Basic Concept of Macroeconomics: Domestic Territory in Economics and Normal Resident in Economics

In Basic Concepts of Macroeconomics Class 12, we will learn about the important terms which are necessary for the computation of an Economy’s NATIONAL INCOME. Some of such terms are normal resident, domestic territory, factor income, transfer income, investments, taxes, other incomes from abroad, etc.

| Category | CBSE Economics Class 12 Notes |

| Subject | Economics |

| Topic | Basic Concepts of Macroeconomics Class 12 |

Basic Concept of Macroeconomics: Domestic Territory in Economics and Normal Resident in Economics

Domestic Territory in Economics

For a layman, the domestic territory is the area within the political boundaries of a country but for the basic concept of macroeconomics and national income accounting, it is used in a wider sense.

In addition to the political boundaries, the domestic territory also includes:-

- The specified areas of international waters and air i.e. the seas and oceans and sky.

- Ships and aircraft of a domestic or foreign country in domestic territory.

- Embassies, military establishments in the country are located abroad.

- Fishing vessels, floating platforms operated by residents of a country in international waters.

However, the domestic territory does not include the following:-

- Embassies, military establishments of a foreign country in the domestic country.

- International organizations such as UNO, WHO, etc. are located within the geographical boundaries of domestic countries.

Some examples of the domestic territory of India are:-

- Microsoft office in India.

- The Indian embassy in the USA.

- AIR India between Russia and India.

- Boats of Indian fishermen in the Indian Ocean.

Normal Resident in Economics

For a layman, a normal resident is a person who resides/stays/lives in the domestic territory for a long period of time.

But in the basic concepts of macroeconomics class 12, the NORMAL RESIDENT in Economics of a country refers to an individual or institution who resides in the country. Its economic interest (earning, spending and accumulation) also lies in that country.

Following are not included in the category of NORMAL RESIDENT:-

- Foreign tourists and visitors.

- Foreign staff of embassies, officials, members of armed forces located in a given country.

- International organizations such as UNO, WHO, etc….

- Employees of international organizations.

- Crew members of foreign vessels, commercial travelers, and seasonal workers.

- Border workers who live near the international boundaries.

Some examples of NORMAL RESIDENT are:-

- Indian officials working in the Indian embassy in Australia.

- Indians going abroad for a holiday.

- Indian employees working in WHO situated in India.

- Indians working in UNO office in the USA.

CITIZENSHIP AND RESIDENTSHIP ARE TWO DIFFERENT THINGS:

Citizenship is a legal concept. It is based on the place of birth or some legal provisions allowing him to be a citizen.

The resident ship is an economic concept. It is based on economic activities performed by a person.

“A PERSON CAN BE A RESIDENT OF ONE COUNTRY AND AT THE SAME TIME HE CAN BE A CITIZEN OF ANOTHER COUNTRY.”

Income Concept of Macroeconomics: Factor Income and Transfer Income

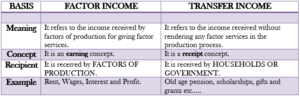

Factor Income

Factor Income refers to income received by factors of production (land, labor, capital, and entrepreneur) for the factor services provided by them in the production process.

Factor income of Normal residents is included in the NATIONAL INCOME.

For example Rent, Interest, Wages, and Profit.

Transfer Income

Transfer Income refers to income received without rendering any productive services in return.

It is a one-sided concept. It can be received either from domestic territory or abroad.

It is NOT included in NATIONAL INCOME.

For example: – Old Age Pension, gifts, and grants, pocket money, scholarships, etc….

Difference between Factor Income and Transfer Income

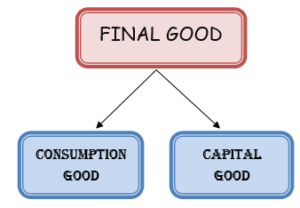

Type Of Goods in Macroeconomics: Final Goods and Intermediate Goods

Final Goods

Final goods are those goods that are either used for consumption or investment purpose.

It includes goods which are purchased by:

- HOUSEHOLDS for consumption purposes. For example Purchase of milk.

- FIRMS for capital formation. For example Purchase of machinery.

FINAL GOODS ARE NEITHER RESOLD NOR USED FOR FURTHER TRANSFORMATION.

Intermediate Goods

Intermediate goods refer to those goods which are inside the production boundary. They are used either for resale or for further production in the same year.

Intermediate goods include goods for:

- For example, Notebooks are purchased by stationery shop owners.

- Further production. For example, Sugar was purchased by a sweet shop owner.

Intermediate goods have “Derived Demand” as their demand depends upon the further demand for final goods.

Durable Goods purchased by the government for military purposes are also included in intermediate goods as they are used to produce defense services. For example submarines, aircraft, etc….

PROBLEM OF DOUBLE COUNTING(Concept of Macroeconomics)

In macroeconomics, the value of Intermediate goods is included in the final good. It is not counted differently otherwise, it will create the problem of double counting. The problem of double counting means the value of a good or service is counted two times- one time as intermediate good and other time the whole as a final good.

For example, the value of sugar used by the sweet shops was Rs. 1200. He then made sweets and valued them at Rs. 1500. The final goodwill price at Rs. 1500 only as it is the final value of the good. The sweet maker only added a value of Rs. 300 to the sweets. Only the value of sweets will be added in NATIONAL INCOME as the value of sugar is already included in sweets.

