AMENDMENT MADE BY FINANCE ACT , 2018 –

BUSINESS CONNECTION WHEN AGENT OF NON-RESIDENT HAS AUTHORITY TO CONCLUDE CONTRACTS IN INDIA – SECTION 9(1)(i)

The “ business connection” shall include any business activity, carried out by the non-resident through a person who, acts on behalf of the non-resident, and in performing such an act he : –

- Has an authority to conclude contracts on behalf of the non-resident which is habitually exercised to conclude contracts on behalf of the non-resident; or habitually plays the principal role leading to conclusion of contracts by the non-resident,

The above provision shall be applicable provided that the contracts are –

- In the name of the non-resident ; or

- For the transfer of the ownership of property owned by that non-resident or property for which the non resident has the right to use ; or

- For the granting of the right to use, property owned by that non-resident or property for which the non resident has the right to use; or

- For the provision of services by that non-resident

When authority is not exercised

If the agent has an authority to conclude contracts but such authority is not exercised , in such a case the non-resident would not have a business connection in India.

Agent qualifies to be an independent agent

Further, if such an agent qualifies to be an independent agent, the non-resident would not have a business connection in India. An agent who is a broker, general commission agent or any other agent, who are acting in the ordinary course of their business, they shall be treated as agent of independent status.

Goods are exported to a third party

However there may be cases, where even though goods are procured in India by the agent , and are exported out of India, the goods are exported to a third party, and the non-resident is merely a broker for a trader. In such a case, the non-resident may have a business connection in India.

- ALIGNING THE SCOPE OF “BUSINESS CONNECTION” WITH MODIFIED PE RULE AS PER MULTILATERAL INSTRUMENT (MLI).

- As discussed above, under the existing Rules relating to Dependent Agent Permanent Establishment (DAPE) in India’s Double Taxation Avoidance Agreements (DTAAs) if any person acting on behalf of the non-resident, is habitually authorised to conclude contracts and such authority is exercised for the non-resident, then such agent would constitute a PE in the source country. Let us understand this scenario with the help of following illustration :-

Illustration :-

XY International (UK) is engaged in the business of selling ‘Product A’. It appoints Mr. R as agent in India for selling such product. Mr. R negotiates with the customers in India on pricing and other terms of the contract and concludes such contract on behalf of XY International. In this case, Mr. R would be deemed as dependent agent of XY International in India. Thus, any profit attributable to his operations in India would be taxable in India.

- In order to avoid establishing an agency PE under Article 5 of the DTAA, the person acting on the behalf of the non-resident, negotiates the contract and finalizes delivery terms, etc. on behalf of non-resident but does not conclude it . Thus, such agents were able to bypass provisions of Agency PE through this route . We can understand this situation with the help of following illustration

Illustration :-

ABCD International (UK) is engaged in the business of selling ‘Product X’. It appoints Mr. B as agent in India for selling such product. Mr. B negotiates the contract with the customers in India and ABCD is bound by price/other conditions negotiated by Mr. B. However, after finalizing terms and conditions of contract with customers in India, Mr. B sends such contract for formal approval and signature by ABCD.

In this case, Mr. B negotiates with the customers in India but does not conclude contracts with them and this way ABCD circumvents the PE rule .

- The OECD, under BEPS Action Plan 7 (refer Chapter relating to BEPS) reviewed the definition of ‘PE’ where taxpayers avoid PE by entering into Commissionaire arrangements or fragmentation of business activities. In order to tackle such tax avoidance scheme, the BEPS Action plan 7 recommended modifications to paragraph (5) of Article 5 to provide that an agent would include not only include a person who habitually concludes contracts on behalf of the non-resident, but also a person who habitually plays a principal role leading to the conclusion of contracts .

