Comparative Statement Examples

A comparative statement is prepared in order to compare the figures of financial statements for two or more years. It gives an idea about the financial health of the organization. Every company which wants to estimate its future progress must refer to its past performance. When financial statements of one firm for two or more years are compared then it is known as an inter-period comparison. Similarly, when financial statements of two or more firms are compared over a number of years then it is known as an inter-firm comparison.

Comparative Statement Examples

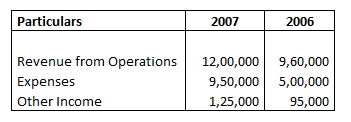

Comparative Statement: Example 1:

Following is the information available from the records of AEE Ltd

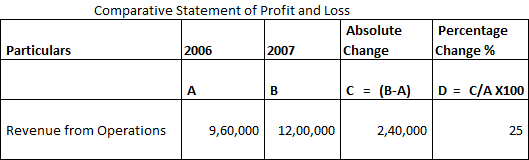

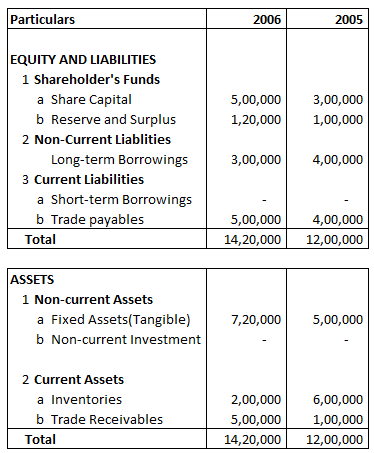

Absolute Change and Percentage Change in Revenue from Operations is:

Explanation: –

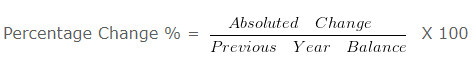

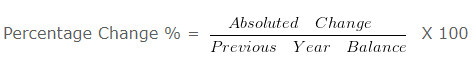

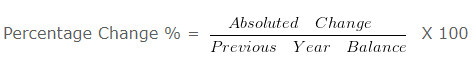

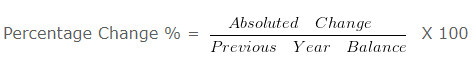

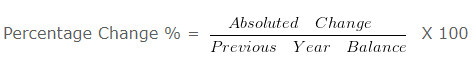

Absolute Change = Current year balance – Previous year balance

Absolute Change = 1200000 – 960000 = 240000

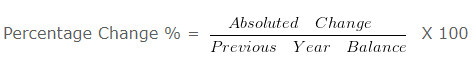

Percentage Change % = 240000/960000 X 100

= 25 %

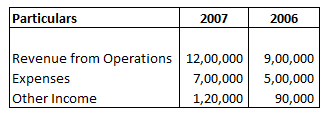

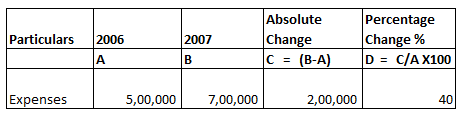

Comparative Statement : Example 2

Following is the information available from the records of N Ltd

Absolute Change and Percentage Change in Expenses is:

Explanation: –

Absolute Change = Current year balance – Previous year balance

Absolute Change = 700000 – 500000 = 200000

Percentage Change % = 200000/500000 X 100

= 40 %

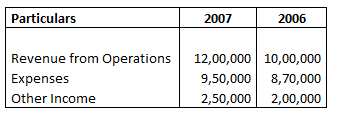

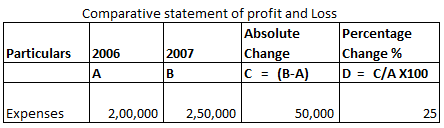

Comparative Statement: Example 3

Following is the information available from the records of ABC Ltd

Absolute Change and Percentage Change in Other income is:

Explanation: –

Absolute Change = Current year balance – Previous year balance

Absolute Change = 250000 – 200000 = 50000

Percentage Change % = 50000/200000 X 100

= 25 %

Comparative Statement : Example 4

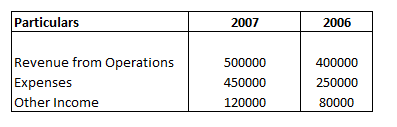

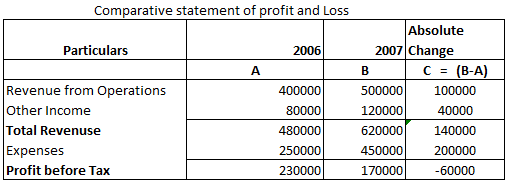

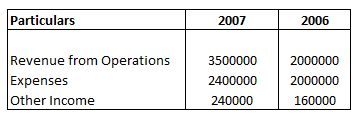

Following is the information available from the records of One Ltd

Profit before tax is :

