ARTICLE – 4(1) OF THE INDIA UAE TREATY

For the purposes of this Agreement the term ‘resident of a Contracting State’ means:

(a) …… ; and

(b) in the case of the United Arab Emirates: an individual who is present in the UAE for a period or periods totalling in the aggregate at least 183 days in the calendar year concerned, and a company which is incorporated in the UAE and which is managed and controlled wholly in UAE.

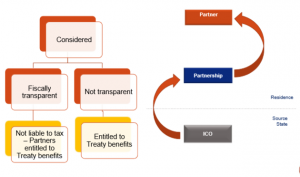

PARTNERSHIP – LIABLE TO TAX ?

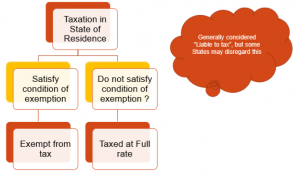

PENSION FUNDS, CHARITABLE TRUSTS – WHETHER LIABLE TO TAX ?

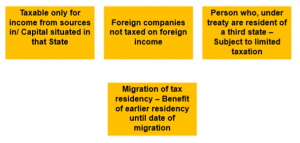

EXCLUSIONS:-

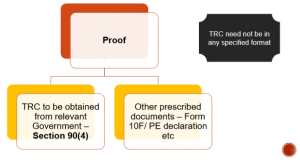

PROOF OF BEING “RESIDENT” OF CONTRACTING STATE

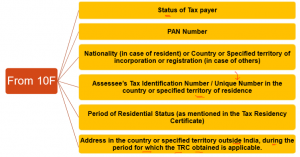

INFORMATION REQUIRED IN FORM 10 F

ARTICLE – 4(2) OF INDIA – USA TREATY – TIE BREAKER INDIVIDUAL

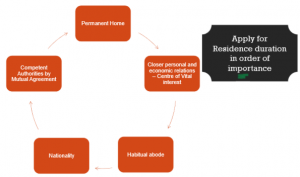

Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows:

(a) He shall be deemed to be a resident only of the State in which he has a permanent home available to him; if he has a permanent home available to him in both States, he shall be deemed to be a resident only of the State with which his personal and economic relations are closer (centre of vital interests);

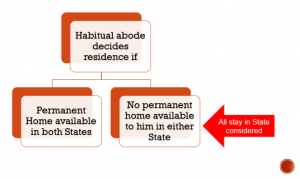

(b) If the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident only of the State in which he has an habitual abode;

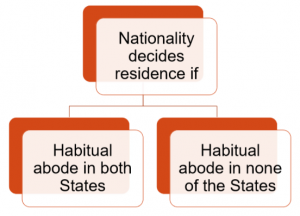

(c) If he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident only of the State of which he is a national;

(d) If he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement.

ARTICLE – 4(2) – TIE BREAKER INDIVIDUAL

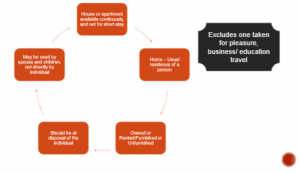

PERMANENT HOME

CENTRE OF VITAL INTEREST

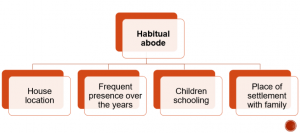

HABITUAL ABODE

HABITUAL ABODE – FACTORS CONSIDERED BY INDIAN COURTS

NATIONALITY