Module 6 – Taxation of E-commerce Transactions, CA Final International Taxation Elective Paper 6C

WHAT IS AN E-COMMERCE TRANSACTION ?

E-commerce transactions are transactions of buying or selling online, which are made through the use of computers / mobiles/ other telecommunications devices and equipments.It also involves conducting any transaction , which involves transfer of ownership or rights to use goods or services through a computer-mediated network

Various authorities have given definition of E-commerce ..Read More

ISSUES IN E-COMMERCE TRANSACTIONS

- DETERMINATION OF ECONOMIC ATTACHMENT

- IDENTIFICATION OF PE

- WHICH COUNTRY’S LAW TO APPLY ?

- WHICH COUNTRY’S LAW TO APPLY IN CASE OF CONTRACT

- HOW TO DETERMINE TAXABLE TERRITORY?

Click here for detailed explanation of Issues in E-commerce Transactions

HOW BUSINESS IS TRANSACTED THROUGH ECOMMERCE TRANSACTIONS?

- Electronic advertising

- Electronic Sales

- Electronic delivery

ELECTRONIC ADVERTISING

Electronic advertising is carried out through the use of internet on various platforms, like Facebook, Google, Linkedin, etc.In such cases, the advertisers pays the advertising company for displaying advertisement relating to their products on the website of these advertisers. The advertisement could be in the form of a banner, a promotional video or text advertising.

ELECTRONIC SALES WITH TRADITIONAL DELIVERY/PAYMENT MECHANISM

Electronic sales is done certain resource which enables the customer to place an order online. In electronic sales, order may be placed online but the rest of the transactions may be completed through traditional means like, making payment via ‘cash on delivery’ (COD) or cheque, delivery of goods through courier, etc.

EXAMPLE :- Sales made by third party vendors through the use of platforms like Amazon, Flipkart, Paytm, etc. would be termed as electronic sales.

ELECTRONIC DELIVERY OF GOODS AND SERVICES

Under Electronic delivery , the seller/ service provider, enables the person to download certain commodities /avail services . Electronic delivery is possible for electronic goods and services like texts material, audio material, e-books, e-designs, games, etc. A large number of goods and services can be delivered digitally or electronically. In such cases, the Sellers, have a website, through which they enable the customer to download the electronic goods and services.

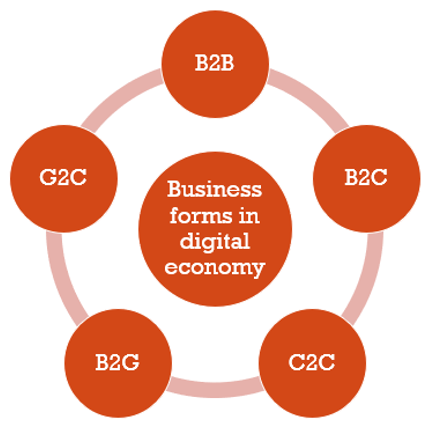

PREVALENT BUSINESS FORMS IN VARIOUS SEGMENTS OF DIGITAL ECONOMY

There are various forms of business which are prevalent in The E-Commerce segment. Depending on who the buyer is, and who the seller is, such forms can be broadly divided into the following categories : –

BUSINESS-TO-BUSINESS MODELS (B2B MODEL)

B2B E-commerce transactions consists of sale of products or services by one business to another business.In such transactions, both the buyer and sellers are business entities.

FOR EXAMPLE : –

- Online advertisements placed by various businesses on Google.

- Cloud computing services taken by organisations, from other business service providers

BUSINESS-TO-CONSUMER MODELS (B2C)

In B2C business model, one business sells goods or services, to individuals who are not in their profession.

B2C models can be of various types, some of which may include the following : –

- “Pureplay” online vendors with no physical stores or offline presence – Online education websites

- Click-and-mortar” businesses, that has both online and offline operations, which generally includes a website and a physical store – For example : – Lenskart that allows customers to order glasses and spectacles online and also has stores from where purchases can be made by the customers directly ; and

- Manufacturers that use online business, to allow customers to order and customise directly – Online tour operators, email, etc.

CONSUMER-TO-CONSUMER MODELS (C2C)

Consumer to consumer, or C2C, is a business model , which facilitates commerce or business transactions between private individuals. C2C models are increasing rapidly. The businesses involved in C2C e-commerce play the role of intermediaries, helping individual consumers to sell or rent their assets (such as residential property, cars, motorcycles, etc.) by publishing their information on the website and facilitating transactions.

