Section 47 of Income tax act 1961 – Transactions not regarded as transfer

| Section | Section 47 of the Income Tax Act, 1961 |

| Type of business | Non-resident |

Capital gains arise when there is a “transfer” of a Capital Asset effected during the previous year. If there is no transfer of a capital asset, no income is chargeable to Tax under the head capital gains.

Section 47 of the Income-tax Act covers certain transactions, which are not regarded as “transfers”. Accordingly, gains arising from such transactions, are not liable to capital gain tax. The rationale for such an exemption: these transactions do not result in any taxable income for the Transferor.

The following transactions shall not be regarded as transfers for the purpose of capital gains tax in respect of non-residents and foreign companies: –

- Transfer of shares of an Indian company on an amalgamation of two foreign companies – Section 47 (via)

- Transfer of shares of foreign company drawing its substantial value from India in amalgamation scheme – Section 47(vib)

- Transfer of shares of an Indian company in a scheme of demerger between two foreign companies – Section 47 (vic)

- Transfer of shares of foreign company drawing its substantial value from shares of Indian company in scheme of demerger – Section 47(vicc)

- Transfer of bond or Global Depository Receipt by a non-resident to another non-resident outside India – Section 47(viia)

- Transfer of rupee denominated bond by a non-resident to another non-resident outside India – Section 47 (viiaa)

- Transfer of Government Security by a non-resident to another non-resident through an intermediary – Section 47(viib)

Each of these transactions are discussed in detail as under : –

Transfer of shares of Indian company on amalgamation of two foreign companies – Section 47 (via) – Section 47 of Income tax act 1961

In case of amalgamation of two Indian companies, any transfer of capital asset from the amalgamating (transferor) company to the amalgamated (transferee) company, is not liable to tax, provided, such an amalgamation is within the definition of “amalgamation” under the Income Tax Act.

A similar benefit is also provided for amalgamation of two foreign companies in respect of shares of an Indian company held by the transferor company.

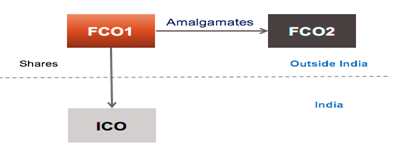

This section provides, that any transfer of shares of Indian company , by amalgamating foreign company (FCO1), to amalgamated foreign company (FCO2), in scheme of amalgamation, shall not be regarded as transfer.

However, the following conditions should be satisfied under such an amalgamation, to avail exemption of capital gains on transfer of shares of Indian company : –

- At least 25 percent of the shareholders of the amalgamating foreign company (FCO1), must continue to remain shareholders of the amalgamated foreign company(FCO2) ;

- Such transfer should not attract capital gains in the country in which the amalgamating company(FCO1) is incorporated.

Thus, following conditions should be satisfied cumulatively to avail the benefit of capital gains exemption : –

- There should be transfer of shares of Indian company

- Transfer is made in scheme of amalgamation between two foreign companies

- Shares are transferred by foreign amalgamating company to foreign amalgamated company

- 25% of shareholders of amalgamating foreign company continue to remain shareholders of amalgamated foreign company

- Transfer should not attract capital gains in the country in which amalgamating company is incorporated.

Transfer of shares of foreign company drawing its substantial value from India in amalgamation scheme – Section 47(vib) – Section 47 of Income tax act 1961

Under the provisions of Section 9(1) – Explanation 5, transfer of shares of a foreign company which derives its value substantially from India (FCO) is liable to tax in India, subject to certain exceptions. In certain cases, instead of amalgamation of the company which directly owns shares of the Indian Company, there may be a case of amalgamation of a foreign company (FCO1), which holds shares in another foreign company (FCO), which derives its value substantially from India.

Since there is a transfer of shares of a foreign company which derives its value substantially from India (FCO), which may be liable to Capital gains Tax under the provisions of Section 9(1). In order to provide, exemption from tax for such transfer, this section provides that any transfer, of a capital asset, being share of a foreign company (referred to in Explanation 5 to section 9(1)(i)), which derives, directly or indirectly, its value substantially from the share or shares of an Indian company, which are held by the amalgamating foreign company (FCO1), to the amalgamated foreign company (FCO2) in a scheme of amalgamation, shall not be regarded as transfer. Accordingly, it shall not attract any capital gains tax in India.

Conditions : –

- At least 25% shareholders of the amalgamating foreign company must continue to remain shareholders of the amalgamated foreign company;

- Such transfer should not attract capital gains in the country in which the amalgamating company is incorporated.

Thus, the following conditions should be satisfied cumulatively to avail the benefit of capital gains exemption: –

- There should be a transfer of shares of a foreign company that derives its value substantially from India

- Transfer of shares of such company is made in a scheme of amalgamation between two foreign companies

- Shares are transferred by a foreign amalgamating company to a foreign amalgamated company

- 25% of shareholders of the amalgamating foreign companies continue to remain, shareholders of amalgamated foreign companies,

- The transfer should not attract capital gains in the country in which amalgamating company is incorporated.

Transfer of shares of an Indian company in a scheme of demerger between two foreign companies – Section 47 (vic)

In case of demerger of a unit of an India company, any transfer of capital asset from the demerged (transferor) company to the resulting (transferee) company, is not liable to tax, provided, such a demerger is within the definition of “demerger” under the Income Tax Act.

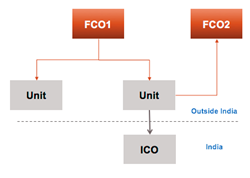

A similar benefit is also provided in respect of transfer of shares of an Indian company by a demerged foreign company (FCO 1 – Unit 1) to the resulting foreign company (FCO 2) in respect of shares of an Indian company (ICO) held by the demerged foreign company (FCO 1).