FINAL GOOD AND INTERMEDIATE GOOD CAN ONLY BE DIFFERENTIATED ON THE BASIS OF THE END-USE OF THE GOOD.

The goods which are used up in the same year are also classified as intermediate goods.

Difference between Final Goods and Intermediate Goods

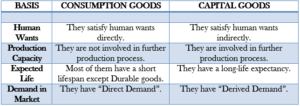

Consumption Goods and Capital Goods(Types of Final Goods)

Consumption Goods

Consumption Goods refers to those goods which are used by the consumer for consumption purpose. They satisfy the needs of the consumers directly. For example: – notebooks, pens, pencils, etc….

Consumption goods can further be sub-classified as:

- DURABLE GOODS: These refer to those goods which can be used again and again for more than a year. For the example Dining table, Refrigerator, etc….

- SEMI- DURABLE GOODS: These refer to those goods which can be used within a year. For example Clothes, Shoes, etc….

- NON- DURABLE GOODS: These refer to those goods which are used at the time of consuming it. For example Milk, Bread, etc….

- SERVICES: These refer to the intangible (unseen) goods which directly satisfy the consumer’s demand at the time of using them. For example Banking, Teaching, etc….

Capital Goods

Capital Goods refer to those final goods which are used in producing further goods. For example Machines, Equipment, etc….

Capital goods are used in the future for further production and have a long life expectancy.

They have “Derived Demand” as their demand depends upon the demand of consumer final goods.

They do not lose their identity in the production process. They need repair and replacement over a certain period of time.

All producer goods are not capital goods but all capital goods are producer goods

As per the concepts of macroeconomics, producer goods include all types of goods which are used for the purpose of production. Producer goods include both capital goods and intermediate goods. Intermediate goods are not capital goods as they cannot be used repeatedly and they also change their form during the production process.

Whereas all capital goods are producer goods as all the capital goods are only used by producers for production purposes.

Thus, all capital goods are producer goods but all producer goods are not capital goods.

Difference Between Consumption Goods and Capital Goods

SOME MORE CONCEPTS OF MACROECONOMICS

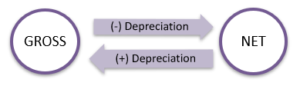

Investment and Depreciation

Investment

Investment or “Capital Formation” refers to the addition to the capital stock of an economy. For example Construction of school, Purchase of machines, etc….

Capital stock consists of Fixed Assets and Unsold Stock.

Investments are of two types:

1. GROSS INVESTMENT:

It means addition to capital stock before deducting depreciation from them.

2. NET INVESTMENT:

It means the actual addition made to capital stock i.e. after the deduction of depreciation on the fixed assets.

Depreciation

Depreciation refers to the fall in the value of a fixed assets due to normal wear and tear, obsolescence, or passage of time.

Depreciation is known by other names such as:

- CURRENT REPLACEMENT FUNDS

- REPLACEMENT COST OF FIXED CAPITAL

- CONSUMPTION OF FIXED CAPITAL

- CAPITAL CONSUMPTION ALLOWANCE

In macroeconomics, this gives us the difference between NET and GROSS.

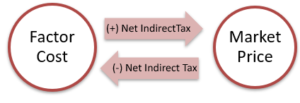

NET INDIRECT TAX (NIT)

Net indirect taxes refer to the difference between indirect taxes and subsidies.

NET INDIRECT TAXES= Indirect Taxes- Subsidies

The components of NIT are:-

- Indirect Tax: Indirect taxes are those taxes that are imposed by the government on the production or sales of goods and services. For example GST, import duty, etc…

- Subsidies: Subsidies refer to the financial assistance given by the government on the production of certain goods and services. For example LPG cylinders.

In Macroeconomics, the concept of NIT gives rise to Factor cost and Market Price.

Factor Cost refers to the amount paid to the factor of production for providing factor services.

Market Price refers to the price of the product that is sold in the market.

Market Price= Factor Cost+ (Indirect Tax- Subsidies)

Market Price= Factor Cost+ Net Indirect Taxes

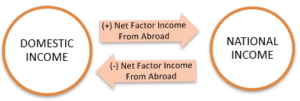

NET FACTOR INCOME FROM ABROAD (NFIA)

NET FACTOR INCOME FROM ABROAD is an important term of basic concepts of macroeconomics. It is the difference between factor incomes received from abroad and factor incomes paid to abroad.

NFIA= FACTOR INCOME FROM ABROAD- FACTOR INCOME TO ABROAD

Factor income received from abroad is the income received by normal residents of a country from the rest of the world.

Factor income paid abroad is the income paid to normal residents of another country for their factor services in the domestic territory of a country.

NFIA can be positive, negative, or zero. It is used to differentiate between domestic and national income.

The components of NFIA are:

- Net Compensation Of Employees

- Net Income from Property and entrepreneurship

- Net Retained Earnings

CBSE Class 12 Economics Notes Term II Syllabus

Part A: Introductory Macroeconomics

- Circular Flow of Income Class 12 Notes

- Basic Concepts of Macroeconomics Class 12 Notes

- National Income and Related Aggregates Class 12 Notes – 10 Mark

- National Income and Related Aggregates Class 12 Numericals

- Determination of Income and Employment Class 12 Notes

Part B: Indian Economic Development

Current challenges facing Indian Economy – 12 Marks

Development Experience of India – A Comparison with Neighbours – 6 Marks