Transfer Pricing MCQ with Answers, cover MCQ on various topics like Concept of Associated Enterprises (Including Deemed Associated Enterprises, Computation of Arm’s Length Price, Methods to compute Arm’s Length price, penalties for non compliance with ALP. The topic of Transfer Pricing International Tax MCQ is a part of our International Taxation Course, which is offered for learners in an online mode on our website. This Article contains a total of 275 questions. Answers to MCQ on Transfer pricing international Taxation are available after clicking on the answer.

Transfer Pricing MCQ with Answers Part 1 – MCQ 1 – 50

Applicability of Transfer Pricing on companies claiming Tax Holiday

1. Transfer pricing intends to arrive a the arm’s length price, for goods sold or services rendered by –

a. One segment of an enterprise to another segment of the same enterprise.

b. One Enterprise to another Enterprise

c. Both A and B

d. Neither A nor B

Answer

Answer: a. One segment of an enterprise to another segment of the same enterprise.

2. If one of the segment of an enterprise claims tax holiday , the purpose of transfer pricing is to ensure that the profit such segment is not –

a) Overstated

b) Understated

c) A or B

d) Neither A nor B

Answer

Answer: a) Overstated

3. If one of the segment of an enterprise claims tax holiday , the purpose of transfer pricing is to ensure that the profits of a non-tax holiday segment were not –

a) Overstated

b) Understated

c) A or B

d) Neither A nor B

Answer

Answer: a) Overstated

4. The purpose of transfer pricing was to ensure that the expenses of a tax holiday segment are not ……………………. and transferred to non-tax holiday unit –

a) Overstated

b) Understated

c) A or B

d) Neither A nor B

Answer

Answer: b) Understated

5. The purpose of transfer pricing was to ensure that the expenses of a non-tax holiday segment were not –

a) Overstated

b) Understated

c) A or B

d) Neither A nor B

Answer

Answer: a) Overstated

6. Transfer pricing provisions are applicable on transactions between which of the following –

a) Two group companies of same MNE group

b) A foreign company and its Indian branch

c) An Indian company and its subsidiary availing tax holiday

d) All of the above

Answer

Answer: d) All of the above

7. Transfer Price means the price, which is charged between –

a. Two or more entities of a MNE [Associated Enterprises (AE’ s)] operating in one country.

b. Two or more entities of a MNE [Associated Enterprises (AE’ s)] operating in different countries

c. Both A and B

d. Neither A nor B

Answer

Answer: b. Two or more entities of a MNE [Associated Enterprises (AE’ s)] operating in different countries

Applicability of Transfer Pricing where companies use Low tax jurisdiction to reduce overall taxes

8. X Ltd. operates in Country A, wherein the tax rates are 30%. It intends to sell goods costing USD 100 to a customer in Country B for USD 150. To save taxes, X Ltd. incorporated a subsidiary in Country Y, namely Subsidiary C, where tax rate is 10% and sold the goods to C for USD 125, which in turn, sold the goods to buyer in Country B for USD 150.

In such a case, tax will be: –

a) USD15

b) USD 10

c) USD 5

d) None of the above

Answer

Answer: b) USD 10

9. Transfer pricing is, arriving at of the price for goods and services, which are transacted between

a) Controlled legal entities within an enterprise

b) Independent entities within an enterprise

c) Both A and B

d) Neither A nor B

Answer

Answer: a) Controlled legal entities within an enterprise

10. Tax planning opportunities arise due to difference in ………… amongst various Countries

a) Tax rates

b) Tax exemptions

c) Both A and B

d) Neither A nor B

Answer

Answer: c) Both A and B

Transfer Pricing MCQ with Answers

Objective of Transfer Pricing

11. Transactions between unrelated entities are carried out at –

a. Arm’s Length Price

b. Control Price

c. Either A or B

d. Both A and B

Answer

Answer: a. Arm’s Length Price

12. The objective of transfer pricing is to ensure which of the following –

a) Taxes are paid in Country of residence

b) Taxes are paid in Country of Source

c) Taxes are not paid

d) Taxes are paid in the jurisdiction where economic activity takes place

Answer

Answer: d) Taxes are paid in the jurisdiction where economic activity takes place

13. Transfer pricing analysis aims to arrive at arm’s length price on the assumption that the parties to the transaction are ……….. parties –

a) Independent

b) Related

c) Controlled

d) Both B and C

Answer

Answer: a) Independent

14. Which of the following is true in the context of transfer pricing –

a. Income arising from international transaction shall be computed on the basis of arm’s length price.

b. Any expense/ allowance for any interest, for computing income for international transaction shall also be computed on the basis of arm’s length price of such expense/interest.

c. The cost or expenses allocated or apportioned between Associated enterprises under a mutual agreement or arrangement shall be at arm’s length price.

d. All of the above

Answer

Answer: d. All of the above

15. The transfer pricing provisions are intended to ensure that –

a) Profits are not understated

b) Expenses are not understated

c) Losses are not overstated

d) Both A and C

Answer

Answer: d) Both A and C

16. The basic intention underlying the transfer pricing regulations is to prevent –

a) Shifting of profits by increasing prices charged by overseas entity or paid by Indian entity in international transactions

b) Shifting of profits by decreasing prices charged by overseas entity

c) Shifting of profits by decreasing prices paid by Indian entity

d) None of the above

Answer

Answer: a) Shifting of profits by increasing prices charged by overseas entity or paid by Indian entity in international transactions

17. Transfer pricing provision should not be applied in cases where the adoption of the arm’s length price would result in a –

a) Reducing the tax payable in India

b) Increasing the tax payable in India

c) Increasing the expenditure of the Indian company

d) Both A and C

Answer

Answer: d) Both A and C

18. ABC Ltd. purchased goods at USD 200 per unit from its AE in USA. However, it was purchasing the same material at USD 250 per unit from independent third party located in USA. In this case, the Arm’s Length Price would be:

a. Rs 200

b. Rs 250

c. A or B

d. Neither A nor B

Answer

Answer: a. Rs 200

19. As per Section 92A (1) of the Act, Associated enterprise refers to an enterprise which participates directly or indirectly or through one or more intermediaries in:

a) Management of the other enterprise

b) Control of the other enterprise

c) Capital of the other enterprise

d) All of the above

Answer

Answer: d) All of the above

20. Prior to amendment made by Finance Act, 2001, the AO was empowered to compute reasonable amount of profit by application of which of the following Rules of Income-Tax Rules, 1962:

a) Rule 10

b) Rule 11

c) Both A and B

d) None of the above

Answer

Answer: c) Both A and B

Transfer Pricing MCQ with Answers

21. Two enterprises shall be deemed to be an associated enterprise when one enterprise directly holds shares carrying:

a) 26% or less of the voting power in the other enterprise.

b) 25% of the voting power in the other enterprise.

c) 26% or more of the voting power in the other enterprise.

d) None of the above

Answer

Answer: c) 26% or more of the voting power in the other enterprise.

22. Two enterprises shall be deemed to be an associated enterprise when one enterprise indirectly holds shares carrying:

a) 26% or less of the voting power in the other enterprise.

b) 25% of the voting power in the other enterprise.

c) 26% or more of the voting power in the other enterprise.

d) None of the above

Answer

Answer: c) 26% or more of the voting power in the other enterprise.

