Capital Structure Class 12 explains the composition of the capital structure of an organization. An organization take funding from multiple sources and the ratio of different funds in the organization’s capital is the firm’s capital structure. A detailed explanation of the topic is given below.

Capital Structure Class 12 in Financial Management

There are several important decisions to be taken under financial management. One of the important decisions is regarding the proportion of use of different kinds/sources of funds to be used. It is thus the financing pattern that should be chosen so that the returns are higher. Sources of funds are classified as:

- On the basis of duration/period:

- Long-term sources

- Medium-term

- Short term

- On the basis of ownership:

- Owner’s funds

- Borrowed funds

- On the basis of the source from which they are generated:

- Internal sources

- External sources

The capital structure mainly focuses on the combination of sources on the basis of ownership. Owner’s funds include personal savings, retained earnings, reserves and surpluses, equity share capital and preference share capital. Borrowed funds include debentures, loans from financial institutions, loans from banks, public deposits; lease financing etc. Capital structure is thus the mixture of- owners’ funds and borrowed funds which are called equity and debt.

Capital structure can be calculated as the ratio of debt to equity or the proportion of debt out of total capital (debt + equity).

Capital structure= debt/equity

OR

Capital structure= debt/debt + equity

The mixture of the two is important because each one has its own benefits and limitations. They differ on the basis of the cost involved and the risk associated.

Debt is considered the cheapest source but a risky one. It is considered cheap because lenders get an assured return and repayment of capital becomes necessary, thus it involves a lower rate of return. The interest paid on the debt is a deductible expense. It is considered risky because payment to the lenders is obligatory. Default of payment can lead to liquidation of the business. Thus, the higher the debt, the higher will be the financial risk of the firm. Financial risk is the risk where the firm is not in a position to pay back the debtors and cannot fulfil the obligations.

Equity on the other hand is less risky but involves more costly as compared to debt. It is less risky because it does not involve any financial risk and it is not an obligation to pay the shareholders. When there is liquidation of the firm, it is last on the priority list for paying back. Moreover, dividends paid to the shareholders are out of after-tax profits.

Capital structure is thus a mixture that should be properly analysed as it affects the profitability, liquidity and financial risk of the business. It should be such that it increases the price of the shares and the overall wealth of the shareholders as it is the main aim of financial management.

Financial leverage under Capital Structure Class 12

The proportion of debt in the overall capital of the business is called financial leverage. When the financial leverage increases, the overall cost of the funds declines but it comes with a higher risk. The impact of debt/financial leverage can be seen through a technique called EBIT-EPS analysis, earnings before interest and tax–earning per share.

Case I: Capital Structure Numerical Class 12

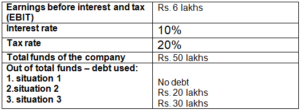

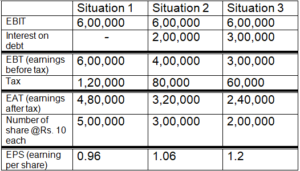

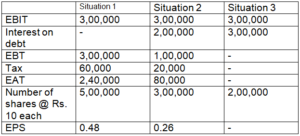

In these three situations, earnings before interest and tax are Rs. 6, 00,000.

The interest rate charged is 10% which will be equal to zero in situation 1 because of no debt involved, Rs. 2 lakhs in situation 2 because of 20 lakhs debt and Rs 3 lakhs in situation 3 because of 30 lakhs debt involved.

So the earnings before tax will be calculated (interest rate subtracted from EBIT)

Then tax will be deducted from the EBT which will give us earnings after tax (EAT).

The total number of shares at the rate of Rs.10 each will be:

Situation 1 – Rs 50 lakhs divided by Rs. 10 = Rs. 5 lakhs

Situation 2 – Rs. 30 lakhs divided by Rs 10 = Rs. 3 lakhs

Situation 3 – Rs. 20 lakhs divided by Rs 10= Rs. 2 lakhs

This will give us earnings per share (EPS) which is equal to EAT divided by the number of shares.

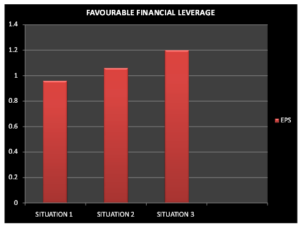

As we can see that the earning per share is increasing with the increase of debt in the capital structure, this is because the return on investment is higher than the interest paid. The return on investment is 12% and the interest rate is 10%. {Return on investment (ROI) = EBIT/total investment * 100}. This case is called favourable financial leverage. Here, the company employs cheaper debt so that a higher EPS can be obtained and it is called trading on equity.

