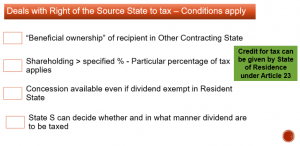

ARTICLE 10(2) OF INDIA USA TREATY – RIGHT OF SOURCE STATE TO TAX DIVIDEND

However, such dividends may also be taxed in the Contracting State of which the company paying the dividends is a resident,

and according to the laws of that State,

but if the beneficial owner of the dividends is a resident of the other Contracting State, the tax so charged shall not exceed :

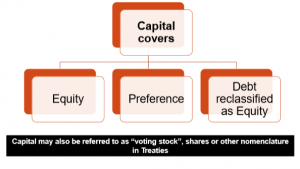

• 15 per cent of the gross amount of the dividends if the beneficial owner is a company which owns at least 10 per cent of the voting stock of the company paying the dividends.

• 25 per cent of the gross amount of the dividends in all other cases.

………..

This paragraph shall not affect the taxation of the company in respect of the profits out of which the dividends are paid

SALIENT FEATURES

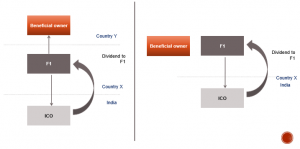

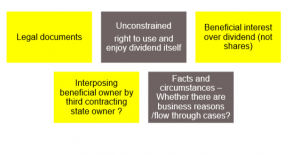

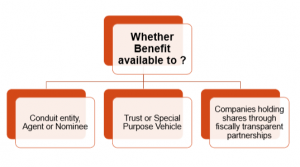

BENEFICIAL OWNERSHIP – NOT DEFINED IN TREATY

TEST OF BENEFICIAL OWNERSHIP ?

BENEFICIAL OWNERSHIP

CAPITAL – NO OECD DEFINITION MAKES REFERENCE TO LOCAL COMPANY LAW MANDATORY

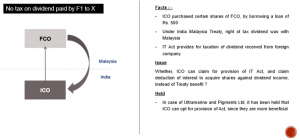

WHETHER TAXPAYER CAN OPT FOR ACT PROVISION INSTEAD OF TREATY ?

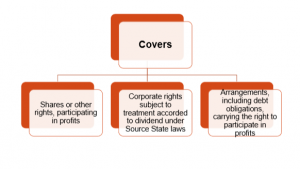

ARTICLE 10(3) OF INDIA USA TREATY – MEANING OF DIVIDEND

The term “dividends” as used in thisArticle means

income from shares or other rights, not being debt-claims, participating in profits,

income from other corporate rights which are subjected to the same taxation treatment as income from shares by the taxation laws of the State of which the company making the distribution is a resident ; and

income from arrangements, including debt obligations, carrying the right to participate in profits, to the extent so characterised under the laws of the Contracting State in which the income arises.

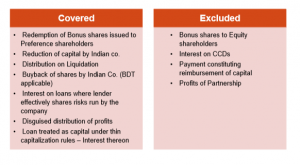

DIVIDEND COVERS

DIVIDEND – WHAT ALL IS COVERED ?