23. Generally, two enterprises shall be deemed to be associated enterprise when one enterprise holds, directly or indirectly 26% or more ………….. in the other enterprise

a) Equity shares

b) Preference Shares

c) Compulsorily convertible debentures

d) Non-convertible debentures

Answer

Answer: a) Equity shares

24. FCO holds 100% equity shares (all equity shares carry equal voting rights) in ICO 1.

ICO 1 holds 49% equity shares (all equity shares carry equal voting rights) in ICO 2. Who all will be the Associated enterprises?

a) FCO and ICO1

b) ICO1 and ICO2

c) FCO and ICO2

d) All of the above

Answer

Answer: d) All of the above

25. Two enterprises shall be deemed to be associated enterprise if any common person or enterprise holds, directly or indirectly, shares carrying –

a) 25% voting power in each of such enterprises,

b) 26% or more of the voting power in each of such enterprises

c) Less than 26% of the voting power in each of such enterprises

d) None of the above

Answer

Answer: b) 26% or more of the voting power in each of such enterprises

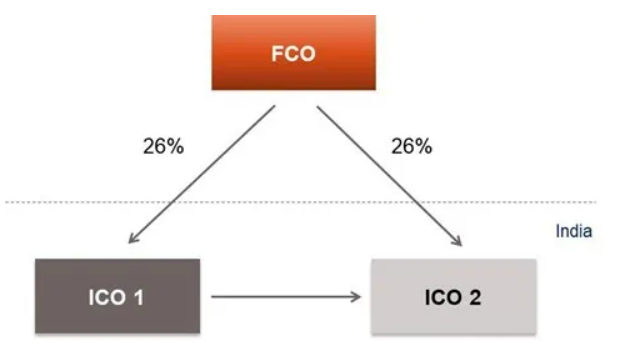

26. Case Study

FCO holds 26% equity shares in ICO 1. FCO also holds 26% shares in ICO 2. Who all will be the Associated enterprises?

a) FCO and ICO1

b) FCO and ICO2

c) ICO1 and ICO2

d) All of the above

Answer

Answer: d) All of the above

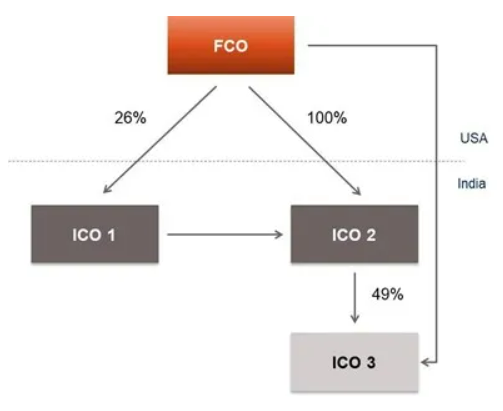

27. Case study

FCO holds 26% equity shares in ICO 1. FCO also holds 100% shares in ICO 2. ICO 2 holds 49% shares in ICO 3. Who all will be Associated enterprises, based on the given facts?

a) FCO and ICO1, FCO and ICO2

b) ICO2 and ICO1, ICO2 and ICO3

c) FCO and ICO3, ICO1 and ICO3

d) All of the above

Answer

Answer: d) All of the above

28. Two enterprises shall be deemed to be associated enterprises if a loan advanced by one enterprise to the other enterprise constitutes –

a) 50% or more of the book value of the total assets of the other enterprise.

b) Less than 50% of the book value of the total assets of the other enterprise.

c) More than 51% of the book value of the total assets of the other enterprise.

d) 51% or more of the book value of the total assets of the other enterprise.

Answer

Answer: d) 51% or more of the book value of the total assets of the other enterprise.

29. HOLO Inc. (USA) advanced loan of Rs 130 crores to POLO India. Select the correct statement:

a) Both are Associated Enterprises when POLO India has total assets worth Rs 250 crores

b) Both are Associated Enterprises when POLO India has total assets worth Rs 260 crores

c) Both are Associated Enterprises when POLO India has total assets worth Rs 300 crores

d) None of the above

Answer

Answer: a) Both are Associated Enterprises when POLO India has total assets worth Rs 250 crores

30. A Inc. owns 20% equity shares of B India. A has also advanced loan of Rs 200 crores to B, whose total assets are Rs 300 crores. In such a case A and B would be ………………….

a) Associated Enterprises

b) Independent parties

c) Strangers

d) Relatives

Answer

Answer: a) Associated Enterprises

Transfer Pricing MCQ with Answers

31. Two enterprises shall be deemed to be associated enterprises when one enterprise:

a) Guarantees 10% or more of the total borrowings of the other enterprise.

b) Guarantees less than 10% of the total borrowings of the other enterprise

c) Holds 26% or more voting power in other enterprises

d) Both A and C

Answer

Answer: d) Both A and C

32. Zero India Private Ltd. borrowed Rs 500 crores from an Indian Bank. Y Inc. (USA) guaranteed the borrowings of Indian Company. Select the correct statement:

a) Both are associated enterprises when the Y Inc. guarantees Rs 40 crores on behalf of Zero India

b) Both are associated enterprises when the Y Inc. guarantees Rs 49 crores on behalf of Zero India

c) Both are associated enterprises when the Y Inc. guarantees Rs 50 crores on behalf of Zero India

d) Both are associated enterprises irrespective of amount of guarantee made by Y Inc.

Answer

Answer: c) Both are associated enterprises when the Y Inc. guarantees Rs 50 crores on behalf of Zero India

33. Two enterprises, shall be deemed to be Associated Enterprises, when one enterprise appoints

a) More than half of the Board of Directors or members of the Governing Board of other enterprise

b) One or more Executive Directors of the Governing Board of other enterprise

c) One or more Executive Members of the Governing Board of other enterprise.

d) All of the above

Answer

Answer: d) All of the above

34. Two enterprises, shall be deemed to be Associated Enterprises when one enterprise:

a) Has power to appoint one or more executive members of the Governing Board of other enterprise, even if it actually does not appoint them

b) Actually, appoints one or more executive members of the Governing Board of other enterprise , exercising power of such appointment

c) Neither A nor B

d) Both A and B

Answer

Answer: b) Actually, appoints one or more executive members of the Governing Board of other enterprise , exercising power of such appointment

35. In which of the following cases would the Indian Company and Foreign company would be deemed as associated enterprise:

a) Foreign company has made the appointment of 5 out of 11 Board of Directors of the Governing Board in Indian company.

b) Foreign company has made the appointment of 8 out of 15 Board of Directors of the Governing Board in Indian company.

c) Both A and B

d) Neither of the above

Answer

Answer: b) Foreign company has made the appointment of 8 out of 15 Board of Directors of the Governing Board in Indian company.

36. In which scenario, Indian Company and Foreign company would be deemed as associated enterprise:

a) Foreign company has made the appointment of Mr. B as an Executive Director of the Governing Board of the Indian Company.

b) Foreign company has made the appointment of Mr. C as an Executive Member of the Governing Board of the Indian Company.

c) Both A and B

d) None of the above

Answer

Answer: c) Both A and B

37. In which of the following scenarios, two enterprises shall be deemed to be associated enterprises:

a) More than half of the Board of Directors or members of the Governing Board of each of the two enterprises, are appointed by same person or persons, or

b) One or more Executive Directors of the Governing Board of each of the two enterprises, are appointed by same person or persons, or

c) One or more Executive Members of the Governing Board of each of the two enterprises, are appointed by same person or persons.

d) All of the above

Answer

Answer: d) All of the above

38. In which of the following scenarios, two enterprises shall be deemed to be associated enterprises:

a) The business of one enterprise is wholly dependent on the know-how, patents, copyrights, etc. of which the other enterprise is the owner

b) The business of one enterprise is wholly dependent on the know-how, patents, copyrights, etc. of which the other enterprise has non exclusive rights

c) Both A and B

d) None of the above

Answer

Answer: a) The business of one enterprise is wholly dependent on the know-how, patents, copyrights, etc. of which the other enterprise is the owner

39. Two enterprises shall be deemed to be associated enterprises when –

a) 50% or less of raw materials and consumables required for the manufacturing of goods by one enterprise, are supplied by the other enterprise.

b) At least 80% of raw materials and consumables required for the manufacturing of goods by one enterprise, are supplied by the other enterprise.

c) 90% or more of raw materials and consumables required for the manufacturing of goods by one enterprise, are supplied by the other enterprise

d) None of the above

Answer

Answer: c) 90% or more of raw materials and consumables required for the manufacturing of goods by one enterprise, are supplied by the other enterprise

40. Zogo Inc. (USA) supplied raw material A, worth Rs 170 crores to MEC India during the FY 2017-18. *Both enterprises would be deemed as associated enterprises when Mec India consumed total raw material A of

a) Rs 200 crores or more during the FY 2017-18

b) Rs 340 crores or more during the FY 2017-18

c) Rs 180 crores or more during the FY 2017-18

d) Rs 250 crores or more during the FY 2017-18

Answer

Answer: c) Rs 180 crores or more during the FY 2017-18

Transfer Pricing MCQ with Answers

41. Two enterprises shall be deemed to be associated enterprise when the –

a) The goods manufactured by one enterprise, are sold to the other enterprise.

b) The goods manufactured by one enterprise, are sold to persons specified by the other enterprise, and the prices and other conditions relating thereto are influenced by such other enterprise.

c) The goods manufactured by one enterprise, are sold to persons specified by the other enterprise, based on price independently negotiated with the other enterprise.

d) Both A and B

Answer

Answer: d) Both A and B

42. Two enterprises shall be deemed to be associated enterprise, where

a) one enterprise is controlled by an individual, the other enterprise is also controlled by such individual, or

b) One enterprise is controlled by an Individual and the other enterprise is controlled by relative of such Individual.

c) One enterprise is controlled by an Individual and the other enterprise is jointly controlled by such Individual and his relative.

d) All of the above

Answer

Answer: d) All of the above

43. Two enterprises shall be deemed to be associated enterprise, where

a) one enterprise is controlled by an individual and the other enterprise is controlled by a friend of such Individual.

b) one enterprise is controlled by an individual and the other enterprise is controlled by brother of such Individual.

c) one enterprise is controlled by an individual and the other enterprise is controlled by wife of such Individual.

d) Both B and C

Answer

Answer: d) Both B and C

Reasoning: Two enterprises shall be deemed to be Associated Enterprise where one enterprise is controlled by an Individual and the other enterprise is controlled by relative of such Individual. As per Section 2(41), relative in relation to an Individual means the husband, wife, brother or sister or any lineal ascendant or descendant of that individual.

