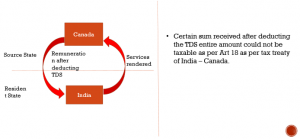

ARTICLE 18 (1) OF INDIA NETHERLANDS TREATY

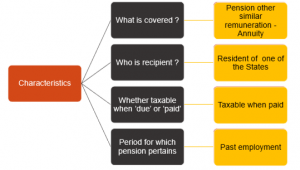

Subject to the provisions of paragraph 2 of Article 19,

pensions and other similar remuneration

paid to a resident of one of the States

in consideration of past employment

as well as any annuity paid to such a resident ,

shall be taxable only in that State.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

CHARACTERISTICS

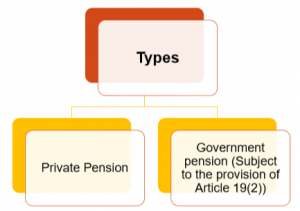

TYPE OF PENSION COVERED

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

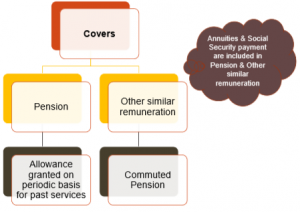

PENSION AND OTHER SIMILAR REMUNERATION – COVERAGE ?

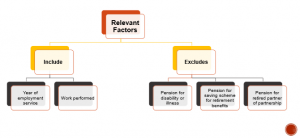

CONSIDERATION FOR PAST EMPLOYEMENT

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

ARTICLE 18(2) OF NETHERLANDS TREATY

However,

where such remuneration is not of a periodical nature and

it is paid in consideration of past employment in the other State,

it may be taxed in that other State

ARTICLE 18(3) OF NETHERLANDS TREATY

Any pension

paid out under the provisions of a social security system

of one of the States

to a resident of the other State

may be taxed in the first-mentioned State

The term ‘annuity’ means

a stated sum payable periodically

at stated times during life or

during a specified or ascertainable period of time,

under an obligation to make the payments

in return for adequate and full consideration in money or money’s worth

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

[2008] 26 Sot 574 (Mumbai)