Accounting Ratios Class 12 MCQ Questions with Answers are covered in this Article. Accounting Ratios Class 12 MCQ Test contains 46 questions. Answers to MCQ on Accounting Ratios Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge.

Accounting Ratios Class 12 MCQ Questions with Answers

1.On the basis of the following information calculate the current ratio.

| Particulars | Amount |

| Inventory | 2,00,000 |

| Trade Receivables | 3,00,000 |

| Prepaid Expenses | 1,50,00 |

| Current Investment | 80,000 |

| Advanced Tax | 70,000 |

| Bank Overdraft | 30,000 |

| Trade Payables | 1,50,000 |

| Other Current Liabilities | 20,000 |

(a) 6 : 3

(b) 4 : 1

(c) 5 : 4

(d) None of these

Answer

Answer: (b) 4 : 1

Explanation: Current Ratio = Current Assets/Current Liabilities

= 8,00,000/2,00,000= 4 : 1

Working note 1 :

Current assets = Inventory + Trade receivable + Current investment + Prepaid expenses + Advance tax

Current assets = 2,00,000 + 3,00,000 + 80,000 + 1,50,000 + 70,000

Current assets = 8,00,000

Working note 2 :

Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 30,000 + 1,50,000 + 20,000

Current liabilities = 2,00,000

2.On the basis of the following information calculate the Quick ratio:

| Particulars | Amount |

| Inventory | 22,000 |

| Trade Receivables | 45,000 |

| Prepaid Expenses | 56,000 |

| Current Investment | 53,000 |

| Advanced Tax | 44,000 |

| Bank Overdraft | 30,000 |

| Unearned Revenue | 25,000 |

| Provision for Tax | 15,000 |

(a) 4.45 : 3

(b) 2.45 : 1

(c) 5 : 4

(d) None of the above

Answer

Answer: (b) 2.45 : 1

Explanation: Quick Ratio = (Current Assets – Inventory)/(Current Liabilities – Bank Overdraft)

Or

= (Liquid Assets)/(Liquid Liabilities)

Quick Ratio = 98,000/40,000= 2.45 : 1

Working note 1 :

Liquid assets = Current assets (-) ( Stock + Prepaid expenses + Advance tax )

Liquid assets = 220000 (-) 22000 + 56000 + 44000

Liquid assets = 98000

Working note 2 :

Quick liabilities = Current liabilities (-) Bank overdraft

Quick liabilities = 70000 (-) 30000

Quick liabilities = 40000

3.On the basis of the following information calculate the liquidity ratio:

| Particulars | Amount |

| Inventory | 1,29,000 |

| Trade Receivables | 2,12,000 |

| Current Investment | 28,000 |

| Prepaid Expenses | 45,000 |

| Advanced Tax | 60,000 |

| Bank Overdraft | 60,000 |

| Unearned Revenue | 45,000 |

| Short Term Borrowings | 95,000 |

(a) 5 : 4

(b) 3.2 : 3

(c) 1.2 : 1

(d) None of the above

Answer

Answer: (c) 1.2 : 1

Explanation: Liquidity Ratio = Quick Assets/ Current Liabilities

= 2,40,000/2.00,000= 1.2 :1

Working note 1 :

Liquid assets = Current assets (-) ( Stock + Prepaid expenses + Advance tax )

Liquid assets = 474000 (-) 129000 + 45000 + 60000

Liquid assets = 240000

Working note 2 :

Current liabilities = Bank overdraft + unearned revenue + Short term borrowings

Current liabilities = 60000 + 45000 + 95000

Current liabilities = 200000

4.From the following information compute the current ratio.

| Particulars | Amount |

| Working Capital | 12,00,000 |

| Total Debt | 4,45,000 |

| Long Term Debt | 1,45,00 |

(a) 6 :2

(b) 5 :1

(c) 8 :3

(d) None of the above

Answer

Answer: (b) 5 :1

Explanation: Current Ratio = Current Assets/Current Liabilities

= 15,00,000/3,00,000= 5 : 1

Working note 1:

