When a partner decides to retire from the partnership firm, his account with the firm needs to be settled as per the conditions agreed to while entering in the partnership deed. The account settlement could be made either through a lump sum payment on the date of retirement or through instalments along with any interest or without interest.

If partners do not have a separate agreement regarding the disposal of the amount due to the retiring partner, then the procedure given in Section 37 of the Indian Partnership Act, 1932 is applicable.

As per this section, the outgoing partner can choose to settle his accounts with the partnership firm either by receiving interest @ 6% p.a. till the date of payment of amount or by accepting any profits earned by the firm with the help of his capital. The amount calculated from either of the two methods mentioned above is then paid immediately to the retiring partner and his account is then settled.

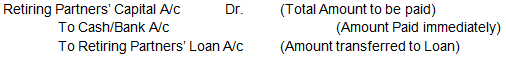

If due to any reason the partnership firm is unable to release the above payment immediately, the amount due to the retiring partner is transferred to a loan account in the name of the partner. The Partner’s Loan Account is shown on the liabilities side of the balance sheet and is settled as and when the firm is capable of making the payment.

The following journal entries are passed on disposal of amount due to the retiring partner –

1. When retiring partner’s account is wholly settled in cash –

![]()

2. When retiring partners’ whole amount is transferred to loan account –

![]()

3. When part payment is processed in cash and remaining is transferred to loan account –

4. When a Partner’s Loan account is settled by paying the loan in instalment. It includes principal and interest –

a) Interest Entry –

![]()

b) Instalment Entry –

![]()

Thus, when a partner retires, his account can be settled either through lump sum cash payment or via instalments or by transferring the amount to the outgoing partner’s loan account.

Chapter 4 – Reconstitution of a Partnership Firm

- Retirement/Death of a Partner

- Ascertaining the Amount Due to Retiring/Deceased Partner

- New Profit Sharing Ratio

- Gaining Ratio

- Treatment of Goodwill

- Adjustment for Revaluation of Assets and Liabilities/Adjustment of Accumulated Profits and Losses

- Disposal of Amount Due to Retiring Partner

- Adjustment of Partners’ Capitals

- Death of a Partner