REVISION OF ORDERS PREJUDICIAL TO REVENUE – SECTION 23

There are instances where the Assessing Officer may pass orders which are prejudicial to the interest of revenue. The Assessing Officer may have interpreted certain provision of the Black Money Act in a manner which leads to lesser tax liability on the assesse, than what is rightfully due to the assesse or may not levy interest or penalty correctly. For example, if the Assessing Officer has computed tax liability of Mr. JJ as $ 20,000 due to wrong interpretation of certain income-tax provisions, while the actual tax liability would have been $ 50,000, if the provision were interpreted in right context, it would be the case of an order prejudicial to the interest of revenue.

These provisions are discussed as under : –

Examination of available records :-

Principal Commissioner/ Commissioner may call for and examine all available records , for the purpose of revising any order passed under the Black Money Act by a subordinate tax authority. “Record” shall include all records relating to any proceeding under the Black Money Act available at the time of examination by the Principal Commissioner or the Commissioner.

Opportunity of being heard

The Principal Commissioner/ Commissioner may pass a revision order if he is satisfied that the order sought to be revised is erroneous and prejudicial to the interests of the revenue. However, such revision order shall be passed only after giving the assessee an opportunity of being heard.

Inquiry

The Principal Commissioner or the Commissioner may make an inquiry for the purposes of passing the revision order. Accordingly, the Principal Commissioner or the Commissioner will the examine the records of the proceedings and then he may make further inquiry before passing the revision order.

No cancellation of assessment or fresh assessment

In the revision order passed by the Principal Commissioner or Commissioner, he may enhance or modify the assessment. Let’s understand this scenario with the help of an example.

Suppose, the Assessing Officer has determined the undisclosed black money as $ 10,000. The Principal Commissioner or Commissioner may enhance such income. He may also modify the assessment without enhancing the income if there is any factual error in the assessment order of the Assessing Officer.

However, it may be noted here that the Principal Commissioner or Commissioner shall not cancel the assessment and direct fresh assessment .

Matters Decided in Appeal

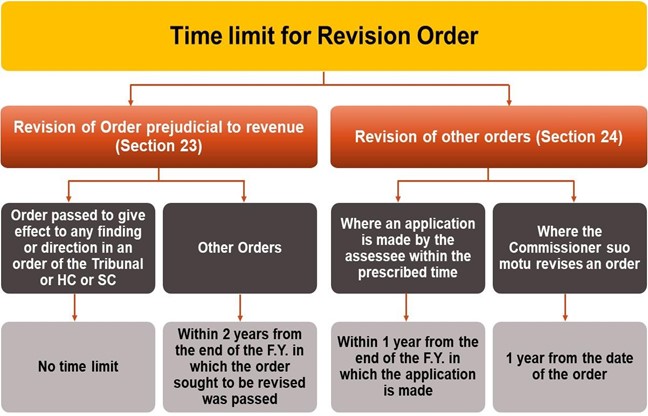

Time Limit for Passing Revision Order

Revision order shall not be passed after expiry of 2 years from end of the financial year in which the order sought to be revised was passed.

For example if the Assessing Officer has passed an order under the Black Money Act on December 15, 2017, the Principal Commissioner or Commissioner can revise such order only till March 31, 2020.

Notes :-

- Date of service of order is not relevant in determining the limitation period for passing the revision order by Principal Commissioner or Commissioner .

- Aforesaid time-limit of 2 years would not be applicable when there is any finding or direction contained in an order of the Appellate Tribunal, the High Court or the Supreme Court, otherwise through an appeal. Accordingly, revision order may be passed at any time in respect of an order which has been passed in consequence of, or to give effect to, any such finding or direction.

Exclusions in computing limitation period

There are certain exclusions of time period, which shall be added to the computing limitation period , to decide the time by which the revision order should be passed by the Principal Commissioner or Commissioner. These are discussed as under :-

- The time taken in giving an opportunity of being heard to the assessee, in case of change in tax authority :-

- The period during which any proceeding is stayed by an order or injunction of any court.

Circumstances in which order deemed to be Erroneous

The Principal Commissioner or the Commissioner cannot revise every order of the Assessing Officer under the Black Money Act. Only those orders which are deemed to be erroneous, can be revised .