44. Two enterprises shall be deemed to be associated enterprise, where –

a) One enterprise is controlled by a HUF, the other enterprise is controlled by a member of such HUF

b) One enterprise is controlled by a HUF, the other enterprise is controlled jointly by member of HUF and his friend.

c) One enterprise is controlled by a HUF, the other enterprise is controlled jointly by member of HUF and his sister.

d) Both A and C

Answer

Answer: d) Both A and C

45. Indian Company and Foreign Company would be deemed to be Associated Enterprises where –

a) HUF controls Indian company and brother of member of HUF also controls such Indian company

b) HUF controls Indian company; member of HUF and his wife jointly control Foreign company.

c) HUF controls Indian company and member of HUF controls Foreign Company

d) Both B and C

Answer

Answer: d) Both B and C

46. Indian firm and foreign company would be deemed as associated enterprises when –

a) Foreign company holds 5% interest in such Indian firm

b) Foreign company holds 10% interest in such Indian firm

c) Foreign company holds 11% interest in such Indian firm

d) Both B and C

Answer

Answer: d) Both B and C

47. Indian AOP and foreign company would be deemed as associated enterprises when –

a) Foreign company holds 51% interest in such Indian AOP

b) Foreign company holds 50% interest in such Indian AOP

c) Foreign company holds 20% interest in such Indian AOP

d) All of the above

Answer

Answer: c) Foreign company holds 20% interest in such Indian AOP

48. A Ltd. (India) and AB international (Mauritius) would be deemed as associated enterprises when –

a) A Ltd.(India) holds 26% non-voting Preference shares in AB International (Mauritius).

b) A Ltd.(India) holds 26% equity shares in AB International (Mauritius).

c) A Ltd.(India) holds 26% debentures in AB International (Mauritius).

d) All of the above

Answer

Answer: b) A Ltd.(India) holds 26% equity shares in AB International (Mauritius).

49. G Ltd. (India) holds 30% Equity shares in U Inc. (USA). It also holds 25% Equity shares in XZ International (UK). Who all would be the Associated enterprises in this example?

a) G Ltd. and U Inc.

b) G Ltd. and XZ International

c) U Inc. and XZ International

d) All of the above

Answer

Answer: a) G Ltd. and U Inc.

Reasoning:

G Ltd. & XZ International are not Associated enterprises, since G Ltd. owns less than 26% voting rights in XZ International.

Further, U Inc. and XZ International are not Associated enterprise as G Ltd. does not hold 26% voting rights in both XZ International and U Inc.

50. Y Ltd. (India) holds 30% Equity shares in Yo Inc. (USA) and 40% Equity shares in Z International (UK). Who all would be the Associated enterprises?

a) Y ltd. and Yo Inc.

b) Y ltd. and Z International

c) Yo Inc. and Z International

d) All of the above

Answer

Answer: d) All of the above

Transfer Pricing MCQ with Answers Part 2 – MCQ 51 – 100

51. Section 92A (2) provides that two enterprises shall be deemed to be associated enterprises if, they satisfy any one or more of 13 conditions of being an AE :-

a) For whole of the previous year

b) At the end of the previous year

c) At the beginning of the previous year

d) At any time during the previous year

Answer

Answer: d) At any time during the previous year

52. X Ltd. (India) holds 30% equity shares in Z International (Switzerland) as on April 1, 2016. Both would be deemed as associated enterprises even when –

a) Shareholding of X ltd. reduced to 10% in Z International as on March 31, 2017.

b) Shareholding of X ltd. reduced to 20% in Z International as on Nov 30, 2016, which was further increased to 29% as on March 31, 2017.

c) There is no reduction in shareholding of X Ltd.

d) All of the above

Answer

Answer: d) All of the above

53. Transfer pricing provisions are applicable to determine –

a) Cost of international transactions between Associated enterprises.

b) Selling price/purchase price of international transactions between Associated enterprises.

c) Market value of transaction u/s 50C between Associated enterprises.

d) The arm’s length price of international transaction between Associated enterprises.

Answer

Answer: d) The arm’s length price of international transaction between Associated enterprises.

54. For transfer pricing purposes, “transaction” includes an arrangement, understanding or action in concert, –

a) Which is in writing

b) Which may be oral

c) Which may be in writing or oral

d) None of the above

Answer

Answer: c) Which may be in writing or oral

55. For transfer pricing purposes, “transaction” includes an arrangement, understanding or action in concert, –

a) Which is intended to be enforceable by legal proceedings

b) Which is not intended to be enforceable by legal proceedings

c) Which may or may not be intended to be enforceable by legal proceedings

d) None of the above

Answer

Answer: c) Which may or may not be intended to be enforceable by legal proceedings

56. RT India Private Ltd. has a show room of cars in New Delhi. Due to high demand of cars during Diwali, RT India places an order for certain cars with X Inc. (USA), the overseas parent of RT India. Such arrangement would be deemed as transaction under transfer pricing when –

a) X Inc. agrees to supply the cars to RT India even if there is no formal arrangement for such purpose

b) X Inc. agrees to supply the cars to RT India and there is formal arrangement for such purpose.

c) V Incl. agrees to supply the furniture to RT India irrespective of whether there is formal arrangement/contract or not.

d) All of the above

Answer

Answer: c) V Incl. agrees to supply the furniture to RT India irrespective of whether there is formal arrangement/contract or not.

57. Under transfer pricing, International Transaction “Means”

a) Transactions between two or more Associated Enterprises either or both of whom are non-residents

b) Transactions between three or more Associated Enterprises who are non-residents

c) Transactions between two or more Associated Enterprises who are residents

d) None of the above

Answer

Answer: a) Transactions between two or more Associated Enterprises either or both of whom are non-residents

58. The International transaction shall be in nature of:

a) Purchase, sale or lease of tangible or intangible property

b) Provision of services or lending or borrowing money; or

c) Any other transaction having a bearing on the profits, income, losses or assets of the enterprises

d) All of the above

Answer

Answer: d) All of the above

59. Which of the following conditions should be satisfied in order to consider a transaction as International transaction under Transfer Pricing regulations :-

a) Transaction should be between Associated enterprises.

b) Either or both of the parties to transaction should be non-residents

c) Transaction should relate to purchase, sale or lease of tangible or intangible property or provisions of services, etc.

d) All of the above

Answer

Answer: d) All of the above

60. Which of the following should be considered as International transaction:

a) Royalty payment made by UB India to its group concern UV India.

b) Payment made by UG (India) to its holding company UG (UK) for installation services.

c) Repayment of buyer’s credit by X (India) to third party Mauritius Bank.

d) None of the above

Answer

Answer: b) Payment made by UG (India) to its holding company UG (UK) for installation services.

Transfer Pricing MCQ with Answers

61. Z India issued 10,000 shares at Rs 110 (face value of Rs. 10 each) at a premium of Rs. 100 per share to its holding company, W International. Choose the correct statement:

a) Transfer pricing provisions would be applicable on such transaction when the fair market value of share is Rs 150 per share

b) Transfer pricing provisions would be applicable on such transaction when the fair market value of share is Rs 90 per share

c) Transfer pricing provisions would not be applicable on such transaction irrespective of the market value of shares.

d) None of the above

Answer

Answer: c) Transfer pricing provisions would not be applicable on such transaction irrespective of the market value of shares.

