What is the Balancing of Accounts?

We know that there are ledger accounts have debit side and credit side. Both side has few entries. Sometimes one side may not have any entries. Following procedure is followed to balance the accounts.

- Add both sides of the account and find out the bigger side of the account.

- Put the bigger total on both the sides i.e. debit and credit.

- Find out the difference between large side and smaller side and put that amount on the smaller side so that both side are equal.

- Total which is bigger is given the name of the balance. Meaning if credit side total is bigger then account has credit side balance and if debit side total is bigger then account has debit balance.

- Amount which has put as a balancing amount on the smaller side, will be written as a Balance brought down i.e. “Balance B/d”

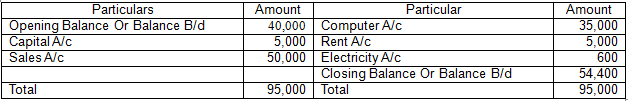

Let us see the balancing example:

Bank A/c

Explanation

In the above example,

- Debit side of the bank account denotes the money deposited in the bank and credit side denotes the payments made from the bank.

- To balance the Bank A/c, total of the both sides is taken. Debit side total is Rs. 95,000. and credit side total is Rs. 46,600.

- Now as per the steps mentioned above difference between bigger total(Debit side) and smaller total(Credit side) is found out which is Rs. 54,400.

- Since credit side total is smaller by Rs. 54,400 it becomes the “Closing balance” or “Balance carried down(Balance C/d)” and should be written on the smaller side, in this case on credit side.

Once the account is closed closing balances of all the accounts are transferred to trial balance on the opposite side of the trial balance. For above example closing balance is on credit side so it will be posted to the debit side of the Trial balance

Chapter 4 – Recording of Transactions Accountancy Class 11