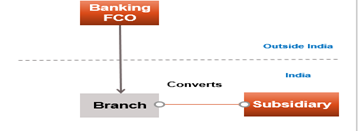

Where the branch of a foreign company, which is engaged in banking business in India is converted into an Indian subsidiary of such foreign company ,any capital gains arising from such conversion would not be chargeable to tax , provided the conditions notified by the Central Govt. are satisfied and such conversion is in accordance with the scheme framed by RBI).

MEANING OF “CONVERSION OF INDIAN BRANCH INTO INDIAN SUBSIDIARY” – DRAFT NOTIFICATION ON SECTION 115JG, DATED 17-11-2017

In terms of the above notification, “Conversion of Indian branch into Indian subsidiary company” shall mean the amalgamation of Indian branch, with Indian subsidiary of the foreign company , in accordance with scheme of amalgamation approved by the shareholders of the foreign bank and Indian subsidiary company , and which scheme has been sanctioned by the RBI .

DATE OF CONVERSION – MEANING

“Date of conversion” shall be the date which the Reserve Bank of India appoint for the vesting of undertaking of the Indian branch in Indian subsidiary company – Draft Notification on section 115JG, dated 17-11-2017

Conditions to be fulfilled on conversion of Indian Branch of foreign bank into subsidiary

a) All the assets and liabilities of the Indian branch immediately before conversion become the assets and liabilities of the Indian subsidiary company ;

b) the foreign company or its nominees hold the whole of the share capital of the subsidiary company ;

c) the foreign company does not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of allotment of shares in the Indian subsidiary company.

APPLICABILITY OF OTHER PROVISIONS

Provisions relating to computation of income

The provisions relating to computation of income of foreign company , and Indian subsidiary company would apply with such exceptions, modifications and adaptations as are specified in the notification.

Provision relating to set off, carry forward and tax credit

The benefit of set-off of unabsorbed depreciation, set-off and carry forward of losses, tax credit in respect of tax paid on deemed income relating to certain companies available under the Act shall apply with such exceptions, modifications and adaptations as specified in the notification.

DRAFT NOTIFICATION ON SECTION 115JG, DATED 17-11-2017

Modifications and adaptations to various provisions

DEPRECIATION

Aggregate deduction, in respect of depreciation of various assets allowable to the Indian branch and the Indian subsidiary company –

a) Shall not exceed in any previous year the deduction calculated at the prescribed rates as if the conversion had not taken place, and

b) Such deduction shall be apportioned between the Indian branch and the Indian subsidiary company in the ratio of the number of days for which the assets were used by them .

ACCUMULATED LOSS AND UNABSORBED DEPRECIATION OF THE BRANCH

Such loss and depreciation, shall be deemed to be the loss or allowance or depreciation of the Indian subsidiary company for the purpose of previous year in which conversion was effected .

| Actual Cost of Block of asset in the case of Indian subsidiary | Actual Cost of Block of asset transferred under such scheme shall be the written down value of the block of assets, in the case of the Indian branch on the date of conversion. |

| Actual cost of any capital asset on which deduction has been allowed to the Branch u/s 35AD | Nil |

| Tax Credit | Tax credit of the Indian branch shall be deemed to be the tax credit of the Indian subsidiary company for the purpose of the previous year in which conversion takes place. |

| Cost of acquisition of the asset acquired by subsidiary on conversion | Cost of acquisition of the asset acquired by subsidiary on conversion of branch shall be : –

a) Cost for which the Indian branch acquired it ; or |

| Credit balance in provision for bad and doubtful debts | It shall be deemed to be credit balance of Indian subsidiary company and the provisions of the Section 36 , other deductions, of the IT Act shall apply accordingly . |

CONSEQUENCES OF FAILURE TO COMPLY WITH THE SPECIFIED CONDITIONS – SECTION 115JG (2)

If the conditions specified in RBI scheme or Central Government notification

are not complied with, then, the benefit, exemption or relief under this section shall not be available to the foreign bank, Indian subsidiary or the branch . The normal provisions of the IT Act would apply to the foreign company and Indian subsidiary.

CONSEQUENCES OF SUBSEQUENT FAILURE TO COMPLY WITH THE CONDITIONS – SECTION 115JG(3)

Where the benefit, exemption or relief under these provisions has been granted to the foreign company or Indian subsidiary company in any previous year, and thereafter, there is a failure to comply with any of the conditions specified under the notification, thensuch benefit, exemption or relief shall be deemed to have been wrongly allowed.

In such a case, the AO, is empowered to re-compute the total income of the assessefor the said previous year and make the necessary amendment, irrespective of any other provision in the Income-tax Act, 1961. To carry out such recomputation, the time limit to carry out rectification under section 154would be applicable until a period of 4 year from the end of the previous year in which the failure to comply with such conditions has taken place.

For any queries, please write them in the Comment Section or Talk to our tax expert