Applicability for Transfer Pricing in India

With many nations exploring beyond their borders and investing in foreign economies, the principle of Transfer Pricing has become immensely important in the field of International Taxation. Quantum of tax liability in an international transaction has become difficult to determine, since they operate outside the jurisdiction of domestic laws of the countries of the respective contracting parties. Transfer pricing ensures that such transactions do not yield in evasion or miscalculation of tax and thus must be understood properly, especially in the context of India.

Bird’s Eye view of the ‘Applicability of Transfer Pricing in India’

| Principle of International Taxation | Transfer Pricing |

| Transaction between | International Parties |

| Aim of Transfer Pricing principle |

|

| Applicability of Transfer Pricing provision in India |

|

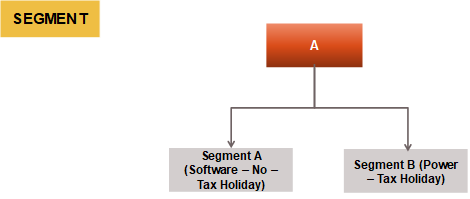

Applicability of Transfer Pricing provision in case of transaction between the Enterprise and its Segment /Divisions

Transfer Pricing provisions can be used for arriving at the arm’s length price, that should be charged for , product sold or services rendered, by one segment of an enterprise (Segment A), to another segment (Segment B) of the same enterprise, instead of being applicable for transaction between two legally separate Enterprises. If two segments of an enterprise are taxable at different rates, companies can manipulate profits and losses of the two segment, to disclose higher profits in the segment where tax rates are low (or Nil as in case of Tax Holidays), and show losses in the segment where tax rate was higher, thereby reducing the overall tax liability of the company.

Let us look at this Diagram 1.2 : –

Diagram 1.2

In this diagram, Segment A does not have any tax holiday, whereas Segment B, Power Sector has a tax holiday. In such case, the tax authorities of a country can apply Transfer Pricing to ensure, that the profits of Segment B are not overstated, or the profits of Segment A are not understated, through transfer of goods or rendering of services between Segment A and Segment B at a price, which is different from price that would have been agreed between two independent enterprises . This aspect would be covered in detail in the Topic , Domestic Transfer Pricing.

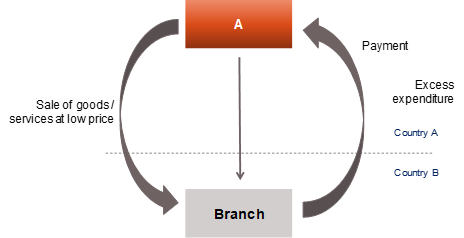

Applicability to the case of Branch – Diagram 1.3

Diagram 1.3

In certain cases, foreign companies, instead of incorporating subsidiaries in other countries like India, may open a Branch to carry on business. A Branch is generally liable to pay tax in the country where it is established. To ensure that the Branch pays lower taxes, the Head Office may : –

- Charge excess expenditure from such Branch (Management Fees, Head Office expenditure allocation etc). Excess expenditure reduces taxable profits of Branch.

- Branch may sell goods or provide services at value which is lower than the fair price. Lower price reduces taxable profits of Branch.

In such cases, Transfer Pricing would be applied to ensure, that, the profits of Branch are not understated, through excess expenditure charged by Head office/ Sale of goods and services below arm’s length price .

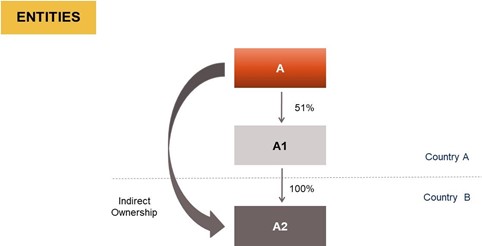

Applicability to the case of Separate Group Companies

With growth in cross border trade and risk in a local country, large companies became Multi National Enterprise (MNE’s) , wherein they incorporated separate companies (instead of segment) in various countries to conduct business at local level in those jurisdiction.

For example, in this diagram Diagram 1.4 , Company A incorporated a Company A2, in country B, instead of a separate Branch.

Diagram 1.4

In recent times, therefore, Transfer Pricing is, applicable, at a larger level on transaction between two companies belonging to the same group. However, TP still continue to apply between the foreign company and its branch in another country, or between two segments of an Enterprise (“this aspect is covered under Specified Domestic Transaction segment – Refer <<>> ) .

For any queries, please write them in the Comment Section or Talk to our tax expert