| Category | CBSE Economics Class 12 Notes |

| Subject | Economics |

| Topic | Circular Flow of Income |

Circular Flow of Income

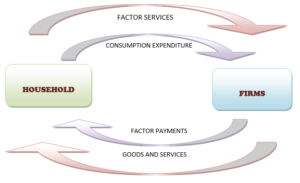

The Circular Flow of Income refers to the flow of income with the exchange of goods and services in the economy among various sectors. In the basic (two-factor) circular flow model, money flows from households to firms as consumption expenditures in exchange for goods and services produced by firms and then returns from firms to households for the work people do.

Circular Flow of Income represents the flow of money among the different sectors of an economy.

The two-sector model depicts the flow of money between households and firms.

- It refers to the cycle of generation of income in the production process, its distribution among the factors of production, and finally, its circulation from households to firms in the form of consumption of goods and services produced by them.

- Households refer to the consumer sector in the economy that provides factors of production to firms and also does consumption expenditure on the goods and services produced by the firms. where,

- Firms refer to the production sector that produces the goods and services with the help of factors of production and makes factor payments to the households for their factor service

- Factors of production refer to the inputs which are required for the production of goods and services. For example Land, Labor, Capital, and Entrepreneur.

- Factors payments are the income that the supplier of factors of production gets in return for their service.. For example Rent, Wages, Interest, and Profits.

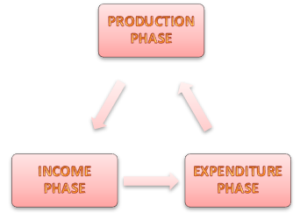

Phases Of Circular Flow Of Income

- Production Phase

- Income Phase

- Expenditure Phase

Phases Of Circular Flow Of Income

- Generation Phase: In this phase, firms produce goods and services with help of factors of production. For example production of yarn from cotton in the textile industry with the help of labor and machines.

- Distribution Phase: In this phase, factor income is transferred from firms to households. For example payment of wages to the labors for their factor service.

- Disposition phase: In this phase, income received by the households is spent on goods and services produced by firms. For example expenditure by the households to meet the daily requirements.

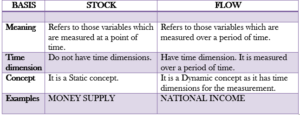

Stock and Flow

Stock

Stock variables are those variables that are measured at a particular point in time. For example national wealth, capital, money supply, bank balance, raw material in godown, etc…

Flow

Flow variables are those variables that are measured over a period of time. For example losses, profits, investment, capital formation, savings, income, etc…

Difference Between Stock And Flow

Types of Flow

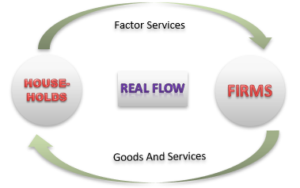

Real Flow and Physical Flow

Real Flow refers to the flow of factor services from households to firms and the flow of goods and services from firms to households.

In Real flow goods and services are exchanged without the involvement of any money. This flow determines the magnitude of the growth process in the economy

It is also known as ‘physical flow’.

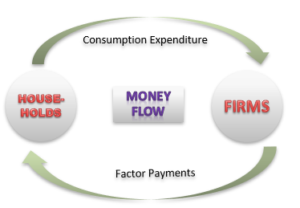

Money FLow

Money Flow refers to the flow of factor payments to households by firms and the flow of consumption expenditure from the household to the firm.

It is also known as NOMINAL FLOW. It involves the exchange of money.

Flow Of Income In Two Sectoral Economy

TWO SECTORAL Economy or SIMPLE Economy assumes only two sectors: Household and Firms.

A closed economy consists of households, firms, government, and the financial sector and not the rest of the world.

An open economy consists of households, firms, the government, and the rest of the world.

Following are some assumptions are taken for a better understanding of this system: –

- There are only two sectors in an economy i.e. households and firms.

- The household sector provides factor services and makes consumption expenditure on goods and services.

- Firms produce goods and services and make factor payments to the household sector.

- There are no savings in the economy which means all income earned by the households is spent on consumption expenditure and the firms are also not saving their profits.

- The outer loop shows the real flow of income and the inner loop shows the money flow of income.

- So there is a circular and continuous flow of money income as the entire factor payment is received back with firms through consumption expenditure.

- This circular flow of income continues as production is a continuous process due to never-ending human wants. It makes the flow of income circular.

CBSE Class 12 Economics Notes Term II Syllabus

Part A: Introductory Macroeconomics

- Circular Flow of Income Class 12 Notes

- Basic Concepts of Macroeconomics Class 12 Notes

- National Income and Related Aggregates Class 12 Notes – 10 Mark

- National Income and Related Aggregates Class 12 Numericals

- Determination of Income and Employment Class 12 Notes

Part B: Indian Economic Development

Current challenges facing Indian Economy – 12 Marks

Development Experience of India – A Comparison with Neighbours – 6 Marks