Revaluation of assets and liabilities in partnership is done at the time of change in the profit sharing ratio among the partners. Assets and liabilities are revalued because the realisable or actual value of assets and liabilities may be different from the figures shown in the Balance Sheet. The need for revaluation for assets and liabilities arises because the value of assets and liabilities belongs to the period prior to change in the profit sharing ratio and the assets or liabilities before revaluation should be shared between the partners in their old ratio.

Revaluation of Assets and Liabilities in Partnership : Example 1

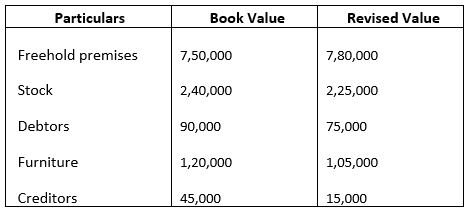

A , B and C are partners sharing profits and losses equally. From 1st April 2016 partners decided to share profits in the ratio of 6 : 3 : 1 . At the time of reconstitution, the following assets and liabilities were revalued and reassessed.

Partners decided to record the above adjustments without affecting the book value of assets and liabilities The single entry to record adjustment will be:

Explanation : –

Net effect of revaluation:

Profit/Loss

Freehold premises = 30000

Stock = -15000

Debtors = -15000

Furniture = -15000

Creditors = 30000

= 15000

Profit on Revaluation 15000

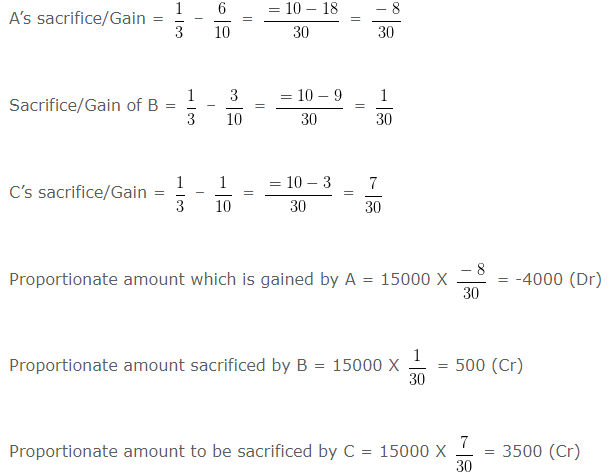

Old profit sharing ratio = 1 : 1 : 1

New profit sharing ratio = 6 : 3 : 1

Sacrificing ratio = Old share – New share

A s capital A/c Dr 4000

To B s capital A/c 500

To C s capital A/c 3500

Adjustment of Accumulated Profits and Losses

A partnership firm, instead of transferring its profit to capital accounts of partners at the end of a year generally accumulates its profit earned or loss incurred to various reserves maintained by it. These reserves could take the form of General reserve and/or Profit and Loss Account.

Since these have been accumulated over the years, the retiring/ deceased partner who had worked all these years has the right on such reserves. The old partners are the rightful owners of such accumulated profits.

Therefore, these accumulated profits (credit balance of Profit and loss account or General Reserve) should be divided between the old partners in their old profit sharing ratio so as to ensure that the retiring/ deceased partner does not suffer.

Further, any accumulated losses (debit balance of profit and loss account and/or deferred revenue expenditure) are also transferred to the old partners’ capital accounts in their old profit sharing ratio.

Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner

- Modes of Reconstitution of a Partnership Firm

- Admission of a New Partner

- New Profit Sharing Ratio

- Sacrificing Ratio

- Goodwill

- Adjustment for Accumulated Profits and Losses and Capitals

- Revaluation of Assets and Reassessment of Liabilities

- Change in Profit Sharing Ratio among the Existing Partners