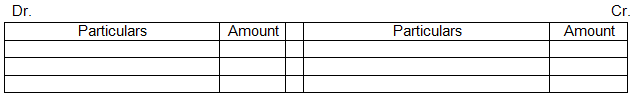

Once the source document is received, it should be analyzed, classified and recorded. The recording of journal entries is a first step towards bookkeeping. Format of journal entry is

![]()

Now second step is to post the above journalized transaction in ledger.

What is ledger?

Ledger is summary of transactions of a specific account for a particular period. Its format is T shaped left of which is Debit side (usually written as Dr.) and right of it is Credit side (usually written as Cr.)

Accountant prepares accounts for all the Asset, Liabilities, Income, Expenses and Capital. Format of the ledger account is given below.

In the Books of XYZ & Co.

<Account Name>

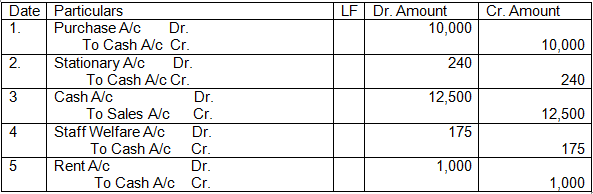

To understand the posting from journal to ledger, let us take few examples to post in the books of ABC & Co.

- Purchased goods for Rs. 10,000.

- Bought Stationary Rs. 240.

- Sold goods for Rs. 12500.

- Staff expenses Rs. 175.

- Paid rent Rs. 1,000

This is how we will journalize the above transactions:

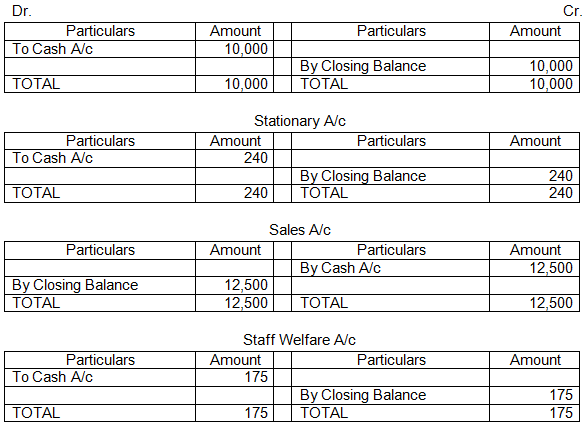

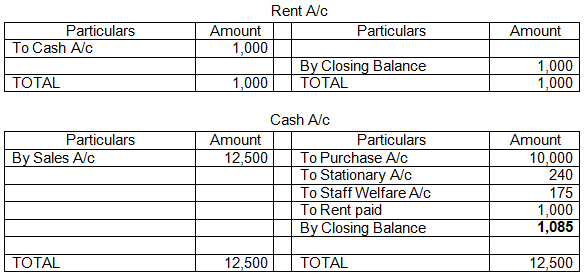

Now let us post above examples in ledger

In the Books of ABC & Co.

Purchase A/c

From the above examples, we get clear idea about how journal entries are posted in the ledger. Once the transactions are posted, total of the debit and credit sides are taken. If the debit side total is bigger than the credit side of the ledger account, it is called Debit Balance. Similarly, if credit side is bigger, it is called Credit Balance. Closing balance is written on the side which is smaller to match with the bigger or opposite side. These closing balances are later transferred to trial balance.

Chapter 3 – Recording of Transactions