MCQ on Fundamentals of Partnership are covered in this Article. Fundamentals of Partnership MCQs Test contains 37 questions. Answers to MCQ on Fundamentals of Partnership Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge. For more MCQ’s, subscribe to our email list.

MCQ on Fundamentals of Partnership – Question 1

What is the nature of partnership from legal point of view?

a) It is a separate legal entity

b) It is not a separate legal entity

c) Both a and b are correct

d) None of the above

Question 2

Which one from the following is the essential features or characteristics of partnership?

a) Two or more person

b) Mutual agreement

c) Liability of partnership

d) All of the above

Fundamentals of Partnership class 12 MCQ – Question 3

The calculation of interest on drawings on unequal amounts drawn at unequal monthly intervals done as :

a) Total drawings x Rate/100 x 7.5/12

b) Total drawings x Rate /100 x 4.5/12

c) Total product x Rate/100 x 1/12

d) None of the above

MCQ on Fundamentals of Partnership – Question 4

Which one from the below is not a right of a partner?

a) Right to inspect the books of

b) Right to take part in the management of the firm

c) Right to share the profit/losses with other partners in agreed ratio

d) Right to receive salary at the end of every

Question 5

X and Y purchased a Building and contributed capital equally to convert the building into an apartment. They let it out on a rent of Rs 35000 and share the rental income equally. Now relation between X and Y is:

a) X and Y are partners

b) X and Y are co – owners

c) Both (a) and (b)

d) None of the above

Question 6

If a fixed amount is withdrawn on the beginning of every quarter, for what period the interest on total amount withdrawn will be calculated?

a) 5 months

b) 6 months

c) 5 months

d) None of the above

MCQ on Fundamentals of Partnership – Question 7

Rakesh and Suresh are equal partners Rakesh is a sleeping partner and who believes that he is not liable for the act of his other partner. which one from the following is correct?

a) Rakesh is right because he is not a active

b) Rakesh is wrong he is liable for the act of his other partner

c) Rakesh will be liable to the extent of his profit sharing ratio

d) None of the above

Question 8

Which one from the following is the content of partnership deed?

a) Name and address of all the partners

b) Name and address of the firm

c) Nature of business

d) All of the above

Fundamentals of Partnership class 12 MCQ – Question 9

Registration of partnership firm is :

a) Optional

b) Compulsory

c) Depends upon numbers of partners in a firm

d) None of the above

MCQ on Fundamentals of Partnership – Question 10

If there is absence of partnership deed or partnership deed remains silent regarding profit/losses of partners then profit sharing ratio among partners will be:

a) Equal

b) In the ratio of capital

c) whole profit will transfer to general reserve

d) None of the above

Question 11

How to deal with interest on partners capital and interest on drawings when there is no partnership deed among partners?

a) Interest will be allowed @ 6% a

b) Interest will be charged @12.5% a

c) No interest will be allowed and charged

d) None of the above

Question 12

In the absence of partnership deed what will be the profit share of a sleeping partner if the contribution made by him for capital is 80% of the total capital of the

a) 80% of the total profit

b) Equal share in profit

c) As mutually decided by partners with each other

d) None of the above

MCQ on Fundamentals of Partnership – Question 13

A and B are partners A advances a loan of Rs 25000 to the Firm don’t have any partnership deed. At the end of the year, A will be allowed

a) More share in profits

b) Interest on loan @6% a

c) Interest on loan @12% a

d) None of the above

Question 14

Appropriation of profit means:

a) Deduction of profit for creating reserve

b) Capital profit of the

c) Distribution of available net profit left out after providing all the appropriations

d) None of the above

Question 15

What is a charge against/ on profits?

a) It means set a side some portion of profit for reserve

b) It means deduction of expenses from the profits for computing net profit/loss for the appropriation

c) It means capital profit earned by the

d) None of the above

MCQ on Fundamentals of Partnership – Question 16

If a fixed amount is withdrawn at the end of every month, for what period the interest on total amount withdrawn will be calculated?

a) 5 months

b) 6 months

c) 5 months

d) None of the above

Fundamentals of Partnership class 12 MCQ – Question 17

The methods by with partner’s capital accounts are maintained known as :

a) Fixed capital method

b) Fluctuating capital method

c) Both (a) and (b)

d) None of the above

Question 18

What will be the interest on drawings of B @ 20 % per annum if B withdrew Rs. 10000 per month in the

beginning of every month.

