Past Adjustments –

While preparing the books of accounts of any partnership firm, a lot of attention is given to the fact that there are no errors so that the final results display the financial information accurately. This provides a true and fair financial position of the firm which helps in better decision making for the future.

However, even after practicing extensive care, a few errors or omissions are bound to happen. This ultimately leads to incorrect presentation of transactions in the books of accounts or other statements. If these errors come in notice before preparing the final accounts they can be easily rectified for any past adjustments.

But at times, these omissions or errors are discovered post preparation of financial statements and distribution of profits between the partners. In such a scenario, instead of alteration of entries already posted a new adjustment entry is required for rectification of mistakes.

The alteration entry is either routed through the Profit and Loss Adjustment account or directly in the capital accounts of the concerned partners.

The omission or error may relate to – interest on capital, interest on drawings, interest on partner’s loan, partner’s salary or outstanding expenses.

The error might also occur due to any changes made in the partnership deed between the partners or any retrospective in the accounting policies so followed.

For eg –

A and B are partners in a firm sharing profits equally. Their capital account balances as on April 01, 2018 were Rs. 1,00,000 and Rs. 2,00,000 respectively. After the finalisation of the books of accounts for the financial year ending March 31, 2019, it is found out that there has been omission of interest on capitals at the rate of 6 per cent per annum, as agreed by the partners in the partnership deed.

So, the amount of interest on capital that should be credited to the capital accounts of A and B –

A = Rs. 6,000 (6/100 × Rs. 1,00,000) and

B = Rs. 12,000 (6/100 × Rs. 2,00,000)

If the interest on capital been duly provided, this would increase the amount of expenditure in the Profit and Loss account and in turn reduce the profits available for distribution between the partners by Rs 18,000.

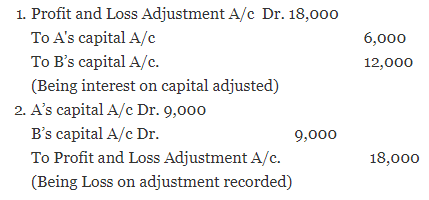

a) Rectification Entry to be passed through Profit and Loss Adjustment Account –

b) Rectification Entry to be passed directly through partner’s capital account –

Firstly, the net effect due to omission is ascertained using the below formula –

Net effect of omitting interest on capital = Amount which should have been credited as interest on capital – Amount actually credited as share of profit

Net effect of omitting interest on A’s capital = 6,000 – 9,000 = 3,000 (Excess)

Net effect of omitting interest on B’s capital = 12,000 – 9,000 = 3,000 (Short)

Entry to be passed –

A’s Capital A/c Dr. 3,000

To B’s Capital A/c. 3,000

(Being adjustment for omission of interest on capital)

Conclusion – Past adjustments implies that a mistake in the recording of transactions is figured out after the preparation of final accounts. Rectification of accounts becomes difficult once the financial statements are prepared. In this case, an adjustment entry is passed for the past adjustments.

Chapter 2 – Accounting for Partnership: Basic Concepts