Bird’s Eye view of Section 9 of Income Tax Act dealing with ‘Income deemed to accrue or arise India’

| Concept of taxation | Non-Resident Taxation |

| Provision of Income Tax Act, 1961 | Section 9 |

| Provision deals with | Income deemed to accrue or arise in India |

Income Deemed to Accrue or Arise in India – Section 9 of Income Tax Act

Indian residents are liable to pay tax on their global income in India, i.e., both Indian income and foreign income. The purpose of Section 9 of Income Tax Act is to provide for taxation of certain income of non-residents in India, which is deemed to accrue or arise in India. Such income may actually accrue or arise outside India in certain cases, but the deeming provision, if applicable would lead to taxation of such income in India.

Income accruing or arising from any Business Connection/ Property/ Source of Income in India – Section 9(1)(i) of Income Tax Act

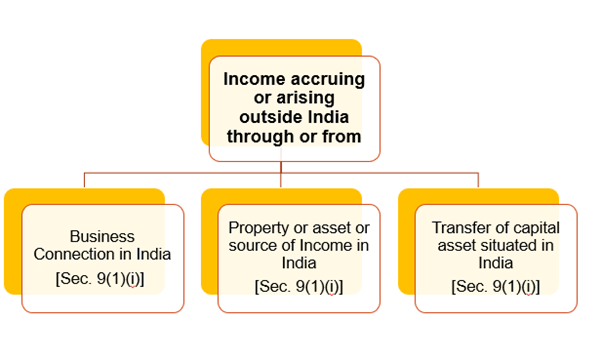

Section 9(1)(i) provides that any income , which directly or indirectly accrues or arise at any place outside India, shall be deemed to accrue or arise in India where such income : –

- Directly or indirectly accrues or arise through any business connection in India or from any business connection in India – Refer Para

- Directly or indirectly accrues or arise through any property in India or from any property in India – Refer Para

- Directly or indirectly accrues or arise through asset or source of income in India or from any asset or source of income in India– Refer Para or

- Directly or indirectly accrues or arise through the transfer of a capital asset situated in India– Refer Para

Deemed Income – Business Connection or asset in India

What is Business Connection under Section 9 of Income Tax Act (Includes Profession Connection) ?

In its simplest terms, business connection involves a relationship, between the business of a non-resident which earns certain profits , and some activity in India, which contributes directly or indirectly to the earning of such profits. The activity in India may be carried out by the non-resident itself, or through an agent. However, the activity in India and non-resident should have some continuity, and an isolated transaction would normally not constitute a business connection. The activity that constitute Business connection may be a part of the main business , incidental to main business or a relation between the business of the non-resident and the activity in India, which facilitates in carrying on that business.

Once the business connection is established, the income of the non-resident, that is taxable by virtue of this business connection, is only the part of the income that can be reasonably attributed to the operations carried out in India (Explanation -1 to section 9(1)(i)of the Act). The entire income of the non-resident from such business is not taxable in India.

A. Business Connection through an agent

As discussed above, ‘Business connection’ shall include any business activity of the non-resident which is carried out through an agent, i.e a person in India, who is acting on behalf of the non-resident – Explanation 2 to section 9(1)(i). Such agent of non-residents could be either : –

- Dependent Agent

- Independent Agent.

A.1 Agents having Independent Status are not included in Business Connection

Where the business of the non-resident is carried on in India, through a broker, general commission agent or any other independent status agent, who is acting in the ordinary course of his business, such person would not constitute a business connection of the non-resident. What this implies is that if a person provides certain routine services in the normal course of their business, such person would ordinarily not constitute a business connection of the NR in India.

In order to ascertain if the agent has an independent status , it would need to be evaluated if the agent works mainly (90% or more is considered as mainly) or wholly for the non-resident. If he works mainly or wholly for the non-resident, he may be considered as a dependent agent, else he is considered as an independent agent.

