Documents and Compliances- Documentation required under the Income Tax Act, 1961

Although safeguards such as transfer pricing provisions have been put into place to regulate international transactions between associated enterprises, it will not prove effective if there is no evidence of its implementation. Thus, Documents and Compliances i.e. Documentation required under the Income Tax Act, 1961 (Section 92D) mandates entities belonging to an international group to maintain documented information of the international group, whether or not such entity has entered into any cross-border transaction.

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Transfer Price | Price charged between two Associated Enterprises |

| Arm’s Length Price Principle | Price charged between two unrelated parties |

| Governing Provision | Section 92D Income Tax Act, 1961 r.w. Rule 10D(1) |

| Documents to be maintained regarding |

|

| Documents to be maintained |

|

| Exemption from maintenance of documentation | Under Rule 10D (2) if the total value of international transactions is below Rs. 1 Crore or less. |

| Penalty for failure to maintain documents | @2% of international transaction |

Documents and Compliances – Documentation required under the income tax act 1961

Assesee undertaking an International Transaction

Under the Indian Transfer Pricing regulations, where an assessee undertakes certain specified intra group transactions with its Associated Enterprise , it is required to keep and maintain certain prescribed information and documents (“Transfer Pricing documentation”). These documentation helps an assessee to substantiate that such transactions have been carried out at arm’s length price before the tax authorities.

Constituent Entity of an International Group

Section 92D imposes responsibility on any entity, which is a constituent entity of an international group to keep and maintain the requisite information and document in respect of the international group irrespective of whether or not any international transaction is undertaken by such constituent entity.

The constituent entity has to furnish the information and document to the authority prescribed under section 286(1), i.e., Director General of Income-tax (Risk Assessment) in the prescribed manner, on or before prescribed date.

Section 92D , read with Rule 10D(1), provides that the information and documents which are required to be kept and maintained can be related to the : –

- Entity undertaking such transaction ;

- Price of the transaction ;

- Transaction related .

For example, let us assume Bright India Private Limited (“Bright” ), an Indian company, engaged in providing software development services to its parent, nvcross Singapore Pte. (“nvcross”) : –

(“Bright” ), (“nvcross”)

These are detailed as under – Please refer this link for Sample Transfer Pricing Documentation of an IT company providing technical services to the Foreign Parent company https://sortingtax.com/ : –

Information and Documents to be kept and maintained u/s 92D (Rule 10D(1))

Entity Related

- Ownership structure of the Assessee (“Bright” ) – Details of shares / or other ownership interest , including voting rights held by other enterprise (“nvcross”) ;

- Profile of the Multinational group to which the assesse belongs in terms of the business operations etc ;

- Basic details of Associated enterprise/s (“nvcross) , with whom the assessee has entered into international transaction (like Name, address, legal status and country of tax residence);

- Business description of the assessee and Associated enterprises (“nvcross), and the industry in which the Assessee operates;

- AE wise, nature of the international transactions and specified domestic transactions, and terms (including price) of the international transactions and specified domestic transactions , details of property transferred or services provided and quantum and value of each such transaction;

Price Related

- Description of functions performed, risks assumed and assets employed by the assessee and Associated enterprises (“nvcross);

- Records of economic and market analysis, budgets, forecasts, financial estimates for the business as a whole and for each division or product separately which may have a bearing on such transaction;

- Record of uncontrolled transaction (if any), including their nature, terms and conditions, for analysing comparability of international transaction and specified domestic transactions with such uncontrolled transaction(s);

- Record of the analysis performed to evaluate comparability of uncontrolled transactions with the relevant international transaction or specified domestic transactions.

- Description of method considered for determining ALP, most appropriate method along with the explanations as to why such method was selected, and applied;

- Analysis performed to compare the transactions and to determine the arm’s length price of the transactions between related parties, etc. Actual workings carried out for such transaction should be considered.

- Assumptions, policies and price negotiations, if any, which critically affected the determination of the arm’s length price;

Transaction Related

- Details of Transfer Pricing adjustment(s) made (if any) to the transfer price, to align them to ALP, and consequent adjustment made to the total income for tax purposes. These adjustment shall arise when the price computed after the application of the ALP is different from the price at which the transaction has taken place. Where the adjustment lowers the tax liability , it shall not be made due to the application of Base Erosion concept.

- Any other information, data or document including information or data relating to Associated enterprise which may be relevant for determining ALP.

Exemption from maintaining transfer pricing documentation – Rule 10D(2)

The assessee is not under an obligation to maintain the information and documents required under Rule 10D(1), if the total value of international transactions is Rs. 1 crore or less,.

Transfer Pricing Documentation – Rule 10D

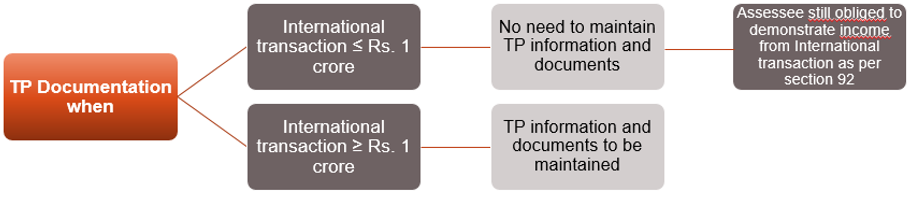

The summary of the Rules for maintaining Transfer Pricing documentation is as under : –

Diagram 1.52

The threshold limit of Rs. 1 crore to maintain information and documents is applicable only for international transactions with AE. There is no exemption from maintenance of documentation for specified domestic transactions . For Specified domestic transactions separate set of information and documents are required to be maintained if value of specified domestic transaction is more than Rs 20 crore during the Financial Year (Rule 10D(2)).