[A] 24000

[B] 11000

[C] 13000

[D] None of the above

MCQ on Fundamentals of Partnership – Question 19

What will be the interest on drawings of B @ 15 % per annum if B withdrew Rs. 5000 per month in the end of

every month.

[A] 9000

[B] 4125

[C] 4875

[D] None of the above

Question 20

What will be the interest on drawings of C @ 10 % per annum if C withdrew Rs. 15000 per month in the middle of every month.

[A] 18000

[B] 9000

[C] 8500

[D] None of the above

MCQ on Fundamentals of Partnership – Question 21

What will be the interest on drawings of B @ 15 % per annum if B withdrew Rs. 10000 per month in the end of every month for 9 months.

[A] 4500

[B] 1350000

[C] 8000

[D] None of the above

Question 22

What will be the interest on drawings of C @ 10 % per annum if C withdrew Rs. 12000 per month in the end of every month for 6 months.

[A] 7200

[B] 5200

[C] 1500

[D] None of the above

Question 23

What will be the interest on drawings of D @ 20 % per annum if D withdrew Rs. 10000 per month in the middle of every month for 6 months.

[A] 3000

[B] 12000

[C] 8500

[D] None of the above

MCQ on Fundamentals of Partnership – Question 24

What will be the interest on drawings of D @ 14 % per annum if D withdrew Rs. 14000 per month in the middle of every month for 9 months.

[A] 17600

[B] 6615

[C] 10685

[D] None of the above

Question 25

What will be the interest on drawings of B @ 5 % per annum if B withdrew Rs. 5000 in the beginning of each quarter during the year.

[A] 625

[B] 100000

[C] 99375

[D] None of the above

Question 26

What will be the interest on drawings of D @ 12 % per annum if D withdrew Rs. 12000 in the end of each quarter during the year.

[A] 3600

[B] 5760

[C] 2160

[D] None of the above

MCQ on Fundamentals of Partnership – Question 27

What will be the interest on drawings of E @ 12 % per annum if E withdrew Rs. 20000 in the middle of each

quarter during the year.

[A] 6800

[B] 4800

[C] 5800

[D] None of the above

Question 28

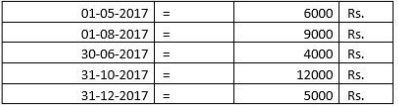

E is a partner in a firm. His drawings during the year given below for the year 2017 . Interests on drawings to be charged @ 10 % per annum.

The interest on E’s drawings for the year will be:

[A] 12000

[B] 10825

[C] 1175

[D] None of the above

Fundamentals of Partnership class 12 MCQ – Question 29

D and E are partners having capital balances as Rs. 30000 and 70000 on 01-Apr-2016 . D introduced further

capital of Rs. 10000 on 01-Jan-2017 and another 10000 on 15-Jan-2017 . Interest on capital to be allowed to D

assuming the rate of interest to be 6 % per annum will be:

[A] 1875

[B] 2075

[C] 1575

[D] None of the above

MCQ on Fundamentals of Partnership – Question 30

E and F are partners sharing profits and losses in the ratio of 2 : 3 .Their capitals at the end of the financial year 2010 – 2011 were Rs. 150000 and Rs. 100000 .During the year 2010 – 2011 , E s drawings were Rs. 30000. Profit before charging interest on capital for the year was Rs. 10000 which was duly credited to their accounts. Interest on capital of E @ 15 % per annum for the year 2010 – 2011 will be:

[A] 18600

[B] 25800

[C] 26400

[D] None of the above

Question 31

C and D started a partnership firm on 1st April 2013 with capitals of Rs. 150000 and Rs. 250000 respectively.