This section provides, that any transfer of shares of Indian company (ICO), in a demerger, by the demerged foreign company (FCO 1 ) to the resulting foreign company (FCO 2)

shall not be regarded as transfer if following conditions are satisfied –

- Shareholders holding at least 3/4 of the shares (in value) of the demerged foreign company (FCO 1 ) continue to remain shareholders of the resulting foreign company (FCO 2 );

- Such transfer does not attract tax on capital gains in the country, in which the demerged foreign company (FCO 1) is incorporated .

NOTE : –

Provisions of sections 391 to 394 of the Companies Act, 1956, or Section 230 to 232 of the Companies Act, 2013 shall not apply in case of such demergers .

Conditions should be satisfied cumulatively: –

- There is transfer of shares of Indian company

- Transfer is made in a scheme of demerger between two foreign companies

- 3/4 (in value) of Shareholders of demerged foreign company, continue to remain shareholders in the resulting foreign company

- Such transfer is not taxable in the country, in which demerged foreign company is incorporated.

Transfer of shares of foreign company drawing its substantial value from shares of an Indian company in a scheme of demerger – Section 47(vicc) of Income tax act 1961

As previously discussed, under the provisions of Section 9(1) – Explanation 5, the transfer of shares of a foreign company that derives its value substantially from India (FCO) is liable to tax in India, subject to certain exceptions. In certain cases, instead of demerger of a unit of a foreign company, which directly owns shares of the Indian Company, there may be a case of demerger of a unit, which has a share of a foreign company (FCO1), which derives its value substantially from India.

Since there is a transfer of shares of a foreign company that derives its value substantially from India (FCO), such gains may be liable to Capital gains Tax under the provisions of Section 9(1). Therefore, to provide an exemption from tax on such transfer, this section provides that any transfer, of a capital asset, being share of a foreign company (referred to in Explanation 5 to section 9(1)(i)), which derives, directly or indirectly, its value substantially from the share or shares of an Indian company, which are held by the demerged foreign company to the resulting foreign company shall not be regarded as transfer.4

Conditions: –

(a) At least 25% shareholders of the demerged foreign company continue to remain shareholders of the resulting foreign company;

(b) Such transfer should not attract capital gains in the country in which the demerged foreign company is incorporated .

Provisions of sections 391 to 394 of the Companies Act, 1956, or Section 230 to 232 of the companies Act, 2013 shall not apply in case of such demergers.

Thus, following conditions should be satisfied cumulatively to avail the benefit of capital gains exemption : –

- There should be transfer of shares of a foreign company which derives its value substantially from India

- Transfer of shares of such company is made in scheme of demeger between two foreign companies

- Shares are transferred by demerged foreign company to the resulting foreign company

- Atleast 25% of shareholders of demerged foreign company continue to remain shareholders of resulting foreign company

- Transfer should not attract capital gains in the country in which demerged foreign company is incorporated.

Transfer of bond or Global Depository Receipt by a non-resident to another non-resident outside India – Section 47(viia)

Any transfer of bonds of an Indian company or Global Depository Receipts purchased in foreign currency [referred to in section 115AC(1)], made outside India, by one non-resident to another non-resident shall not be regarded as a transfer.

The following conditions should be satisfied under this clause :

- There should be a transfer of

- Bonds of Indian Companies purchased in foreign currency, or

- Global Depository Receipt purchased in foreign currency

- The transfer must be made by one non-resident to another non-resident.

- The transfer must be made outside India ;

Transfer of rupee-denominated bond by a non-resident to another non-resident outside India – Section 47 (viiaa) Income-tax Act

Any transfer, made outside India, of a rupee-denominated bond of an Indian company issued outside India, by a non-resident to another non-resident.

The following conditions should be satisfied under this clause :

- There should be a transfer of rupee denominated bond of an Indian company issued outside India

- The transfer must be made by one non-resident to another non-resident.

- The transfer must be made outside India ;

Certain Transactions on a recognized stock exchange located in any IFSC – Section 47(VIIAB) – Inserted by the finance act 2018

The following transactions made by non-residents on a recognized stock exchange located in any International Financial Services Centre shall not be regarded as transfers. Furthermore, they shall not be chargeable to capital gains tax:-

- Transfer of Bond or Global depository receipt referred to in Section 115AC (1) or

- Transfer of Rupee denominated bond of an Indian company or

- Transfer of Derivative

However, non-residents can claim exemption under such provision only when the following conditions are satisfied:-

Conditions:-

- A transfer is made by a non-resident on a recognized stock exchange located in any International Financial Services Center.

- Consideration for such transfer is paid or payable in foreign currency.

Note:-

Global Depository Receipts are instruments in the form of a depository receipt or certificate created by the Overseas Depository Bank. Such Bank is located outside India. It is to be noted that such Receipt is issued to investors against the issue of,

- Ordinary shares of issuing company, being a company listed on a recognized stock exchange in India; or

- Foreign currency convertible bonds of issuing company

Transfer of Government Security by a non-resident to another non-resident through an intermediary – Section 47(viib) of Income Tax Act, 1961

Any transfer of Government Security carrying a periodic payment of interest, made outside India through an intermediary dealing in the settlement of securities, by a non-resident to another non-resident would not be considered as a transfer. Accordingly, would not be liable to capital gains tax.

For any queries, please write them in the Comment Section or Talk to our tax expert

Related Content

- Capital Gains – Section 45 of the Income Tax Act

- No Exemption u/s 10 on Urban Agricultural Land – Explanation 1 to Section 2(1A)

- Short Term and Long Term Capital Assets

- Section 48 of Income Tax Act – Mode of Computation of Capital Gains

- Section 111a of the Income Tax Act

- Section 112a of the Income Tax Act