RELEVANT PREVIOUS YEAR FOR CHARGEABILITY TO TAX – UNDISCLOSED FOREIGN INCOME – SECTION 3

The provisions of the Black Money Act are effective prospectively from July 1, 2015 . They do not cover undisclosed foreign income earned prior to July 1, 2015 . It shall cover only undisclosed foreign income earned on or after July 1, 2015 .

EXAMPLE : –

Mr . Depesh was a tax resident of India during PY 2014-15 . He earned rental income from property situated outside India during the PY 2014-15, which was not disclosed in his income-tax return . Whether he would be covered under the Black Money Act in respect of such income ?

SOLUTION : –

The Black Money Act does not cover undisclosed foreign income earned prior to July 1, 2015 . Rental income from property situated outside India shall not be covered under the Black Money Act as rental income pertained to period prior to July 1, 2015 . However, such undisclosed income would be taxable as per the provisions of the Income-Tax Act .

RELEVANT PREVIOUS YEAR FOR CHARGEABILITY TO TAX – UNDISCLOSED ASSET LOCATED OUTSIDE INDIA – SECTION 3

Undisclosed asset located outside India

shall be charged to tax on its

value [i .e ., fair market value as per Rule 3(1)]

in the previous year

in which the asset comes to the notice of Assessing Officer .

EXAMPLE : –

S acquired a bungalow in UK in 1980 when she was resident in India, out of undisclosed income chargeable to tax in India . The AO discovered such bungalow in the PY 2016-17 . Whether market value of bungalow in the PY 2016-17 would be charged to tax under the Black Money Act ?

SOLUTION : –

The provisions of the Black Money Act are applicable from July 1, 2015 . However, in case of undisclosed foreign assets, the year in which such asset is discovered by the AO would be the relevant previous year in which tax shall be charged even if such asset was acquired prior July 1, 2015 .

Thus, the fair market value of the bungalow [as per Rule 3(1)] in the PY 2016-17 would be charged to tax under the Black Money Act .

VALUATION OF AN UNDISCLOSED ASSET LOCATED OUTSIDE INDIA – SECTION 3(2)

The Fair market value of an asset (including financial interest in any entity) located outside India shall be determined as per Rule 3 of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Rules, 2015 .

VALUATION OF BANK ACCOUNT – RULE 3(1)

Sum of all deposits made in the account since the date of opening of account shall be considered as value of such bank account on which tax shall be paid under the Black Money Act.

However, any deposit made from withdrawal proceeds

from the account, shall not be considered

while computing such value of the account.

EXAMPLE 1

An Indian resident has a foreign bank account since 2008 in which undisclosed income has been deposited over several years as under:

He has spent the money in the account over these years and current balance is $500 on March 31, 2016.

Determine the value of foreign bank account on which Indian resident is liable to pay tax under the Black Money Act ?

SOLUTION: –

Tax on undisclosed asset is required to be paid on its fair market value as per Rule 3(1) . In case of a bank account, the fair market value is the sum of all the deposits made in the account computed in accordance with Rule 3(1) . Therefore, the fair market value of such deposit would be USD 5700 on which tax would be paid under the Black Money Act.

VALUATION OF BULLION, JEWELLERY OR PRECIOUS STONE – RULE 3(1)

The fair market value of bullion, jewellery or precious stone shall be higher of :

- Its cost of acquisition; or

- The price it would ordinarily fetch if sold in the open market (i.e., market price) on the valuation date .

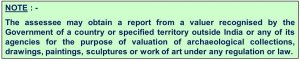

VALUATION OF ARCHAEOLOGICAL COLLECTIONS, DRAWINGS, PAINTINGS, SCULPTURES OR WORK OF ART- RULE 3(1)

The fair market value of archaeological collections, drawings, paintings, sculptures or work of art shall be higher of : –

- Its cost of acquisition ; or

- The price it would ordinarily fetch if sold in the open market (i.e., market value) on the valuation date .

VALUATION OF QUOTED SHARES AND SECURITIES- RULE 3(1)

The fair market value of quoted shares and securities shall be higher of :

- Their cost of acquisition; or

- The price as determined in the following manner:

- Where there is trading in such shares and securities – The average of the lowest and highest price of such shares and securities quoted on any established securities market on the valuation date.

- Where there is no trading in such shares and securities – The average of the lowest and highest price of such shares and securities on any established securities market on a date immediately preceding the valuation date when such shares and securities were traded on such securities market.

