Introduction of CBSE Exchange Rate Class 12

In foreign exchange rate class 12, we will study about the foreign exchange rates, depreciation and appreciation of currencies, determination of foreign exchange rate and foreign exchange markets.

Every country has their own currency to exchange goods and services. But the currency of one country is not acceptable in the other country. For this purpose, we need foreign exchange rate to convert the domestic currency into foreign currency.

FOREIGN EXCHANGE RATE

It is the exchange rate at which one currency is exchanged for other currency in the exchange rate market. It represents the price of one currency in terms of other currency.

This exchange rate depends upon the demand and supply of foreign exchange with other countries indulged in exchanging. For example, the value of $1 is equals to Rs. 76.

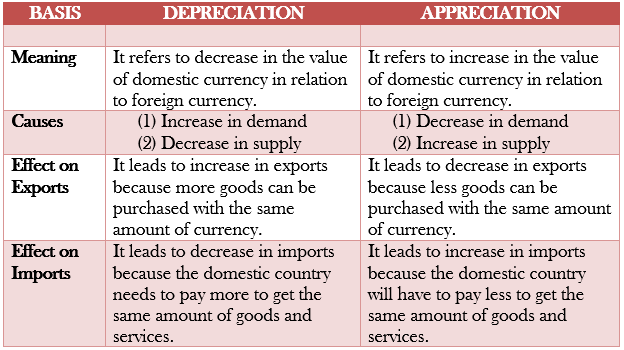

DEPRECIATION V/S APPRECIATION

Currency Depreciation

- It refers to decrease in the value of domestic currency in relation to the foreign currency.

- It means the value of domestic currency is less than the value of foreign currency and domestic currency is required in more number to buy the foreign currency.

- It is caused because of (1) increase in demand, or (2) decrease in supply.

- Due to depreciation of domestic currency, the exports will rise because the domestic currency becomes relatively cheaper and the foreign country will purchase more from the domestic country.

- The imports will fall because the domestic country need to pay more currency to buy same amount of goods and services.

Currency Appreciation

- It refers to increase in the value of domestic currency in relation to the foreign currency.

- It means the value of domestic currency is more than the value of foreign currency and domestic currency is required in less number to buy foreign currency.

- It is caused because of (1) decrease in demand, or (2) increase in supply.

- Due to appreciation of domestic currency, the exports will fall because domestic currency becomes relatively expensive and foreign country will purchase less from domestic country.

- The imports will rise because the domestic country will be able to buy more with the same amount of currency.

TYPES OF EXCHANGE RATE SYSTEMS

There are 3 types of Foreign Exchange Rate Systems:

- Fixed exchange rate system

- Flexible exchange rate system

- Manages floating exchange rate system

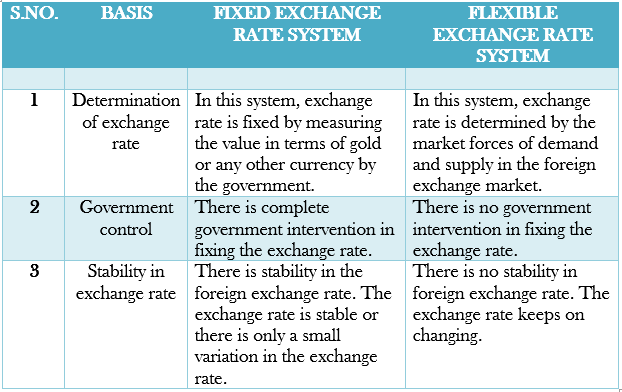

FIXED EXCHANGE RATE SYSYTEM

- It refers to the system in which exchange rate for the currency is fixed by the government. The main aim of this system is to fix the exchange rate and ensure stability in foreign exchange.

- In this system, each country keeps something as a common unit, such as gold or any other precious metal, as some external standard. With the help of this, the exchange rate with the other country is determined by the value of difference between the external unit kept by both the countries.

- When the value of currency is fixed in terms of other currency, it is known as parity value.

- Fixed exchange rate is of two types:

-

- Gold Standard System: In this system, the value of all the currencies is measured by keeping something as a common unit. In this system, the common unit is taken as gold. Each country keeps the amount of gold they have and the excess and deficit of gold between the countries decides the foreign exchange rate.

- Adjustable Peg System: In this system, the value of currencies is pegged or fixed to a major currency. Under this system ,all the currencies were pegged to US dollars at a fixed exchange rate.

- This gives rise to the devaluation and revaluation of domestic currency. Devaluation refers to the decrease in the value of domestic currency intentionally done by the government. Revaluation refers to increase in the value of domestic currency intentionally done by the government.

FLEXIBLE EXCHANGE RATE SYSTEM

- It refers to a system in which exchange rate is determined by the forces of demand and supply of the foreign currencies in the foreign exchange market.

- This system of exchange is also called ‘Floating Exchange Rate’.

- There is no intervention of the government in fixing the exchange rate.

- This gives rise to the depreciation and appreciation of domestic currency in the foreign exchange market.