On 1st July 2013 ,they decided that their capitals should be Rs . 200000 each. The necessary adjustments in the

capitals are made by introducing or withdrawing cash. Interest on capital is to be allowed @ 15 % per annum.

Interest on partners capital will be :

[A] 28125 for C

31875 for D

[B] 27525 for C

31875 for D

[C] 28025 for C

31875 for D

[D] None of the above

Fundamentals of Partnership class 12 MCQ – Question 32

A and D are partners in a firm. A is to get a commission of 10 % of net profit before charging any commission. Net profit before charging any commission was Rs. 100000 .Commission of A will be :

[A] 10000

[B] 9600

[C] 9700

[D] None of the above

MCQ on Fundamentals of Partnership – Question 33

C and D are partners in a firm. C is to get a commission of 12 % of net profit before charging any commission. D is to get a commission of 12 % of net profit after charging all commission. Net profit before charging any commission was Rs. 70,000 .Commission of C and D will be :

[A] 16950 for C

12750 for D

[B] 12750 for C

17250 for D

[C] 17250 for C

12750 for D

[D] None of the above

Fundamentals of Partnership class 12 MCQ – Question 34

C and D are partners in a firm. C is to get a commission of 10 % of net profit before charging any commission. D is to get a commission of 10 % of net profit after charging all commission. Net profit before charging any commission was Rs. 99000 .Journal entry for Commission of C and D will be :

[A] C’s commission A/c Dr 9100

D’s commission A/c Dr 7300

To C’s capital/current A/c 9100

To D’s capital/current A/c 7300

[B] C’s commission A/c Dr 9600

D’s commission A/c Dr 7800

To C’s capital/current A/c 9600

To D’s capital/current A/c 7800

[C] C’s commission A/c Dr 9900

D’s commission A/c Dr 8100

To C’s capital/current A/c 9900

To D’s capital/current A/c 8100

[D] None of the above

Question 35

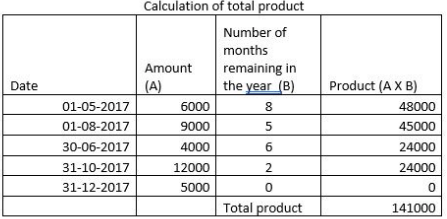

A and D are partners sharing profits and losses in the ratio of 1 : 1 with capitals of Rs. 40000 and 30000 respectively. On 1st December 2015 A and D granted loans of Rs. 100000 and 80000 respectively. The profit before charging interest is 6500 .The total amount of distributable profits will be:

[A] 2900

[B] 3000

[C] 3200

[D] None of the above

MCQ on Fundamentals of Partnership – Question 36

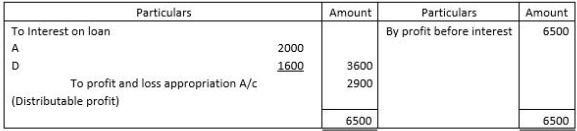

C and D are partners sharing profits and losses in the ratio of 1 : 1 with capitals of Rs 60000 and 70000 respectively. On 1st October 2013 C and D granted loans of Rs. 90000 and 80000 respectively to the firm. The partnership deed is silent as to the interest on partner’s loan. The profits before any interest for the year amounted to Rs. 6000 .The interest on partners loan will be:

[A] 2400 for C

2000 for D

[B] 2000 for C

2000 for D

[C] 2700 for C

2400 for D

[D] None of the above

Question 37

The firm DEF earned a profit of Rs. 200000 during the year ending on 31st March 2016 . 15 % of this profit was to be transferred to general reserve. The necessary journal entry for the same will be:

[A] Profit and loss appropriation A/c Dr 27272

To General Reserve A/c 27272

[B] Profit and loss appropriation A/c Dr 30000

To General Reserve A/c 30000

[C] General Reserve A/c Dr 30000

To Profit and loss appropriation A/c 30000

[D] None of the above

MCQ on Fundamentals of Partnership – Explanation and Answers

Explanation 1:-

Partnership is a separate business entity from accounting point of view, but from a legal point, partnership is not a separate legal entity from its partners and partners are responsible for all its act.

