Topics Covered under Module 5 – Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act 2015 in International Taxation CA Final Elective Paper 6C

- What is Black Money

- Basis of Charge – Section 3 – Black money and imposition of Tax Act 2015

- Definition of Assessee – Section 2(2)

- Applicability of Black Money Act to Persons Resident in India

- Definition of Undisclosed asset located outside India – Section 2(11)

- Asset Located outside India Acquired by NR out of income not chargeable to tax in India – Section 2(11)

- Relevant previous year for chargeability to tax

- Valuation of an Undisclosed Asset located outside India – Section 3(2)

- Scope of total undisclosed Foreign Income and Asset – Section 4(1)

- No Allowance and Set off for computation of Total undisclosed Foreign Income and Asset – Section 5

- Tax Authorities under the Black Money Act – Section 6

- Assessment of foreign income and assets – Section 10

- Rectification of Mistake Section 12

- Appeal to Commissioner – Black Money and Imposition of Tax Act 2015

- Appeal to Appellate Tribunal – Black Money and Imposition of Tax Act 2015

- Appeal to High Court – Section 19 – Black Money Act

- Revision of Orders Prejudicial to Revenue – Black Money Act

- Recovery of Tax Dues – Black Money and Imposition of Tax Act 2015

- Penalty on undisclosed foreign income and asset

- Offences and Prosecution under Income tax act

- Interest for Default in Furnishing Return and Payment or Deferment of Advance Tax – Section 40

- Agreement with Foreign Countries or Specified Territories – Section 73

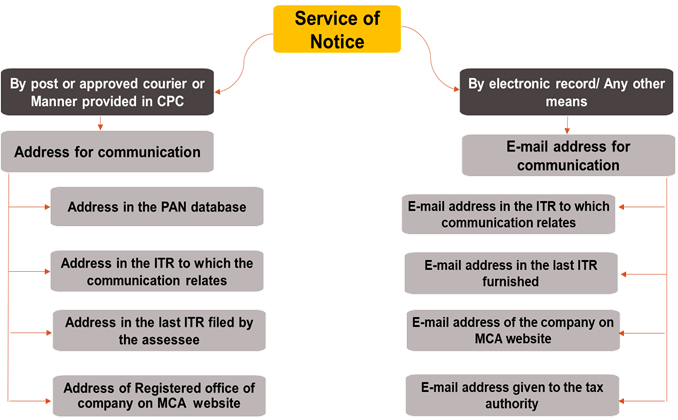

- Modes of Serving Notice- Section 74

- Address for Communication of Notice by Post or Approved Courier Service – Section 74 read with Rule 14

- Email Address for Communication of Notice – Section 74 read with Rule 14

- Address for Communication of Notice – Section 74 read with Rule 14

- Authentication of Notices and other Documents – Section 75

- Notice deemed to be valid in certain circumstances – Section 76

- Appearance by approved valuer in certain matters or authorised representative – Section 77 and 78

- Meaning of Authorised Representative – Section 78

- Rounding off of income, value of asset and tax – Section 79

- Congnizance of offence – Section 80

- Assessment not to be invalid on certain Grounds- Section 81

- Bar of Suits in Civil Courts – Section 82

- Income Tax papers to be available for the purposes of the Black Money Act – Section 83

- Application of Provisions of the Income Tax Act – Section 84

- Amendment of Prevention of Money-Laundering Act, 2002 – Section 88

INTEREST FOR DEFAULT IN FURNISHING RETURN AND PAYMENT OR DEFERMENT OF ADVANCE TAX – SECTION 40

The provisions of the Income-Tax Act , provide for imposition of interest , if there is any failure to file return of income or deferment of advance tax. Such provisions are also applicable in the Black Money Act. They are discussed herein below :-

1. Interest for default in furnishing return of income

Interest shall be charged if there is any failure to disclose income from a source outside India in the return of income filed under section 139(1) or if there is any failure to furnish return of income under section 139(1) of the Income-tax Act, 1961.

Interest is charged u/s 234A @ 1 % of outstanding tax , from the first day after the due date of filing the return of income , until the date of the actual filing of the return.

2. INTEREST FOR DEFERMENT OF ADVANCE TAX

Interest shall be charged if there is any failure to pay advance tax on undisclosed income from a source outside India in accordance with Part C of Chapter XVII of the Income-tax Act.