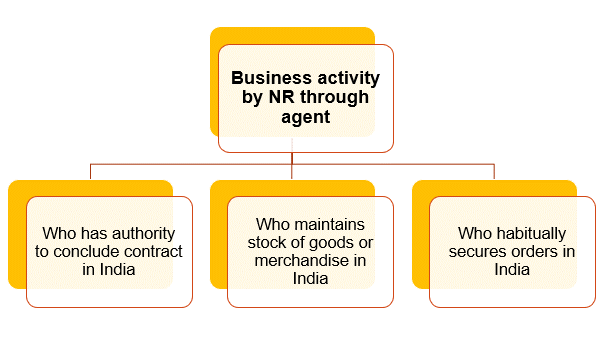

Business connection of a non-resident through an agent, shall include the following three cases : –

- Where the agent has an authority to conclude contract

- Where the agent maintains a stock of goods in India on behalf of the non-resident ;

- Where an agent secures order in India on behalf of the non-resident .

The Agent, would not be considered to have an independent status in the three situations, where he is employed by such a non-resident.

Similar provisions are generally found in various Indian Treaties. A sample provision of Article 5(4) and Article 5(5) of the India USA Treaty reads as under : –

Notwithstanding the provisions of paragraphs 1 and 2, where a person—other than an agent of an independent status to whom paragraph 5 applies – is acting in a Contracting State on behalf of an enterprise of the other Contracting State, that enterprise shall be deemed to have a permanent establishment in the first-mentioned State, if :

a) he has and habitually exercises in the first-mentioned State an authority to conclude on behalf of the enterprise, unless his activities are limited to those mentioned in paragraph 3 which, if exercised through a fixed place of business, would not make that fixed place of business a permanent establishment under the provisions of that paragraph ;

b) he has no such authority but habitually maintains in the first-mentioned State a stock of goods or merchandise from which he regularly delivers goods or merchandise on behalf of the enterprise, and some additional activities conducted in the State on behalf of the enterprise have contributed to the sale of the goods or merchandise ; or

c) he habitually secures orders in the first-mentioned State, wholly or almost wholly for the enterprise.

5. An enterprise of a Contracting State shall not be deemed to have a permanent establishment in the other Contracting State merely because it carries on business in that other State through a broker, general commission agent, or any other agent of an independent status, provided that such persons are acting in the ordinary course of their business. However, when the activities of such an agent are devoted wholly or almost wholly on behalf of that enterprise and the transactions between the agent and the enterprise are not made under arm’s length conditions, he shall not be considered an agent of independent status within the meaning of this paragraph.

Profit attribution to Agent

Further, even where a non-resident has a business connection in India, the entire income is not taxable in India. Only income which is attributable to the operations carried out in India , shall be deemed to accrue or arise in India [Explanation 3 to section 9(1)(i)]

Each of these three cases are discussed as under : –

A.2 Business Connection when agent of Non-resident has authority to conclude contracts in India – Section 9(1)(i) of Income Tax Act

The term “ business connection” shall include any business activity, carried out by the non-resident through a person who, acts on behalf of the non-resident, and in performing such an act he : –

- Has an authority to conclude contracts on behalf of the non-resident which is habitually exercised to conclude contracts on behalf of the non-resident; or

Habitually plays the principal role leading to conclusion of contracts by the non-resident.

The above provision shall be applicable provided that the contracts are –

- In the name of the non-resident ; or

- For the transfer of the ownership of property owned by that non-resident or property for which the non-resident has the right to use ; or

- For the granting of the right to use, property owned by that non-resident or property for which the non-resident has the right to use; or

- For the provision of services by that non-resident

When authority is not exercised

If the agent has an authority to conclude contracts but such authority is not exercised , the non-resident would not have a business connection in India.

Agent qualifies to be an independent agent

Further, if such an agent qualifies to be an independent agent, the non-resident would not have a business connection in India. An agent who is a broker, general commission agent or any other agent, who are acting in the ordinary course of their business, are treated as agent of independent status.

Goods are exported to a third party

This provision does not cover cases where an agent has authority on behalf of a non resident to purchase goods or merchandise which are exported to the non-resident. However there may be cases, where even though goods are procured in India by the agent , and are exported out of India, the goods are exported to a third party, and the non-resident is merely a broker for a trader. In such a case, the non-resident may have a business connection in India.

