GOVERNMENT BUDGET

A government budget is a statement showing item wise estimated receipts and estimated expenditures under various heads during a fiscal year which runs from April 1 to March 31.

Article 112 the Constitution of India states that “an annual financial statement” will be placed before both Lok Sabha and Rajya Sabha which is the budget of the Central Government. Each state government (Article 202) is required to lay an “annual financial statement” before the legislature of the state, called the budget of a state government.

Objectives of Budget

- Redistribution of Income and Wealth through fiscal tools of taxation, subsidies transfer payments

Budget shows financial accounts of the previous year, the budget and revised estimates of the current year and the budget estimates of the coming year.

- Reallocation of Resources So that social and economic objectives met to produce public goods park, bridges, national defence, etc.

- Economic Stability government prevent business fluctuations and maintain price and employment stability. Which acts al inducement to invest and increases the rate of growth and development.

- Managing Public Enterprises. Often, pubic sector enterprises are encouraged areas of natural monopolies. (e.g., water lines, railways etc. where there are advantages if a single firm produces the good).

Impact of Budget

Budget impacts an economy at three levels:

(a) Aggregate fiscal discipline level, i.e., an ideal balance between revenues and expenditures of the government.

(b) Allocation of resources to social sectors to bring about equitable distribution of income and wealth.

(c) Effective and efficient provision of programmes.

COMPONENTS OF THE GOVERNMENT BUDGET

- Revenue Budget. It consists of revenue receipts of the government and the expenditure met from such revenues.

- Capital Budget capital receipts and payments.

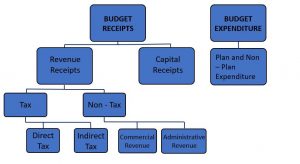

1. BUDGET RECEIPTS

taxes, prices of goods and services supplied by public enterprises, fees, fines, gifts, grants, etc. budget receipts are estimated money receipts of the government from all sources during the fiscal year like.

Components

The main components of government revenue are divided into Revenue receipts and Capital receipts.

A. Revenue Receipts

This receipt does not either create a liability or lead to reduction in assets and can be divided into tax-revenue and non – tax revenue.

(a) Receipts from Tax Revenue

What is a Tax?

Tax is a legally compulsory payment imposed by government on income, manufacturing, transportation, wealth, gifts, properties, exports, imports, etc.

Types of Taxes: There are two types of taxes:

(i) Direct Tax. When the liability to pay a tax and the burden of that on the same person, it is called a direct tax. For example, income tax is a direct tax. The burden of this tax cannot be shifted on to others.

(ii) Indirect Tax. When the liability to pay a tax and the burden of that tax can be on different person, it is called an indirect tax. For example, sales tax is an indirect tax because the liability to pay sales tax is that shopkeeper but he shifts the burden of this tax on the customers.

(b) Receipts from Non – Tax Revenue

What is Non – Tax Revenue? Non – tax revenue refers to the revenue receipts of the government from sources other than the tax.

Types of Taxes: Type of Non – Tax Revenues:

(i) Commercial Revenue revenue received by the government by the goods and services produced by the government agencies. Payments for postage, toll, interest on funds borrowed from government credit corporations, etc.

(ii) Administrative Revenue that arises from administrative function of the government.

Examples:

(i) Fees. e.g., college fees, registration fees, etc.

(ii) Fines and Penalties for infringement of Law.

(iii) Forefeitures. Penalty imposed by the court for non – compliance orders.

(iv) Escheat A claim of the government on the property of a person who dies without having any legal heirs or without leaving a will.

B. Capital Receipts

Capital receipts are receipts under capital account include market borrowings, external loans, recoveries of loans and advances the government and provident fund. For example, disinvestment of PSU the budget capital receipts are classified into three groups:

(i) Recoveries of Loans granted by the central government to state and union territory governments and parties.

(ii) Borrowings and other Liabilities. Government raises loans from the market, Reserve Bank of India foreign governments and other bodies.

(iii) Other Receipts. Include capital receipts other than recovery of loans and borrowing. Funds raised from ‘disinvestment’. Disinvestment means selling a part or whole of the public sector enterprises held by government. It is called capital receipt because it reduces the assets of the government.

2. BUDGET EXPENDITURE

Budget expenditure is the expense which the government incurs for its own maintenance as also for the society and the economy as a whole and includes expenditure of the central, state and local governments on various social, economic and political activities in the country to promote public welfare.

Components

Two components of budget expenditure are plan and non – plan expenditure

Plan Expenditure and Non – Plan Expenditure

(i) Plan Expenditure. The expenditure to be incurred during the programmes under the current five year plan. On financing central plan relating to different sectors of an economy.

(ii) Non – Plan Expenditure. Expenditure other than the expenditure related to the current Five – Year Plan is treated as non-plan expenditure.