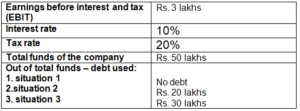

Case II: Capital Structure Numerical Class 12

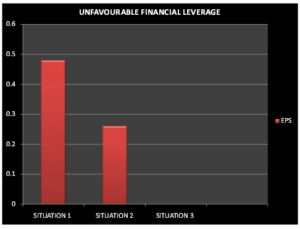

There can be a case where the return on investment is lower than the interest rate, and then in that case the earning per share will decline with the increase of debt in capital structure. That situation will be unfavourable financial leverage and trading on equity will not be advisable for the company.

Here each detail is the same except the EBIT, that is, Rs.3 lakhs.

Here we can clearly see that with the increase in debt, the EPS is declining. It is because the ROI (6%) is lower than the interest rate (10%).

Thus, these two cases show that the return on investment should be higher than the interest we are paying and the optimum balance of debt and equity should be selected so that risk and cost are kept as low as possible and the main aim of maximising the shareholder’s wealth is reached.

Factors Affecting Capital Structure Class 12

- Cash flow position: cash flow position plays a very important role in choosing the ratio of debt and equity because cash is very necessary for a business. It requires cash for the normal course of business i.e. day to day activities, for payment of interest on the debt taken or repayment of principles, and also for investment activities such as the expansion of business or getting new machinery.

- Interest coverage ratio (ICR): Although, this is not an adequate measure but should be taken into account. The interest coverage ratio is the ratio between the earnings before interest and taxes (EBIT) and the interest. This shows how much earnings we have in comparison to the interest we need to pay. The higher the ratio, the lower will be the risk of default on interest payments. This is not considered an adequate factor because it does not make the repayment of the principal into account.

- Debt service coverage ratio (DSCR): debt service coverage ratio is the ratio that shows how much cash is available to pay the debts of the firm including the interest, principal and lease payments. This ratio is broader than the interest coverage ratio and includes the areas which ICR lacks.

- Return on investment (ROI): return on investment is a very important factor because it helps in finding out how much debt in the capital structure will be considered favourable financial leverage and will help in maximising the shareholder’s wealth. When the return on investment is higher than the interest rate then the condition is considered to have favourable financial leverage and the debt can be taken more and which would help in trading on equity Class 12.

- Cost of debt: each source of funds comes with some cost. Debt is however considered the cheapest cost but still, it includes the payment of interest. When a firm gets the debt at a lower rate, then it can take up higher debt.

- Cost of equity: due to the risk the shareholders assume, they expect a higher rate of return. When the debt in capital structure increases, the financial risk increases and this risk is taken by the shareholders thus they expect a higher dividend/higher rate of return. That is why only a certain amount of debt can be included in the capital structure so that the cost of equity does rise too much.

- Risk: there are two types of risks that are to be considered- financial risk and business risk. Financial risks are the risk where the firm is unable to meet its financial obligations such as interest, repayment of principal and dividend on preference shares. Business risk is the operating risk which means the firm has higher operating costs. When the business risk is lower the firm is in a position to take up more debt in its capital structure.

- Flexibility: A firm should choose the right proportion of debt and equity so that it is flexible enough for unforeseen circumstances.

- Control: equity comes with a dilution of control. Shareholders are considered owners because they can take part in the management of the firm and thus dilution of the control takes place. If the firm does not want that the control gets more diluted then it should keep the funds from equity to a limited extent.

- Regulatory framework: each source of finance has its own regulations for raising the fund. For example: issuing the shares should be done under the SEBI guidelines, loans or debentures also have certain rules and norms. When these procedures are easy then the source becomes attractive.

- Stock market conditions: there are two situations, a bullish stock market period where the stocks are sold easily even at a higher price and a bearish stock market period where it becomes difficult for the firm to issue the shares. These conditions play an important role in the choice of source of funds.

- Industry norms: a company must consider other companies’ capital structures in the same industry. This will help a firm in deciding what kind of combination to choose. Although it should be carefully analysed first and should not be followed blindly because each company is different and has its own cash flow position, operating/business risk etc.

Capital structure Class 12 is the financing pattern which the company chooses from the funds based on ownership- owner’s fund and borrowed funds. These funds are different in their risk and cost. An ideal ratio between debt and equity is considered to be 2:1, but a company should properly analyse the position of the firm and other factors before making any decision because it can have an effect on its profitability, liquidity and financial risk.

Other factors such as cash flow position, interest coverage ratio, debt service coverage ratio, flexibility, control, regulatory framework, and stock market conditions are also important and should be considered before making the decision so that there are no regrets later on.

BST Chapter 9 – Financial Management

- Business Finance

- Objectives of Financial Management

- Financial Planning

- Financial decisions in Financial Management

- Capital Structure in Financial Management