Balanced And Unbalanced Budget

1. Balanced Budget

It is one when estimated revenues are equal to estimated expenditures or the amount of tax is equal to the amount of expenditure. This kind of budget leads to slight increase in aggregate. It is not good for a less developed country like India. In such a country, the government should have more expenditures (than revenue) which will raise aggregate demand.

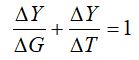

Balanced budget theory states that an increase in government expenditure which is financed by equal amount of tax leads to an increase in income (or aggregate demand) equivalent to the amount of government expenditure (or tax).

Balanced Budget multiplier defined as the ratio of increase in income to increase in government expenditure financed by taxes. Its value is always equal to unity.

2. Unbalanced Budget

2. Unbalanced Budget

In this, receipts are not equal to expenditures of the government. It is of two kinds:

(a) Surplus Budget. It is one where estimated revenues are more than estimated expenditures. It lowers aggregate demand.

(b) Deficit Budget. One where estimated revenue is less than estimated expenditure. It is a good policy to control recession when an economy is in an underemployment equilibrium level.