Working Capital = Current assets (-) Current liabilities

1200000 = Current assets (-) 300000

Current assets = 1500000

Working note 2:

Current liabilities = Total debt (-) Long term debt

Current liabilities = 445000 (-) 145000

Current liabilities = 300000

5.From the following information compute the current ratio.

| Particulars | Amount |

| Working Capital | 72,00,000 |

| Trade Payables | 14,00,000 |

| Other Current Liabilities | 4,00,000 |

(a) 10 :3

(b) 5 :1

(c) 20 :7

(d) None of the above

Answer

Answer: (b) 5 :1

Explanation: Current Ratio = Current Assets/ Current Liabilities

= 90,00,000/18,00,000= 5 : 1

Working note 1:

Working Capital = Current assets (-) current liabilities

7200000 = Current assets (-) 1800000

Current assets = 9000000

Working note 2:

current liabilities = Trade Payables (+) Other Current Liabilities

current liabilities = 1400000 (+) 400000

current liabilities = 1800000

Accounting Ratios Class 12 MCQ Questions with Answers

6.From the following information compute the current ratio.

| Particulars | Amount |

| Working Capital | 6,00,000 |

| Current Assets | 16,00,000 |

| Inventory | 4,50,000 |

(a) 14.4 :4

(b)4. 8 :2

(c) 1.6 :1

(d) None of the above

Answer

Answer: (c) 1.6 :1

Explanation: Current Ratio = Current Assets/ Current Liabilities

= 16,00,000/10,00,000= 1.6 : 1

Working note 1:

Working Capital = Current assets (-) Current liabilities

600000 = 1600000 (-) Current liabilities

Current liabilities = 1000000

7.A firm had current assets of RS. 525000, it then paid a current liability of RS. 125000. After this payment the current ratio was 5 : 4. Determine the current liabilities and working capital Before the payment.

(a) Current liabilities 400000 and Working capital 320000

(b) Current liabilities 445000 and Working capital 80000

(c) Current liabilities 40000 and Current liabilities 60000

(d) None of the above

Answer

Answer: (a) Current liabilities 400000 and Working capital 320000

Explanation: Working capital = Current assets (-) Current liabilities

= 400000 (-) 320000

= 80000

Workings:

Current Assets = 525000

Current Assets After the payment of RS. 125000 would be 525000 (-) 125000 = 400000

As current ratio is 5 : 4 and current assets are RS. 400000,

Current Ratio = Current Assets/Current Liabilities

5 : 4 = 4,00,000/(current liabilities)

Current liabilities = 3,20,000

8.A firm had current assets of RS. 875000, it then paid a current liability of RS. 105000. After this payment the current ratio was 11 : 9. Determine the current liabilities and working capital after the payment.

(a) Current liabilities 40000 and Current liabilities 60000

(b) Current liabilities 770000 and Working capital 630000

(c) Current liabilities 630000 and Working capital 140000

(d) None of the above

Answer

Answer: (c) Current liabilities 630000 and Working capital 140000

Explanation : Working capital = Current assets (-) Current liabilities

= 770000 (-) 630000

= 140000

Workings:

Current Assets = 875000

Current Assets After the payment of RS. 105000 would be 875000 (-) 105000 = 770000

As current ratio is 11 : 9 and current assets are RS. 770000,

Current Ratio = Current Assets/Current Liabilities

11 : 9 = 7,70,000/(current liabilities)

Current liabilities = 6,30,000

9.Calculate Inventory turnover ratio from the following information.

| Particulars | Amount |

| Gross Profit Ratio | 10% |

| Cash Sales | 2,00,000 |

| Credit Sales | 2,00,000 |

| Return Inwards | 50,000 |

| Opening inventory | 30,000 |

| Closing inventory | 33,000 |

(a) 10 Times

(b) 11 Times

(c) 5 Times

(d) None of the above

Answer

Answer: (a) 10 Times

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/ Average Inventory

= 3,15,000/31,500= 10 times

Working note 1:

Cost of goods sold = Net Sales (-) gross profit

= 350000 (-) 10% X 350000

= 350000 (-) 35000

= 315000

Working note 2:

Average inventory = (opening inventory + closing inventory)/2

= (30,000 + 33,000)/2= 31,500

10.Calculate Inventory turnover ratio and average age of inventory from the following information:

| Particulars | Amount |

| Gross Profit Ratio | 50% |

| Cash Sales | – |

| Credit Sales | 2,00,000 |

| Return Inwards | 1,04,000 |

| Opening inventory | 60,000 |

| Closing inventory | 60,000 |

(a) 8 Times and 455 Days

(b) 8 Times and 450 Days

(c) 6 Times and 440 Days

(d) None of the above

Answer

Answer: (b) 8 Times and 450 Days

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

= 48,000/60,000= 0.8 times

Average age of Inventory = Number of Days in a year/Inventory turnover ratio

= 360/0.8= 450 days

Working note 1:

Cost of goods sold = Net Sales (-) gross profit

= 96000 (-) 50% X 96000

= 96000 (-) 48000

= 48000

Working note 2:

Average inventory = (opening inventory + closing inventory)/2

= (60,000 + 60,000)/2= 60,000

Accounting Ratios Class 12 MCQ Questions with Answers

11.Calculate Inventory turnover ratio from the following information:

| Particulars | Amount |

| Cost of revenue from operations | 2,00,000 |

| Purchases | 2,50,000 |

| Direct expenses | 50,000 |

| Opening inventory | 1,50,000 |

(a) 1 Times

(b) 2 Times

(c) 3 Times

(d) None of the above

Answer

Answer: (a) 1 Times

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/ Average Inventory

= 2,00,000/2,00,000= 1 times

Working note 1:

Cost of goods sold = Opening inventory + Purchases + Direct expenses – Closing inventory

200000 = 150000 + 250000 + 50000 – Closing inventory

Closing inventory = 250000

Working note 2:

Average inventory = (opening inventory + closing inventory)/2

= (1,50,000 + 2,50,000)/2= 2,00,000

12.Calculate Inventory turnover ratio from the following information:

| Particulars | Amount |

| Gross Profit Ratio | 60% |

| Credit Sales | 4,00,000 |

| Cash Sales | 10,00,000 |

| Purchases | 8,40,000 |

| Opening inventory | 3,00,000 |

(a) 8.5 Times

(b) 7.5 Times

(c) 3.5 Times

(d) None of the above

Answer

Answer: (c) 3.5 Times

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

= 5,60,000/1,60,000= 3.5 times

Working note 1:

Cost of goods sold = Net Sales (-) gross profit

= 1400000 (-) 60% x 1400000

= 1400000 (-) 840000

= 560000

Net sales = Cash sales + Credit Sales

= 1000000 + 400000

= 1400000

Working note 2:

Average inventory = (opening inventory + closing inventory)/2

= (20,000 + 3,00,000)/2= 1,60,000

Cost of goods sold = Opening inventory + Purchases (-) Closing inventory

560000 = Opening inventory + 840000 (-) 300000

= Opening inventory + 540000

Opening inventory = 20000

13.Cost of revenue from operations is 22,00,000, Inventory turnover ratio is 2 Times and opening inventory is 112000 less than the closing inventory. Calculate the value of opening Inventory.

(a) 1042000

(b) 1049000

(c) 1044000

(d) 2088000

Answer

Answer: (c) 1044000

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

2 times = 22,00,000/(Average inventory)

Average inventory = 11,00,000

Average inventory = (opening inventory + closing inventory)/2

Let closing inventory be ‘a’, so opening inventory is a-1,12,000.