Explanation: –

Absolute change = Current year balance – Previous year balance

Revenue from Operations = 500000 – 400000 = 100000

Other Income = 120000 – 80000 = 40000

Expenses = 450000 – 250000 = 200000

Revenue from Operations = 100000/400000 X 100 = 25

Other Income = 40000/80000 X 100 = 50

Expenses = 200000/250000 X 100 = 80

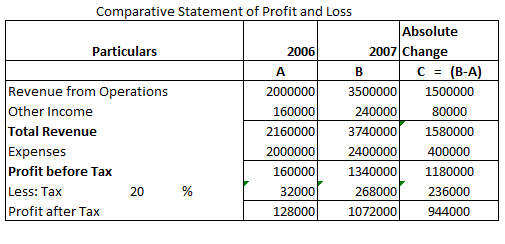

Comparative Statement: Example 5

Following is the information available from the records of ANY LTD

The rate of Tax is 20 %

Profit after Tax is :

Explanation: –

Absolute Change = Current year balance – Previous year balance

Revenue from Operations = 3500000 – 2000000 = 1500000

Other Income = 240000 – 160000 = 80000

Expenses = 2400000 – 2000000 = 400000

Revenue from Operations = 1500000/2000000 X 100 = 75

Other Income = 80000/160000 X 100 = 50

Expenses = 400000/2000000 X 100 = 20

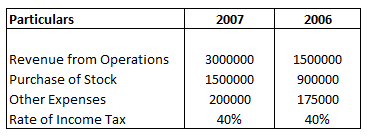

Comparative Statement : Example 6

Following is the information provided by A LTD

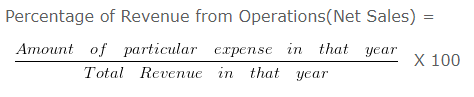

Purchase of Stock Percentage to Revenue from Operations is:

Explanation: –

Purchase of Stock

2006 = 900000/1500000 X 100

= 60

2007 = 1500000/3000000 X 100

= 50

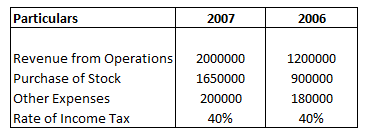

Comparative Statement: Example 7

Following is the information provided by A LTD

Other Expenses Percentage to Revenue from Operations is:

Explanation : –

Other Expenses

2006 = 180000/1200000 X 100

= 15

2007 = 200000/2000000 X 100

= 10

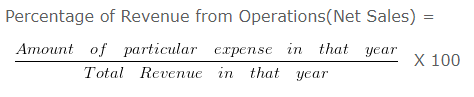

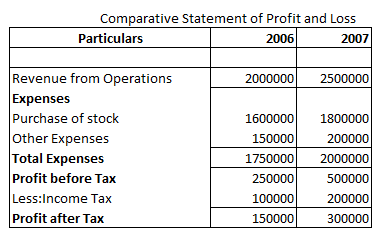

Comparative Statement: Example 8

Following is the information provided by A LTD

Profit after Tax for the year 2006 is

Explanation: –

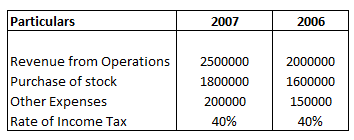

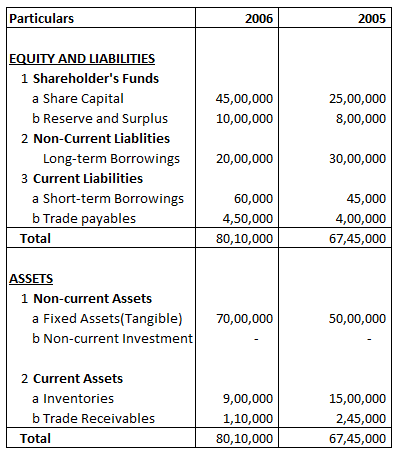

Comparative Statement: Example 9

Following is the information provided by A LTD

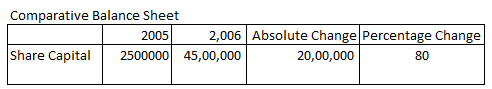

Absolute Change and Percentage Change in share capital is

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 4500000 – 2500000

= 2000000

= 2000000/2500000 X 100

= 80 %

Comparative Statement : Example 10

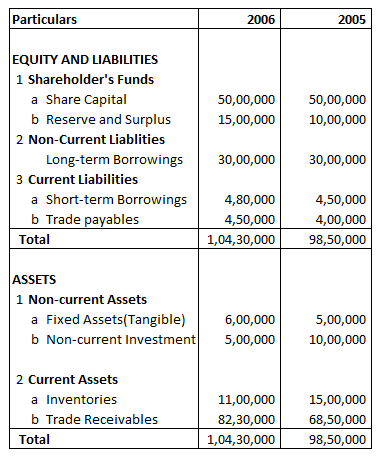

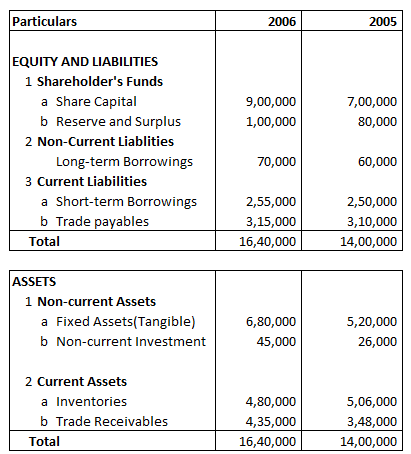

Following is the Balance sheet of AA Ltd

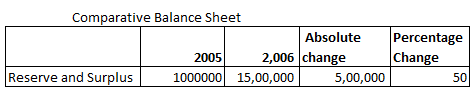

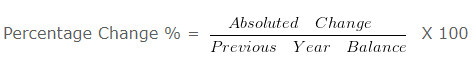

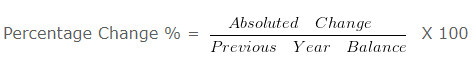

Absolute Change and Percentage Change in Reserve and Surplus is:

Explanation: –

Absolute change = Current year’s figure – Previous year’s figure

= 1500000 – 1000000

= 500000

= 500000/1000000 X 100

= 50

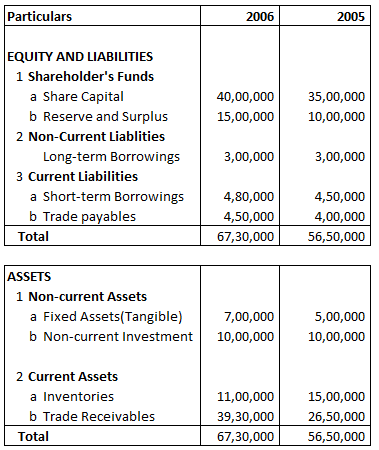

Comparative Statement: Example 11

Following is the Balance sheet of B Ltd

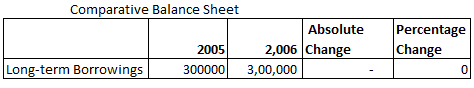

Absolute Change and Percentage Change in Long-term Borrowings is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 300000 – 300000

= 0

= 0/300000 X 100

= 0

Example 12

Following is the Balance sheet of A Ltd

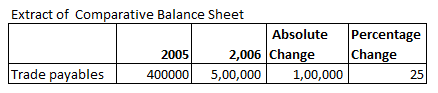

Absolute Change and Percentage Change in Trade payable is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 500000 – 400000

= 100000

= 100000/400000 X 100

= 25

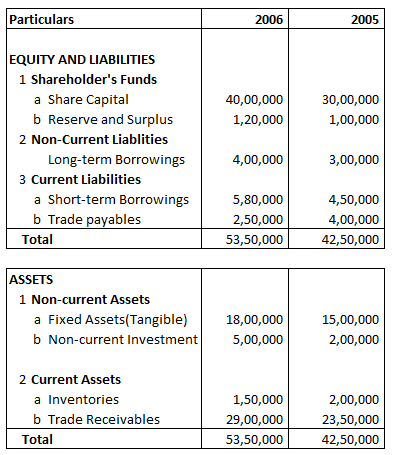

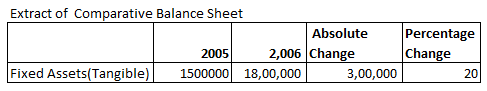

Comparative Statement: Example 13

Following is the Balance sheet of A Ltd

Absolute Change and Percentage Change in Fixed Assets(Tangible) is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 1800000 – 1500000

