ARTICLE – 4(3) – TIE BREAKER RULE – PERSON OTHER THAN AN INDIVIDUAL

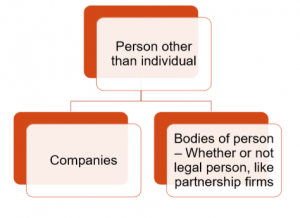

Where by reason of application of paragraph 1 a

person other than an individual is a resident of both

Contracting States, then it shall be deemed to be a

resident only of the State in which its place of

effective management is situated

ARTICLE – 4(3) OF INDIA-USA TREATY

Where by reason of the provisions of paragraph 1

a person other than an individual

is a resident of both Contracting States,

then it shall be deemed to be a resident only of the State

in which its place of effective management is situated.

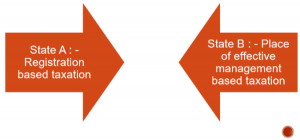

APPLICABILITY

WHEN A COMPANY CAN BE TAXED IN TWO STATE

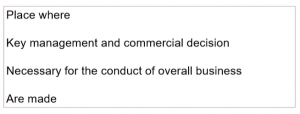

PLACE OF EFFECTIVE MANAGEMENT

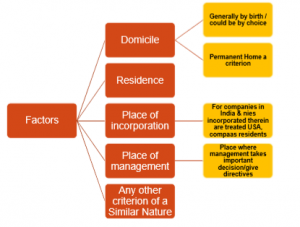

RELEVANT FACTORS

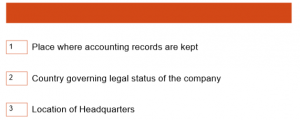

RELEVANT FACTORS

PROTOCOL TO INDIA – BELARUS TREATY

With reference to Article 4, it is understood that when establishing the “place of effective management” as used in paragraph 3 of Article 4, circumstances which may, inter alia, be taken into account are

the place where a company is actually managed and controlled,

the place where the decision making at the highest level on important policies essential for the management of a company takes place,

the place that plays a leading part in the management of a company from an economic and functional point of view and

the place where the relevant accounting books are kept.

INDIAN GUIDELINES ON POEM

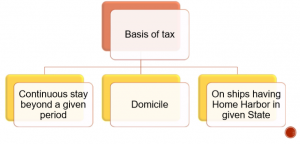

PERIOD OF STAY

OTHER FACTORS