VALUATION OF UNQUOTED SHARES AND SECURITIES- RULE 3(1)

The fair market value of unquoted shares and securities shall be higher of –

- Cost of acquisition ; or

- Fair market value of unquoted equity shares on the valuation date, which is calculated as:

(A + B – L)

————– x PV

PE

A denotes –

book value of all the assets (other than bullion, jewellery, precious stone, artistic work, shares, securities and immovable property) as reduced by,-

- Any amount of income-tax paid, if any, less the amount of income-tax refund claimed, if any ; and

- Any amount shown as asset including the unamortised amount of deferred expenditure which does not represent the value of any asse

B denotes fair market value of bullion, jewellery, precious stone, artistic work, shares, securities and immovable property as determined in the manner provided in this rule

L denotes book value of liabilities, excluding :

- Value of Paid-up Equity shares;

- Amount set apart for payment of dividends ( preference shares and equity shares) ;

- Reserves and surplus (positive or negative) other than depreciation reserves ;

- Provision for tax, other than ( income tax paid – income-tax refund claimed – MAT credit carried forward) ;

- Provisions for meeting unascertained liabilities ;

- Contingent liabilities ( excluding dividends payable on cumulative preference shares) ;

PE denotes –

total amount of paid up Equity share capital (as shown in the balance sheet)

PV denotes paid up value of Equity shares

VALUATION OF UNQUOTED SHARES AND SECURITIES (OTHER THAN EQUITY SHARES) – RULE 3(1)

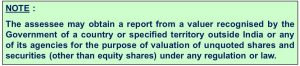

The fair market value of unquoted shares and securities (other than equity shares) shall be higher of –

- Its cost of acquisition; or

- The price it would ordinarily fetch if sold in the open market (i.e., Market Price) on the valuation date .

VALUATION OF AN INTEREST OF A PERSON IN A PARTNERSHIP FIRM /AOP /LLP – RULE 3(1)

The value of an interest of a person as a member in a partnership firm or in an Association of persons or a limited liability partnership shall be determined in following manner :

Step 1 : –

Determine the net asset of the firm, AOP or LLP on the valuation date. [Net assets of the firm or AOP shall be (A+B-L)

Step 2 : –

Allocate net wealth of the firm, AOP or LLP as equivalent to its capital, shall be allocated amongst partners in the proportion of capital contributed by partners .

Step 3 : –

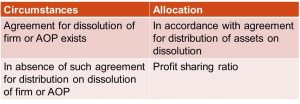

Remaining Net asset shall be allocated in the following manner:

Step 4 : –

The total of amount allocated to partner or member in Step 2 and Step 3 shall be treated as the value of the interest of that partner or member in the partnership or AOP.

VALUE OF INTEREST

TRANSFER OF ASSETS BEFORE VALUATION DATE

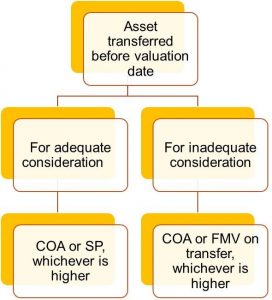

VALUATION OF AN ASSET (OTHER THAN BANK ACCOUNT) TRANSFERRED BEFORE THE VALUATION DATE – RULE 3(2)

WHERE ASSET WAS TRANSFERRED FOR ADEQUATE CONSIDERATION:

Where an asset (other than a bank account) was transferred before the valuation date, fair market value of such asset shall be higher of –

- Its cost of acquisition or

- Sale price

WHERE ASSET WAS TRANSFERRED WITHOUT CONSIDERATION OR INADEQUATE CONSIDERATION

If asset (other than bank account) was transferred without consideration or for inadequate consideration before the valuation date, the fair market value of such asset shall be higher of –

- Its cost of acquisition ; or

- Fair Market Value on the date of transfer (and not on the valuation date)

VALUATION IN CASE OF ACQUISITION OF ASSET OUT OF CONSIDERATION OF OLD ASSET OR BANK ACCOUNT – RULE 3(3)

Where a new asset has been acquired or made out of

consideration received on account of transfer of an old asset or

withdrawal from a bank account,

then the fair market value of

the old asset or

the bank account,

determined as per Rule 3(1) and Rule 3(2)

shall be reduced by the amount of the consideration

invested in the new asset .

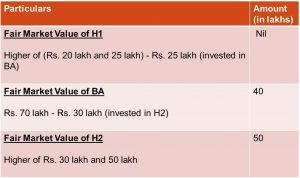

EXAMPLE : –

- A house property (H1) located outside India was bought in 1997 for Rs 20 lakh.

- It was sold in 2001 for Rs 25 lakh rupees which were deposited in a foreign bank account (BA).

- In 2002 another house property (H2) was bought for Rs 30 lakh.

- The investment in H2 was made through withdrawal from BA.

- H2 has not been transferred before the valuation date and its value on the valuation date is Rs 50 lakh. The value of BA as computed under Rule 3(1)(e) is Rs 70 lakh.

- Determine the fair market value (FMV) of the assets ?

SOLUTION:-