- Any amendment in tax treaty is carried out through a long-drawn negotiation between two countries and it takes months/years to bring that amendment in tax treaty. So, if any country wishes to bring BEPS related measures in all its tax treaties, it would take years. Multilateral Instrument, is an international agreement which brings simultaneous changes in all tax treaties , entered into by various signatories of MLI, at the same time. For example, if India wants to bring certain BEPS related measures in all its tax treaties at one go, then it can do so with the changes in multilateral instrument.

- These recommendations have now been included in Article 12 of Multilateral Convention (‘MLI’) to Implement Tax Treaty Related Measures, and India is also a signatory to the Multilateral Instrument. Thus, an agent of non-resident would be deemed as dependent agent under tax treaty , even if such agent plays principal role leading to conclusion of contract . The effect of inclusion of such recommendations in Article 12 of MLI would be that it will automatically modify India’s bilateral tax treaties covered by MLI, where treaty partner has also opted for Article 12. As a result, the DAPE provisions in Article 5(5) of India’s tax treaties, as modified by MLI, shall become wider in scope than the current provisions in Explanation 2 to section 9(1)(i).

- As per Section 90 of the IT Act, provisions of tax treaty or IT Act, whichever is more beneficial would be applicable to assessee. Thus, where amendment is made in the PE definition under the tax treaty without making any changes in the IT Act, such amendment would be ineffective. The reason for this is that the assessee would be govern by the provisions of Section 9(1)(i), in which no amendment is carried out. In view of the above, the Finance Act, 2018 has amended the provision of section 9 of the Act so as to align them with the provisions in the DTAA as modified by MLI so as to make the provisions in the treaty effective.

EXAMPLE 1 : – AGENT HABITUALLY EXERCISING AUTHORITY TO CONCLUDE CONTRACT ON BEHALF OF NON-RESIDENT

Beta Inc., USA manufactures and sells certain software worldwide. It appoints Rajesh as sales head who negotiates price and delivery terms with customers . Beta Inc. is bound by terms negotiated by Rajesh. Whether Beta Inc. has any business connection in India?

SOLUTION : –

In order to establish business connection in India, the agent must have an authority, which is habitually exercised to conclude contracts on behalf of the non-resident. Rajesh is negotiating with customers on pricing and delivery terms and Beta Inc. does not have an authority to modify the pricing and delivery terms. Beta Inc. has a Business connection in India as Mr. Rajesh is habitually exercising authority to conclude contract on behalf of Beta Inc.

EXAMPLE 2 : – AGENT NOT EXERCISING AUTHORITY TO CONCLUDE CONTRACT ON BEHALF OF NON-RESIDENT

NY Inc. manufactures and sells certain software for distribution worldwide. It appoints TOM as sales head in India. TOM informs potential customers in India about Product features, price list but does not negotiate with customers on the pricing and delivery terms. Only NY Inc. negotiates on pricing and delivery terms of contract, and the contracts are concluded outside India. Whether NY Inc. has any business connection exist in India?

SOLUTION : –

In order to establish a business connection in India, the agent must have an authority, which is habitually exercised to conclude contracts on behalf of the non-resident. Tom is only informing product details & standard price lists on behalf of NY Inc. and he does not negotiate or conclude contracts with customers on pricing and delivery terms. NY Inc. has authority to negotiate or decide pricing and delivery terms. Thus, Tom does not have an authority to conclude contracts on behalf of NY Inc. In view of this NY Inc. has no business connection in India .

AMENDMENT MADE BY FINANCE ACT , 2018

SIGNIFICANCT ECONOMIC PRESENCE OF A NON-RESIDENT IN INDIA – [EXPLANATION 2A TO SECTION 9(1)(I) INSERTED BY FINANCE ACT, 2018] –

- Under the existing provisions of the International Tax laws, business profits of an enterprise are taxable in the Country of Residence (For Example where a US enterprise is doing business in India, profit arising from such business would be taxable only in US) of such enterprise. However, such business profits may be taxed in the Source Country, only if the enterprise has a PE in Source State (i.e., business profit of US enterprise may be taxable in India, if such entity has a PE in India) .

