Classification of Ratios : Accounting ratios are used to analyse the financial position of the firm. They are being categorised into different types which are given as below:

- Balance Sheet Ratios

- Statement of Profit & Loss Ratios

- Composite Ratios

However, from the users point of view, they are interested to know about the liquidity, solvency, turnover and profitability of the organisation. So, the main categories of ratio from financial users perspective are:

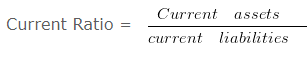

Liquidity Ratios : Liquidity means the firms ability to meet its current liabilities. In other words, the ability of a business to pay its short-term debts is frequently referred to as liquidity position of the business. Short term creditors of the firm are generally interested to know about the liquidity position of the firm. The liquidity ratio is further categorised into two parts: (i) Current Ratio & (ii) Liquid Ratio

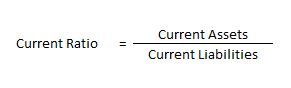

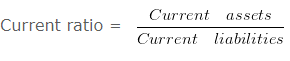

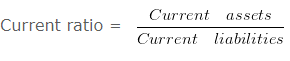

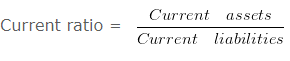

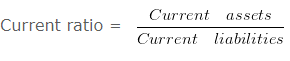

a. Current Ratio : It shows the relationship between current assets and current liabilities. It is also known as working capital ratio. The ideal current ratio is 2:1. The term current assets means the assets which are easily convertible into cash or cash equivalents within 12 months & the term current liabilities means the liabilities which are payable within a period of 12 months.

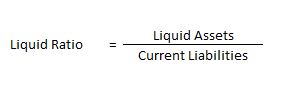

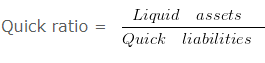

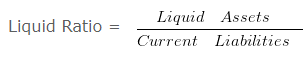

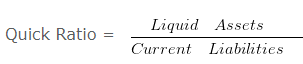

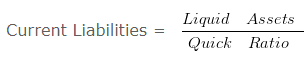

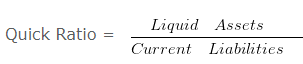

b. Liquid Ratio : It shows the relationship between liquid assets and current liabilities. It is also known as acid test ratio or quick ratio. The ideal liquid ratio is 1:1. The term liquid assets means the assets which are easily convertible into cash or cash equivalents very shortly. All current assets except inventories and prepaid expenses are included in liquid assets.

Computation of current ratio

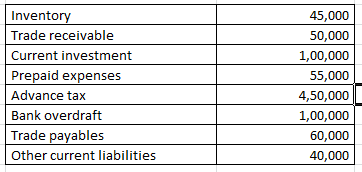

Classification of Ratios : Example 1

On the basis of the following information calculate the current ratio:

Explanation : –

Current ratio = 700000/200000

Current ratio = 3.5 :1

Working note 1 : Current assets = Inventory + Trade receivable + Current investment + Prepaid expenses + Advance tax

Current assets = 45000 + 50000 + 100000 + 55000 + 450000

Current assets = 700000

Working note 2 : Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 100000 + 60000 + 40000

200000

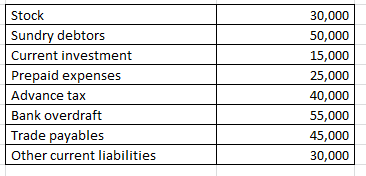

Computation of liquidity ratio

Classification of Ratios : Example 2

On the basis of the following information calculate the liquidity ratio:

Explanation : –

![]()

Liquidity ratio = 65000/130000

Liquidity ratio = 0.5 :1

Working note 1 : Liquid assets = Current assets (-) ( Stock + Prepaid expenses + Advance tax )

Liquid assets = 160000 (-) 30000 + 25000 + 40000

Liquid assets = 65000

Working note 2 : Current assets = Stock + Sundry debtors + Current investment + Prepaid expenses + Advance tax

Current assets = 30000 + 50000 + 15000 + 25000 + 40000

Current assets = 160000

Working note 3 : Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 55000 + 45000 + 30000

130000

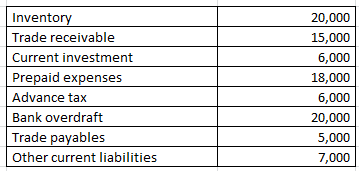

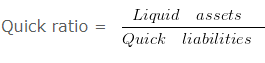

Computation of quick ratio

Classification of Ratios : Example 3

On the basis of the following information calculate the Quick ratio:

