign currency should be reported in which payment is to be made (like US dollar, Pounds, etc.)

2. Amount payable :- In this column amount payable to non-resident as per invoice should be reported . The amount payable in foreign currency would be readily available from the invoice or agreement .

3. Bank details :- Details of banks should be reported from which payment is to be made to the non-resident

5. Proposed date of remittance :- Proposed date of remittance would be available from the bank advice sent by deductor to its bank for payment to non-resident .

5. Proposed date of remittance :- Proposed date of remittance would be available from the bank advice sent by deductor to its bank for payment to non-resident .

6. Nature of remittance as per agreement :- In this column nature of remittance should be selected , i.e., whether remittance is made for royalty , short-term capital gains , professional services, etc. Nature of remittance as per service agreement or contract should be reported .

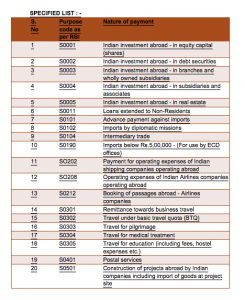

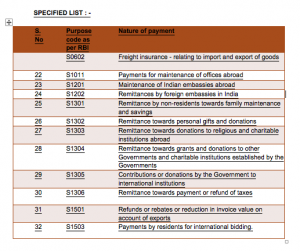

7. Relevant purpose code as per RBI :- After selecting the nature of service, list of RBI code relating to such service would appear in order to pin point and report relevant service .

Grossing-up :- Where withholding tax is borne by the deductor then ‘Yes’ option should be selected in this column .

8. Tax liability without considering DTAA :- In this column, the tax liability will be computed without considering the impact of relevant DTAA .

- Remittance chargeable to tax India :- Where remittance is chargeable to Income Tax then the option of “Yes” should be selected from the drop down list . Where remittance is not chargeable to tax then there is no need to file Form 15CB and in such case Part D of Form 15CA should only be filed .

- Relevant section under which remittance is covered :- In this column we need to mention the relevant section under which such remittance is taxable or under which tax rate is prescribed. In case of Royalty / Fees for Technical Services Section 9(1)(vi)/ (vii) read with Section 115A should be mentioned

- Amount of income chargeable to tax :- In this column amount payable in INR which is reported in S. No 2 in INR should be mentioned in case of income taxable on gross basis (like, Interest , Royalty, Fee for Technical Services) . Otherwise net income should be computed after deducting expenditure and that net income should be mentioned in this column .

- Tax liability :- In order to compute tax liability, amount of income chargeable to tax should be multiplied with the rate of tax under Income Tax Act

9. If income is chargeable to tax in India and any relief is claimed under DTAA :- In this column the tax liability will be computed on the basis of relevant DTAA .

- Whether TRC is obtained from the recipient of remittance :- Where TRC is obtained from the non-resident payee then option of Yes should be selected . Where TRC is not obtained from the recipient then the withholding tax liability would be determined as per the Income Tax Act .

- Please specify relevant DTAA :- In this column we need to mention the relevant Article of DTAA . Generally in many DTAAs Article 10, Article 11 and Article 12 are mentioned for Dividend , Interest and Royalty and Fees for Technical Services, respectively . We also need to mention the relevant paragraph of Article in this column .

- Taxable income as per DTAA :- In case income of non-resident payee is taxable as per DTAA , then such amount of income should be specified in this column. In case of income taxable on gross basis, the grossed up amount should be mentioned here. However, if such income is not taxable under DTAA then nil amount should be mentioned here .

- Tax liability as per DTAA :- Amount of taxable income should be multiplied with the applicable rate under DTAA in order to determine the tax liability .

A. If the remittance is for royalties , fee for technical services , interest , dividend , etc. :- In this column ‘Yes’ option should be selected where the payment to non-resident relates to royalties , Fee for technical services, interest or dividend .

- Article of DTAA :- In this column relevant article of DTAA should be mentioned, (i.e., Article 10 , Article 11 or Article 12 which is used for such income in most of the DTAAs)

- Rate of TDS required to be deducted in terms of such article of the applicable :- In this column rate of TDS given in DTAA should be mentioned .

B. In case remittance is on account of business income , please indicate :- In this column ‘Yes’ option should be selected where the payment to non-resident relates to business income .

- Whether such income is liable to tax in India :- In this column relevant option ‘Yes’ should be selected if such income is taxable in India . Generally business income is taxable in India when non-resident payee has Permanent Establishment in India and such business income is connected with such Permanent Establishment .

- If not please furnish brief reasons thereof, specifying relevant article of DTAA :- Generally business income of non-resident is not taxable in India when NR does not have any Permanent Establishment in India or such business income is not connected with such Permanent Establishment in India . Thus, in the column, relevant paragraph of Article 7 of DTAA should be mentioned wherein requirement of Permanent Establishment is specified to tax business profits of non-resident in India .

C. In case remittance is on account of capital gains , please indicate :- In this column ‘Yes’ option should be selected where the payment to non-resident relates to capital gains .

- Amount of long-term capital gains :- In this column amount of long-term capital gains should be mentioned .

- Amount of short-term capital gains :-In this column amount of short-term capital gains should be mentioned .

- Basis of arriving taxable income :- In this column, relevant Article of DTAA should be mentioned as per which taxability of capital gains is determined .

D. In case of other remittance not covered by sub-items A, B and C of Form 15CB :- In this column ‘Yes’ option should be selected where the payment to non-resident relates to other income. Other income would be selected where such income is not covered as dividend, interest, royalty, Fee for Technical services, capital gains .

- Please specify nature of remittance :- In this column nature of remittance of other income should be specified

- Whether taxable in India as per DTAA :- In this column ‘Yes’ option should be selected where other income is taxable in India

- If yes, rate of TDS required to be deducted in terms of such article of applicable DTAA :- Generally no rate of tax is specified for other income in DTAA . Thus, in such case tax rate of 40% given in the IT Act should be specified here .

- If not, please furnish brief reasons thereof, specifying relevant article of DTAA :- In numerous DTAAs , other income is taxable in the country of residence only . Thus, in such a case relevant para of Article of DTAA should be specified here .

10. Amount of TDS :-

- In foreign currency

- In Indian Rs

11. Rate of TDS :- There is an option in the drop down list to select rate of TDS as per the Income Tax Act or rate of TDS as per DTAA. Where the rate of TDS under the DTAA is beneficial , then the option of ‘As per DTAA’ should be selected .

12. Actual amount of remittance after TDS (in foreign currency) :- Where the withholding tax is borne by the payor, and the income of non-resident is taxable on gross basis (i.e, in case of dividend, interest, royalty, Fee for Technical Services), the grossed up amount should be reported. Where the withholding tax is not borne by the payor, the net amount should be mentioned after deducting TDS.

13. Date of deduction of tax at source, if any :- Where TDS is already deducted on credit basis, the date of such deduction of TDS should be mentioned.

2 thoughts on “FORM 15CB”

A NRI has sold property in India and received sale proceeds in NRO A/c.

Now want to transfer these funds to abroad.

1. What will be the RBI purpose code to be used in 15 CB ?

2. Buyer has deducted. Whether TDS amount to be mentioned in 15 CB as there is no reference of buyer as funds are being transferred from own NRO a/c to foreign

3. Whether it is to be mentioned as taxable or not. There is net Long term capital loss.

Himanshu

I have the same problem struggling to find some answer for the same

If aware pl let me know

Thq