Generally, PE of an enterprise is created on the basis of its physical presence in another Country. However, due to technological advancements, an enterprise can continue doing business in any Country, without any physical presence in that Country. - Therefore, the existing nexus rule based on physical presence do not hold good anymore for taxation of business profits in source country. As a result, the rights of the source country to tax business profits that are derived from its economy is unfairly and unreasonably eroded . In order to deal with such challenges, certain changes were required so that an enterprise may constitute PE , based on its significance economic presence in another Country.

- OECD under its BEPS Action Plan 1 addressed the tax challenges in a digital economy wherein it had discussed several options to tackle the direct tax challenges arising in digital businesses. One such option is a new nexus rule based on “significant economic presence”. As per the Report on Action Plan 1 , a non-resident enterprise would create a taxable presence in a country if it has a significance economic presence in that country on the basis of factors , that have a purposeful and sustained interaction with the economy by the aid of technology and other automated tools. It further recommended that revenue factor may be used in combination with the aforesaid factors to determine ‘significance economic presence’

- The scope of existing provisions of clause (i) of sub-section (1) of section 9 is restrictive as it essentially provides for physical presence based nexus rule for taxation of business income of the non-resident in India. Explanation 2 to the said section which defines ‘business connection’ is also narrow in its scope since it limits the taxability of certain activities or transactions of non-resident to those carried out through a dependent agent. Therefore, emerging business models such as digitized businesses, which do not require physical presence of itself or any agent in India, is not covered within the scope of clause (i) of sub-section (1) of section 9 of the Act.

In order to deal with such challenges and incorporate the provision of Action Plan 1 in Indian legislation, Explanation 2A to Section 9(1)(i) of the IT Act was added to provide that ‘significant economic presence’ in India, shall also constitute ‘business connection’ and “significant economic presence” for this purpose, shall mean –

a) Any transaction carried out by a non-resident in India in respect of any goods, services or property including provision of download of data or software in India .

Note:

In order to constitute a significance economic presence the aggregate of payments or revenue arising from physical goods or services and digital goods or services during the previous year should exceed the prescribed limit . However, no threshold limit of revenue has been prescribed by the CBDT till now for applicability of such provision .

b) Systematic and continuous soliciting of its business activities in India or engaging in interaction with such number of users in India as may be prescribed, through digital means.

Note:

No threshold of number of users has been prescribed by the CBDT with whom a non-resident engages in interaction or carries out systematic and continuous soliciting of business activities in India for applicability of such provision .

It is further provided that only so much of income as is attributable to such transactions or activities shall be deemed to accrue or arise in India . The transactions or activities refered above shall constitute significant economic presence in India, whether or not, —

- the agreement for such transactions or activities is entered in India; or

- the non-resident has a residence or place of business in India; or

- the non-resident renders services in India.

- This amendment will enable India to negotiate for inclusion of the new nexus based rule in the form of ‘significant economic presence’ in the DTAA . However, for the current purpose, even after insertion of significant economic presence based taxation u/s 9, the cross border business profits will continue to be taxed as per the existing treaty rules , which are more beneficial .

ROYALTY AND FTS PAYMENT BY NTRO TO A NON-RESIDENT – SECTION 10(6D)

The following income arising to foreign company or non-corporate non-resident shall be exempt from tax:-

a) Income by way of royalty from the National Technical Research Organisation (NTRO), or

b) Fees for technical services rendered in or outside India to, the NTRO.

Consequently, NTRO will not be required to deduct tax at source on such payments.

AMENDMENT MADE BY FINANCE ACT , 2018

INCOME ACCRUING OR ARISING TO A FOREIGN COMPANY FROM SALE OF LEFTOVER STOCK OF CRUDE OIL – SECTION 10(48B)

Any income accruing or arising to a foreign company from sale of leftover stock of crude oil, from a facility in India shall be exempt in the following cases : –

- After the expiry of an agreement or an arrangement referred to in section 10(48A), or

- Termination of the said agreement or arrangement referred to in section 10(48A).