Explanation : –

Quick ratio = 21000/12000

Quick ratio = 1.75 :1

Working note 1 : Liquid assets = Current assets (-) ( Inventory + Prepaid expenses + Advance tax )

Liquid assets = 65000 (-) 20000 + 18000 + 6000

Liquid assets = 21000

Working note 2 : Quick liabilities = Current liabilities (-) Bank overdraft

Quick liabilities 32000 (-) 20000

Quick liabilities 12000

Working note 3 : Current assets = Inventory + Trade receivable + Current investment + Prepaid expenses + Advance tax

Current assets = 20000 + 15000 + 6000 + 18000 + 6000

Current assets = 65000

Working note 4 : Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 20000 + 5000 + 7000

32000

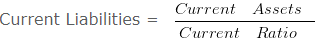

when current liabilities are given

Classification of Ratios : Example 4

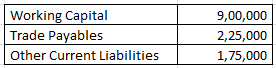

From the following information compute the current ratio.

Explanation : –

Current Ratio = 1300000/400000

Current Ratio = 3.25 :1

Workings:

Working Capital = Current assets (-) current liabilities

900000 = Current assets (-) 400000

Current assets = 1300000

Workings:

current liabilities = Trade Payables (+) Other Current Liabilities

current liabilities = 225000 (+) 175000

current liabilities = 400000

Determination of working capital

Classification of Ratios : Example 5

From the following given information:

A firm had current assets of RS. 140000

it then paid a current liability of RS. 20000

After this payment the current ratio was 3 : 2

Determine the current liabilities and working capital after the payment.

Explanation : –

Working capital = Current assets (-) Current liabilities

= 120000 (-) 80000

= 40000

Workings:

Current Assets = 140000

Current Assets After the payment of RS. 20000 would be 140000 (-) 20000 = 120000

As current ratio is 3 : 2 and current assets are RS. 120000

3/2 = 120000/Current liabilities

Current liabilities = 240000/3

Current liabilities = 80000

Determination of working capital when current ratio given

Classification of Ratios : Example 6

From the following information:

A firm had current assets of RS. 225000

it then paid a current liability of RS. 45000

After this payment the current ratio was 9 : 7

Determine the current liabilities and working capital Before the payment.

Explanation : –

(i) Working capital = Current assets (-) Current liabilities

= 180000 (-) 140000

= 40000

Workings:

Current Assets = 225000

Current Assets After the payment of RS. 45000 would be 225000 (-) 45000 = 180000

As current ratio is 9 : 7 and current assets are RS. 180000

9/7 = 180000/Current liabilities

Current liabilities = 1260000/9

Current liabilities = 140000

Before the payment of liabilities of RS. 45000 total amount of

Current liabilities = 45000 + 140000

Current liabilities = 185000

Working capital = 40000

Liquid ratio on the basis of working capital

Classification of Ratios : Example 7

Current Assets = Rs. 80000 . Inventory = Rs. 15000 . Prepaid Expenses = Rs. 50000 . Working Capital = Rs. 50000 Calculate Liquid Ratio.

Explanation : –

Liquid Assets = Current Assets (-) Inventory (-) Prepaid Expenses

Liquid Assets = 80000 (-) 15000 (-) 50000

Liquid Assets = 15000

Current Liabilities = 30000

Liquid Ratio = 15000/30000

Liquid Ratio = 0.5

Working Note 1 :

Current Liabilities = Current Assets (-) Working Capital

= 80000 (-) 50000

= 30000

Calculation of Liquid Ratio

Classification of Ratios : Example 8

Current Assets of ABC Ltd. are Rs. 72000 and the current ratio is 1.2 . Value of inventories is Rs. 27000 . Calculate liquid ratio.

Explanation : –

OR

Current Liabilities = 72000/1.2

Current Liabilities = 60000

Quick Ratio = 45000/60000

Quick Ratio = 0.75

Working Notes:

Liquid Assets = Current Assets (-) Inventory

Liquid Assets = 72000 (-) 27000

Liquid Assets = 45000

Current Ratio on the basis of Quick Ratio

Classification of Ratios : Example 9

Value of Inventory of HRD & Co. is Rs. 240000 . Liquid Assets are Rs. 120000

Quick Ratio is 0.5 . Calculate the current ratio .

Explanation : –

OR

Current Liabilities = 120000/0.5

Current Liabilities = 240000

Current Ratio = 360000/240000

Current Ratio = 1.5 :1

Working Notes:

Current Assets = Liquid Assets + Inventory

= 120000 + 240000

= 360000

Solvency Ratio Analysis

Solvency Ratio Analysis : It measure the ability of a business to survive for a long period of time. These ratios are very important for stockholders and creditors as these ratios assess the ability of the firm to meet its long term liabilities.