62. A Ltd. (India), purchases raw material from its parent AB Ltd for Rs. 30 crore during FY 2017-18. (India). Such transaction may be considered as :-

a) International Transaction under Transfer Pricing

b) Specified Domestic Transaction

c) Any of the above

d) None of the above

Answer

Answer: b) Specified Domestic Transaction

63. D Ltd. (India) imports goods from E International (Switzerland). D Ltd holds 10% shares in E International. Such transaction :-

a) Would be considered as International transaction

b) Would be considered as Specified domestic transaction

c) A or B

d) None of the above

Answer

Answer: d) None of the above

64. C Ltd. (India) imports 10,000 units of goods from its Associated enterprise C International (Germany) at USD 50 per unit. Such transaction :-

a) Would not be considered as international transaction, where the Arm’s length price of such transaction is USD 50 per unit

b) Would be considered as international transaction when arm’s length price of such transaction is USD 40 per unit.

c) Would be considered as international transaction irrespective of the Arm’s length price of such transaction.

d) None of the above

Answer

Answer: c) Would be considered as international transaction irrespective of the Arm’s length price of such transaction.

65. A ltd. (India) is the subsidiary of AB International (UK). A Ltd. import certain goods from B International (Australia), independent third party. There exists a prior agreement between B International and AB International (UK) for import of such goods. Such transaction of import from third party :-

a) Shall not be deemed to be an international transaction as both parties (i.e. A ltd. and AB International) are not associated enterprises.

b) Shall be deemed to be an international transaction even if transaction is made with Independent third party.

c) Any of the above

d) None of the above

Answer

Answer: b) Shall be deemed to be an international transaction even if transaction is made with Independent third party.

66. GO Ltd. (India) is the subsidiary of GO International (UK). Go Ltd. imports goods from B ltd. (India), independent third party. There exists a prior agreement between Go International (UK) and B ltd. (India) for import of such goods. Such transaction of import from independent third party :-

a) Shall not be deemed to be an international transaction as both parties (i.e. Go Ltd. and B Ltd.(India)) are not associated enterprises.

b) Shall not be deemed to be an international transaction as neither GO ltd. nor B ltd. is foreign company.

c) Shall be deemed to be an international transaction.

d) None of the above

Answer

Answer: c) Shall be deemed to be an international transaction.

67. “Arm’s length price” means a price which is applied or proposed to be applied in a transaction between persons (other than associated enterprises) in …………….

a) Controlled conditions

b) Uncontrolled conditions

c) Market conditions

d) None of the above

Answer

Answer: b) Uncontrolled conditions

68. Provision relating to arm’s length price are not applicable where such application results in……………………. for tax purposes in India.

a) Increase in losses

b) Reduction of taxable income

c) Reduction of expense

d) Any of the above

Answer

Answer: b) Reduction of taxable income

69. Hozo India Ltd. sold ‘Product A’ to Mozo International (UK). The arm’s length price of product A can be ascertained under CUP Method, where : –

a) Hozo India sold similar goods to unrelated party, YO International (UK).

b) Unrelated enterprise, D India sold similar goods to MO International (UK), which is not a related party of D India

c) Hozo India sold similar goods to another related party, ZOZO International (UK).

d) Both A and B

Answer

Answer: d) Both A and B

70. AB India purchases product X from its subsidiary AB International (UK). Select internal CUP from the following transactions :-

a) AB India purchases similar product from its another subsidiary ABB Inc. (UK)

b) AB India purchases similar product from unrelated party BC International (UK)

c) BC India purchases similar product from unrelated party RC International (UK)

d) None of the above

Answer

Answer: b) AB India purchases similar product from unrelated party BC International (UK)

Transfer Pricing MCQ with Answers

71. AB India purchases product X from its subsidiary AB International (UK). Select external CUP from the following transactions :-

a) AB India purchases similar product from its another subsidiary ABB Inc. (UK)

b) AB India purchases similar product from unrelated party BC International (UK)

c) BC India purchases similar product from unrelated party RC International (UK)

d) None of the above

Answer

Answer: c) BC India purchases similar product from unrelated party RC International (UK)

72. Associated Enterprise 1 sold coffee beans to Associated Enterprise 2. Associated Enterprise 1 did not sell similar coffee beans to third party (Non-Associated Enterprise). Thus, sale of coffee beans of similar type, quality and volume between non- Associated Enterprise 1 and non- Associated Enterprise 2 would be ………. CUP.

a) External CUP

b) Internal CUP

c) Any of the above

d) None of the above

Answer

Answer: a) External CUP

73. While calculating arm’s length price under CUP method :-

a) Use of external CUP is preferred over internal CUP

b) Only internal CUP can be used

c) Use of Internal CUP is preferred over external CUP

d) None of the above

Answer

Answer: c) Use of Internal CUP is preferred over external CUP

74. After calculating CUP on basis of internal or external CUP adjust the price so arrived at for functional differences between the international transaction under review, and the comparable uncontrolled transactions :-

a) Which could materially affect the price in the open market.

b) Which could affect price in the open market, even if immaterial

c) Which does not affect price in the open market

d) None of the above

Answer

Answer: a) Which could materially affect the price in the open market.

75. Associated Enterprise 1 sold Product B to Associated Enterprise 2 at Rs 5,00,000. Associated Enterprise 1 sold Product B of similar type, quality and quantity to third party (Non- Associated Enterprise) at Rs 4,00,000. The Arm’s Length Price of such transaction between Associated Enterprises would be –

a) Rs 5,00,000

b) Rs 4,00,000

c) Either A or B

d) None of the above

Answer

Answer: a) Rs 5,00,000

76. Associated Enterprise 1 sold Product B to Associated Enterprise 2 at Rs 3,00,000. Associated Enterprise 1 sold Product B of similar type, quality and quantity to third party (Non- Associated Enterprise) at Rs 6,00,000. The Arm’s Length Price of such transaction between Associated Enterprises would be –

a) Rs 3,00,000

b) Rs 6,00,000

c) Either A or B

d) None of the above

Answer

Answer: b) Rs 6,00,000

77. Associated Enterprise 1 sold Product C to Associated Enterprise 2 at Rs 5,00,000. Associated Enterprise 1 sold Product C of similar type, quality and quantity to third party (Non- Associated Enterprise) at Rs 5,50,000.

Independent third party (i.e., Non- Associated Enterprise) sold Product C of similar type, quality and quantity to third party (Non-AE) at Rs 6,00,000. In this case the Arm’s length Price under CUP method would be :-

a) 5,00,000.

b) 5,50,000.

c) 6,00,000.

d) None of the above

Answer

Answer: b) 5,50,000.

78. Under Resale Price Method, ……………….. derived by an enterprise, from the resale price of such property or services in comparable uncontrolled transactions, should be reduced from the price in controlled transaction :-

a) Normal Net Profit Margin

b) Profit Margin

c) Normal Gross Profit Margin

d) None of the above

Answer

Answer: c) Normal Gross Profit Margin

79. In Resale Price Method, impact of Functional and other differences, which could materially affect the amount of ……………….. in the open market should be considered :-

a) Gross profit margin

b) Net Profit Margin

c) Profit Margin

d) None of the above

Answer

Answer: a) Gross profit margin

80. Under Resale Price Method, the resale price margin earned by re-seller in comparable uncontrolled transactions would be considered as …………. Comparable –

a) External

b) Suitable

c) Internal

d) None of the above

Answer

Answer: c) Internal

Transfer Pricing MCQ with Answers

81. The resale price margin earned by an independent enterprise, in comparable uncontrolled transactions would be considered as …………. Comparable

a) External

b) Suitable

c) Internal

d) None of the above

Answer

Answer: a) External

82. Under Cost plus Method, Arms Length Price is determined by adding appropriate gross profit margin to the Associated Enterprise’s …….. of producing goods/ providing services.

