Adjustment of Partners’ Capitals – When a partnership firm is reconstituted due to retirement or death of a partner, the continuing partners can come to an agreement where they decide to bring their capital contributions in proportion to their profit sharing ratio.

This adjustment of capital amount is carried out by treating the sum of capital balances of the remaining partners as the base i.e., considering this amount as the total capital of the reconstituted firm. This amount is then divided between the remaining partners in their profit sharing ratio and any excess or deficit is settled. If this results in excess, then the partner shall adjust his capital by withdrawing the excess balance and if it results in deficiency, then the partner is required to bring in capital contribution.

The following journal entries are passed –

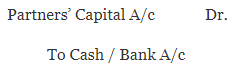

In case of excess capital to be withdrawn –

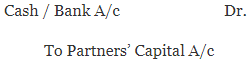

In case of deficit, capital contribution to be made-

The adjustments of a partner’s capital account can be done in any of the below mentioned three ways depending on the demand of the question.

- When the partners together decide the capital amount of the new firm.

- When there is no specific agreement on capital amount. In this case, the total capital of the new firm is the sum total of the capital of the continuing partners.

- When the continuing partners decide to contribute the amount payable to the retiring partner in such a way that their capitals become automatically proportionate to their new profit sharing ratio.

Upon retirement or death of a partner, the remaining partners may decide to adjust their capital accounts to bring them in line to a pre-decided amount or in proportion of their profit sharing ratio.

Example 1

G , H and I are partners sharing profits and losses in the ratio of 2 , 1 and 2 respectively. H retired from the

rm and adjusted capitals of G and I on the date of retirement was Rs. 70000 and 80000 respectively.The entire

capital of the new firm is fixed at Rs. 150000 .What will be the necessary entry for cash to be paid off or to be

brought in by G and I to make their total capital equal to new capital of the firm.

Explanation:

New ratio between G and I after the retirement of H = 2/4 : 2/4

Total capital of the new firm = 150000

New capital of G = 75000 ( 150000 x (2/4) )

Less: Adjusted capital of G = 70000

Deficiency = 5000

New capital of I = 75000 ( 150000 x (2/4) )

Less: Adjusted capital of I = 80000

Surplus = -5000

Cash/Bank A/c Dr 5000

To G s Capital A/c 5000

I s Capital A/c Dr 5000

To Cash/Bank A/c 5000

Adjustment of Partners’ Capitals – Example 2

H , I and J are partners sharing profits and losses in the ratio of 1 , 2 and 3 respectively. I retired from the

firm and adjusted capitals of H and J on the date of retirement was Rs. 90000 and 60000 respectively.The entire

capital of the new firm is fixed at Rs. 180000 .What will be the necessary entry for cash to be paid off or to be

brought in by H and J to make their total capital equal to new capital of the firm.

Explanation:

New ratio between H and J after the retirement of I = 1/4 : 3/4

Total capital of the new firm = 180000

New capital of H = 45000 ( 180000 x (1/4))

Less: Adjusted capital of H = 90000

Surplus = -45000

New capital of J = 135000 ( 180000 x (3/4))

Less: Adjusted capital of J = 60000

Decience = 75000

H s Capital A/c Dr 45000

To Cash/Bank A/c 45000

Cash/Bank A/c Dr 75000

To J s Capital A/c 75000

Chapter 4 – Reconstitution of a Partnership Firm

- Retirement/Death of a Partner

- Ascertaining the Amount Due to Retiring/Deceased Partner

- New Profit Sharing Ratio

- Gaining Ratio

- Treatment of Goodwill

- Adjustment for Revaluation of Assets and Liabilities/Adjustment of Accumulated Profits and Losses

- Disposal of Amount Due to Retiring Partner

- Adjustment of Partners’ Capitals

- Death of a Partner