Structure of Balance of Payment (BoP)

Meaning of Balance of payment: Balance of payment(BoP) is an accounting statement which records economic transactions between Normal Resident of a specific country with the rest of the world.

It is a double entry system, which means it compromises of debit and credit.

In this we ‘Credit’ All Incomes and Gains.

‘Debit’ All Expenses and Loses.

The items of Credit side are placed on right and the items of Debit side are placed on left.

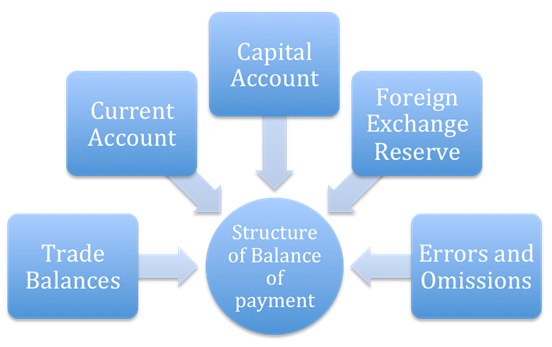

Structure of Balance of Payment (BoP)

The structure of BoP consists of:

- Trade balances

- Current Account

- Capital account

- Financing Account

- Errors and Omissions

Trade Balances:

Trade Balances are the difference between Exports and Imports of visible goods. These items can be touched, seen and measured. It shows whether a nation enjoys surplus or deficit

Current Account:

Current acoount includes flows of goods, invisible services, income receipts , unilateral transfers. Since the trade balances are already recorded in the above heading, it deals with shipping, insurance, payments due to foreign travel, government and private one sided payments and receipts.

Capital Account:

It is the account which records change in assets and liabilities of normal resident with the rest of the world. It accounts for change in non financial assets, like borrowings from UN or from the other countries etc. It includes:

- Borrowings and lendings from and to the rest of the world.

- Investments to and from rest of the world.

- Net banking receipts or payments excluding those of Reserve Bank of India.

- Miscellaneous government receipts or payments.

Errors and Omissions:

Since it’s such a huge account there are chances of errors . Accounting follows a double entry system- for every credit, there is a debit, there should be a balance in Balance of Payment as well. But at times many entries are not recorded or there is some kind of discrepancy. To overcome that there exists errors and omissions.

Foreign Exchange Reserve:

Foreign exchange reserves exhibits the reserves that are kept in the form of foreign currencies. If the overall balance is surplus, it is moved to the official reserves account which raises the foreign exchange reserves. It may be in form of dollar, pound, gold and Special Drawing Rights (SDRs). If there is deficit then it makes the foreign curreny dearer.