The solvency ratios are categorised into following types :

a) Debt Equity Ratio

b) Total Assets to Debt Ratio

c) Proprietary Ratio

d) Interest Coverage Ratio

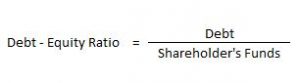

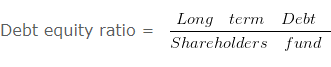

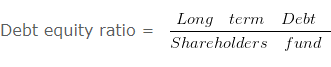

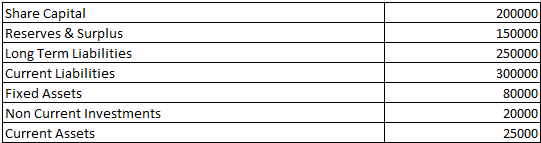

Debt Equity Ratio

It explains the relationship between long term debts and shareholder’s funds. The debt-equity ratio of 2:1 is considered as ideal.

Here, Debt includes Long-term Borrowings and Long-term Provisions. Shareholder’s Funds include Share Capital and Reserve & Surplus.

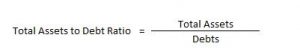

Total Assets to Debt Ratio

This ratio is a variation of debt-equity ratio. In this ratio, assets are expressed in terms of long term debts.

Here, Total Assets = Non- Current Assets + Non-Current Investments + Long Term Loans & Advances + Current Assets

Debts = Long-term Borrowings and Long-term Provisions

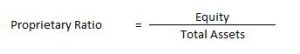

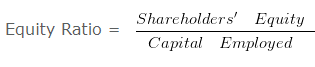

Proprietary Ratio

It is the proportion of total assets funded by the shareholders. A higher proprietary ratio is an indicator of sound financial position from long-term point of view.

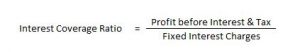

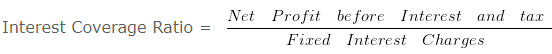

Interest Coverage Ratio

The interest coverage ratio is a debt ratio and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. This ratio indicates how many times the interest charges are covered by the profits available to pay interest charges.

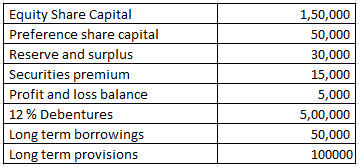

How to compute debt equity ratio – Solvency Ratio Analysis – Question 1

From the following information calculate the debt equity ratio.

Explanation : –

= 650000/250000

= 2.6 : 1

Working note 1 : Long term Debt = 12 % Debentures + Long term borrowings + Long term provisions

Long term Debt = 500000 + 50000 + 100000

Long term Debt = 650000

Working note 2 : Shareholders fund = Equity Share Capital + Preference share capital + Reserve and surplus + Securities premium + Profit and loss balance

Shareholders fund = 150000 + 50000 + 30000 + 15000 + 5000

Shareholders fund = 250000

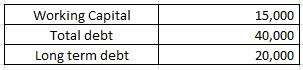

When total debts are given – Solvency Ratio Analysis – Question 2

From the following information compute the current ratio.

Explanation : –

Current Ratio = 35000/20000

Current Ratio = 1.75 :1

Workings:

Working Capital = Current assets (-) Current liabilities

15000 = Current assets (-) 20000

Current assets = 35000

Workings:

Current liabilities = Total debt (-) Long term debt

Current liabilities = 40000 (-) 20000

Current liabilities = 20000

How to compute debt equity ratio – Solvency Ratio Analysis – Question 3

From the following information calculate debt equity ratio.

Explanation : –

Debt equity ratio = 200000/400000

Debt equity ratio = 0.5 : 1

Working note 1 : Long term Debt = Long term borrowings + Long term provisions

Long term Debt = 120000 + 80000

Long term Debt = 200000

Working note 2 : Shareholders fund = Non current assets + Working capital (-) Non current liabilities

OR

Shareholders fund = Non current assets + Current assets (-) Current liabilities (-) Long term borrowings (-) Long term provisions

Shareholders fund = 500000 + 200000 (-) 100000 (-) 120000 (-) 80000

Shareholders fund = 400000

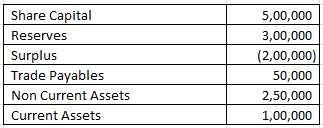

Calculation of Equity ratio – Solvency Ratio Analysis – Question 4

From the Following information calculate Equity Ratio

Explanation : –

Equity Ratio = 600000/300000

Equity Ratio = 2

Working note 1 :

