Budget 2019 – Tax impact on individuals

MANDATORY FILING OF RETURN OF INCOME

PERSON OTHER THAN COMPANY OR FIRM

- Deposited amount exceeding 1 crore or more in current account maintained with a banking company or a co-operative bank

- Incurred expenditure of more than Rs. 2 lakh for travel to a foreign country

- Incurred expenditure of more than Rs. 1 lakh for electricity

- Claims rollover benefits on investment in a house or a bond or other assets, under sections 54, 54B, 54D, 54EC, 54F, 54G, 54GA and 54GB

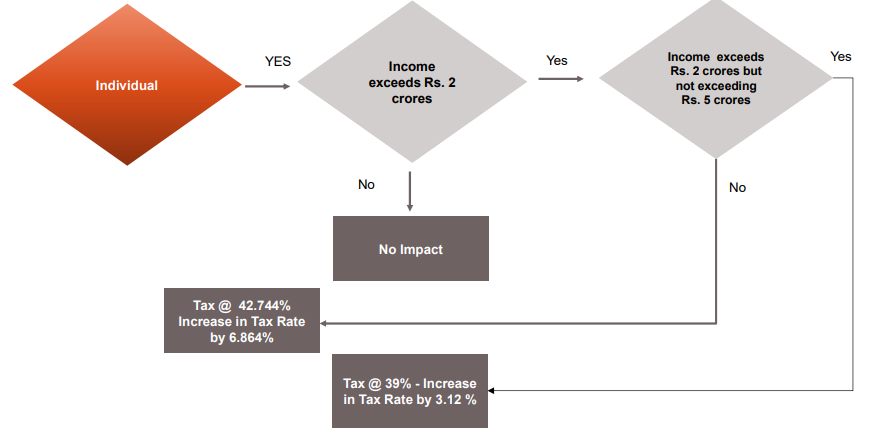

INCREASE IN TAX RATES – INDIVIDUALS

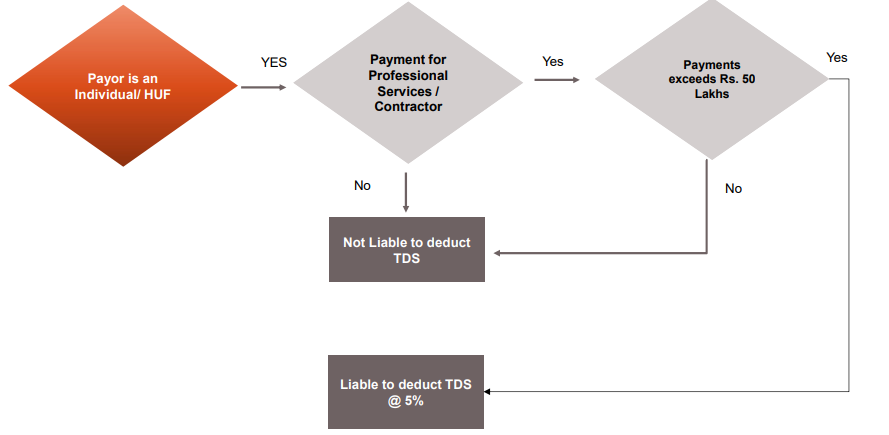

SECTION 194M – TDS BY INDIVIDUAL/HUF

SECTION 194IA – TDS ON PURCHASE OF IMMOVABLE PROPERTY

TOTAL CONSIDERATION SHALL INCLUDE

- Club Membership Fee

- Car Parking fee

- Electricity and water facility fees

- Maintenance fee, advance fee

- Any other charges of similar nature, which are incidental to transfer of the immovable property

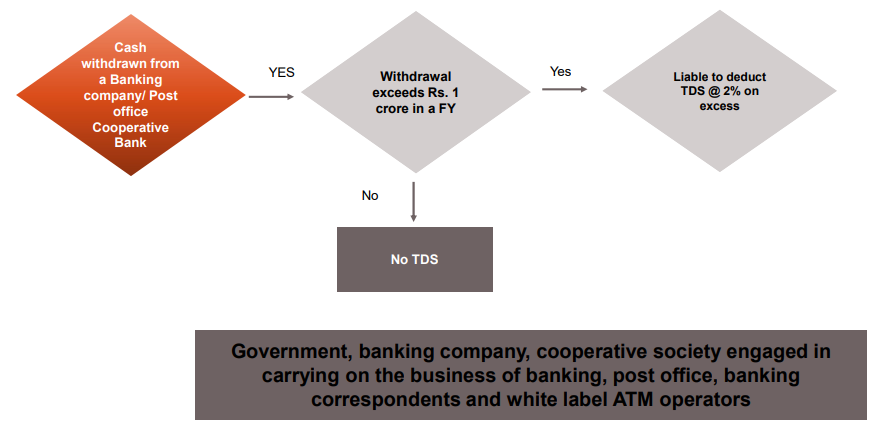

SECTION 194N – TDS ON CASH WITHDRAWAL

OTHER PROVISIONS

AMENDMENTS

- Interest on loan upto Rs. 1.5 lakh for acquisition of a residential house property – Stamp duty value of property is upto Rs. 45 lakhs

- Interest on loan upto Rs. 1.5 lakh for acquisition of an electric vehicle

- Prosecution proceedings for non filing of return shall be initiated if tax payable is Rs. 10,000 or more.

- NPS holders can withdraw 60% from NPS total corpus as tax free amount.

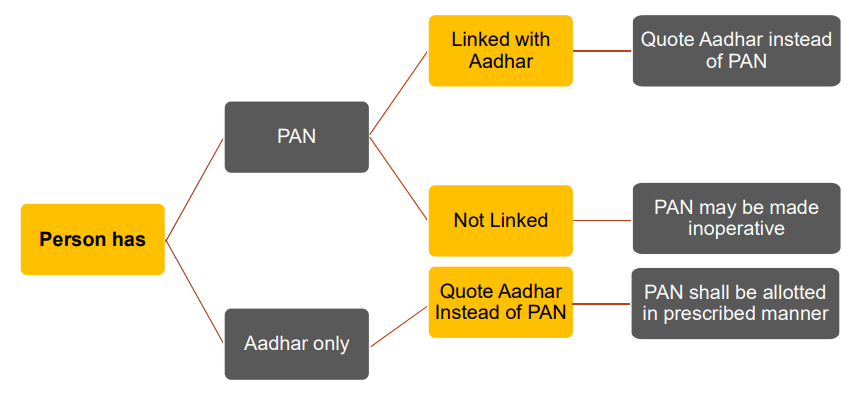

INTEROPERABILITY OF PAN AND AADHAR

BUDGET 2019 – Tax Impact on Companies

CHANGES IMPACTING COMPANIES

- Income-tax shall be 25% if total turnover of company in FY 2017-18 does not exceed Rs. 400 crores

- Provisions for filing SFT are proposed to be modified

- If NR recipient deposits tax and files return, Indian payor shall not be considered as assessee in default for non deduction of TDS

- Buy Back Distribution tax of 20% (plus SC and Cess) applicable on Listed companies as well

- Lower WHT applications can be filed online

SECONDARY ADJUSTMENT – AY 2018-19 ONWARDS

- Secondary adjustment provision shall apply to agreements signed on or after 1st April, 2017

- Assessee can pay additional income-tax @ 18% of excess money increased by a surcharge of 12%. Interest for secondary adjustment upto the date of payment of tax is additionally payable.

- No income tax deduction in respect of the amount on which such tax has been paid.