= 300000

= 300000/1500000 X 100

= 20

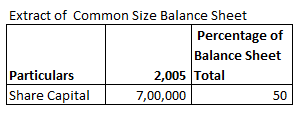

Comparative Statement: Example 14

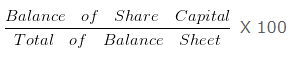

Following is the Balance Sheet of AX Ltd

Share Capital Percentage of Balance Sheet total for 2005 will be:

Explanation: –

Share Capital Percentage of Balance Sheet Total 2005 =

= 700000/1400000 X 100

= 50

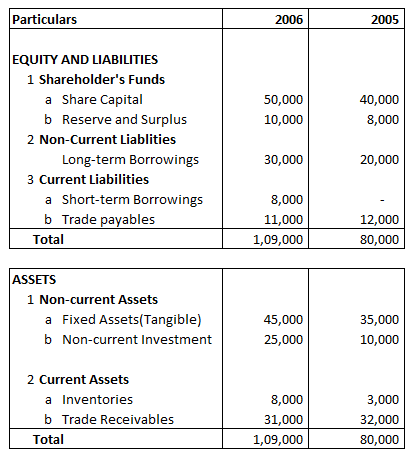

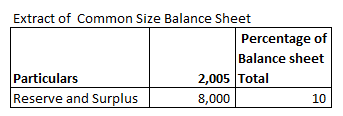

Example 15

Following is the Balance Sheet of A Ltd

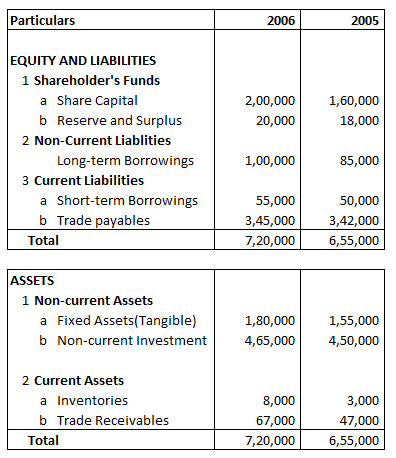

Reserve and Surplus Percentage of Balance Sheet total for 2005 will be:

Explanation: –

Reserve and Surplus Percentage of Balance Sheet Total 2005 =

= 8000/80000 X 100

= 10

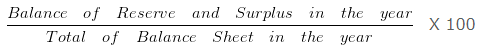

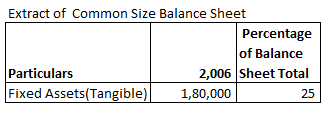

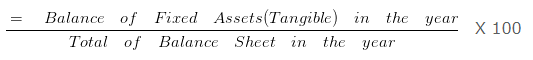

Comparative Statement: Example 16

Following is the balance sheet of A Ltd

Fixed Assets(Tangible) Percentage of Balance Sheet Total for 2006 will be:

Explanation: –

Fixed Assets(Tangible) Percentage of Balance Sheet Total 2006

= 180000/720000 X 100

= 25

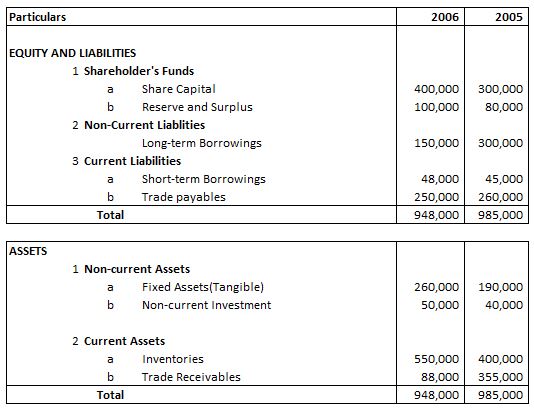

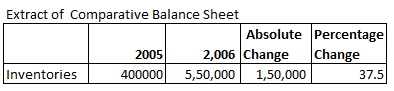

Comparative Statement: Example 17

Following is the Balance sheet of AB Ltd

Absolute Change and Percentage Change in Inventories is:

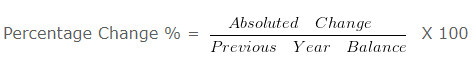

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 550000 – 400000

= 150000

= 150000/400000 X 100

= 37.5

Chapter 4 – Analysis of Financial Statements