Answers 1. – b) It is not a separate legal entity

Fundamentals of Partnership class 12 MCQ – Explanation 2:-

The essential features of partnership are as follows:

- Two or more person – partnership is the association of two or more

- Registration – Registration of a partnership is not However, if the partners so decide, they may get the firm registered with the registrar of firms.

- Liability of partnership – Each partner is liable jointly and severally with all other partners to the third party for all the acts of the firm, while he is a

- Mutual agreement – The agreement becomes the basis of relationship between the partners if not in written an oral agreement is equally

- Business – The business of the partnership can be carried on by any one of them, acting for Partners are agents as well as the principals of the firm.

- Sharing of profit – The agreement between the partners must be to share profits of a business.

- Management and control – Every partner has a right to take part in the management of the firm.

Answer 2.- d) All of the above

MCQ on Fundamentals of Partnership – Explanation 3:-

Interest on drawings = Total product x Rate/100 x 1/12

Answers 3 – c) Total product x Rate/100 x 1/12

Explanation 4:-

Answer 4 – d) Right to receive salary at the end of every

Explanation 5:-

According to section 4 of the Indian partnership Act, 1932, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

Answer 5 – a) X and Y are partners

Explanation 6:-

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (12+3)/2

= 15/2

= 7.5

Answer 6 – None of the above

Explanation 7:-

Sleeping partner is liable for the acts of other partner because of mutual agency relationship.

Answer 7 – b) Rakesh is wrong he is liable for the act of his other partner

MCQ on Fundamentals of Partnership – Explanation 8:-

Following are the contents of partnership Deed

- Name and address of all the partners.

- Name and address of all the firm.

- Principal place of business.

- Nature of Business.

- Date of commencement of the Partnership.

- Rules regarding operation of bank account.

- Salary/Commission to partners.

- Interest on capital to partners.

- Interest on drawings of partners.

- Accounting period of the firm etc…

Answer 8 – d) All of the above

Explanation 9:-

Registration of a partnership is not compulsory. However, if the partners so decide, they may get the firm registered with the registrar of firms.

Answer 9 – a) Optional

Explanation 10:-

In the absence of partnership deed, profits and losses will be distributed equally among the partners.

Answers 10 – a) Equal

Fundamentals of Partnership class 12 MCQ – Explanation 11:-

In the absence of partnership deed, no interest in allowed on capital and no interest is charged on drawings.

Answer 11 – c) No interest will be allowed and charged

Explanation 12:-

In the absence of partnership deed, each partner gets equal share in profit, no matter how much contribution made by him including sleeping partner.

Answer 12 – b) Equal share in profit

Explanation 13:-

In the absence of partnership deed, interest @6% p.a is to be allowed on loans and advances of partners.

Answer 13 – b) Interest on loan @6% a

Explanation 14:-

Appropriation of profits means distribution of available net profits left out after providing all expenses. Appropriations are provided only in case a firm has profits(not in case of loss).

Answer 14 – c) Distribution of available net profit left out after providing all the appropriations

Explanation 15:-

Charge against profit implies deduction of expenses from the profits in order to compute net profit/net loss during the accounting year.