2. Revenue Expenditure and Capital Expenditure plan and non – plan expenditures are further subdivided into revenue and capital expenditures:

(i) Revenue Expenditure. Expenditure which does not result in creation of assets or reduction of liability is treated as revenue expenditure for the normal running of government departments and maintenance of services salaries, pensions, interest payments.

(ii) Capital Expenditure. Expenditure which leads to creation of assets reduction in liabilities is treated as capital expenditure. For example : expenditure on purchasing land, building, shares, etc.

3. Development and Non-Developmental Expenditure

(i) Non-developmental Expenditure. Expenditure on essential general services of the government is called non-development expenditure. For example : expenditure on defence and administration.

(ii) Developmental Expenditure. Expenditure n activities which directly related to economic and social development of a country called developmental expenditure. For example : expenditure agriculture and industrial development.

BALANCED, SURPLUS AND DEFICIT BUDGETS

1. Unbalanced Budget

In this, receipts are not equal to expenditures of the government. It is of two kinds:

(a) Surplus Budget. It is one where estimated revenues are more than estimated expenditures. It lowers aggregate demand.

(b) Deficit Budget. One where estimated revenue is less than estimated expenditure. It is a good policy to control recession when an economy is in an underemployment equilibrium level.

2. Balanced Budget

It is one when estimated revenues are equal to estimated expenditures or the amount of tax is equal to the amount of expenditure. This kind of budget leads to slight increase in aggregate. It is not good for a less developed country like India. In such a country, the government should have more expenditures (than revenue) which will raise aggregate demand.

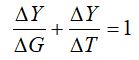

Balanced budget theory states that an increase in government expenditure which is financed by equal amount of tax leads to an increase in income (or aggregate demand) equivalent to the amount of government expenditure (or tax).

Balanced Budget multiplier defined as the ratio of increase in income to increase in government expenditure financed by taxes. Its value is always equal to unity.

MEASURES OF GOVERNMENT DEFICITS

Four types of deficits are as under

REVENUE DEFICIT : MEANING, MEASUREMENT AND IMPLICATIONS

Revenue deficits are defined as the excess of revenue expenditure over revenue receipts.

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Revenue Expenditure = Interest payments + Non-interest expenditure (subsidies)

Revenue Receipts = Tax revenue + Non – tax revenue (i.e., Interest + Grants – in – aid)

Implication / Significance

Implication of revenue deficit is that the government is borrowing maintain even its consumption expenditure. It shows that the country’s financial system is getting destabilized.

Fiscal Deficit : Meaning, Measurement and Implications

Fiscal deficit is sum of borrowings and other liabilities of the government.

Fiscal Deficit = Total Expenditure – Total Receipts other Borrowings and other Liabilities

= [Revenue Expenditure + Capital Expenditure] – [Revenue Receipts + Capital Receipts other than Borrowings and Other Liabilities]

= Revenue Expenditure + Capital Expenditure ] – [Revenue Receipts + Recoveries of Loans + Other Receipts]

= Borrowings and Other Liabilities

Capital receipts have three components:

(1) Recovery of Loans

(2) Other receipts (mainly through disinvestment)

(3) Borrowing and other liabilities

Fiscal deficit = Borrowing and other liabilities

OR

= [Total Expenditure] – [Component (1) + (2)]

The safe limit of fiscal deficit is considered to be 5% of GDP.

Implication / Significance

Fiscal deficit shows the extent of dependence of the government on borrowings to meet the budget expenditure. Implications of fiscal deficit are as follows:

(a) Causes Inflation as raises the circulation of money.

(b) Government borrows from rest of the world. There is economic and political interference by the lender countries.

(c) Reduces Future Growth and Development by creating burden on future generations to repay loans and interest amount.

(d) Debt Trap to repay huge interest amount, the government has to take further loans. A vicious circle sets in wherein the government takes more loans to repay earlier loans.

Primary Deficit : Meaning, Measurement and Implications

Primary deficit is equal to fiscal deficit reduced by interest payments.

Primary Deficit = Fiscal Deficit – Interest Payments

Implication / significance

Primary deficit indicates borrowing requirements of the government to meet deficit net of interest payments.

Budget Deficit : Meaning and Measurement

Excess of total expenditure over total receipts.

Budget Deficit = Total Expenditure (Revenue + Capital) – Total Receipts (Revenue + capital)

MEASURES TO CORRECT DIFFERENT DEFICITS

- Monetary Expansion or Deficit Financing government can print currency notes to the extent of the deficit. It involves borrowing by the government from the Central bank through the issue of treasury bills to the Central Bank.

- Borrowing from The Public government may raise loans from general public by issuing bonds of various types.

- Disinvestment government may choose to sell its existing shares in public sector enterprises.

- Lowering Government Expenditure to reduce non – developmental expenditure. The government can also reduce its expenditure by giving greater role to private sector in the development process.

- Raising Government Revenue Government should take steps restore balance between direct and indirect taxes. There is scope to have wider coverage in indirect taxes.