Shareholders’ Equity = Share Capital + Reserves + Surplus

= 500000 + 300000 + -200000

= 600000

Capital employed = Non Current Assets + Current Assets (-) Trade Payables

Capital employed = 250000 + 100000 (-) 50000

Capital employed = 300000

Calculation of Proprietary Ratio – Solvency Ratio Analysis – Question 5

Compute Proprietary ratio if equity share capital is Rs. 125000 ,Preference Share Capital is Rs. 100000 ,Capital Reserve is Rs. 80000 ,Profit & Loss Balance is Rs. 55000 . The value of 7 % Debentures is Rs. 62500 and 9 % Mortgage loan- Rs. 112500 .Value of Current Liabilities

is Rs. 262500 Non Current Assets is worth Rs. 275000 Value of Current Assets is Rs. 125000 .

Explanation : –

Proprietary Ratio = 360000/400000

Proprietary Ratio = 0.9

Working note 1 : Shareholders’ Funds = Equity share capital + Preference share capital + Capital reserve + Profit and loss balance

Shareholders’ Funds = 125000 + 100000 + 80000 + 55000 Shareholders’ Funds = 360000

Working note 2 : Total Assets = Non current assets + Current assets

Total Assets = 275000 + 125000

Total Assets = 400000

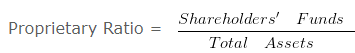

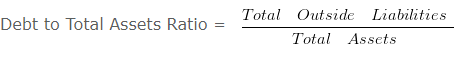

Debt to total assets ratio – Solvency Ratio Analysis – Question 6

Compute Debt to Total Assets Ratio from the above information.

Explanation : –

Debt to Total Assets Ratio = 250000/125000

Debt to Total Assets Ratio = 2 :1

Working note 1 :

Total Assets = Fixed Assets + Non Current Investments + Current Assets

= 80000 + 20000 + 25000

Total Assets = 125000

Interest Coverage Ratio – Solvency Ratio Analysis – Question 7

Compute Interest Coverage ratio if equity share capital is Rs. 1200000 ,Preference Share Capital is Rs. 720000 ,Capital Reserve is Rs. 360000 ,Profit & Loss Balance is Rs. 600000 . The Value of 13 % debentures is Rs. 250000 and 11 % Mortgage loan of Rs. 300000 .The value of Current Liabilities is Rs. 1180000 Non Current Assets is worth Rs. 2400000 Value of Current Assets is Rs. 3000000 .

Explanation : –

Interest Coverage Ratio = 589500/65500

Interest Coverage Ratio = 9 times

Working Notes:

Interest on debenture = 13% x 250000

= 32500

Interest on loan = 11% x 300000

33000

Total interest charges = 6550

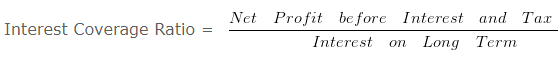

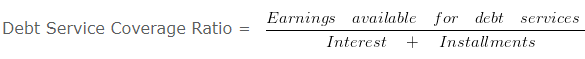

Interest Coverage Ratio & Debt Service Coverage Ratio – Question 8

Calculate- Interest Coverage Ratio & Debt Service Coverage Ratio from the following information. Net Profit before interest and tax is Rs. 300000 . 5 % Long Term Debt 500000 (Principle amount is repayable in 10 equal installments) .

Explanation : –

= 300000/25000

= 12 times

Debt Service Coverage Ratio = 300000/(25000+50000)

Debt Service Coverage Ratio = 300000/75000

Debt Service Coverage Ratio = 4 times

Working Notes:

1. Interest on Long Term Debt = 5 % x 500000

25000

Activity Ratio Analysis

Activity Ratio Analysis – Activity ratios are financial analysis tools used to measure a business’ ability to convert its assets into cash. These ratios are known as turnover ratios because they indicate the rapidity with which the resources available to the concern are being used to produce revenue from operations.

The different types of activity ratios are:

- Inventory Turnover Ratio

- Trade Receivables Turnover Ratio

- Trade Payables Turnover Ratio

- Working Capital Turnover Ratio

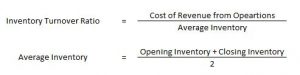

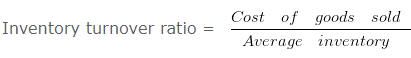

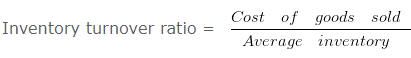

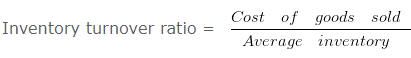

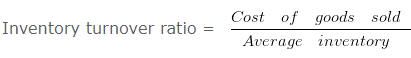

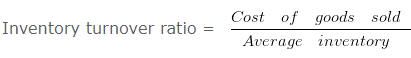

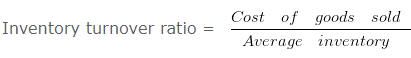

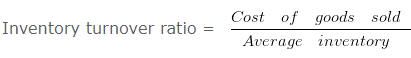

Inventory Turnover Ratio

It indicates the relationship between the cost of revenue from operations during the year and average inventory during the year.

