GST reverse charge

GST reverse charge, means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act;

Categories of goods subject to Reverse Charge

Goods like cashew nuts [not shelled/peeled], bidi wrapper leaves, tobacco leaves, supply of lottery, silk yarn, used vehicles, seized and confiscated goods, old and used goods, waste and scrap, raw cotton, etc. are taxable under reverse charge, i.e. recipient is liable to pay tax.

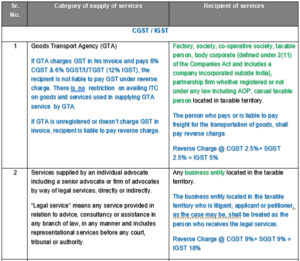

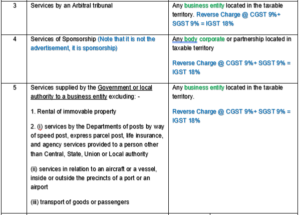

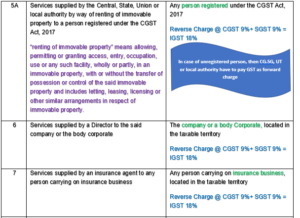

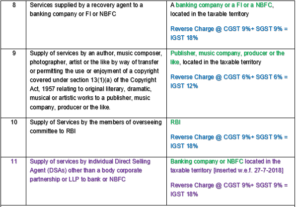

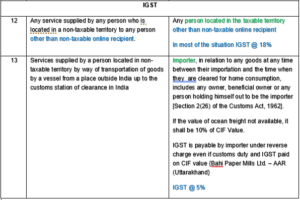

Categories of Services subject to Reverse Charge

Contributed by CA Amit Jain