a) Selling price

b) Resale price

c) Cost

d) None of the above

Answer

Answer: c) Cost

83. As per the Organisation for Economic Co-operation and Development (OECD), Cost Plus Method is applicable when :-

a) Semi-finished goods are sold between Associated enterprises,

b) There is contract manufacturing

c) Any other transfer pricing method is not applicable

d) Both A and B

Answer

Answer: d) Both A and B

84. Under the Cost-Plus Method, ……………………..in a tested party transaction is determined, and then normal gross profit mark-up would be added to such costs, arising from the transfer or provision of the same or similar goods or services to determine the Arm’s Length Price

a) Direct costs of production

b) Indirect costs of production

c) Cost of sales

d) Both A and B

Answer

Answer: d) Both A and B

85. Profit-based transfer pricing methods, recognised by the TP legislation, as satisfying the arm’s length principle are : –

a) Profit Split Method;

b) Transactional Net margin method.

c) CUP Method

d) Both A and B

Answer

Answer: d) Both A and B

86. Profit Split Method is typically applicable :-

a) In international transactions that are so interrelated that they cannot be evaluated separately to determine Arm’s Length Price of any one transaction

b) When CUP Method is not applicable

c) When Resale Price Method is not applicable

d) None of the above

Answer

Answer: a) In international transactions that are so interrelated that they cannot be evaluated separately to determine Arm’s Length Price of any one transaction

87. The allocation of profit or loss under the Profit Split Method must be made in accordance with one of the following allocation methods :-

a) Comparable Profit Split Method

b) Uncontrolled Profit Split Method

c) Residual Profit Split Method

d) Both A and C

Answer

Answer: d) Both A and C

88. A comparable profit split is derived, from the …………………..of uncontrolled taxpayers whose transactions and activities are similar to those of the controlled taxpayers.

a) Operating Profit

b) Combined Operating Profit

c) Comparable Uncontrolled Price

d) None of the above

Answer

Answer: b) Combined Operating Profit

89. Under Transaction Net Margin Method, the Arm’s Length Price is arrived at by comparing ………………. of the “tested” party with the ……………….of an uncontrolled party engaged in comparable transactions, with an appropriate base.

a) Uncontrolled Price

b) Resale Price

c) Operating Profit

d) Combined Operating Profit

Answer

Answer: c) Operating Profit

Transfer Pricing MCQ with Answers

90. CBDT has prescribed the ‘Other Method’ by inserting a new rule 10AB to the Income-Tax Rules. For determination of arm’s length price in relation to international transaction, the Other Method shall be :-

a) Any method which takes into account the price which has been charged or paid, for the same or similar uncontrolled transaction, between Non-Associated enterprises, under similar circumstances

b) Resale Price Method

c) Transaction Net Margin Method

d) Profit Split Method

Answer

Answer: a) Any method which takes into account the price which has been charged or paid, for the same or similar uncontrolled transaction, between Non-Associated enterprises, under similar circumstances

91. There are various participants in an international transaction. In order to find comparables for a transaction, ……………………..is selected as tested party.

a) Assessee, resident in India

b) Foreign Associated Enterprise

c) One of the participant

d) None of the above

Answer

Answer: c) One of the participant

92. Under Transfer Pricing any party which is chosen as Tested Party from two parties, shall be : –

a) “Least complex”

b) Does not own valuable intangible property

c) Both A and B

d) None of the above

Answer

Answer: c) Both A and B

93. Under Transfer Pricing, Profit Level Indicator (PLI) is :-

a) Ratio that measure relationships between profits and cost incurred or resources employed.

b) Break-even point

c) A and B

d) None of the above

Answer

Answer: a) Ratio that measure relationships between profits and cost incurred or resources employed.

94. The most appropriate method under the transfer pricing shall be: –

a) CUP Method

b) Resale Price Method

c) Transaction Net Margin Method

d) The Method which is best suited to facts and circumstances of each particular international transaction, and which provides the most reliable measure of an arm’s length price

Answer

Answer:

d) The Method which is best suited to facts and circumstances of each particular international transaction, and which provides the most reliable measure of an arm’s length price

95. Which factors should not be taken into consideration in determining the most appropriate method?

a) Nature and class of transaction

b) Class of Associated Enterprise

c) Availability, coverage and reliability of data

d) Country of Associated Enterprise entering into international transaction

Answer

Answer: d) Country of Associated Enterprise entering into international transaction

96. In case of royalty payments between Associated Enterprises, which of the following methods are generally used under transfer pricing?

a) CUP Method

b) Transaction Net Margin Method

c) Resale Price Method

d) Other Method

Answer

Answer: a) CUP Method

97. In case of sale of semi-finished goods between Associated Enterprises, which of the following methods are generally used under transfer pricing?

a) CUP Method

b) Transaction Net Margin Method

c) Resale Price Method

d) Cost Plus Method

Answer

Answer: d) Cost Plus Method

98. Where the most appropriate method for determination of ALP of an international transaction entered into on or after 1.4.2014 is Resale price method, or Cost plus method, or Transactional net margin method, then, the data to be used for analyzing the comparability of an uncontrolled transaction with an international transaction shall be the data relating to –

a) Current year

b) Financial year immediately preceding the current year, if the data relating to the current year is not available at the time of furnishing the return of income.

c) Preceding three years

d) Both A or B

Answer

Answer: d) Both A or B

99. When the price determined by the application of Most Appropriate Method is a single price, then …………………. would apply :-

a) Arithmetic Mean

b) Range

c) Mean

d) None of the above

Answer

Answer: d) None of the above

100. DD India Ltd. enters into certain transaction from DDI International (UK) of Rs 10,000. It determines arm’s length price of such transaction as Rs 20,000 and Rs 15,000 under CUP Method. Such calculation is made by using four comparables. The arms’ length price of such transaction would be –

a) Rs 20,000

b) Rs 15,000

c) Rs 10,000

d) Rs 17,250

Answer

Answer: d) Rs 17,250

Transfer Pricing International Tax MCQ with Answers Part 2 – MCQ 101 – 150

101. Where more than one price is determined by use of most appropriate method, and the range concept is not applicable then, Arm’s Length price shall be taken to be……………

a) Arithmetic Mean of such prices

b) Median

c) +-3% variation from actual transaction price

d) None of the above

Answer

Answer: a) Arithmetic Mean of such prices

102. Actual transaction price would be taken as Arm’s Length Price, where variation between the Arm’s length price (determined by use of Arithmetic Mean), and actual transaction price does not exceed –

a) 1% of actual transaction price – In case of whole sale trading

b) 3% of actual transaction price – In case of other business

c) 2% of actual transaction price – In case of whole sale trading/other business

d) Both A and B

Answer

Answer: d) Both A and B

103. AE India sold product A to AE Incl. (USA) at Rs. 2,00,000 (Equivalent to USD 3077). Sale price of product A determined under CUP method are Rs. 1,50,000, Rs. 1,00,000, Rs. 3,00,000, Rs. 50,000 and Rs. 4,00,000.

Determine the Arm’s Length Price when AE India is not a wholesale trader?

a) Rs 2,00,000

b) Rs 1,45,500

c) Rs 1,54,500

d) None of the above

Answer

Answer: a) Rs 2,00,000

104. Range concept is applicable when : –

a) More than one price are determined by use of Most Appropriate Method and Transaction is undertaken on or after April 1, 2014

b) Arm’s length price is determined by use of Transactional Net Profit Method (TNMM), or Comparable uncontrolled price Method (CUP Method), or Cost Plus Method (CPM), or Resale Price Method (RPM).

c) Six or more comparables are available in the dataset

d) All of the above

Answer

Answer: d) All of the above

105. Range concept is not applicable when ……………….. is used to determine the Arm’s length price.

a) Profit Split Method

b) Transaction Net Margin Method

c) Other method (given under Rule 10AB)

d) A or C

Answer

Answer: d) A or C

106. Range concept is applicable when ……………….. method is used to determine the Arm’s length price.

a) CUP Method

b) Transaction Net Margin Method

c) Other method (given under Rule 10AB)

d) A and B

Answer

Answer: d) A and B

107. Under Transfer Pricing, actual transaction price or profit margin would be accepted if it falls in the range of :-

a) 35th-65th percentile of the given dataset

b) 65th-75th percentile of the given dataset

c) 35th-45th percentile of the give dataset

d) 15th-35th percentile of the given dataset

Answer

Answer: a) 35th-65th percentile of the given dataset

108. Under Range Concept, …………………..of dataset would be computed and taken as arm’s length price if, actual transaction price or profit margin is outside the range of 35th-65th percentile

