The basic meaning of trial balance is a summary of debit and credit balances of all the ledger accounts maintained by the organization. The major objective of preparing a trial balance is to check the arithmetical accuracy and correctness of ledgers.

Trial Balance forms the basis for preparing the financial statements at the end of the accounting year. The accountant can prepare the financial statements just by referring the trial balance rather than going through the effort of posting figures from individual ledger accounts, thereby making the process simpler and speedier.

Also, a trial balance helps in communicating the complete financial picture to the user in a summarized form. It simplifies the complex ledger accounts into easily understandable information.

Period for which Trial Balance is prepared –

As a general practice trial balance is prepared at the end of each accounting year. However, it is not a compulsion. One can choose to prepare it at the end of any period – monthly, quarterly, half yearly or annually depending upon its requirements.

Steps for preparation of Trial Balance –

The following steps are taken to prepare the trial balance-:

- Check closing ledger balances of each account

- The closing balance of each account as ascertained above is then placed in either the debit or credit columns of the trial balance accordingly. In case an account has nil balance, the same should be reflected in the trial balance.

The following balances are posted on the debit side of trial balance – all the assets held with the organization, any expenses incurred during the year and any account receivables appearing in the books.

The following balances are posted on the credit side of trial balance – all the liabilities or obligations of the organization, any income/ revenue earned during the year and any account payables appearing in the books.

- Once the balances are divided into debit and credit side, the next step is the total each side to find out the total debit balance and total credit balance.

- After totaling each side, it is checked whether the totals of both debit side credit side tally. If there is any difference in the two balances, it indicates that there is some error in the accounts. If so, review the same so that the total of two sides becomes equal.

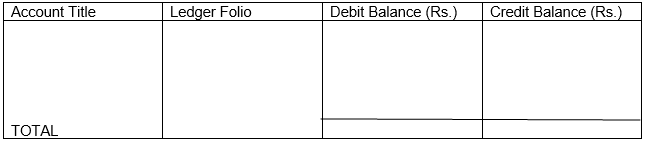

Format of Trial Balance –

Trial Balance of _____ as on March 31, 2020

Thus, the meaning of trial balance is in reference to the entire accounts of an organization. It can be said to be the foundation of preparing the financial statement of any organization. It not only helps in easier preparation of Balance Sheet and Profit and Loss Account, it also ensures that the financial statements are accurate.

Chapter 6 -Trial Balance and Rectification of Errors