11,00,000 = ((a-1,12,000) + a)/2

22,00,000 = 2a – 1,12,000

2a = 23,12,000

a = 11,56,000

Therefore, opening inventory = 11,56,000 – 1,12,000

= 10,44,000

14Calculate Inventory turnover ratio from the following information:

| Particulars | Amount |

| Gross Profit | -20% |

| Revenue from operations | 5,00,000 |

| Purchases | 5,50,000 |

| Carriage inwards | 30,000 |

| Carriage outwards | 15,000 |

| Opening inventory | 70,000 |

(a) 12 Times

(b) 9 Times

(c) 10 Times

(d) None of the above

Answer

Answer: (c) 10 Times

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

= 6,00,000/60,000= 10 times

Working note 1:

Cost of goods sold = Revenue from operation (-) gross profit

= 500000 (-) -20% X 500000

= 500000 (-) -100000

= 600000

Working note 2:

Average inventory = (opening inventory + closing inventory)/2

= (70,000 + 50,000)/2= 60,000

Cost of goods sold = Opening inventory + Purchases + carriage inwards – closing inventory

6,00,000 = 70,000 + 5,50,000 + 30,000 – closing inventory

Closing inventory = 6,50,000 – 6,00,000

= 50,000

15.Calculate Inventory turnover ratio from the following information: Gross profit ratio is 60 % Of cost and revenue from operation is RS. 2100000 . Opening inventory was 2/3rd of closing inventory and closing inventory was 25 % of revenue from operation.

(a) 3 Times

(b) 6 Times

(c) 5 Times

(d) None of the above

Answer

Answer: (a) 3 Times

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

= 13,12,500/4,37,500= 3 times

Working note: = Gross profit ratio is 60% Of cost

Therefore goods costing Rs. = 100 is sold for RS. 160

Cost of goods sold = 100

If revenue from operation is = 2100000

Cost of Goods Sold = 13,12,500 ((21,00,000 * 100)/160)

Average inventory = (opening inventory + closing inventory)/2

= (3,50,000 + 5,25,000)/2= 4,37,500

Closing inventory = 25% x Revenue from operation

Closing inventory = 25% x 2100000

Closing inventory = 525000

Opening inventory = (2/3)x Closing inventory

Opening inventory = (2/3) x 525000

Opening inventory = 350000

Accounting Ratios Class 12 MCQ Questions with Answers

16.Cost of revenue from operations is 250000, Inventory turnover ratio is 2 times and opening inventory is 0.5 times More than the closing inventory. Calculate the value of opening Inventory.

(a) 62500

(b) 100000

(c) 150000

(d) None of the above

Answer

Answer: (c) 150000

Explanation: Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

2 times = 2,50,000/(Average inventory)

Average inventory = 1,25,000

Average inventory = opening inventory + closing inventory

2

Let closing inventory be ‘a’, so opening inventory is a + 0.5a.

1,25,000 = ((a + 0.5a) + a)/2

2,50,000 = 2.5a

a = 1,00,000

Therefore, opening inventory = 1,00,000 + 0.5 x 1,00,000

= 1,50,000

17.From the following information, calculate fixed assets turnover ratio:

| Particulars | Amount |

| Long term borrowings | 1,00,000 |

| Trade receivables | 50,000 |

| Plant | 12,00,000 |

| Building | 5,00,000 |

| Equipment | 3,00,000 |

Revenue from the operations for the year was RS. 9000000.

(a) 7.5 Times

(b) 4.5 Times

(c) 2.5 Times

(d) None of the above

Answer

Answer: (b) 4.5 Times

Explanation: Fixed Asset Turnover Ratio = Net Sales/Total Fixed Assets

= 90,00,000/20,00,000= 4.5 times

Working Note 1:

Total Fixed assets = Plant + Building + Equipment

Total Fixed assets = 1200000 + 500000 + 300000

Total Fixed assets = 2000000

18.From the following information calculate the working capital turnover ratio:

| Particulars | Amount |

| Inventory | 1,50,000 |

| Bank | 1,75,000 |

| Trade receivables | 1,00,000 |

| Trade payables | 1,20,000 |

| Short term borrowings | 1,60,000 |

| Land | 4,00,000 |

| Plant | 2,00,000 |

Revenue from the operation for the year was RS. 2175000.