- In this system of exchange, the foreign exchange rate keeps on changing continuously.

FIXED EXCHNAGE RATE SYSTEM V/S FLEXIBLE EXCHNAGE RATE SYSTEM

Manages floating exchange rate system

- It refers to a system in which exchange rate is determined by the market forces of demand and supply but there is some interference of the Central banking fixing the foreign exchange rate in the foreign exchange market.

- It a hybrid of fixed exchange rate and flexible exchange rate system.

- It is also known as ‘Dirty Floating’ as it is done by the RBI to maintain the forex rate within the desired target value.

- The rate is freely determined by the market forces but the RBI intervenes in between to restrict the fluctuations in the exchange rate when it exceeds the limit.

DEMAND AND SUPPLY OF FOREIGN EXCHANGE

Demand and supply of foreign exchange happens when the countries want to trade their goods and services internationally. This causes deprecation or appreciation of currencies as well.

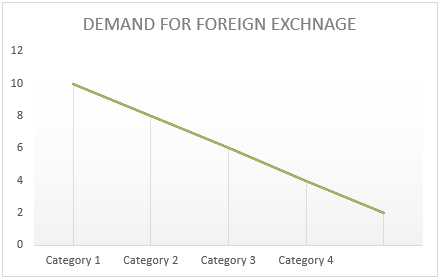

DEMAND FOR FOREIGN EXCHANGE

The demand of foreign exchange arises when the people need foreign exchange to purchase goods or services from other countries. The demand for foreign exchange arises because of the following reasons:

- Imports of goods and services: Foreign exchange is required to make payment for the goods or services purchased from other country.

- Unilateral transfers to rest of the world: Foreign exchange is required to send gifts or money to the person living abroad.

- Tourism: Foreign exchange is required to meet the expenses made during the foreign tours.

- Speculations: Foreign exchange is required when people want to gain money from the speculative activities or currency appreciation.

- Purchase of Assets in foreign country: Foreign exchange is required to make payments for the purchase of land, building, shares, debentures, bonds, etc…. in foreign countries.

- Imports of goods and services: Foreign exchange is required to make payment for the goods or services purchased from other country.

- Unilateral transfers to rest of the world: Foreign exchange is required to send gifts or money to the person living abroad.

- Tourism: Foreign exchange is required to meet the expenses made during the foreign tours.

- Speculations: Foreign exchange is required when people want to gain money from the speculative activities or currency appreciation.

- Purchase of Assets in foreign country: Foreign exchange is required to make payments for the purchase of land, building, shares, debentures, bonds, etc…. in foreign countries.

There exists a negative relation between foreign exchange rate and demand for foreign exchange. The Demand curve of the foreign exchange is ‘DOWNWARD SLOPING’ because of inverse relation between demand of foreign exchange and foreign exchange rate. When the foreign exchange rate decreases, people demand more of foreign exchange. When the foreign exchange rate rises, its demand decreases.

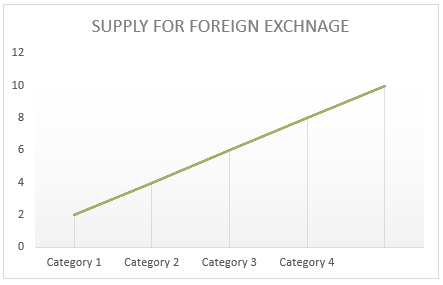

SUPPLY OF FOREIGN EXCHANGE

The supply of foreign exchange arises when people demand for the foreign exchange to purchase goods or services form their country. The supply for foreign exchange arises because of the following reasons:

- Export of goods and services: Foreign exchange is earned when goods or services are purchased form the domestic country.

- Foreign investment: When the foreign country makes investment in domestic country, the foreign exchange comes to the domestic country.

- Speculations: Supply of foreign exchange comes when the foreign countries speculate on the value of foreign currency.

- Unilateral transfers from abroad: Supply of foreign exchange increases when the foreign country gives remittance to domestic country in form of gifts or transfers.

There exists a positive relationship between foreign exchange rate and supply of foreign exchange. When the foreign exchange rate decreases, its supply also falls. When foreign exchange rate rises, its supply also increases.

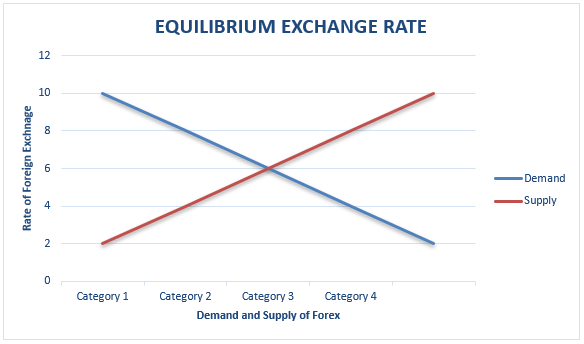

DETERMINATION OF FOREIGN EXCHNAGE RATE

- Foreign exchange rate is determined by the flexible exchange rate system. In this, the forces of demand and supply meet together to determine the foreign exchange rate.