Here, Cost of Revenue from Operations = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

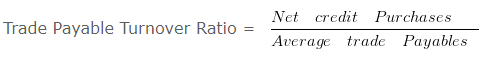

Trade Payables Turnover Ratio

It indicates the relationship between credit purchases and average trade payables during the year.

Trade Payables include Creditors and Bills Payables.

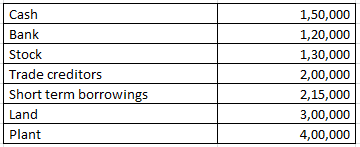

Trade Receivables Turnover Ratio

It indicates the relationship between credit revenue from operations and average trade receivables during the year.

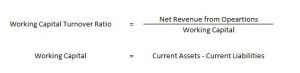

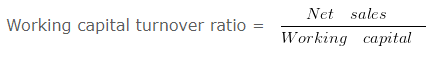

Working Capital Turnover Ratio

This ratio is important in non-manufacturing concerns where current assets play a major role in generating sales. It indicates the efficient use of working capital.

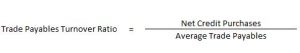

Calculation of current assets turnover ratio – Classification of Ratios – Question 1

From the following information calculate the Current assets turnover ratio:

Revenue from the operation for the year were RS. 2800000

Explanation : –

Current assets turnover ratio = 2800000/400000

Current assets turnover ratio = 7 Times

Working note 1 : Current assets = Cash + Bank + Stock

Current assets = 150000 + 120000 + 130000

Current assets = 400000

Calculation of inventories when Inventory Ratio is given – Classification of Ratios – Question 2

Calculate the value of opening Inventory from the following information.

Cost of revenue from operations is 1200000 and Inventory turnover ratio is 3 Times. and opening inventory is 40000 less than the closing inventory

Explanation : –

3 = 1200000/Average inventory

Average inventory = 400000

Workings:

Opening inventory = 400000 (-)40000/2

Opening inventory 380000

Closing inventory = 400000 (+)40000/2

Closing inventory = 420000

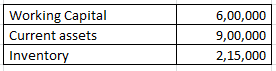

Activity Ratio Analysis – Classification of Ratios – Question 3

Calculate the value of opening Inventory from the following information:

Cost of revenue from operations is 16000 and Inventory turnover ratio is 1 Times. and opening inventory is 6 Times More than the closing inventory.

Explanation : –

1 = 16000/Average inventory

Average inventory = 16000

Workings:

32000 = Opening inventory + Closing inventory

Since the opening inventory is 6 Times More than the closing inventory therefore the ratio between opening inventory and closing inventory will be 7 : 1

Opening inventory = 32000 x 7/8

Opening inventory = 28000

Closing inventory = 32000 x 1/8

Closing inventory = 4000

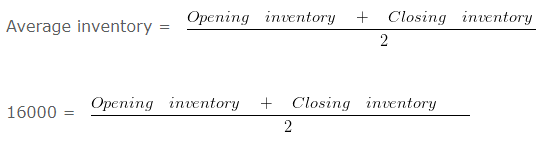

When inventory and current assets given – Classification of Ratios – Question 4

From the following information compute the current ratio.

Explanation : –

Current Ratio = 900000/300000

Current Ratio = 3 :1

Workings:

Working Capital = Current assets (-) Current liabilities

600000 = 900000 (-) Current liabilities

Current liabilities = 300000

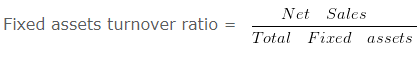

Fixed assets turnover ratio – Classification of Ratios – Question 5

From the following information, calculate fixed assets turnover ratio:

Revenue from the operation for the year were RS. 2000000

Explanation : –

Fixed assets turnover ratio = 2000000/500000

Fixed assets turnover ratio = 4 Times

Total Fixed assets = Land + Building + Furniture

Total Fixed assets = 300000 + 50000 + 150000

Total Fixed assets = 500000

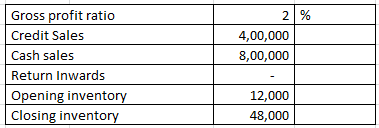

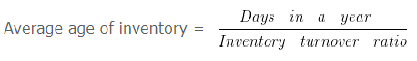

Inventory turnover ratio and average age of inventory – Classification of Ratios – Question 6

