Demand in Economics

Demand is the number of goods or commodities, which a consumer is both, willing, and able to buy, at each possible price during a given period of time.

The definition of demand highlights four essential elements of demand:-

- Quantity of the commodity

- Willingness of consumer to buy the commodity

- Price of the commodity at each given level of Quantity of the commodity

- Period of time

Demand for a commodity may be either with respect to an individual or to the entire market.

- Individual demand : – Individual demand refers to the quantity of a commodity that a consumer is willing and able to buy at each possible price during a given period of time.

- Market demand :- Market demand refers to the quantity of a commodity that all consumers are willing and able to buy at each possible price during a given period of time.

Characteristics of demand :-

- Defined with reference to price:-

Demand for any commodity , is always given with reference to a particular price. A the price changes, the quantity demanded of commodity may also change . As a general rule, demand is higher at a lower price, and lower as the price increases.

- It is always expressed with respect to a period of time:-

Demand , is expressed, with reference to the time. With the change of time (which may be an hour, a day a month or a year), even if the price remains the same, the demand may change .

Determinants of demand : – (Individual demand):-

Demand for a commodity increases or decreases due to a number of factors. The various factors affecting demand are :-

1. Price of the Given commodity :

It is the most important factor affecting demand for the given commodity. Generally there exists an inverse relationship between price and quantity demanded. It means as price increases, quantity demanded falls due to decrease in the satisfaction level of consumers.

For example:- If the price of the given commodity (say tea) increases its quantity falls as satisfaction derived from tea will fall due to rise in its price.

The following determinants are termed as ‘other factors’ or factors ‘other than price’

2. Price of related goods

Demand for the given commodity is also affected by the change in prices of the related goods. Related goods are of two types :-

(i) Substitute goods:- Substitute goods are those goods which can be used in place of one another for satisfaction of a particular want, like tea and coffee. An increase in the price of substitute leads to an increase in the demand for given commodity and vice – versa.

For example : – If price of a substitute good (say, coffee) increases then demand for given commodity (say, tea) will rise as tea will become relatively cheaper in comparison to coffee. So, demand for a given commodity is directly affected by change in price of substitute goods.

(ii) Complementary goods:- Complementary goods are those goods which are used together to satisfy a particular want, like tea and sugar, An increase in the price of complementary good leads to a decrease in the demand for given commodity and vice – versa.

For example : – if the price of a complementary good (say, sugar) increases, then demand for given commodity (say, tea) will fall as it will be relatively costlier to use both the goods together. So, demand for a given commodity is inversely affected by change in price of complementary goods.

Example of substitute goods:-

- Tea and coffee

- Coke and Pepsi

- Pen and Pencil

- CD and DVD

- Ink pen and ball pen

- Rice and wheat

- Example of complementary goods:-

- Tea and Sugar

- Pen and ink

- Car and Petrol

- Bread and Butter

- Pen and Refill

- Brick and cement

3. Income of the consumer:-

Demand for a commodity is also affected by income of the consumer. However, the effect of change in income on demand depends on the nature of commodity under consideration.

- If the given commodity is a normal good, then an increase in income lads to rise in its demand, while a decrease in income reduces the demand.

- If the given commodity is an inferior good, then an increase in income reduces the demand while a decrease in income leads to rise in demand.

Example :- Suppose income of a consumer increases. As a result, the consumer reduces consumption of toned milk and increases consumption of full cream milk. In this case ‘Toned milk’ is an inferior good for the consumer and ‘Full cream milk’ is a normal good.

4. Tastes and Preferences : –

Tastes and preferences of the consumer directly influence the demand for a commodity. They include changes in fashion, customs, habits etc. If a commodity is in fashion or is preferred by the consumers, then demand for such a commodity rises. On the other hand, demand for a commodity falls, if the consumers have no taste for that commodity.

5. Expectation of change in the price in future : –

If the price of a certain commodity is respected to increase in near future, then people will buy more of that commodity than what they normally buy. There exists a direct relationship between expectation of change in the prices in future and change in demand in the current period

For example:- If the price of petrol is expected to rise in future, its present demand will increase. Change in quantity demanded us change in demand:-

- Change in quantity demanded : – Whenever demand for the given commodity changes due to change in its own price, then such change in demand is known as “ Change in Quantity Demand”. For example, if demand for Pepsi changes due to. Change in its own price, then such change in demand is known as “Change in Quantity Demanded”. For example, if demand for Pepsi changes due to change in its own price, then such change in demand for Pepsi is known as change in quantity demanded.