- The point of equilibrium where demand curve of foreign exchange meets supply curve of foreign exchange is the point of foreign exchange rate.

- If the exchange rate rises, the demand for forex falls and the supply for forex rises. In this case, there will be excess supply. This situation pushes the exchange rate downwards and foreign exchange rate falls.

- If exchange rate falls, the demand for forex rises and supply for forex falls. This will lead to excess demand. This situation pushes the exchange rate upwards and foreign exchange rate rises.

CHANGES IN EXCHANGE RATE

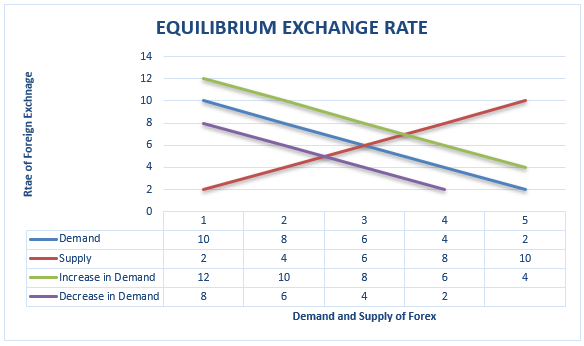

The equilibrium exchange rate is changed due to changes in the demand and supply of foreign exchange rate.

CHANGE IN DEMAND

Change in demand may be because of either ‘increase in demand’ or ‘decrease in demand’.

- Increase in supply: Due to increase in supply, the supply curve will shift leftwards. As a result of this, the exchange rate will fall. Due to the fall in exchange rate, the domestic currency will be appreciated.

- Decrease in supply: Due to decrease in supply, the supply curve will shift rightwards. As a result of this, the exchange rate will rise. Due to the increase in exchange rate, the domestic currency will be depreciated.

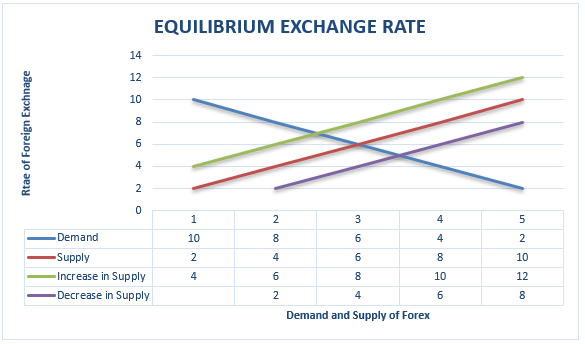

Change in Supply Curve of Foreign Exchange

Change in supply may be because of either ‘increase in supply’ or ‘decrease in supply’.

- Increase in supply: Due to increase in supply, the supply curve will shift to leftwards. As a result of this, the exchange rate will fall. Due to the fall in exchange rate, the domestic currency will be appreciated.

- Decrease in supply: Due to decrease in supply, the supply curve will shift to rightwards. As a result of this, the exchange rate will rise. Due to the increase in exchange rate, the domestic currency will be depreciated.

FOREIGN EXCHNAGE MARKET

Foreign exchange market is the market where the foreign currencies are bought and sold. The foreign exchange market is not a place but a system where the exchange rate is determined and foreign currencies are exchanged.

The buyers and sellers of foreign currency includes individual, firms, commercial banks, central bank and foreign exchange brokers.

FUNCTIONS OF FOREIGN EXCHANGE MARKET

Foreign exchange market performs the following functions:

- Transfer function: This function transfers the purchasing power between the countries involving in purchasing and selling of foreign exchange.

- Credit function: It provides credit to the foreign countries in terms of foreign currency for the purpose of international payments.

- Hedging functions: This functions of foreign exchange market provides security form the risk of fluctuation of prices in the foreign exchange market. When seller and buyer enter into an agreement for a future date at the current year price, it is called hedging. This is done to avoid the losses that might be caused due to exchange rate variation.

TYPES OF FOREIGN EXCHNAGE MARKET:

Foreign exchange markets can be classified into two types: Spot and Forward.

- Spot market: Spot market is a market in which the exchange of currencies is done immediately. This market is of daily nature and deals only in on the spot transactions. The rate of exchange at which transactions in spot market are dealt is known as spot exchange rate or current exchange rate.

- Forward market: Forward market refers to the market in which the exchange of currencies is fixed for a future date at the current rate of foreign exchange. Generally, the international transactions are fixed upon an early date and completed on a future date. This is done to minimize the risk of uncertainty and to make profits for speculative purpose. The exchange rate at which the transactions in this market are done is called forward exchange rate.

CBSE Economics Class 12 Notes Term I Syllabus

Part A: Introductory Macroeconomics

- Money and Banking Class 12 Notes

- Government Budget and the Economy Notes

- Balance of Payments Class 12 Notes

Part B: Indian Economic Development

Development Experience (1947-90) and Economic Reforms since 1991:- 12 Marks

- Indian Economy on the eve of Independence Notes

- Indian Economy (1950-90) Notes

- Economic Reforms since 1991 Notes

Current challenges facing Indian Economy – 10 Marks