NOTES :

- Such exemption would be subject to such conditions, as may be notified by the Central Government in this behalf.

END OF AMENDMENT MADE BY FINANCE ACT , 2018

AMENDMENT MADE BY FINANCE ACT , 2018

TAXATION OF CAPITAL GAINS AT CONCESSIONAL RATE OF 10% [SECTION 112A] – INSERTED BY THE FINANCE ACT 2018

Under the existing regime of the Income-Tax Act (the Act), there was an income-tax exemption u/s 10(38) of the IT Act on long term capital gains from transfer of equity shares of a company or an unit of equity oriented fund or an unit of business trusts, provided certain conditions like chargeability to securities transaction tax (STT) were satisfied. It was felt by the Government, that this regime was inherently biased against manufacturing, and has encouraged diversion of investment in financial assets. It has also led to significant erosion in the tax base resulting in revenue loss.

In order to minimize economic distortions and curb erosion of tax base, the Finance Act, 2018 has withdrawn exemption u/s 10(38) and introduced a new section 112A in the Act.

Section 112A , in the IT Act provides for a concessional tax rate on long-term capital gains, arising from transfer of equity share or a units of an equity-oriented fund / business trust.

Section 112A override Section 112, and provides that the tax payable by an assessee on long-term capital gains exceeding Rs 1 lakh (Long-term capital gains on equity shares, etc. are not taxable at 10% u/s 112A if the amount of capital gains is Rs. 1 lakh or less) shall be @ 10%, subject to the following conditions : –

- The total income of an assessee includes any income chargeable under the head “Capital gains;

- The capital gains arises from the transfer of a long-term capital asset, which is equity share in a company, or a unit of an equity-oriented fund or a unit of a business trust;

- Securities Transaction Tax has been paid at the time of acquisition and transfer of such equity shares. In case of unit of equity-oriented funds or unit of business trust , the securities Transaction Tax has been paid only at the time of transfer of shares.

The requirement of payment of STT at the time of transfer of long term capital asset, shall not apply if –

- the transfer is undertaken on recognized stock exchange located in any International Financial Services Centre (IFSC), and

- Consideration of such transfer is received or receivable in foreign currency.

EXAMPLE:-

ABC International (USA), earns long-term capital gains of Rs 90,000 on transfer of listed equity shares during the PY 2018-19. Such gains are not taxable u/s 112A as it does not exceed Rs 1 lakh.

EXAMPLE:-

XY Inc. earns long-term capital gains of Rs 1,10,000 on transfer of listed equity shares during the PY 2018-19. Tax liability on such gains would be Rs 1040 [(Rs 1,10,000- 1,00,000)*10.4%]. Concessional rate of 10% u/s 112A shall be increased by cess of 4%. Thus, the tax shall be computed @ 10.40%.

Other Points : –

- As per third proviso to Section 48, the long-term capital gains referred to in Section 112A will be computed without giving effect to the first and second provisos to section 48. Thus, inflation indexation in respect of cost of acquisition and cost of improvement, if any, and the benefit of computation of capital gains in foreign currency in the case of a non-resident, will not be allowed.

- As Section 112A overrides Section 112, tax rates prescribed under Section 112 for long-term capital gains arising from listed equity shares would not be applicable where the matter is covered u/s 112A.

A. Benefit of unutilized exemption limit

In the case of an individual or a Hindu undivided family, being a resident, where the total income as reduced by such long-term capital gains is below the maximum amount which is not chargeable to income-tax, then, the long-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax.

Note:- This benefit is available only for resident Individuals and HUF. Thus, such benefit is not available for non-residents.