Interest under Section 234B is payable if a person, who is liable to pay advance tax , has paid less than 90% of the assessed tax as advance tax. Such interest is payable @ 1% per month from the 1st day of the relevant AY until the date of payment. Further, interest u/s 234C for deferment of advance tax at 1% simple interest on the tax amount due, calculated from individual cut off dates on which advance tax installment is payable, until the date of actual payment of outstanding taxes.

AGREEMENT WITH FOREIGN COUNTRIES OR SPECIFIED TERRITORIES – SECTION 73

The Central Government may enter into an agreement with the Government of any other country or specified territory outside India for the purpose of : –

- Exchange of information for prevention of evasion or avoidance of tax on undisclosed foreign income chargeable under the Black Money Act or under the corresponding law in force in that country, or

- Investigation of cases of such evasion or avoidance.

- Recovery of tax under the Black Money Act and under the corresponding law in force in that country.

Generally, in every Comprehensive Tax Treaty, there is a clause which facilitates exchange of information between tax authorities of two countries, for the purpose of ascertaining tax liabilities of person, who may be liable to tax in each of these countries.

MODES OF SERVING NOTICE – SECTION 74

The service of any notice, summons, requisition, order or any other communication under the Black Money Act (herein referred to in this section as “communication”) may be made by delivering or transmitting a copy thereof, to the person named therein by following modes :-

- By post or approved courier service or

- In the manner provided in CPC for service of summons; or

- In the form of electronic record (i.e., email, etc) or

- by other means of transmission.

ADDRESS FOR COMMUNICATION OF NOTICE BY POST OR APPROVED COURIER SERVICE – SECTION 74 READ WITH RULE 14

The address for communications of notice to be delivered by post or approved courier service shall be –

- Address available in the PAN database of the addressee; or

- Address available in the return furnished under Income-tax Act, to which the communication relates; or

- Address available in the last return furnished under the Income-tax Act by the addressee; or

- In case of company, address of registered office as available on the website of Ministry of Corporate Affairs

Note :-

The communication shall not be delivered or transmitted to the aforesaid address where the addressee furnishes in writing any other address for the purposes of communication to the tax authority .

E-MAIL ADDRESS FOR COMMUNICATION OF NOTICE – SECTION 74 READ WITH RULE 14

The address for communications of notice to be delivered electronically shall be –

- The e-mail address available in the return furnished under the Income-tax Act by the addressee to which the communication relates; or

- The e-mail address available in the last return furnished under the Income-tax Act by the addressee; or

- In the case of addressee being a company, e-mail address of the company as available on the website of the Ministry of Corporate Affairs; or;

- Any e-mail address made available by the addressee to the tax authority or any person authorized by such tax authority.

ADDRESS FOR COMMUNICATION OF NOTICE – SECTION 74 READ WITH RULE 14

AUTHENTICATION OF NOTICES AND OTHER DOCUMENTS – SECTION 75

Every notice or other document required to be issued, served or given, for the purposes of the Black Money Act by any tax authority shall be authenticated by that tax authority .

Such notice or document shall be deemed to be authenticated, if name and office of a designated tax authority is printed, stamped and otherwise written thereon.

The designated tax authority means any tax authority authorized by the CBDT to issue, serve or give such notice or other document after such authentication.

NOTICE DEEMED TO BE VALID IN CERTAIN CIRCUMSTANCES – SECTION 76

- The notice, which is required to be served for the purpose of assessment under the Black Money Act, shall be deemed to be duly served upon a person, if such person has –

- Appeared in any proceeding relating to assessment or

- Cooperated in any enquiry relating to assessment.

- Such person cannot take any objection in any proceeding or inquiry under the Black Money Act that the –

-

- Notice was not served upon him or

- Was not served upon him in time or

- Was served upon him in an improper manner .

-

- Notice shall, however, not be deemed to have been served, if the person has raised the objection before the completion of an assessment .

APPEARANCE BY APPROVED VALUER IN CERTAIN MATTERS OR AUTHORIZED REPRESENTATIVE – SECTIONS 77 & 78

Any assessee, who is required to attend any proceedings under the Black Money Ac before any tax authority or Appellate Tribunal, he may do so through an authorized representative. In the case of matter relating to valuation of any asset, assessee may attend through a valuer as approved by Principal Commissioner or Commissioner in accordance with the prescribed Rules.

EXCEPTION : –

The above provision would not apply, where assessee is required to attend tax authority personally for examination on oath or affirmation under section 8.

