ZERO COUPON BOND (ZCB) – SECTION 2(48)

Zero coupon bond means a

- Bond issued by any infrastructure capital company or infrastructure capital fund or a public sector company or a scheduled bank on or after 1st June, 2005,

- in respect of which no payment and benefit is received or receivable before maturity or redemption from such issuing entity and

- which the Central Government may notify in this behalf .

NOTES : –

- Income on transfer of a ZCB (not being held as stock-in-trade) is taxable as capital gains .

- Section 2(47)(iva) provides that maturity or redemption of a ZCB shall be treated as a transfer for the purposes of capital gains tax .

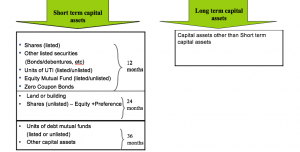

SHORT TERM CAPITAL GAINS & LONG TERM CAPITAL GAINS – PERIOD OF HOLDING

PERIOD OF HOLDING OF SHARES ACQUIRED ON REDEMPTION OF GLOBAL DEPOSITORY RECEIPT

Where share(s) of a company are acquired by the non-resident assessee on redemption of Global Depository Receipts [referred to in Section 115AC(1)(b)] held by such assesse, the period of holding of such shares shall be reckoned from the date on which the request for such redemption was made .

PERIOD OF HOLDING IN CASE OF GDR

EXAMPLE : –

Newton Inc. acquire Global Depository Receipt (GDR) of Diksha India on April 1, 2015.

Newton Inc. requested for redemption of GDR on April 12, 2017, in Lieu of which it received shares on April 20, 2017.

It sold such shares on July 1, 2017. Determine the Period of holding of shares ?

SOLUTION : –

In this case, the period of holding of shares shall be reckoned from the date on which a request for redemption of GDR was made, i.e., from April 12, 2017.

Thus, period of holding shall be April 12, 2017 to July 1, 2017.

TRANSACTIONS NOT REGARDED AS TRANSFER -SECTION 47

Section 47 covers certain transactions, which are not regarded as transfer and, accordingly gains arising thereon are not liable to capital gain tax.

Following transactions shall not be regarded as transfer for the purpose of capital gains tax in respect of non-residents and foreign companies : –

- Transfer of shares of Indian company on amalgamation of two foreign companies – Section 47 (via)

- Transfer of shares of foreign company drawing its substantial value from India in amalgamation scheme – Section 47(vib)

- Transfer of shares of Indian company in a scheme of demerger between two foreign companies – Section 47 (vic)

- Transfer of shares of foreign company drawing its substantial value from shares of Indian company in scheme of demerger – Section 47(vicc)

- Transfer of bond or Global Depository Receipt by a non-resident to another non-resident outside India – Section 47(viia)

- Transfer of rupee denominated bond by a non-resident to another non-resident outside India – Section 47 (viiaa)

- Transfer of Government Security by a non-resident to another non-resident through an intermediary – Section 47(viib)