Calculate Inventory turnover ratio and average age of inventory from the following information:

Explanation : –

Inventory turnover ratio = 1176000/30000

Inventory turnover ratio = 39.2 Times

Average age of inventory = 360/39.2

= 9.18 Days

Workings:

Cost of goods sold = Net Sales (-) gross profit

1200000 (-) 2% X 1200000

1200000 (-) 24000

1176000

Net sales = Cash sales + Credit Sales (-) Return Inwards

800000 + 400000 (-) 0

1200000

= 30000

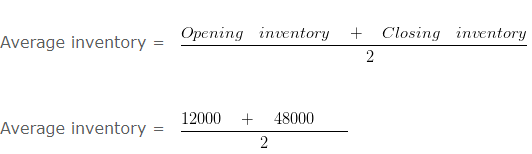

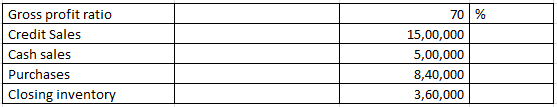

Inventory turnover ratio when closing stock is given – Classification of Ratios – Question 7

Calculate Inventory turnover ratio from the following information:

Explanation : –

Inventory turn over ratio = 600000/240000

= 2.5 Times

Workings:

Cost of goods sold = Net Sales (-) gross profit

= 2000000 (-) 70% x 2000000

= 2000000 (-) 1400000

= 600000

Net sales = Cash sales + Credit Sales

500000 + 1500000

2000000

Average inventory = 240000

Cost of goods sold = Opening inventory + Purchases (-) Closing inventory

600000 = Opening inventory + 840000 (-) 360000

= Opening inventory + 480000

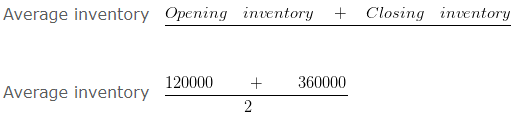

Opening inventory = 120000

Inventory turnover ratio when GP ratio based on cost – Classification of Ratios – Question 8

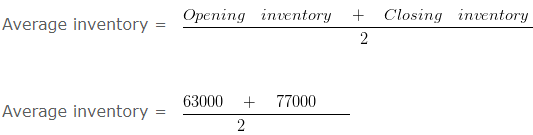

Calculate Inventory turn over ratio from the following information: Gross profit ratio is 10 % Of cost and revenue from operation is RS. 770000 . Opening inventory was 9/11 of closing inventory and closing inventory was 10 % of revenue from operation.

Explanation : –

Inventory turnover ratio = 700000/70000

Inventory turnover ratio = 10 Times

Working note: = Gross profit ratio is 10% Of cost

Therefore goods costing Rs. = 100 is sold for RS. 110

Cost of goods sold = 100

If revenue from operation is = 770000

Cost of goods sold = 700000 ( 770000 X 100/110 )

= 70000

Closing inventory = 10% x Revenue from operation

Closing inventory = 10% x 770000

Closing inventory = 77000

Opening inventory = 9/11 x Closing inventory

Opening inventory = 9/11 x 77000

Opening inventory = 63000

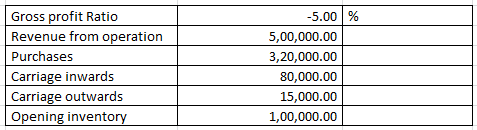

Inventory turnover ratio when GP ratio is negative – Classification of Ratios – Question 9

Calculate Inventory turnover ratio from the following information:

Explanation : –

Inventory turnover ratio = 525000/37500

Inventory turnover ratio = 14 Times

Workings:

Cost of goods sold = Revenue from operation (-) gross profit

= 500000 (-) -5% X 500000

= 500000 (-) -25000

= 525000

= 37500

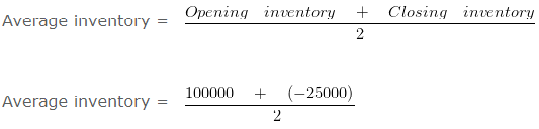

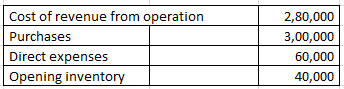

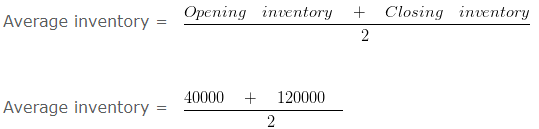

Inventory turnover ratio when opening stock is given – Classification of Ratios – Question 10