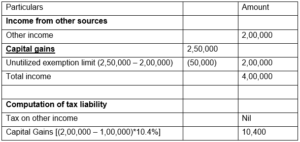

EXAMPLE:-

Mr. Aamir, who is 23-year-old, earns long-term capital gains of Rs 2,50,000 during the PY 2018-19. He also earns other income of Rs 2,00,000 during the same year. In such a case, his tax liability would be computed as under:-

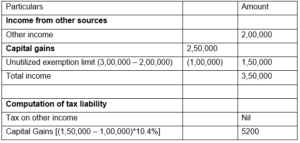

EXAMPLE:-

Mr. Samir, who is a 62-year-old person, earns long-term capital gains of Rs 2,50,000 during the PY 2018-19. He also earns other income of Rs 2,00,000 during the same year. Now his tax liability would be computed as under:-

C. Deduction under chapter VI-A

Deductions under Chapter VIA cannot be availed in respect of the long-term capital gains, for which benefit of concessional tax u/s 112A has been claimed by the assessee.

D. Rebate under Section 87A

Where the total income of an assessee includes any long-term capital gains as referred to in Section 112A, the rebate under section 87A shall not be available from the income-tax calculated on such capital gains.

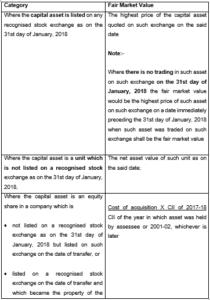

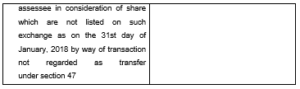

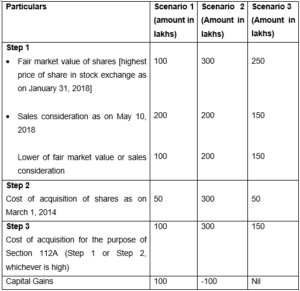

E. Special method to compute cost of acquisition [ Section 55]

Where equity share or unit, etc. is acquired before February 1, 2018, then its cost of acquisition shall be computed by the following method :-

Step 1:-

Determine the lower of –

- Fair market value of such asset ; or

- The full value of consideration received or accruing as a result of the transfer of the capital asset.

Step 2:-

Determine cost of acquisition of such capital asset

Step 3:-

Determine higher of Step 1 or Step 2, which shall be the cost of acquisition for computing capital gains

NOTES:-

Meaning of fair market value

Meaning of certain terms

Equity oriented fund :-

“Equity oriented fund” means a fund set up under a scheme of a mutual fund specified under clause (23D) of Section 10 and,

a. In a case where the fund invests in the units of another fund which is traded on a recognised stock exchange –

- a minimum of ninety per cent of the total proceeds of such fund is invested in the units of such other fund; and

- such other fund also invests a minimum of ninety per cent of its total proceeds in the equity shares of domestic companies listed on a recognised stock exchange

b. In any other case, a minimum of sixty-five per cent of the total proceeds of such fund is invested in the equity shares of domestic companies listed on a recognised stock exchange.

Provided that the percentage of equity shareholding or unit held in respect of the fund, as the case may be, shall be computed with reference to the annual average of the monthly averages of the opening and closing figures.

EXAMPLE:-

Consider the following data for computation of cost of acquisition of listed equity shares :-

EXAMPLE:-

Mr. Kapil has purchased 10,000 listed equity shares on March 1, 2013 for Rs 1,00,000. He has sold such shares on August 10, 2018 for Rs 10,00,000. The highest price of such shares on stock exchange is Rs 4,00,000 as on January 31, 2018. He has also sold house property as on July 1, 2018 for Rs 10,00,000 (CII – 280). Such house property was purchased on July 1, 2012 for Rs 2,00,000 (CII 200). Compute the tax liability for the PY 2018-19 on each individual gains ignoring , the basic exemption limit ?