Aligning the scope of “Business Connection” with modified PE rule as per Multilateral Instrument (MLI).

As discussed above, under the existing Rules relating to Dependent Agent Permanent Establishment (DAPE) in India’s Double Taxation Avoidance Agreements (DTAAs) if any person acting on behalf of the non-resident, is habitually authorised to conclude contracts and such authority is exercised for the non-resident, then such agent would constitute a PE in the source country. Let us understand this scenario with the help of following illustration :-

Illustration :-

XY International (UK) is engaged in the business of selling ‘Product A’. It appoints Mr. R as a full time agent in India for selling such product. Mr. R negotiates with the customers in India on pricing and other terms of the contract and concludes such contract on behalf of XY International. In this case, Mr. R would be deemed as dependent agent of XY International in India. Thus, any profit attributable to his operations in India would be taxable in India.

In order to avoid establishing an agency PE under Article 5 of the DTAA, the person acting on the behalf of the non-resident, can negotiate the contract and finalize delivery terms, etc. on behalf of non-resident , but does not conclude it . By doing so, such agents were able to bypass provisions of Agency PE . We can understand this situation with the help of following illustration

Illustration for Section 9 of Income Tax Act :-

ABCD International (UK) is engaged in the business of selling ‘Product X’. It appoints Mr. B as full time agent in India for selling such product. Mr. B negotiates the contract with the customers in India and ABCD is bound by price/other conditions negotiated by Mr. B. However, after finalizing terms and conditions of contract with customers in India, Mr. B sends such contract for formal approval and signature by ABCD.

In this case, Mr. B negotiates with the customers in India but does not conclude contracts with them and this way ABCD circumvents the PE rule.

- The OECD, under BEPS Action Plan 7 recommended modifications to paragraph (5) of Article 5 dealing with agency PE to provide that an agent would include a person who habitually plays a principal role leading to the conclusion of contracts.

- These recommendations have now been included in Article 12 of Multilateral Convention (‘MLI’) to Implement Tax Treaty Related Measures, and India is also a signatory to the Multilateral Instrument. Thus, an agent of non-resident would be deemed as dependent agent under tax treaty , even if such agent plays principal role leading to conclusion of contract. The effect of inclusion of such recommendations in Article 12 of MLI would be that it will automatically modify India’s bilateral tax treaties covered by MLI, where treaty partner has also opted for Article 12. As a result, the DAPE provisions in Article 5(5) of India’s tax treaties, as modified by MLI, shall become wider in scope than the current provisions in Explanation 2 to section 9(1)(i).

To bring provision of domestic law at par with Treaty, Finance Act, 2018 amended the section 9 whereby even cases where an agent habitually plays the principal role leading to conclusion of contracts by the non-resident, it would result in business connection of the non-resident in India.

Example 1 : – Agent Habitually exercising authority to conclude contract on behalf of Non Resident

Beta Inc., USA manufactures and sells certain software worldwide. It appoints Rajesh as sales head for the territory of India, who negotiates price and delivery terms with customers . Beta Inc. is bound by terms negotiated by Rajesh. Whether Beta Inc. has any business connection in India?

Solution : –

In order to establish business connection in India, the agent must have an authority, which is habitually exercised to conclude contracts on behalf of the non-resident. Rajesh is negotiating with customers on pricing and delivery terms and Beta Inc. does not have an authority to modify the pricing and delivery terms. Beta Inc. has a Business connection in India as Mr. Rajesh is habitually exercising authority to conclude contract on behalf of Beta Inc.

Example 2 : – Agent not exercising authority to conclude contract on behalf of Non Resident

NY Inc. manufactures and sells certain software for distribution worldwide. It appoints TOM as sales head in India. TOM informs potential customers in India about Product features, price list but does not negotiate with customers on the pricing and delivery terms. Only NY Inc. negotiates on pricing and delivery terms of contract, and the contracts are concluded outside India. Whether NY Inc. has any business connection exist in India?