Example : –

Indian subsidiary company (ICO) purchases certain raw material from its foreign parent company for Rs 0.50 crores and provides back office services for Rs. 0.75 crores during the PY 2019-20. Discuss whether ICO is required to maintain information and documents under Rule 10D(1) ?

Solution : –

ICO is required to maintain information and documents under Rule 10D(1) for the PY 2019-20, as the aggregate value of international transaction with AE is more than Rs 1 crore (Rs. 1.25 crores).

Transfer Pricing Documentation – Rule 10D – Points to consider

- Obligation to justify transaction at Arm’s Length

In case of assessee, whose aggregate value of international transaction is not more than Rs. 1 crore, they are not obliged to maintain TP documents, but they are still under an obligation to substantiate through documents or otherwise, that international transactions with Associated enterprises are at an arm’s length and in accordance with Section 92.

- Penalty for failure to keep information and documents

Section 271AA provides that failure to keep information and documents as required under Rule 10D(1) shall attract a penalty @ 2% of value of international transaction.

Case Study – Penalties for Non maintenance of TP Document and Data

During the course of proceedings for income escaping assessment, the case of Dolphin Inc., for AY 2015-16 was referred to the Transfer Pricing Officer. The total value of international transaction was Rs. 5 crores, and the TPO served a valid notice on the company to provide the information and documents required to be kept under Section 92D(1) and Section 92D(2). However, the company indicated that since, the time limit for notice u/s 143(2) had expired, it had destroyed, all the documents and information relating to the said year. The Tax officer wants to levy a penalty of Rs. 15 lakhs on the company. Comment whether the action of the Tax officer is justified ?

Solution

Section 271AA empowers the AO to levy a penalty @ 2% of the value of each international transaction on a person, who fails to keep and maintain any such document and information, which are required to be kept, under Section 92D(1) and Section 92D(2). These Section, read with Rule 10D(5) provides that Transfer Pricing information and documents should be kept and maintained for a period of 8 years from the end of relevant assessment year. In the present case, since the requisite document have not been maintained , penalty @ 2% of the value of each international transaction amounting to Rs. 10 lakh (and not Rs. 15 lakhs proposed by the AO) can be levied by the AO.

Structure of Transfer Pricing Documentation

If a company is required to maintain documents under Rule 10D(1), it can maintain a Transfer Pricing Study , which can have the following Illustrative structure – Please visit <> for a Sample Transfer Pricing documentation : –

| Executive Summary | • Brief description of business profile of the group to which the company belongs • Brief business profile of the Assessee • Brief business profile of the AE with whom the company has undertaken international transaction • Overview of international transactions • Overview of specified domestic transactions |

| Group Overview | • Brief description and overview of the Group’s : – • Business operations • Divisions • Factual informational of the Group during relevant period such as turnover, number of employees etc. • Information pertaining to various products and services offered by the group • Significant development during the year |

| Industry Analysis | • Background of the industry, in which the company operates • Key drivers • Challenges • Future outlook of the industry |

| Functional Analysis | • Functions performed by each of the entities in a transaction • Assets utilized in the rendering of the above functions • Risks assumed by each of the entities in a transaction |

| Economic Analysis | • Search process – Database searched, publicly available information, other sources • Comparable details |

| Conclusion | • High level summary of the Transfer Pricing study including transactions involving Most appropriate method etc. |

Structure of Transfer Pricing Documentation – Group Overview

A brief description of Group’s business operations, and taxpayer’s business operations.

The information relating to the Group overview can be obtained from several sources, including : –

- Annual report of the Group – Information like nature of business operations, shareholding structure, products and services offered by the group, etc. can be obtained from Annual report of the Group.

- In addition to the Annual report , Group overview can also be ascertained from other sources such as : –

- Group website and other reference websites ,

- Publicly available databases like Prowess, Capitaline, etc.

Group Overview – Example

Borris Ltd. UK, a software development company in USA, sells software to an independent customer in India. Its wholly owned subsidiary, Saarthak Limited, , an Indian company, provides IT support to X Ltd. in connection with maintenance of the software.

In the instant case, the Group overview would include the following broad headings : –

Brief description of the business operations of the Group –

- Range of products/services offered (software, type of software, nature of services), geographical presence (US, India or other countries),

Brief description of business operations of Borris Ltd. UK and Saarthak Limited –

- Date of incorporation, shareholding and ownership structure, details of products/services offered.

Industry Overview

Industry overview provides an understanding of company’s relative position in the industry , vis-à-vis other players. The objective of the industry overview are to : –

- Ascertain taxpayer’s position within the industry ;

- Market share of the taxpayer in the industry – Majority share, monopoly etc ;

- How industry overview is linked to the functional and economic analysis ;

- Key growth drivers , challenges and opportunities, past trends and future projections of the industry;

- Overall justification of the taxpayer’s financial results.

For any queries, please write them in the Comment Section or Talk to our tax expert