COMPONENTS OF ASSOCIATED ENTERPRISE

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ASSOCIATED ENTERPRISE – ARTICLE 9(1) OF INDIA – USA TREATY

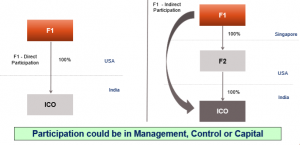

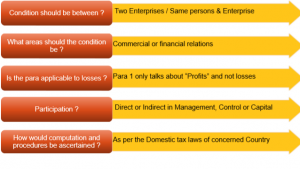

Where

a. an enterprise of a Contracting State participates directly or indirectly in the management, control or capital of an enterprise of the other Contracting State ; or

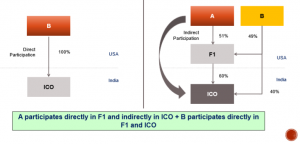

a. the same persons participate directly or indirectly in the management, control, or capital of an enterprise of a Contracting State and an enterprise of the other Contracting State,

and in either case conditions are made or imposed between the two enterprises in their commercial or financial relations which differ from those which would be made between independent enterprises, then any profits which, but for those conditions would have accrued to one of the enterprises, but by reason of those conditions have not so accrued, may be included in the profits of that enterprise and taxed accordingly.

ENTERPRISE – DIRECT OR INDIRECT PARTICIPATION

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

SAME PERSON – DIRECT OR INDIRECT PARTICIPATION

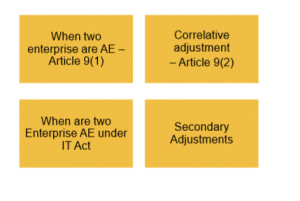

ARTICLE 9(1) – CHARACTERISTICS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

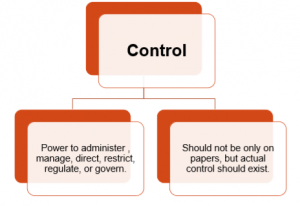

CONTROL

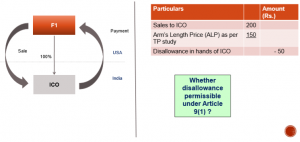

CASE 1 – SALES AT MORE THAN ALP

CIT V NESTLE INDIA LTD. – CASE STUDY

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

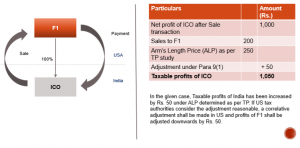

ARTICLE 9(2) OF THE INDIA USA TREATY – CORRELATIVE ADJUSTMENTS

Where a Contracting State (INDIA) includes in the profits of an enterprise of that State, and taxes accordingly, profits on which an enterprise of the other Contracting State has been charged to tax in that other State,

and the profits so included are profits which would have accrued to the enterprise of the first-mentioned State (INDIA) if the conditions made between the two enterprises had been those which would have been made between independent enterprises,

then that other State (USA) shall make an appropriate adjustment to the amount of the tax charged therein on those profits.

In determining such adjustment, due regard shall be had to the other provisions of this Convention and the competent authorities of the Contracting States shall, if necessary, consult each other.

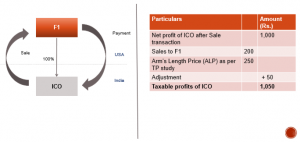

CASE STUDY – CORRELATIVE ADJUSTMENT

CORRELATIVE ADJUSTMENTS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

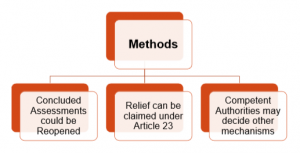

METHODS OF CORRELATIVE ADJUSTMENT

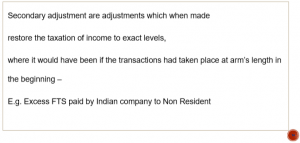

SECONDARY ADJUSTMENT

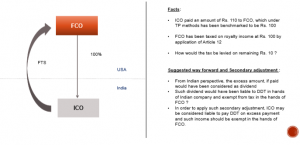

SECONDARY ADJUSTMENT FOR EXCESS FTS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ASSOCIATED ENTERPRISES AS PER PROVISION OF IT ACT

DIRECT OR INDIRECT HOLDING OF 26% OR MORE VOTING POWER IN THE ENTERPRISE

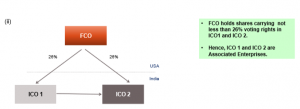

COMMON PERSON/ ENTERPRISE HAS DIRECT OR INDIRECT HOLDING OF 26% OR MORE VOTING POWER IN TWO ENTERPRISE

LOAN TO AN ENTERPRISE NOT LESS THAN 51% OF BOOK VALUE OF TOTAL ASSETS

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

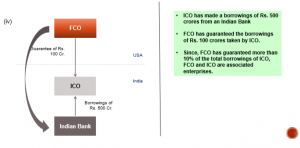

GUARANTEE OF NOT LESS THAN 10% OF TOTAL BORROWINGS

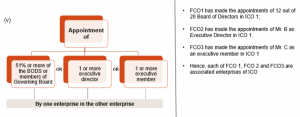

APPOINTMENT BY ENTERPRISE OF BOARD OF DIRECTORS OR MEMBERS OF THE GOVERNING BOARD

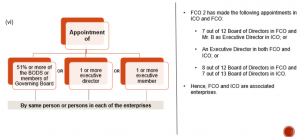

APPOINTMENT BY SAME PERSON – BOARD OF DIRECTORS OR MEMBERS OF THE GOVERNING BOARD

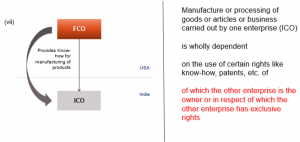

KNOW HOW ETC. USED IN MANUFACTURE OR PROCESSING OF GOODS OR ARTICLES

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

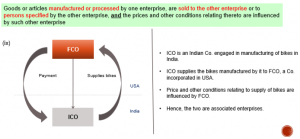

RAW MATERIAL / CONSUMABLES REQUIRED FOR MANUFACTURE OR PROCESSING OF GOODS OR ARTICLES

PRICE INFLUENCED BY PURCHASERS OF ARTICLE

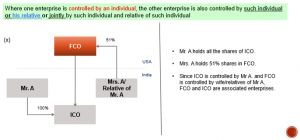

COMMON INDIVIDUAL/RELATIVE CONTROL

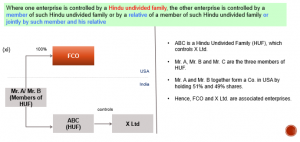

HUF CASES

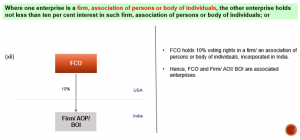

OWNERSHIP OF MORE THAN 10% IN FIRM/AOP/BOI

OTHER PRESCRIBED RELATIONSHIP

CASE STUDY 2