Answer 15 – b) It means deduction of expenses from the profits for computing net profit/loss for the appropriation

Explanation 16:-

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (11+0)/2

= 11/2

= 5.5

Answer 16 – d) None of the above

Explanation 17:-

In a partnership firm there are two methods by which partners capital accounts may be maintained. These are:

1 Fixed capital method

2 Fluctuating capital method

Answer 17 – c) Both (a) and (b)

Fundamentals of Partnership class 12 MCQ – Explanation 18:-

Per month drawing of B = 10000

Total months in a year = 12

Total drawings made by B during the year = 10000 x 12

= 120000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (12+1)/2

= 13/2

= 6.5 Months

Interest on drawings = Annual Drawings x Rate of Interest x Average Period/12

= 120000 x 20% x (6.5/12)

= 13000

Answer 18 – [C] 13000

MCQ on Fundamentals of Partnership – Explanation 19:-

Per month drawing of B = 5000

Total months in a year = 12

Total drawings made by B during the year = 5000 X 12

= 60000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= 11+0/2

= 11/2

= 5.5 Months

Interest on drawings = Annual drawings x Rate of interest x Average Period/12

= 60000 x 15% x 5.5/12

= 4125

Answer 19 – [B] 4125

MCQ on Fundamentals of Partnership – Explanation 20:-

Per month drawing of C = 15000

Total months in a year = 12

Total drawings made by C during the year = 15000 X 12

= 180000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (11.5+0.5)/2

= 12/2

= 6 Months

Interest on drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 180000 x 10% x 6/12

= 9000

Answer 20 – [B] 9000

MCQ on Fundamentals of Partnership – Explanation 21:-

Per month drawing of B = 10000

Total months in a period = 9

Total months in a year = 12

Total drawings made by B during the period = 10000 X 9

= 90000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (8+0)/2

= 8/2

= 4 Months

Interest on drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 90000 x 15% x (4/12)

= 4500

Answer 21 – [A] 4500

Fundamentals of Partnership class 12 MCQ – Explanation 22:-

Per month drawing of C = 12000

Total months in a period = 6

Total months in a year = 12

Total drawings made by C during the period = 12000 x 6

= 72000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (5+0)/2

= 5/2

= 2.5 Months

Interest on drawings = Annual drawings x Rate of interest x (Average Period/12){12}\)

= 72000 x 10% x (2.5/12)

= 1500

Answer 22 – [C] 1500

Explanation 23:

Per month drawing of D = 10000

Total months in a period = 6

Total months in a year = 12

Total drawings made by D during the period = 10000 x 6

= 60000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (5.5+0.5)/2

= 6/2

= 3 Months

Interest on drawings = Annual drawings x Rate of interest x (Average Period/2)

= 60000 x 20% x (3/12)

= 3000

Answer 23 – [A] 3000

MCQ on Fundamentals of Partnership – Explanation 24:-

Per month drawing of D = 14000

Total months in a period = 9

Total months in a year = 12

Total drawings made by D during the period = 14000 x 9

= 126000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (8.5+0.5)/2

= 9/2

= 4.5 Months

Interest on Drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 126000 x 14% x (4.5/12)

= 6615

Answer 24 – [B] 6615

Explanation 25:-

Per month drawing of B = 5000

Total number of quarters in a year = 4

Total months in a year = 12

Total drawings made by B during the year = 5000 x 4

= 20000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (12+3)/2

= 15/2

= 7.5 Months

Interest on drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 20000 x 5% x (7.5/12)

= 625

Answer 25 – [A] 625

MCQ on Fundamentals of Partnership – Explanation 26:-

Per month drawing of D = 12000

Total number of quarters in a year = 4

Total months in a year = 12

Total drawings made by D during the year = 12000 x 4

= 48000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (9+0)/2

= 9/2

= 4.5 Months

Interest on drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 48000 x 12% x (4.5/12)

= 2160

Answer 26 – [C] 2160

Explanation 27:-

Per month drawing of E = 20000

Total number of quarters in a year = 4

Total months in a year = 12

Total drawings made by E during the year = 20000 x 4

= 80000

Average period for Interest on drawings = (Months remaining after first drawings + Months remaining after last drawings)/2

= (10.5+1.5)/2

= 12/2

= 6 Months

Interest on drawings = Annual Drawings x Rate of Interest x (Average Period/12)

= 80000 x 12% x (6/12)

= 4800

Answer 27 – [B] 4800

MCQ on Fundamentals of Partnership – Explanation 28:-

Interest on Drawings = Total of Product x Rate of Drawings x (1/12)

= 141000 x 10% x (1/12)

= 1175 Rs.