MEANING OF AUTHORISED REPRESENTATIVE – SECTION 78

“Authorized representative” means a person authorized by the assessee in writing to appear on his behalf, being —

- a person related to the assessee in any manner, or a person regularly employed by the assessee;

- any officer of a scheduled bank with which the assessee maintains a current account or has other regular dealings;

- any legal practitioner who is entitled to practice in any civil court in India;

- an accountant ;

- any person who has passed any accountancy examination recognized in this behalf by the CBDT; or

- any person who has acquired a degree in Commerce or Law conferred by any Indian University incorporated by any law for the time being in force or certain prescribed foreign universities.

ROUNDING OFF OF INCOME, VALUE OF ASSET AND TAX – SECTION 79

The amount of undisclosed foreign income and undisclosed foreign assets shall be rounded off to the nearest multiple of one hundred rupees. For example, if the undisclosed foreign income was determined as Rs 1,15,160, then it shall be rounded off to Rs 1,15,200.

The amount payable or receivable by the assesse, under the Black Money Act shall be rounded off to the nearest multiple of ten rupees. For example, if the tax payable under the Black Money Act is Rs 10,134, then it shall be rounded off to Rs 10,130.

Where such amount contains a part of a rupee consisting of paise then, if such part is fifty paise or more, it shall be increased to one rupee and if such part is less than fifty paise it shall be ignored.

CONGNIZANCE OF OFFENCE – SECTION 80

A court inferior to that of a metropolitan magistrate or a magistrate of First Class cannot try any offence under this Act.

ASSESSMENT NOT TO BE INVALID ON CERTAIN GROUNDS – SECTION 81

No assessment, notice, summons or other proceeding under the Black Money Act shall be invalid or deemed to be invalid merely, by reason of any mistake, defect or omission in such assessment, notice, etc, when such assessment, notice, etc., is in substance and effect, in conformity with the intent and purpose of the Black Money Act.

In other words, the entire assessment should not be deemed to be invalid due to any minor mistake or defect in the notice or assessment orders.

BAR OF SUITS IN CIVIL COURTS – SECTION 82

No suit shall be brought in any civil court to set aside or modify any proceeding taken or order made under the Black Money Act.

Further, no prosecution, suit or other proceeding shall lie against the Government or any officer of the Government, for anything in good faith done or intended to be done, under the Black Money Act.

INCOME-TAX PAPERS TO BE AVAILABLE FOR THE PURPOSES OF THE BLACK MONEY ACT – SECTION 83

All information contained in any statement or return furnished under Income-tax Act or obtained or collected for the purposes of Income-Tax Act may be used for the purpose of the Black Money Act.

APPLICATION OF PROVISIONS OF THE INCOME-TAX ACT – SECTION 84

Following provisions of the Income-Tax Act shall apply with necessary modifications as if the said provisions refer to undisclosed foreign income and asset instead of to income-tax : –

- Clauses (c) and (d) of sub-section (1) of section 90,

- Clauses (c) and (d) of sub-section (1) of section 90A,

- Sections 119, 133, 134, 135, 138,

- Chapter XV and

- Sections 237, 240, 245, 280, 280A, 280B, 280D, 281, 281B and 284

| Section | Provision |

| 90(1)(c)/(d) | Power of Government to enter into an agreement with foreign country for exchange of tax information or recovery of tax |

| 90A(1)(c)/(d) | Power of Government to enter into an agreement with Specified territory outside India for exchange of tax information or recovery of tax |

| 119 | Instructions to sub-ordinate authorities |

| 133 | Power to call for information |

| 134 | Power to inspect registers of companies |

| 135 | Power of tax authority to make an enquiry |

| 138 | Disclosure of information respecting assesses |

| 237 | Refunds |

| 240 | Refund on appeal, etc |

| 245 | Set off of refunds against tax remaining payable. |

| 280 | Disclosure of particulars by public servants. |

| 280A | Special Courts |

| 280B | Offences triable by Special Court. |

| 280D | Application of Code of Criminal Procedure, 1973 to proceedings before Special Court. |

| 281 | Certain transfers to be void |

| 281B | Provisional attachment to protect revenue in certain cases |

| 284 | Service of notice in the case of discontinued business. |

| Chapter XV | Liability in special cases – Firm, AOP and BOIs |

AMENDMENT OF PREVENTION OF MONEY-LAUNDERING ACT, 2002 – SECTION 88

The Prevention of Money Laundering Act, 2002 has been amended to include offence of willful attempt to evade any tax, penalty or interest referred to in Section 51 under this legislation as a scheduled offence under Prevention of Money Laundering Act, 2002.