Calculate Inventory turn over ratio from the following information:

Explanation : –

Inventory turn over ratio = 280000/80000

Inventory turn over ratio = 3.5 Times

Workings:

Cost of goods sold = Opening inventory + Purchases + Direct expenses – Closing inventory

280000 = 40000 + 300000 + 60000 – Closing inventory

Closing inventory = 120000

Average inventory = 80000

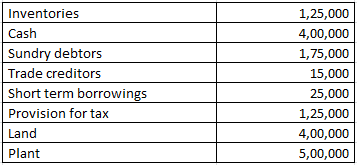

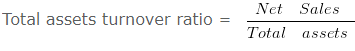

Total assets turnover ratio – Classification of Ratios – Question 11

From the following information calculate the total assets turnover ratio.

Revenue from the operation for the year were RS. 4800000

Explanation : –

Total assets turnover ratio = 4800000/1600000

Total assets turnover ratio = 3 Times

Working note 1 : Total assets = Inventories + Cash + Sundry debtors + Land + Plant

Total assets = 125000 + 400000 + 175000 + 400000 + 500000

Total assets = 1600000

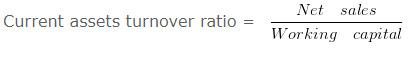

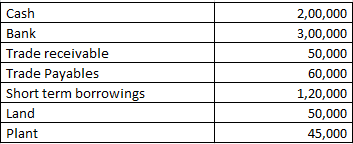

Working capital turnover ratio – Classification of Ratios – Question 12

From the following information calculate the working capital turnover ratio:

Revenue from the operation for the year were RS. 1850000

Explanation : –

Working capital turnover ratio = 1850000/370000

Working capital turnover ratio = 5 Times

Working note 1 : Working capital = Current assets (-) Current liabilities

Working capital = 550000 (-) 180000

Working capital = 370000

Working note 2 : Current assets = Cash + Bank + Trade receivable

Current assets = 200000 + 300000 + 50000

Current assets = 550000

Working note 3 : Current liabilities = Trade Payables + Short term borrowings

Current liabilities = 60000 + 120000

Current liabilities = 180000

Determination of current assets when current ratio is given – Question 13

Current Ratio of a business is 13 : 11 and Quick Ratio is 0.75 .

If Working Capital is Rs. 200000 then calculate the value of current assets and inventory.

Explanation : –

Working Capital = Current Assets (-) Current Liabilities

or

Current Liabilities = Current Assets (-) Working Capital

= 1300000 (-) 200000

= 1100000

or

Liquid Assets = Current Liabilities x Quick Ratio

= 1100000 x 0.75

= 825000

Inventory = Current Assets (-) Liquid Assets

= 1300000 (-) 825000

= 475000

Working Note 1 :

Working Capital = Current Assets (-) Current Liabilities

Working Capital = 13 (-) 11

Working Capital = 2

When working capital = 2 then Current Assets = 13

When working capital = 200000 then Current Assets = 1300000

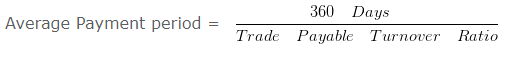

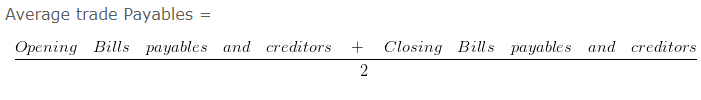

Trade payable turnover ratio – Classification of Ratios – Question 14

Calculate the trade payable turnover ratio and average payment period From the following information. Credit purchases during the 2016-2017 is 1000000 . Balance of opening Creditors and Bills payable on 01.04.2016 is RS. 40000 and 15000 and the Balance of Closing Creditors and bills payable on 31.03.2017 is RS. 35000 and 10000

Explanation : –

Trade Payable Turnover Ratio = 1000000/50000

Trade Payable Turnover Ratio = 20 Times

Average Payment period = 360/20

Average Payment period = 18 Days

Workings:

Average trade Payables = 100000/2

Average trade Payables = 50000

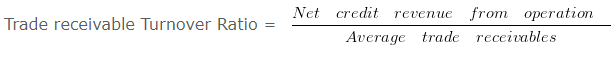

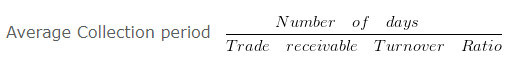

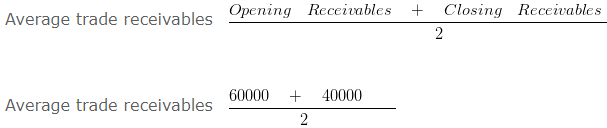

Trade receivable turnover ratio – Classification of Ratios – Question 15

Calculate the Trade receivable Turnover Ratio and average collection period from the following information: Total revenue from the operation is 100000 and cash revenue is 10 % of total revenue from the operation. Balance of opening receivable on 01.04.2016 is RS. 60000 and the Balance of Closing receivable on 31.03.2017 is 40000