SOLUTION:-

Computation of total income of Mr. Kapil for the PY 2018-19

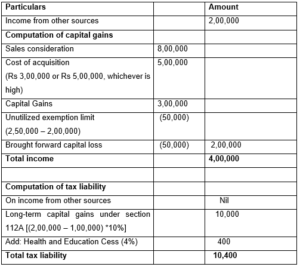

EXAMPLE:-

Mr. Rahul, who is 40-year-old, had purchased 1,000 unlisted units of equity-oriented funds on March 1, 2010 for Rs 5,00,000. He has sold such units in April, 2018 for Rs 8,00,000. The net asset value of such units is Rs 3,00,000 as on January 31, 2018. He has also earned other income of Rs 2,00,000 during the PY 2018-19. He also has brought forward capital loss of Rs 50,000. Compute total income and tax liability for the PY 2018-19.

SOLUTION:-

Computation of total income of Mr. Rahul for the PY 2018-19

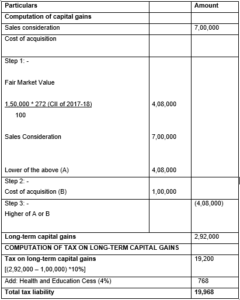

EXAMPLE:-

Mr. Anuj, who is 25-year-old, has purchased 1,000 unlisted equity shares on March 1, 1999 for Rs 1,00,000. He has sold such units in October 10, 2018 for Rs 7,00,000. Such shares were listed for the first time in September, 2018. Fair market value of such shares was Rs 1,50,000 on the basis of net assets value as on April 1, 2001. Compute total income and tax liability for the PY 2018-19 ?

SOLUTION:-

Computation of total income and tax liability of Mr. Anuj for the PY 2018-19

END OF AMENDMENT MADE BY FINANCE ACT , 2018

TAXATION OF INCOME FROM UNITS/ OR CAPITAL GAINS OF SUCH UNITS OF OFFSHORE FUND – SECTION 115AB

Income from certain units, or capital gains arising from transfer of such units, by non-resident/foreign company from the following shall be chargeable to tax @ 10% : –

- Income received by Overseas financial institution (“OFI”) in respect of Units of Mutual Funds or UTI , which are purchased in foreign currency

- Long-term capital gains to Overseas financial institution from transfer of Units of Mutual Funds or UTI , which are purchased in foreign currency

For the purpose of this Section, Overseas financial institution means

Any fund, institution, association or body, whether incorporated or not, established under the laws of a country outside India, which has entered into an arrangement (Such arrangement should be approved by the SEBI for investment in India ) with any public sector bank or public financial institution or a mutual fund specified under section 10(23D).

The following points should be noted in this regard :-

- The benefit of first proviso to section 48 for currency fluctuation , and the second proviso to section 48 for indexation, is not available for computation of such long-term capital gains

- No deduction shall be allowed under sections 28 to 44C or section 57(i)/(iii) or under Chapter VI-A in computing the above income . Chapter VI provisions relating to set-off, carry forward and set off of losses are applicable .

- Other income of OFI shall be taxable as per normal provisions of the Income-tax Act,196, and entitled to deduction under Chapter VI- A.

- The long-term capital gains on units of equity oriented funds were exempt under section 10(38) on satisfaction of conditions specified therein . However, the Finance Act, 2018 has inserted a fourth proviso to Section 10(38) , to provide that exemption u/s 10(38) shall not apply on long-term capital gains exceeding Rs. 1 lakh, arising on or after April 1, 2018 from transfer of equity shares or units of equity-oriented funds or units of business trust. Such gains would now be liable to tax at the rate of 10 per cent u/s 112A without any indexation benefit for resident transferor, and without foreign currency fluctuation benefit for non-resident transferor. Other conditions given under Section 112A should also be satisfied in order to avail benefit of concessional rate of tax under this provision

- Short term capital gains on units of equity oriented fund are taxable @15% under section 111A provided securities transaction tax has been paid on the sale of such units.

EXAMPLE 1: –

Ronhson Inc. (USA) purchased 10,000 listed equity shares of an Indian company for Rs 10 lakhs as on April 1, 2016. On May 10, 2018, it sold all such shares of an Indian company and paid STT on such shares. Such transfer would not be exempt from income-tax u/s 10(38).