(a) 15 Times

(b) 17 Times

(c) 45 Times

(d) None of the above

Answer

Answer: (a) 15 Times

Explanation: Working Capital Turnover Ratio = Net Sales/Working Capital

= 21,75,000/1,45,000= 15 times

Working note 1 :

Working capital = Current assets (-) Current liabilities

Working capital = 425000 (-) 280000

Working capital = 145000

Working note 2 :

Current assets = Inventories + Bank + Trade receivable

Current assets = 150000 + 175000 + 100000

Current assets = 425000

Working note 3 :

Current liabilities = Trade creditors + Short term borrowings

Current liabilities = 120000 + 160000

Current liabilities = 280000

19.From the following information calculate the Current assets turnover ratio:

| Particulars | Amount |

| Inventory | 1,22,000 |

| Bank | 2,28,000 |

| Trade receivables | 2,50,000 |

| Bills payables | 1,80,000 |

| Salary outstanding | 1,30,000 |

| Land | 6,00,000 |

| Goodwill | 2,00,000 |

Revenue from the operation for the year was RS. 48,00,000.

(a) 24 Times

(b) 10 Times

(c) 8 Times

(d) None of the above

Answer

Answer: (c) 8 Times

Explanation: Current Assets Turnover Ratio = Net Sales/Current Assets

= 48,00,000/6,00,000= 8 times

Working note 1 :

Current assets = Inventories + Bank + Trade receivable

Current assets = 122000 + 228000 + 250000

Current assets = 600000

20.From the following information calculate the total assets turnover ratio:

| Particulars | Amount |

| Inventory | 2,00,000 |

| Bank | 4,00,000 |

| Trade receivables | 1,00,000 |

| Trade payables | 75,000 |

| Salary outstanding | 1,75,000 |

| Sales Tax payable | 2,75,000 |

| Land | 2,50,000 |

| Plant | 4,50,000 |

Revenue from the operation for the year was RS. 7000000.

(a) 10 Times

(b) 5 Times

(c) 8 Times

(d) None of the above

Answer

Answer: (b) 5 Times

Explanation: Total Asset Turnover Ratio = Net Sales/Total Assets

= 70,00,000/14,00,000= 5 times

Working note 1 :

Total assets = Inventories + Bank + Trade receivable + Land + Plant

Total assets = 200000 + 400000 + 100000 + 250000 + 450000

Total assets = 1400000

Accounting Ratios Class 12 MCQ Questions with Answers

21.From the following information calculate the debt equity ratio:

| Particulars | Amount |

| Equity share capital | 4,00,000 |

| Preference share capital | 1,50,000 |

| Reserves and surplus | 75,000 |

| Securities premium | – |

| Profit and loss | -25000 |

| 12% Debentures | 6,00,000 |

| Long term borrowings | 2,00,000 |

| Loan from bank | 1,00,000 |

(a) 1.5 : 1

(b) 3.5 : 2

(c) 5 : 4

(d) None of the above

Answer

Answer: (a) 1.5 : 1

Explanation: Debt Equity Ratio = Long Term Debt/Shareholders Fund

= 9,00,000/6,00,000= 1.5 : 1

Working note 1 :

Long term Debt = 12 % Debentures + Long term borrowings + Loans from bank

Long term Debt = 600000 + 200000 + 100000

Long term Debt = 900000

Working note 2 :

Shareholders fund = Equity Share Capital + Preference share capital + Reserve and surplus + Securities premium + Profit and loss balance

Shareholders fund = 400000 + 150000 + 75000 + 0 + (-25000)

Shareholders fund = 600000

22.From the following information calculate debt equity ratio.:

| Particulars | Amount |

| Long term borrowings | 80,000 |

| Long term provisions | 50,000 |

| Current liabilities | 40,000 |

| Non- current assets | 1,00,000 |

| Current assets | 1,20,000 |

(a) 7.8 : 5

(b) 2.6 : 1

(c) 5.2 : 4

(d) None of the above

Answer

Answer: (b) 2.6 : 1

Explanation: Debt Equity Ratio = Long Term Debt/Shareholders Fund

= 1,30,000/50,000= 2.6 : 1

Working note 1 :