a) Arithmetic Mean

b) Median

c) Mode

d) None of the above

Answer

Answer: b) Median

109. First step to determine range under transfer pricing to arrange dataset of Prices or profit margins in :-

a) Ascending order

b) Descending order

c) Either A or B

d) None of the above

Answer

Answer: a) Ascending order

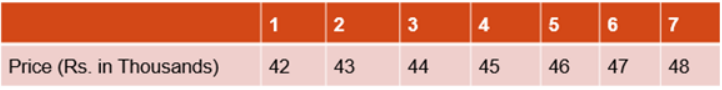

110. In the given case, dataset of 7 prices arranged in Ascending order is as under:

In this case, the Range would be :-

a) 42,000-43,000

b) 43,000-44,000

c) 44,000-46,000

d) 47,000-48,00

Answer

Answer: c) 44,000-46,000

Transfer Pricing MCQ with Answers

111. In which of the transfer pricing method, range concept is not applicable :-

a) Cost Plus Method

b) CUP Method

c) TNMM

d) Profit Split Method

Answer

Answer: d) Profit Split Method

112. When a single price is determined by use of any transfer pricing method:-

a) Range is applicable

b) Arithmetic Mean is applicable

c) A or B

d) None of the above

Answer

Answer: d) None of the above

113. Arithmetic Mean is applicable when : –

a) Transactions were undertaken before April 1, 2014

b) Profit Split Method is the most appropriate method

c) Other Method (Rule 10AB) is applicable

d) Either of the above is applicable

Answer

Answer: d) Either of the above is applicable

114. When more than one price is determined for international transaction undertaken after March 1, 2014 : –

a) Range is applicable

b) Arithmetic Mean is applicable

c) A or B

d) None of the above

Answer

Answer: b) Arithmetic Mean is applicable

115. Functions, Assets and Risk (‘FAR’) analysis is the method of finding and organizing facts about the business of a MNE in terms of –

a) the functions performed;

b) assets used

c) risks assumed by business

d) All of the above

Answer

Answer: d) All of the above

116. A manufacturer of software can be selected as comparable under transfer pricing for :-

a) A BPO service provider,

b) KPO Service Provider

c) Trader of software

d) None of the above

Answer

Answer: d) None of the above

117. Components of FAR analysis are :-

a) Functions performed, Asset employed, risk assumed by business

b) Fixed Assets, Asset employed, Ratio of Gross Profit to Asset employed

c) Functions performed, Analysis of comparables, Risk assumed

d) None of the above

Answer

Answer: a) Functions performed, Asset employed, risk assumed by business

118. Associated Enterprise undertaking intra group transactions (specified) are required to keep and maintain :-

a) Entity related information and documents

b) Price related information and documents

c) Transaction related information and documents

d) All of the above

Answer

Answer: d) All of the above

119. The assessee is not obliged to maintain the information and documents for international transaction under transfer pricing, where the aggregate value of international transactions is :-

a) Rs 20 crore or less

b) Rs 5 crore or less

c) 1 crore or less

d) Rs 50 lakhs or less

Answer

Answer: c) 1 crore or less

120. AV India Ltd. is claiming profit linked deduction u/s 80-IC and it has obtained certain services amounting to Rs 5 crores with its other Indian group concern during the FY 2017-18. In this case, AV India is :-

a) Required to maintain documentation under Rule 10D as aggregate value of transaction is more than Rs 1 crore

b) Not required to maintain documentation under Rule 10D as it is a specified domestic transaction

c) Not required to maintain documentation under Rule 10D as provisions of specified domestic transactions are not applicable

d) None of the above

Answer

Answer: c) Not required to maintain documentation under Rule 10D as provisions of specified domestic transactions are not applicable

Transfer Pricing MCQ with Answers

121. Every person who enters into an ……………………….. during a previous year is required to obtain a report from a Chartered Accountant, and furnish such report on or before 30th November of the relevant assessment year in Form No.3CEB.

a) International transaction above Rs 1 crore

b) International transaction of any amount

c) Both A or B

d) None of the above

Answer

Answer: b) International transaction of any amount

122. For under-reported income, penalty is leviable u/s 270A @…….. of tax payable.

a) 100%

b) 300%

c) 50%

d) 200%

Answer

Answer: c) 50%

123. Indian company imports raw material from its foreign subsidiary at Rs. 5 lakhs during the P.Y. 2017-18. ICO has maintained documents for such international transaction as per Section 92D and included such transactions in income-tax return and Form No.3CEB at Rs. 5 lakhs. During assessment proceedings, the TPO determined the ALP of such transaction at Rs. 3 lakhs. Amount of penalty to be levied on Indian Company for underreporting of income u/s 270A would be :-

a) 100%

b) 300%

c) 50%

d) Nil

Answer

Answer: d) Nil

124. Failure to report any …………………………to which the provisions of transfer pricing [i.e., Chapter X] applies would constitute ‘misreporting of income’ u/s 270A(9), and it would attract penalty @ 200% of tax payable due to misreporting of income.

a) International transaction, or

b) Deemed international transaction [as referred to in Section 92B(2)]

c) Specified domestic transaction

d) All of the above

Answer

Answer: d) All of the above

125. Indian company provided consultancy services to its foreign parent but failed to report such transaction in Form 3CEB and income-tax return. During assessment, the AO identified such transaction and made additions of Rs. 10 lakhs in accordance with ALP determined by TPO. Determine the penalty leviable on ICO assuming a tax rate (including surcharge and cess) of 30% u/s 270A ?

a) Rs 6,00,000

b) Rs 3,09,000

c) Rs 9,27,000

d) Rs 1,54,500

Answer

Answer: a) Rs 6,00,000

126. Failure to furnish transfer pricing report in Form 3CEB would attract penalty u/s 271BA of :-

a) Rs 1,00000

b) Rs 5,00,000

c) Rs 10,00,000

d) None of the above

Answer

Answer: a) Rs 1,00000

127. Transfer Pricing information and documents are required to be kept and maintained for a period of ………………. from the end of relevant AY :-

a) 5 years

b) 10 years

c) 8 years

d) None of the above

Answer

Answer: c) 8 years

128. Failure to keep and maintain information and documentation as required by Section 92D would attract penalty u/s 271AA for :-

a) @ 50% of the value of international transaction entered into by a taxpayer

b) @ 2% of the value of international transaction entered into by a taxpayer for which documents are not kept

c) @ 2% of the value of all transactions entered into by a taxpayer

d) None of the above

Answer

Answer: b) @ 2% of the value of international transaction entered into by a taxpayer for which documents are not kept

129. Penalty u/s 271AA @ 2% shall be computed on …………………of international transaction. :-

a) Actual Price

b) Arm’s Length Price

c) Fair Value

d) None of the above

Answer

Answer: b) Arm’s Length Price

130. If any person who has entered into an international transaction fails to furnish any such information or document as required by Assessing Officer or Commissioner (Appeals) within a period of ………..from the date of receipt of a notice, then such person shall be liable to a penalty up to 2% of the value of international transactions or specified domestic transaction.

a) 60 days

b) 30 days

c) 90 days

d) None of the above

Answer

Answer: b) 30 days

Transfer Pricing MCQ with Answers

131. The key objectives of the Country by Country Reporting are: –

a) To articulate consistent transfer pricing position, across the globe.

b) To provide tax administration with useful information to assess TP risk in given cases.

c) To determine Arm’s Length Price of International Transaction

d) Both A and B

Answer

Answer: d) Both A and B

132. International group shall maintain information and documents in Master file when Consolidated group revenue of the international group is (as reflected in Consolidated Financial Statements of the international group) is

a) More than Rs 500 crores

b) Less than 2500 crores

c) Less than Rs 500 crores

d) None of the above

Answer

Answer: a) More than Rs 500 crores

133. Monetary threshold for maintaining a master file is :-

a) Consolidated group revenue of the international group is less than Rs 500 crores and aggregate value of international transaction is more than Rs 50 crores.

b) Consolidated group revenue of the international group is less than Rs 500 crores and aggregate value of international transaction is more than Rs 10 crores in respect of purchase, sale, transfer, lease or use of intangible property.

c) Consolidated group revenue of the international group is more than Rs 500 crores and aggregate value of international transaction is more than Rs 50 crores.

d) None of the above

Answer

Answer: c) Consolidated group revenue of the international group is more than Rs 500 crores and aggregate value of international transaction is more than Rs 50 crores.