Explanation : –

Trade receivable Turnover Ratio = 90000/50000

Trade receivable Turnover Ratio = 1.8 Times

Average Collection period = 360/1.8

Average Collection period = 200 Days

Workings:

Credit sales = 100000 x 0.9

= 90000

Average trade receivables 50000

Profitability Ratios

It is also known as income ratio. The objective of every organisation is to earn profit and hence the organisations would definitely want to keep a track on various aspects of profit like operating profit, net profit etc. Therefore, they prepare and compute the profitability ratios.

The different types of profitability ratios are:

- Gross Profit Ratio

- Operating Ratio

- Net Profit Ratio

- Operating Profit Ratio

- Earning Per Share

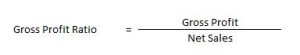

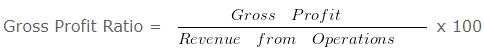

Gross Profit Ratio

This ratio establishes a relationship between Gross profit and revenue from Operations i.e. Net Sales.

Gross Profit = Revenue from Operations – Cost of Revenue from Operations

Cost of Revenue from Operations = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

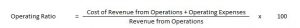

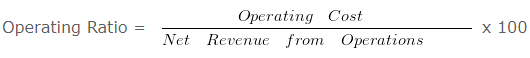

Operating Ratio

This ratio compares an enterprise’s cost of revenue from operations and operating expenses to its revenue from operations.

Cost of Revenue from Operations = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

Operating Expenses = Employee Benefit Expense + Depreciation Expense + Other Expense

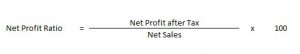

Net Profit Ratio

This ratio establishes a relationship between Net profit and revenue from Operations i.e. Net Sales.

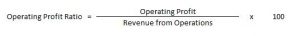

Operating Profit Ratio

Operating Profit = Gross Profit – Other Operating Expenses + Other Operating Incomes

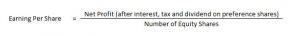

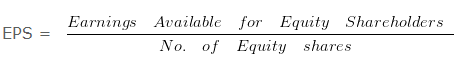

Earning Per Share

Earning per share helps in calculating the profitability of the company.

Calculation of Earning Per Share

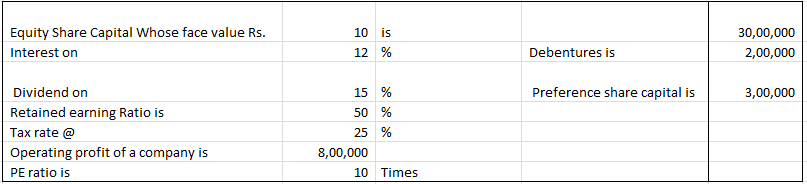

Profitability Ratios – Questions 1 : –

On the basis of the following data calculate earning per share

Explanation: –

EBIT = 800000

Less: Interest on Debentures = 200000

EBT = 600000

Less: Tax = 150000

EAT = 450000

Less: Preference Dividend = 300000

Earnings for Equity Shareholders = 150000

Less: Retained Earnings = 75000

Dividend Paid = 75000

= 150000/300000

= 0.5 Per share

Gross Profit Ratio, Operating Ratio & Operating Profit Ratio

Profitability Ratios – Question 2 : –

The following information is given

If Revenue from Operations of XYZ Ltd is Rs. 1000000 Cost of Revenue from Operations is Rs. 450000 Selling Expense is Rs. 80000 Administrative Expenses is Rs. 60000

Calculate- Gross Profit Ratio ,Operating Ratio , Operating Profit Ratio

Explanation : –

Gross Profit Ratio= 550000/1000000 x 100 = 55%

Operating Ratio = 590000/1000000 x 100

Operating Ratio = 59 %

= 100 (-) Operating Ratio

= 100 (-) 59

Operating Profit Ratio = 41 %

Working Notes:

Gross Profit = Revenue from Operations (-) Cost of Revenue from Operations

Gross Profit = 1000000 (-) 450000

Gross Profit = 550000

Operating Cost = Cost of Revenue from Operations + Selling Expenses + Administrative Expenses

Operating Cost = 450000 + 80000 + 60000

Operating Cost = 590000