- Change in Demand : – Whenever demand for the given commodity changes due to factors other than price, then such change in demand is known as “Change in demand”. For example : – If demand for Pepsi changes due to change in price of Coke or due to change in income or due to a change in taste, then such change in demand for Pepsi is known as change in demand.

Determinants of Market demand:-

(1) Size and composition of Population :-

Market demand for a commodity is affected by size of population in the country. Increase in population in the country. Increase in population in the country. Increase in population raises the market demand, while decrease in population reduces the market demand. Composition of population i.e. ratio of males, females, children and number of old people in the population also affects the demand for a commodity. For example :- if a market has larger proportion of women, then there will be more demand for articles of their use such as lipstick, sarees etc.

(2) Season and weather : –

The seasonal and weather conditions also affect the market demand for a commodity. For example : – during winters, demand for woolen clothes and jackets increases, whereas, market demand for raincoat and umbrellas increases during the rainy season.

(3) Distribution of Income : –

If income in the country is equitably distributed, then market demand for commodities will be more. However if income distribution is uneven i.e. people are either very rich or very poor, then market demand will remain at lower level.

Demand function :-

Demand function shows the relationship between quantity demanded for a particular commodity and the factors influencing it. It can be either with respect to one consumer (individual demand function) or to al the consumers in the market (market demand function).

Individual Demand function:-

Individual demand function refers to the functional relationship between individual demand and the factor affecting individual demand.

It is expressed as

Dx = f (Px, Pr, Y, T, F)

Where

Dx = Demand for commodity x

Px = Price of the given commodity x,

Pr = Prices of related Goods

y = Income of the consumer

T = Tastes and Preferences

F = Expectation of change in price in future.

Market demand function :-

Market demand function refers to the functional relationship between market demand and the factors affecting market demand. Market demand function can be expressed as

Dx = Market demand of commodity x,

Px = Price of given commodity x,

Pr = Prices of related goods;

y = Income of the consumers;

T = Tastes and Preferences,

F = Expectation of change in price in future;

Po = Size and composition of population;

S = Season and weather;

D = Distribution of Income.

Demand schedule:-

Demand schedule is a tabular statement showing various quantities of a commodity being demand at various levels of price, during a given period of time. It shows the relationship between price of the commodity and its quantity demanded.

A demand schedule can be determined both for individual buyers and for the entire market. So, demand schedule is of two types:-

- Individual demand schedule

- Market demand schedule

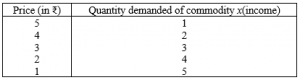

Individual demand schedule :- Individual demand schedule refers to a tabular statement showing various quantities of a commodity that a consumer is willing to buy at various levels of price, during a given period of time.

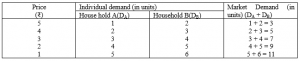

Market demand schedule refers to a tabular statement showing various quantities of a commodity that all the consumers are willing to buy at various levels of price, during a given period of time. Market demand schedule can be expressed asMarket demand schedule:-

Dm = DA + DB + ……..

Where

Dm is the market demand DA + DB + …….. are the individual demands of household A, household B and so on

Demand Curve:-

Let us assume that A and B are two consumers for commodity x in the market Table shows that market demand schedule is obtained by horizontally summing the individual demand. Market demand is obtained by adding demand of households A and B at different prices. At ₹ 5 per unit, market demand is 3 units. When price falls to ₹ 4, market demand rises to 5 units. So, market demand schedule also shows the inverse relationship between price and quantity demanded.

Demand curve is a graphical representation of demand schedule. It is the locus of all the points showing various quantities of a commodity that a consumer is willing to buy at various levels of price, during a given period of time, assuming no change in other factors.

Unit 5: Consumer’s Equilibrium and Demand

- Concept of Utility in Economics

- Measurement of Utility in Economics

- Total Utility and Marginal Utility

- Law of Diminishing Marginal Utility

- Conditions of Consumer’s Equilibrium

- Theory of Demand

- What is Demand in Economics

- Demand Characteristics

- Determinants of demand

- Determinants of Market Demand

- Demand Function In Economics

- Demand Schedule | Individual demand schedule | Market demand schedule

1 thought on “Theory of Demand in Economics Class 11 Notes”

Helpful content

Comments are closed.