When a partner leaves the partnership firm either due to his retirement or due to his death, he or is legal representative are entitled to his share of goodwill. This is because, the goodwill is earned with the help of his capital and efforts invested by him in the business. So at the time of retirement/death of a partner, the adjustments are made to value goodwill as per the agreement between the partners and the the retiring/ deceased partner is compensated for his share in the goodwill by the remaining partners in their gaining ratio.

The accounting treatment for such goodwill adjustment is decided by the fact that the goodwill is appearing in the books of the firm or not.

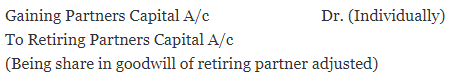

1. When goodwill is not appearing in the books of accounts –

The following journal entry is passed in this case –

For eg –

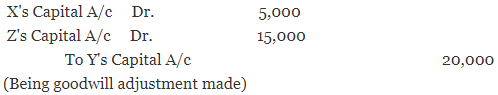

X, Y and Z are partners in a firm sharing profits in the ratio of 1:2:3. Y retired and the value of goodwill of the firm in valued at Rs. 60,000. X and Z continue the business sharing profits in the ratio of 3:1.

Y’s share in goodwill = 60,000 x (2/6) = Rs. 20,000

The journal entry for adjustment of goodwill will be :

2. Hidden Goodwill

As the name suggests, goodwill of this kind is not present by its name rather it is hidden in the amount so adjusted in the retiring or deceased partner’s capital account. When the account of retiring or deceased partner is settled by paying him a lump sum amount, then the excess amount over what is due as calculated by carrying out the adjustments is assumed as the amount paid for goodwill.

For eg –

A, B and C are partners in a firm and their profit sharing ratio is 3:2:1. C retires, and it is decided to settle his account by paying him Rs. 75,000. Whereas, after all adjustments the amount due to him is worked out to be Rs. 60,000. So the difference is treated as Hidden Goodwill.

The journal entry for adjustment of goodwill will be :

A’s Capital A/c Dr. 9,000

B’s Capital A/c Dr. 6,000

To C’s Capital A/c 15,000

(Being goodwill adjustment made in the gaining ratio 3:2)

Thus, upon retirement or death of a partner, he is entitled to his share of goodwill and the subsequent treatment of goodwill depend on whether the goodwill amount is recorded in the books of accounts.