FOR EXAMPLE : –

Quickr.com and Olx.com – Allows consumers to sell there used products to other customers who may be interested in purchasing them

BUSINESS-TO-GOVERNMENT MODELS (B2G)

Business-to-government models (B2G) refers to business conducted between private firms and Government.It may covers contracts for goods, services and information , between private players and government at all levels (state, local andfederal).

FOR EXAMPLE : – Contractors providing services to the Government relating to the construction of road, building dams etc.

GOVERNMENT-TO-CONSUMER MODELS (G2C)

- G2C concept is model which refers to the transactions between public administration and citizens, like demand of information by the citizen of an official document to the citizen.

FOR EXAMPLE: Office website Ministry of Corporate Affairs (MCA) which provides information to individuals relating to companies , or public service catalog

PERMANENT ESTABLISHMENT IN E-COMMERCE

Under the existing principles of international taxation, business income of non-resident , is liable to tax in Source State (India) , only when such a non-resident has PE in the Source State.

There are various criterion to constitute a PE in Source State under the Source State. However, in order to constitute a PE, there should be some fixed place of business/dependent agent, in the Source Country through which business of the non-resident enterprise is carried on in Source State. Additionally, such a place should be at the disposal of the non-resident, i.e the non resident should have a right to use such place at will and should be able to exercise control on when and how to use such place.

However, it is difficult to apply the conventional PE test in case of E-Commerce Transactions , where the business is carried out through the use of a website. There may not be any physical presence of the non-resident in the Source State and such transactions take place through website of non-resident. In such a case, the issue that arises is whether the existence of the website can result into a PE of the non-resident in the Source State. A website, is generally a set of documents which are located (hosted) on a Server, and are made available to the user. Sometimes , the server of a website may be located outside the Source Country.

When an enterprise does business in host Country through its website, then following three situations are required to be evaluated, to decide the existence of Permanent Establishment : –

- Situation 1 : – Existence of website in host Country

- Situation 2 : – Existence of server in host Country

- Situation 3 : – Server functioning as dependent agent

Situation 1 : – Existence of website in host country

Permanent Establishment means, a fixed place of business of a non-resident in the Source State, through which the business of such non-resident is carried on in the Source State. There should be some degree of permanence in the Source state for such fixed place, before it can constitute a Permanent Establishment. A temporary access to a place, on which the company does not have any right or control, does not result in a PE in Source State.

In the context of a website, a website is a set of documents, data and programme in digitized form, owned by one organization, and stored on server which may be owned by the company or Internet Service Provider.

Under the existing rules and judicial precedence, mere existence of website in host country, where the server is also located outside the Source country, would not constitute a Permanent Establishment of the non-resident owner of website in that country.

Situation 2 : – Existence of server in host country

In certain cases, the server may be located within the Source country. In such case, the operation or control of the server would be the relevant deciding factor , to ascertain if the server would constitute a Permanent Establishment of the non-resident in the Source country.

Following scenarios may arise in such a case : –

Case 1 : – When server is operated by another independent enterprise

Case 2 : – When enterprise itself owns or leases and operates the server.

CASE 1 : – WHEN SERVER IS OPERATED BY ANOTHER ENTERPRISE

In certain cases, the enterprise, which carries on business in the Source State through the website may be different from the enterprise which maintains the server, on which such website is hosted. In this case the location of server, is not at the disposal of the enterprise. Thus, server’s location would not be considered as PE of the enterprise which carries on business through website.

CASE 2 : – WHEN THE ENTERPRISE OWNS OR LEASES AND OPERATES SERVER

When an enterprise carries on business through website, whose server is at its disposal, then such server could be construed as PE of the enterprise.

SITUATION 3 : SERVER FUNCTIONING AS DEPENDENT AGENT

Smart servers are servers that provide information to the company and also take and process orders from persons who hit on the website.Such smart server , which are located in the Source country, may be considered as dependent agent. However, a contrary view that is taken by many taxpayers is that such a server , that hosts website is only a medium through which orders are placed. Therefore, website and server may not constitute a PE.

DETERMINATION OF NATURE OF INCOME IN E-COMMERCE TRANSACTIONS

Characterization of income of the non-resident implies, ascertaining under which head should such an income be taxed. This would imply that one is to identify whether a particular receipt is taxable as business profits, income from independent personal services, fee for Technical Services, capital gains etc . The manner of taxation of income from E-Commerce transactions would depend on the characterization of income.

The characterization of income is relevant because different type of income are taxed differently. For example, Business profits of non-resident are taxable only when such a non resident has PE in source Country. Further, such income would be liable to tax @ 40%.

As against this, in case of passive income (i.e., royalty, interest, Fees for Technical services), existence of PE in source Country is not required. such income can b taxed in the source country, even if the non resident does not have a PE in the source country.