134. Master file shall be filed in Form 3CEAA. Part A of Form 3CEAA needs to be filed by constituent entity of international group when Consolidated group revenue of the international group is

a) More than Rs 500 crores and aggregate value of international transaction is more than Rs 50 crores.

b) More than Rs 500 crores and aggregate value of international transaction is more than Rs 10 crores in respect of purchase, sale, transfer, lease or use of intangible property.

c) More than Rs 500 crores or aggregate value of international transaction is more than Rs 50 crores.

d) None of the above

Answer

Answer: d) None of the above

135. Master file shall be filed in Form 3CEAA. Part B of Form 3CEAA needs to be filed by constituent entity of international group when :-

a) Consolidated group revenue of the international group is more than Rs 500 crores and aggregate value of international transaction is more than Rs 50 crores.

b) Consolidated group revenue of the international group is more than Rs 500 crores and aggregate value of international transaction is more than Rs 10 crores in respect of purchase, sale, transfer, lease or use of intangible property.

c) Both A and B.

d) None of the above

Answer

Answer: c) Both A and B.

136. Country-by-country report is required to be filed when Consolidated group revenue of the international group is –

a) More than Rs 5500 crores

b) More than Rs 500 crores

c) More than Rs 50 crores

d) None of the above

Answer

Answer: a) More than Rs 5500 crores

137. X India Ltd. is a resident constituent entity of an International group. Its parent entity, Y International is resident of Country Y. Y international furnished CbC report in Country Y and Country Y shared the details with Indian tax authorities. In this case, X India Ltd. –

a) Is required to file CbC report in India if the consolidated group revenue of international group is more than Rs 5500 crores

b) Is required to file CbC report in India if the consolidated group revenue of international group is more than Rs 500 crores

c) Is not required to file CbC report at all

d) None of the above

Answer

Answer: c) Is not required to file CbC report at all

138. A India Ltd. is a resident constituent entity of an International group. Its parent entity, B International is resident of Country C. A India Ltd. is required to furnish CbC report if :-

a) India does not have an arrangement for exchange of the CbC report with country C.

b) Country C is not exchanging information with India, even though there is an agreement (i.e. existence of systematic failure)

c) Either A or B

d) None of the above

Answer

Answer: c) Either A or B

139. A India Ltd. is a resident constituent entity of an International group. Its parent entity, B International is resident of Country C. A India Ltd. is required to furnish CbC report if :-

a) B international is resident in a country with which India does not have an arrangement for exchange of the CbC report

b) Country C is not exchanging information with India even though there is an agreement (i.e. existence of systematic failure)

c) Both A and B

d) None of the above

Answer

Answer: c) Both A and B

140. Entity D is required to furnish report under CbC provisions but it filed such report after 20 days from the due date. The amount of penalty shall be :-

a) Rs 1,00,000

b) Rs 3,00,000

c) Rs 10,00,000

d) None of the above

Answer

Answer: a) Rs 1,00,000

Transfer Pricing MCQ with Answers

141. Entity E is required to furnish report under CbC provisions but it filed such report after 25 days from the due date. The amount of penalty shall be :-

a) Rs 1,00,000

b) Rs 1,25,000

c) Rs 3,75,000

d) No penalty as there was reasonable cause for such failure

Answer

Answer: b) Rs 1,25,000

142. Entity F is required to furnish report under CbC provisions but it filed such report after 35 days from the due date. The amount of penalty shall be :-

a) Rs 17,50,000

b) Rs 2,25,000

c) Rs 1,75,000

d) None of the above

Answer

Answer: b) Rs 2,25,000

143. Entity F is required to furnish report under CbC provisions but it filed such report after 24 days from the due date. The amount of penalty per day shall be :-

a) Rs 5,000

b) Rs 15,000

c) Rs 50,000

d) None of the above

Answer

Answer: a) Rs 5,000

144. Entity F is required to furnish report under CbC provisions but it filed such report after 40 days from the due date. The amount of penalty per day shall be :-

a) Rs 5,000

b) Rs 15,000

c) Rs 50,000

d) None of the above

Answer

Answer: b) Rs 15,000

145. An Entity is required to furnish report under CbC provisions but it failed to file such report even after service of penalty order. The amount of penalty per day shall be :-

a) Rs 5,000

b) Rs 15,000

c) Rs 50,000

d) None of the above

Answer

Answer: c) Rs 50,000

146. In case information called by prescribed authority for determination of accuracy of CbC report is not submitted within the time specified in the notice, reporting entity shall be penalized by …………..per day after expiry of the period specified in such notice.

a) Rs 5,000

b) Rs 15,000

c) Rs 50,000

d) None of the above

Answer

Answer: a) Rs 5,000

147. Information, called where any by prescribed authority for determination of accuracy of CbC report is not submitted. Further, for any default that continues even after service of order levying penalty, for non-furnishing of information penalty for default beyond date of service of penalty order shall be

a) Rs 5,000 per day

b) Rs 15,000 per day

c) Rs 50,000 per day

d) None of the above

Answer

Answer: c) Rs 50,000 per day

148. GB India Ltd has provided inaccurate information in the CbC report. Penalty for furnishing inaccurate information shall be would be :-

a) Rs 1,00,000

b) Rs 15,000 per day

c) Rs 50,000 per day

d) Rs 5,00,000

Answer

Answer: d) Rs 5,00,000

149. If an entity has provided any inaccurate information in the CbC report, penalty would be levied if the :-

a) Entity has knowledge of the inaccuracy but does not inform the prescribed authority about error.

b) The entity furnishes inaccurate information or document in response to notice of the prescribed authority.

c) The entity discovers the inaccuracy after the report is furnished and fails to inform the prescribed authority and furnish correct report within a period of 15 days of such discovery

d) All of the above

Answer

Answer: d) All of the above

150. For applicability of CbC provisions, the definition of “international group” means any group that includes:-

a) Two or more enterprises which are resident of different countries or territories

b) Two or more enterprises which are resident of same country or territory

c) An enterprise, being a resident of one country or territory, which carries on any business through a permanent establishment in other countries or territories

d) Both A and C

Answer

Answer: d) Both A and C

Transfer Pricing MCQ with Answers Part 2 – MCQ 151 – 200

151. For applicability of CbC provisions, the “group” means:-

a) A parent entity and all the entities in respect of which, a consolidated financial statement for financial reporting purposes is required to be prepared

b) A parent entity and all the entities in respect of which, a consolidated financial statement would have been required to be prepared, had the preference shares of any of the enterprises were to be listed on a stock exchange in the country or territory of which the parent entity is resident

c) Any group of entities, which has more than one company

d) Any entity which is liable to submit transfer pricing Form 3CEB.

Answer

Answer: a) A parent entity and all the entities in respect of which, a consolidated financial statement for financial reporting purposes is required to be prepared

152. Specified domestic transaction includes :-

a) Any transaction between related entities where one of the party is a non-resident.

b) Inter-unit transfer of goods at less than Fair Market Value between two independent Indian companies

c) Inter-unit transfer of goods at less than and Fair Market Value between Indian companies which are part of same group where one of the company is claiming profit linked deduction u/s 80-ID.

d) All of the above

Answer

Answer: c) Inter-unit transfer of goods at less than and Fair Market Value between Indian companies which are part of same group where one of the company is claiming profit linked deduction u/s 80-ID.

153. E India is claiming profit linked deduction u/s 80-IC. It made following transactions during the PY 2017-18. In which of the following cases, arm’s length price would be considered to determine income of E India, assuming total specified domestic transaction exceed Rs 20 crore:-

a) It avails certain services from its group concern EE India for Rs 1,00,000. It avails same services from third party at Rs 1,25,000.

b) It avails certain services from its group concern EEE India for Rs 2,00,000. It avails same services from third party at Rs 1,25,000.

c) It avails certain services from its group concern EEEE India for Rs 2,00,000 and also avails same services from third party at Rs 2,00,000.

d) All of the above

Answer

Answer: b) It avails certain services from its group concern EEE India for Rs 2,00,000. It avails same services from third party at Rs 1,25,000.