Solution : –

In order to establish a business connection in India, the agent must have an authority, which is habitually exercised to conclude contracts on behalf of the non-resident. Tom is only informing product details & standard price lists on behalf of NY Inc. and he does not negotiate or conclude contracts with customers on pricing and delivery terms. NY Inc. has authority to negotiate or decide pricing and delivery terms. Thus, Tom does not have an authority to conclude contracts on behalf of NY Inc. In view of this NY Inc. has no business connection in India.

A.3 Business connection when agent of NR maintains stock of goods in India – Section 9(1)(i) of Income Tax Act

In certain cases, a non-resident may carry on business in India through a person who does not have any authority to conclude contract on behalf of the non-resident, but such person habitually maintains a stock of goods or merchandise on behalf of the non-resident in India. Further, such person may regularly deliver goods or merchandise on behalf of the non-resident from such stock. In such a case, such person would constitute a business connection of the non-resident in India.

Similar clause in the India USA Treaty reads as under : –

“he has no such authority but habitually maintains in the first-mentioned State a stock of goods or merchandise from which he regularly delivers goods or merchandise on behalf of the enterprise, and some additional activities conducted in the State on behalf of the enterprise have contributed to the sale of the goods or merchandise”.

The terms of the Treaty are generally in line with the provision of the Act.

A.4 Business connection when agent of NR secures orders in India for the NR – Section 9(1)(I) of Income Tax Act

A person who is appointed as an agent of the non-resident, may either work mainly for exclusively for one non-resident or a group of company belonging to a particular multinational Enterprise, or he may work for several principle without having anyone person who constitutes the significant part of his business.

Where a non-resident company carries on business activities in India through a person who habitually secures orders in India, mainly or wholly for such non-resident/ group, such a person would constitute a business connection of a non-resident in India.

Further, when the person acting on behalf of such non-resident (NR 1) secure order for other non-residents, the business for other non-residents would also be established if,

a) Such other non-resident controls the NR-1 or

b) Such other non-resident is controlled by NR-1 or

c) Such other non-resident is subject to same control as that of NR-1.

In all the three situations, business connection is established, where a person habitually secures orders in India, mainly (more than 90% but less than 100%) or wholly for such non-residents.

Similar clause in the India USA Treaty reads as under : –

“he habitually secures orders in the first-mentioned State, wholly or almost wholly for the enterprise.”

The terms of the Act are generally broader than the provision of the Treaty, and therefore, given a choice one should opt for the provision of the Treaty as that may limit the taxation in India.

Examples of Ordinary Course of Business [No Business Connection] : –

Indian newspaper company collecting advertisement for other Foreign newspaper

An Indian newspaper company collecting advertisement for other foreign newspaper, acts in ordinary course of its business when it enters into a solicitation agreement with foreign principal. In such a case, no business connection exit in India.

Department of posts accepting money orders for transfer of funds within India

The department of posts accepts money orders for transfer of funds within India. Engaging itself with same type of business, i.e., money transfer services across international borders is just an extension of its business and hence, is in the ordinary course of business.

A.5 Exceptions in case of Business Connection

Under the provision of the Income Tax Act, the following activities carried out in India on behalf of the non-resident shall not be treated as business connection of a non-resident in India [Explanation 1 to section 9(1)(i)] : –

a) Purchase of goods in India for export [Explanation 1(b) to section 9(1)(i)] : –

No income shall be deemed to accrue or arise in India to a non-resident , from operations, which are confined to the purchase of goods in India for the purpose of export. For example, in case of a non-resident engaged in the business of sale of raw cotton, purchase of raw cotton in India by an agent of the non-resident, which are exported to the non-resident would not result in a business connection of the non-resident in India. However, in case the non-resident is a commission agent who procures goods on behalf of another non-resident, and he appoints an agent in a India for procuring goods on behalf of those other non-resident, the income of the non-resident commission agent would be deemed to accrue or arise in India.

b) Collection of news and views in India for transmission out of India [Explanation 1(c) to section 9(1)(i)]:

Where a non-resident is engaged in the business of running a news agency or of publishing newspapers, magazines or journals, no income shall be deemed to accrue or arise to the non-resident in India through activities which are confined to the collection of news and views in India, for transmission out of India.

c) Shooting of cinematograph films in India [Explanation 1(d) to section 9(1)(i)]:

In the case of a non-resident, no income shall be deemed to accrue or arise in India through or from operations which are confined to the shooting of any cinematograph film in India, if such non-resident is :

- individual, who is not a citizen of India or

- a firm which does not have any partner, who is a citizen of India or who is resident in India; or

- a company which does not have any shareholder who is a citizen of India or who is resident in India.

