ARTICLE 11 (3) INDIA USA – EXEMPTION IN SOURCE STATE FOR CERTAIN INTEREST

Notwithstanding the provisions of paragraph 2 of this Article, interest arising in a Contracting State

a. and derived and beneficially owned by the Government of the other Contracting State, a political subdivision or local authority thereof, the Reserve Bank of India, or the Federal Reserve Bank of the United States, as the case may be, and such other institutions of either Contracting State as the competent authorities may agree pursuant to Article 27 (Mutual Agreement Procedure) ;

b. with respect to loans or credits extended or endorsed

• by the Export Import Bank of the United States, when India is the first-mentioned Contracting State ; and

• by the EXIM Bank of India, when the United States is the first-mentioned Contracting State, and

• to the extent approved by the Government of that State, and derived and beneficially owned by any person, other than a person referred to in sub-paragraphs (a) and (b), who is a resident of the other Contracting State, provided that the transaction giving rise to the debt-claim has been approved in this behalf by the Government of the first-mentioned Contracting State ;

shall be exempt from tax in the first-mentioned Contracting State.

ARTICLE 11(4) INDIA USA – DEFINITION OF INTEREST

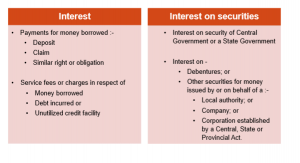

The term “interest” as used in this Convention means

income from debt-claims of every kind, whether or not secured by mortgage, and whether or not carrying a right to participate in the debtor’s profits,

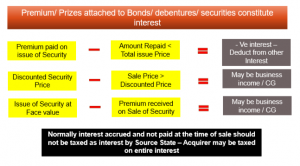

and in particular, income from Government securities, and income from bonds or debentures, including premiums or prizes attaching to such securities, bonds, or debentures.

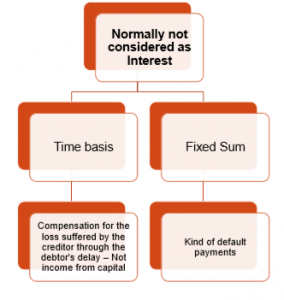

Penalty charges for late payment shall not be regarded as interest for the purposes of the Convention.

However, the term “interest” does not include income dealt with in Article 10 (Dividends)

ARTICLE 11(4) – ISSUES FOR CONSIDERATION

INTEREST – WHAT ALL IS COVERED UNDER DOMESTIC PROVISION ?

PREMIUM/ DISCOUNT/ PROFIT ON INSTRUMENT

PENALTY

ARTICLE 11 (5) INDIA USA – PERMANENT ESTABLISHMENT CASE

The provisions of paragraphs 2 and 3 shall not apply if the beneficial owner of the interest,

being a resident of a Contracting State,

carries on business in the other Contracting State in which the interest arises,

through a permanent establishment situated therein,

or performs in that other State independent personal services from a fixed base situated therein,

and the interest is attributable to such permanent establishment or fixed base.

In such case the provisions of Article 7 (Business Profits) or Article 15 (Independent Personal Services), as the case may be, shall apply

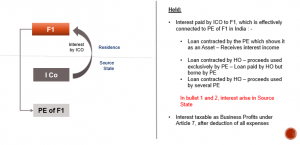

PE SITUATION

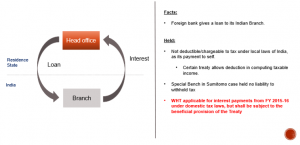

INTEREST PAID BY BRANCH OF FOREIGN BANK

ARTICLE 11 (6) INDIA USA – WHEN SHALL INTEREST ARISE IN A CONTRACTING STATE

Interest shall be deemed to arise in a Contracting State

when the payer is that State itself or a political sub-division, local authority, or resident of that State.

Where, however, the person paying the interest, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base, and such interest is borne by such permanent establishment or fixed base,

then such interest shall be deemed to arise in the Contracting State in which the permanent establishment or fixed base is situated