154. The aggregate of Specified Domestic transactions entered into by the assessee in the previous year should exceed a sum of ………………., to be considered as specified domestic transaction.

a) Rs 1 crore.

b) Rs 20 crore

c) Rs 10 crore

d) None of the above

Answer

Answer: b) Rs 20 crore

155. Aaj Hotels India Private ltd. is claiming exemption under Section 80-ID. AHIPL was group concern of Aaj Hotels, but it is not claiming any profit linked deduction. It has used the hotel space of Aaj Hotels for certain event and paid Rs 10 crores during the PY 2017-18 and there is no other transaction during such PY. In this case, provisions of :-

a) Transfer pricing for Specified Domestic Transactions would be applicable

b) Transfer pricing for international transactions would be applicable

c) Transfer pricing for Specified Domestic Transactions would be applicable as the value of transaction exceeds Rs 1 crore

d) None of the above

Answer

Answer: d) None of the above

Reasoning

The aggregate SDT entered into by the assessee in the previous year should exceed a sum of Rs 20 crore to be considered as specified domestic transaction. Thus, such transaction would not be considered as specified domestic transaction.

156. In which of the following cases, maintenance of information and documents is required under transfer pricing:-

a) Where value of specified domestic transactions is Rs 15 crores during the PY

b) Where value of international transaction is Rs 10 crores during the PY.

c) Where value of specified domestic transactions is Rs 25 crores during the PY

d) Both B and C

Answer

Answer: d) Both B and C

157. Failure to report Specified Domestic Transaction in Form 3CEB would be considered as………… :-

a) Under-reporting of income

b) Misreporting of income

c) Concealment of income

d) None of the above

Answer

Answer: b) Misreporting of income

158. Failure to report specified domestic transaction would attract penalty of ……. u/s 270A:-

a) Rs 1,00,000

b) 200% of tax payable.

c) 300% of tax payable.

d) None of the above

Answer

Answer: b) 200% of tax payable.

159. Jek India ltd. has availed services from its foreign subsidiary of Rs 1,00,00 and it has also disclosed such transaction in Form 3CEB during the PY 2017-18. It has also prepared TP study to justify application of appropriate TP method. During assessment, the AO made additions on basis of arm’s length price determined by TPO. The addition would be considered as –

a) Under-reporting of income

b) Misreporting of income

c) Concealment of income

d) None of the above

Answer

Answer: d) None of the above

160. Failure to furnish Form 3CEB for specified domestic transactions would attract penalty of :-

a) 300% of tax payable

b) Rs 1,00,000

c) 200% of tax payable

d) None of the above

Answer

Answer: b) Rs 1,00,000

Transfer Pricing MCQ with Answers

161. Which of the following transfer pricing methods may be adopted to determine arm’s length price in relation to specified domestic transactions :-

a) CUP

b) TNMM

c) Profit Split Method

d) All of the above

Answer

Answer: d) All of the above

162. Provision of specified domestic transaction would be applicable:-

a) For all transaction between domestic related parties.

b) For all transaction between domestic related parties aggregate value of which exceeds Rs 20 crores.

c) For all transaction between domestic related parties aggregate value of which exceeds Rs 20 crores, provided one of the parties to transaction is claiming profit linked deduction u/s 80-IA, 80-IB, etc.

d) None of the above

Answer

Answer: c) For all transaction between domestic related parties aggregate value of which exceeds Rs 20 crores, provided one of the parties to transaction is claiming profit linked deduction u/s 80-IA, 80-IB, etc.

163. Every person who enters into an ………………………….during a previous year is required to obtain a report from a chartered accountant and furnish such report on or before due date of filing of return of income in Form No.3CEB :-

a) Specified Domestic transactions

b) International Transactions

c) Domestic transactions

d) Both A and B

Answer

Answer: d) Both A and B

164. Which of the following persons can opt for safe harbour rules under provisions of specified domestic transactions?

a) Any Indian company which enters into specified domestic transactions exceeding Rs 20 crore

b) Government company engaged in the business of generation, supply, transmission or distribution of electricity

c) Co-operative society engaged in the business of procuring and marketing milk and milk products.

d) Both B and C

Answer

Answer: d) Both B and C

165. Which of the following transactions can be considered as eligible Specified Domestic Transaction for application of safe harbour rules?

a) Supply/transmission/wheeling of electricity

b) Purchase of milk or milk products by a co-operative society from its members.

c) Any specified domestic transaction aggregate value of which exceeds Rs 20 crores

d) Both A and B

Answer

Answer: d) Both A and B

166. In safe harbour Rules, the actual price declared by Government company for supply/transmission/distribution of electricity would be accepted when :-

a) Supply/transmission/wheeling of electricity is made at the Market Price

b) Supply/transmission/wheeling of electricity is made at less than Market Price

c) Tariff in respect of supply/transmission/wheeling of electricity is determined by appropriate Commission.

d) None of the above

Answer

Answer: c) Tariff in respect of supply/transmission/wheeling of electricity is determined by appropriate Commission.

167. In safe harbour Rules, the actual price declared by the Co operative society for purchase of milk products from its members would be accepted when :-

a) Prices are determined on the basis of market value of milk in the open market

b) Prices are determined on the basis of quality of milk, namely, fat content and solid not fat content of milk

c) Prices are determined on basis of market value after adjusting for quantity discount

d) None of the above

Answer

Answer: b) Prices are determined on the basis of quality of milk, namely, fat content and solid not fat content of milk

168. The provisions relating to maintenance of information and document and submission of report in Form No. 3CEB in respect of specified domestic transaction :-

a) Shall apply irrespective of the fact that the assessee exercises his option for Safe Harbour Rules.

b) Shall apply only when assessee has not exercised option for safe harbour rules

c) Shall not apply at all

d) None of the above

Answer

Answer: a) Shall apply irrespective of the fact that the assessee exercises his option for Safe Harbour Rules.

169. ABB, Society has procured milk from its members during the PY 2017-18. It can apply for safe harbour rules in Form 3CEFB on or before :-

a) 30th November, 2018

b) 30th September, 2018

c) 30th July, 2018

d) None of the above

Answer

Answer: a) 30th November, 2018

170. The Assessing Officer shall pass the order declaring the option exercised by the assessee as invalid within a period of …………from the end of the month in which application in Form 3CEFB is received by him.

a) 6 months

b) 9 months

c) 3 months

d) None of the above

Answer

Answer: c) 3 months

Transfer Pricing MCQ with Answers

171. If assessee does not accept the AO’s order to declare Safe Harbour option invalid, he can file objection with ______ of receipt of order of the AO.

a) 30 days

b) 60 days

c) 15 days

d) None of the above

Answer

Answer: c) 15 days

172. On receipt of the objection from assessee the Principal Commissioner or the Commissioner or the Principal Director or the Director, shall pass appropriate order, within a period of ………..from the end of the month in which the objection filed by the assessee is received by them

a) 2 months

b) 3 months

c) 6 months

d) None of the above

Answer

Answer: a) 2 months

173. “Safe harbour” is a mechanism :-

a) To determine range where more than one price is determined by use of appropriate method

b) To determine Arm’s Length Price

c) To reduce litigation, and implies circumstances under which, the tax authorities shall accept the Transfer Price declared by the taxpayer

d) None of the above

Answer

Answer: c) To reduce litigation, and implies circumstances under which, the tax authorities shall accept the Transfer Price declared by the taxpayer

174. In which of the following international transactions safe harbour rules may be applied :-

a) Corporate guarantee to wholly owned subsidiary

b) Software development services

c) Royalty / Fees for Technical services received from foreign subsidiary

d) Both A and B

Answer

Answer: d) Both A and B

175. In which of the following international transactions safe harbour rules may be applied :-

a) Provision of Information Technology Enabled Services with insignificant risk

b) Provision of KPO services with insignificant risk

c) Provision of contract R & D relating to software development

d) Both A and C

Answer

Answer: d) Both A and C

176. In which of the following international transactions safe harbour rules may be applied :-

a) Provision of Information Technology Enabled Services with significant risk

b) Provision of KPO services with significant risk

c) Provision of contract R & D relating to software development

d) All of the above

Answer

Answer: c) Provision of contract R & D relating to software development

177. What would be the operating margin under Safe Harbour Rules where value of software development services with insignificant risk is Rs 80 crores?

a) 10% or more

b) 17% or more

c) 18% or more

d) None of the above

Answer

Answer: b) 17% or more

178. What would be the operating margin under Safe Harbour Rules where value of KPO services with insignificant risk is Rs 90 crores?

a) 24% or more

b) 21% or more

c) 18% or more

d) Depends upon the % of employee cost to operating expense

Answer

Answer: d) Depends upon the % of employee cost to operating expense

179. What would be the operating margin under Safe Harbour Rules where value of KPO services with insignificant risk is Rs 300 crores?