Answer 28 – [C] 1175

Explanation 29:-

Calculation of interest on capital to be allowed to D

On Rs. 30000 for full year = 30000 x 6% = 1800

On Rs. 10000 for 3 months = 10000 x 6% x (3/12) = 150

On Rs. 10000 for 2.5 months = 10000 x 6% x (2.5/12) = 125

=2075

Answer 29 – [B] 2075

Explanation 30:-

Calculation of capital at the beginning of the year

Capital at the end = 150000 Rs.

Add: Drawings = 30000 Rs.

= 180000 Rs.

Less: profit credited for the year = 4000 Rs.

= 176000 Rs.

Less: Additional capital introduced =0

Capital in the beginning = 176000 Rs.

Interest on E s capital = 176000 x 15% = 26400

Answer 30 – [C] 26400

MCQ on Fundamentals of Partnership – Explanation 31:-

Calculation of interest on capital

For C

Interest on capital from 1st April 2013 to 1st July 2013 = 150000 x 15% x (3/12)

= 5625

Interest on capital from 1st July 2013 = 200000 x 15% x (9/12)

= 22500

Total interest for the year = 5625 + 22500

= 28125

For D

Interest on capital from 1st April 2013 to 1st July 2013 = 250000 x 15% x (3/12)

= 9375

Interest on capital from 1st July 2013 = 200000 x 15% x (9/12)

= 22500

Total interest for the year = 9375 + 22500

= 31875 Rs.

Answer 31 – [A] 28125 for C 31875 for D

Explanation 32:-

A’s commission as percentage of net profit before charging such commission

= (Net Profit before Commission x Rate of Commission)/100

= 100000 x (10/100) = 10000

Answer 32 – [A] 10000

MCQ on Fundamentals of Partnership – Explanation 33:-

C’s commission as percentage of net profit before charging such commission

= (Net Profit before Commission x Rate of Commission)/100

= (70000 x 12)/100 = 8400

D’s commission as percentage of net profit after charging such commission

= (Net Profit after any other Commission x Rate)/(100+Rate of Commission)

= 70000 – 8400 x (12/100+12)

= 61600 x (12/112)

= 6600

Answer 33 – [D] None of the above

Explanation 34:-

C s commission as percentage of net profit before charging such commission

= (Net Profit before Commission x Rate of Commission)/100

= 99000 x (10/100)= 9900

D s commission as percentage of net profit after charging such commission

= (Net Profit after any other Commission x Rate)/(100+Rate of Commission)

= 99000 – 9900 x (10/100+10)

= 89100 x (10/110)

= 8100

Answer 34 – [C] C’s commission A/c Dr 9900

D’s commission A/c Dr 8100

To C’s capital/current A/c 9900

To D’s capital/current A/c 8100

Explanation 35:-

Total month in a year = 12

Total months to which loan was outstanding during the year = 4

Interest on A s loan = 100000 x (6/100) x (4/12) = 2000

Interest on D s loan = 80000 x (6/100) x (4/12) = 1600

Answer 35 – [A] 2900

MCQ on Fundamentals of Partnership – Explanation 36:-

Total month in a year = 12

Total months to which loan was outstanding during the year = 6

Interest on C s loan = 90000 x (6/100) x (6/12) = 2700

Interest on D s loan = 80000 x (6/100) x (6/12) = 2400

Answer 36 – [C] 2700 for C

2400 for D

Explanation 37:-

Amount to be transferred to general reserve = 200000 x (15/100) = 30000

Answer 37 – (B)

Profit and loss appropriation A/c Dr 30000

To General Reserve A/c 30000