EXAMPLE 2 : –

Hojo Inc. (USA) purchased 1,00,000 listed equity shares of an Indian company for Rs 1 crores as on November 1, 2014. It had paid STT on such purchases. On Feb 10, 2018, it sold all such shares of an Indian company and paid STT on such shares. Such transfer would be exempt from income-tax u/s 10(38) as transfer is made before April 1, 2018.

END OF AMENDMENT MADE BY FINANCE ACT , 2018

AMENDMENT MADE BY FINANCE ACT , 2018

AMT / MAT ON UNIT LOCATED IN AN INTERNATIONAL FINANCIAL SERVICE CENTER-

Section 115JC of the Act provides for alternate minimum tax at the rate of 18.50% of adjusted total income in the case of a non-corporate person. However, in case of a unit located in an International Financial Service Center, the alternate minimum tax under section 115JC shall be charged at the rate of 9%.

MAT APPLICABILITY ON SPECIFIED FOREIGN COMPANY

Explanation 4A to Section 115JB , has been inserted by Finance Act, 2018, and provides that the MAT provision shall not be applicable to a foreign company (including for any of earlier previous years), if the total income of the foreign company, comprises solely of profits and gains from business referred to in following sections, and such income has been offered to tax at the rates specified in the said sections –

- Section 44B (Special provision for computing profits and gains of shipping business in the case of non-residents ), or

- Section 44BB (Special provision for computing profits and gains in connection with the business of exploration, etc., of mineral oils ) or

- Section 44BBA (Special provision for computing profits and gains of the business of operation of aircraft in the case of non-residents) or

- Section 44BBB (Special provision for computing profits and gains of foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects)

RELIEF FROM LIABILITY OF MINIMUM ALTERNATE TAX (MAT) FOR COMPANY IN CORPORATE INSOLVENCY – INSERTED BY THE FINANCE ACT, 2018

For the purpose of computing book profit under Section 115JB, certain positive and negatives adjustments are required be made to the net profit as shown in profit and loss account . Section 115JB provides for a deduction from net profit in respect of the amount of loss brought forward or unabsorbed depreciation, whichever is less as per books of account. Consequently, where the loss brought forward or unabsorbed depreciation is Nil, no deduction is allowed. This non-deduction is a barrier to rehabilitating companies seeking insolvency resolution.

Finance Act, 2018 has amended the existing Section 115JB to provide that the aggregate amount of unabsorbed depreciation and loss brought forward shall be allowed to be reduced from the book profit, if a company’s application for corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 has been admitted by the Adjudicating Authority.

EXAMPLE :-

XYZ India Ltd. has no unabsorbed depreciation during the AY 2018-19 in the books of account. However, it has unabsorbed business loss of Rs 1,00,000 in such AY. XYZ India Ltd. has applied for corporate insolvency resolution process and such application was admitted . In this case XYZ India is entitled to reduce unabsorbed business loss of Rs 1,00,000 from the book profits while computing MAT.

DIVIDEND DISTRIBUTION TAX ON DIVIDEND PAY OUTS TO UNIT HOLDERS IN AN EQUITY- ORIENTED FUND [SECTION 115R]

An equity oriented Mutual Fund , is liable to pay additional income-tax at the rate of ten per cent on any income distributed by it. Mutual fund is liable to charge dividend distribution tax , even when dividend is paid to a unit holder of equity-oriented fund who is non-resident Individual or foreign company. For this purpose, equity-oriented fund will have the same meaning assigned to it in the new section 112A of the Act.The rate of dividend distribution tax is further increased by surcharge of 12% and health and education cess of 4%.

END OF AMENDMENT MADE BY FINANCE ACT , 2018

AMT / MAT on unit located in an International Financial Service Center-

Relief from liability of minimum alternate tax (MAT) for company in Corporate Insolvency

Dividend distribution tax on dividend pay outs to unit holders in an equity- oriented fund [Section 115R]

CA Final Amendment – Transfer Pricing – Country by Country reporting