Attribution of income to India when only part of business operations are carried out in India [Explanation 1(a) to section 9(1)(i)]:

Where the business of non-resident comprises of several parts of operations, and only some of the operations are carried out in India, the income of the business of the non-resident which is deemed to accrue or arise in India, shall be only such part of income , which can be reasonably attributable to the operations carried out in India.

Significance Economic Presence of a non-resident in India – [Explanation 2A to section 9(1)(i) applicable from AY 2019-20 ]:

Under the existing provisions of the International Tax laws, business profits of an enterprise are taxable in the Country of Residence (For Example where a US enterprise is doing business in India, profit arising from such business would be taxable only in US) of such enterprise. However, such business profits may be taxed in the Source Country, only if the enterprise has a PE in Source State (i.e., business profit of US enterprise may be taxable in India, if such entity has a PE in India). Generally, PE of an enterprise is created on the basis of its physical presence in another Country. However, due to technological advancements, an enterprise can continue doing business in any Country, without any physical presence in that Country.

- Therefore, the existing nexus rule based on physical presence do not hold good anymore for taxation of business profits in source country. As a result, the rights of the source country to tax business profits that are derived from its economy is unfairly and unreasonably eroded . In order to deal with such challenges, certain changes were required so that an enterprise may constitute PE , based on its significance economic presence in another Country.

- OECD under its BEPS Action Plan 1 addressed the tax challenges in a digital economy wherein it had discussed several options to tackle the direct tax challenges arising in digital businesses. One such option is a new nexus rule based on “significant economic presence”. As per the Report on Action Plan 1 , a non-resident enterprise would create a taxable presence in a country if it has a significance economic presence in that country on the basis of factors , that have a purposeful and sustained interaction with the economy by the aid of technology and other automated tools. It further recommended that revenue factor may be used in combination with the aforesaid factors to determine ‘significance economic presence’

In order to deal with such challenges and incorporate the provision of Action Plan 1 in Indian legislation, Explanation 2A to Section 9(1)(i) of the IT Act was added to provide that ‘significant economic presence’ in India, shall also constitute ‘business connection’ . For this purpose significant economic presence shall mean –

a) Any transaction carried out by a non-resident in India in respect of any goods, services or property including provision of download of data or software in India .

Note:

In order to constitute a significance economic presence the aggregate of payments or revenue arising from physical goods or services and digital goods or services during the previous year should exceed the prescribed limit . However, no threshold limit of revenue has been prescribed by the CBDT till now for applicability of such provision .

b) Systematic and continuous soliciting of its business activities in India or engaging in interaction with such number of users in India as may be prescribed, through digital means.

Note:

No threshold of number of users has been prescribed by the CBDT , which would resuld in situation where the non-resident would be deemed to be engaged in interaction or carries out systematic and continuous soliciting of business activities in India for applicability of such provision .

It is further provided that , only so much of income as is attributable to such transactions or activities shall be deemed to accrue or arise in India, and not the entire income of the non resident.

The transactions or activities referred above shall constitute significant economic presence in India, whether or not,-

- the agreement for such transactions or activities is entered in India; or

- the non-resident has a residence or place of business in India; or

- the non-resident renders services in India.

- This amendment will enable India to negotiate for inclusion of the new nexus based rule in the form of ‘significant economic presence’ in the DTAA. However, for the current purpose, even after insertion of significant economic presence based taxation u/s 9, the cross border business profits will continue to be taxed as per the existing treaty rules , which are more beneficial to the taxpayer, and may result in Nil/ lower taxes, unless the Treaties are renegotiated.

For any queries, please write them in the Comment Section or Talk to our tax expert