An order passed by a tax authority shall be deemed to be erroneous in so far as it is prejudicial to the interests of the revenue and in the opinion of the Principal Commissioner or the Commissioner such order contains the following features :-

a) The order of the Assessing Officer is passed without making inquiries or verification which should have been made . For example suppose, Mr. B had a house property outside India , and the Assessing Officer did not enquire about the source of funds for investment in such property. In such case, the Principal Commissioner of the Commissioner can revise such order of the Assessing Officer.

b) The order of the Assessing Officer has not been made in accordance with any order, direction or instruction issued by the Board :-

There may be certain directions or instructions issued by the CBDT on the issues to be considered by the Assessing Officer while passing orders. If the Assessing Officer has passed order without considering such direction or instruction of CBDT, it would be deemed as erroneous order and it could be revised by the Principal Commissioner or the Commissioner.

c) The order of the Assessing Officer has not been passed in accordance with any decision, prejudicial to the assessee : –

There may be certain orders prejudicial to assessee , which are rendered by the Jurisdictional High Court or the Supreme Court on the issue considered by the Assessing Officer. These orders are binding on the AO and he needs to follow such decisions while passing orders. Where the Assessing Officer failed to do so, his order would be deemed to be erroneous and such order can be revised by the Principal Commissioner or the Commissioner.

REVISION OF OTHER ORDERS – SECTION 24

In the preceding paragraph, we had discussed about the powers of the Principal Commissioner or the Commissioner to revise orders, which are prejudicial to the interest of the revenue. Now we shall discuss about the Powers of the Principal Commissioner or the Commissioner to revise orders which are prejudicial to the interest of the assessee. The Principal Commissioner/Commissioner may, call for and examine all available records of the proceedings for the purpose of revising any order passed by subordinate authority. Such revision may be made by the Principal Commissioner or the Commissioner himself or on an application made by the assessee in this behalf. However, such revision shall be made only when order is prejudicial to the assessee. For example, if the Assessing Officer has assessed the undisclosed foreign income of the assessee at $ 20,000, the Principal Commissioner or the Commissioner cannot increase such undisclosed foreign income.

Power of the Principal Commissioner or the Commissioner declining to interfere with the order of the Assessing Officer

In certain cases, the application filed by the assessee may not be justified and the Principal Commissioner or the Commissioner , can decline to interfere with the order passed by the Assessing Officer. In such a case, the order passed by the Principal Commissioner or the Commissioner, declining to interfere shall not to be an order prejudicial to the assessee for the purposes of this section.

Orders which cannot be revised

There are certain orders which cannot be revised by the Principal Commissioner or the Commissioner. Such orders are given hereunder :-

a. Order against which an appeal has not been filed, but the time for filing an appeal before the Commissioner (Appeals) has not expired :-

For example, if the time-limit for filing appeal before the Commissioner (Appeals) is December 31, 2017, and the assessee files an application for revision of order of the Assessing Officer before the Commissioner on December 10, 2017. In such a case, the Commissioner shall not revise such order of the Assessing Officer , as the time limit for filing appeal before the Commissioner (Appeals) has not expired yet.

b. Order against which an appeal is pending before the Commissioner (Appeals) :-

Where the appeal against the order of the Assessing Officer is already pending before the Commissioner (Appeals), the Principal Commissioner or the Commissioner cannot revise such order of the Assessing Officer.

c. Order which has been considered and decided in any appeal :-

Where the order of Assessing Officer is challenged before the Commissioner (Appeals), and it was decided in such appeal, then the Commissioner cannot revise such order of the Assessing Officer.

Time limit for revision application by assessee

The assessee shall make the application for revision of any order, within the earlier of the following –

a) 1 year from the date on which the order sought to be revised was communicated to him, or

b) the date on which he otherwise came to know of it.

Extended time-limit for making an application for revision of order

The Principal Commissioner or the Commissioner, may admit the application for revision after the expiry of aforesaid period of one year, if he is satisfied that the assessee was prevented by sufficient cause from making an application.

However, such revision application shall be made before expiry of two years from the date –

- on which the order sought to be revised was communicated to him,

- or the date on which the assessee otherwise came to know of it,

whichever is earlier.

Fees for filing revision application

Every application by an assessee for revision under this section shall be accompanied by such fees as may be prescribed.

Time limit for passing revision order

| Circumstances | Time-limit for passing revision order |

| Where application for revision is made by assessee | No revision order shall be passed after expiry of 1 year from the end of FY in which application is made by assessee |

| Where order is revised by the Commissioner suo-motu | No revision order shall be passed after expiry of 1 year from the date of order sought to be revised |

Exclusions in computing the time limit for passing revision order

The following period shall not be included in computing the limitation period for passing revision order :-

- Time taken in giving an opportunity of being heard to the assessee [under section 7 ] in case of change in tax authority ; or

- The period during which any proceeding under this section is stayed by an order or injunction of any court.

The provisions relating to the time-limit for revision of order are as under : –

For any queries, please write them in the Comment Section or Talk to our tax expert