The general rules of taxation in case of E-Commerce transactions, are as under : –

a) When limited rights in property are transferred digitally, it would amounts to royalty. In this case, existence of PE is not required in host Country to tax royalty.

b) When all rights in property are transferred digitally, it would be considered as outright sale. Accordingly, it would be characterised as business profits which are not taxable in another Country in absence of PE in that Country. However, it may be noted that under certain circumstances, transfer of all rights in a property may be taxable as royalty under the provision of the Income Tax Act, and if such a property is a Capital Asset, professor rising on its transfer may be liable to Capital gains tax.

E-COMMERCE GROWTH

The supply and procurement of digital goods and services are rising at a rapid pace globally as well as in India, with expansions of ‘information and communication technology’ (hereinafter referred as ICT). Such new technology has given rise to new business models that do not require physical presence and rely more on digital and telecommunication networks.

Entrepreneurs across the world have been quick to evolve their businesses to take advantage of these changes. The digital economy has not only forced radical departures in ways of doing business it has also created entirely new businesses and opened up new markets job opportunities.

These new business models have also created new tax challenges in terms of nexus, characterization and valuation of data, and user contribution. These challenges have been recognized by the international community, leading to their inclusion in the Base Erosion and Profit Shifting (BEPS) Project endorsed by G-20 and OECD.

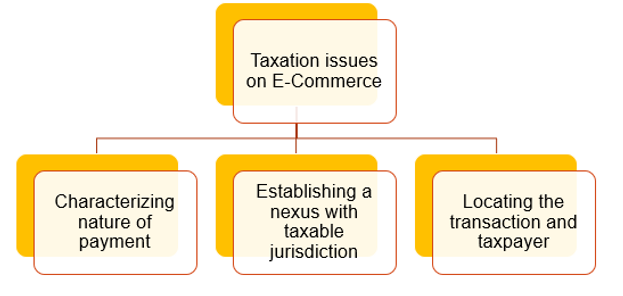

TAXATION ISSUES IN E-COMMERCE TRANSACTIONS

The typical taxation issues relating to E-Commerce are as under : –

a) Difficulty in characterizing nature of payment : –

Given the various new models that have arisen in e-commerce, it is difficult to decide, whether the payment for digital transactions would be characterized as Royalty or Fees for technical services, or business receipts.

b) Difficulty in establishing a nexus between the digital transaction, activity and a taxing jurisdiction : –

The right of the Source state to tax a particular income of the non resident, depends on whether the income of the non-resident has some Nexus with the source country. In case the non resident has a physical presence in the source country, such Nexus is easy to establish. However, when the transaction takes place online, without any physical presence of service provider in the Source country, it is difficult to establish a nexus between digital transaction and taxing jurisdiction. This may result in denial of any taxing right to the source country.

c) Difficulty in locating the transaction, activity and identity of the taxpayer : –

In many cases, the non-resident taxpayer can operate a digital business by having multiple layers of subsidiaries in several countries, and they may not be any physical involvement of the taxpayer in the country from where the income is generated. Since, digital transactions occur in one jurisdiction, without any physical involvement of taxpayer in another jurisdiction, it is difficult to locate the transaction trail and identify the taxpayer.

OECD RECOMMENDATIONS UNDER ACTION PLAN 1 OFBEPS TO TACKLE TAXATION ISSUES OF E-COMMERCE TRANSACTIONS

The OECD, under Action Plan 1 of BEPS has provided that countries can take the following approach to prevent erosion of their tax base.

Modification of PE definition –

Existing definition of PE to be modified to provide that whether an enterprise would constitute a PE due to its significant digital presence in another Country

Introduction of concept of virtual PE –

- Introduction of concept of Virtual PE

- Virtual PE means creation of PE when foreign enterprise carries on business via website and its server is located in another jurisdiction

Introduction of withholding tax or Equalisation levy –

- Imposition of withholding tax on digital transactions

- Imposition of Equalisation levy on digital transactions

INTRODUCTION OF NEW CHAPTER OF EQUALIZATION LEVY

Considering the potential of new digital economy, and the rapidly evolving nature of business operations, it is essential that countries take necessary steps to address the challenges which arise relating to taxation of digital transactions. In order to address these challenges, a new Chapter titled “Equalization Levy” was inserted by the Finance Act, 2016, to provide for an Equalization Levy for specified digital services. CBDT issued a notification No. 38/2016, dated 27-05-2016 to enforce equalisation levy rules with effect from June 1, 2016 …Read more

For any queries, please write them in the Comment Section or Talk to our tax expert