Long term Debt = Long term borrowings + Long term provisions

Long term Debt = 80000 + 50000

Long term Debt = 130000

Working note 2 :

Shareholders fund = Non current assets + Working capital (-) Non current liabilities

OR

Shareholders fund = Non current assets + Current assets (-) Current liabilities (-) Long term borrowings (-) Long term provisions

Shareholders fund = 100000 + 120000 (-) 40000 (-) 80000 (-) 50000

Shareholders fund = 50000

23.Total revenue from the operation is 12,00,000 and cash revenue is 60 % of total revenue from the operation. Balance of opening receivable on 01.04.2016 is RS. 60,000 and the Balance of Closing receivable on 31.03.2017 is 20,000. Calculate the Trade receivable Turnover Ratio and average collection period.

(a) 12 Times 30 Days

(b) 18 Times 26 Days

(c) 36 Times 32 Days

(d) None of the above

Answer

Answer: (a) 12 Times 30 Days

Explanation: Trade Receivables Ratio = Net Revenue from Operations/Average Trade Receivables

= 4,80,000/40,000= 12 times

Average Collection Period = Number Of Days/ Trade Receivables Turnover Ratio

= 360/12= 30 Days

24.Calculate the trade payable turnover ratio and average payment period From the following information. Credit purchases during the 2016-2017 is 22,00,000 . Balance of opening Creditors and Bills payable on 01.04.2016 is RS. 60,000 and 30,000 and the Balance of Closing Creditors and bills payable on 31.03.2017 is RS. 1,90,000 and 1,20,000.

(a) 13 Times 37.72 Days

(b) 11 Times 32.72 Days

(c) 22 Times 27.72 Days

(d) None of the above

Answer

Answer: (b) 11 Times 32.72 Days

Explanation: Trade Payables Turnover Ratio = Net Purchases/Average Trade Payables

= 22,00,000/2,00,000= 11 times

Average Payment Period = Number Of Days/Trade Payables Turnover Ratio

= 360/11= 32.72 Days

Average trade payables = (opening bills payable + closing bills payable)/2

= 4,00,000/2= 2,00,000

25.Current Ratio is 5 : 4. Current Assets = 4,50,000. Calculate Net Working Capital.

(a) 90,000

(b) 4,50,000

(c) 4,00,000

(d) None of the above

Answer

Answer: (a) 90,000

Explanation: Net Working Capital = Current Assets (-) Current Liabilities

Net Working Capital = 450000 (-) 360000

Net Working Capital = 90000

Working note 1 :

Current Ratio = Current Assets/Current Liabilities

5 : 4 = 4,50,000/(current liabilities)

Current liabilities = 3,60,000

Accounting Ratios Class 12 MCQ Questions with Answers

26. Current Ratio of a business is 3 : 2 and Quick Ratio is 1.1. If Working Capital is Rs. 300000 then calculate the value of current assets and inventory.

(a) 6,00,000 and 2,40,000

(b) 3,00,000 and 2,40,000

(c) 9,00,000 and 2,40,000

(d) None of the above

Answer

Answer: (c) 9,00,000 and 2,40,000

Explanation: Working Capital = Current Assets (-) Current Liabilities

or

Current Liabilities = Current Assets (-) Working Capital

= 900000 (-) 300000

= 600000

Liquid Assets = Current Liabilities x Quick Ratio

= 600000 x 1.1

= 660000

Inventory = Current Assets (-) Liquid Assets

= 900000 (-) 660000

= 240000

Working Note 1 :

Working Capital = Current Assets (-) Current Liabilities

Working Capital = 3 (-) 2

Working Capital = 1

When working capital = 1 then Current Assets = 3

When working capital = 300000 then Current Assets = 900000

27.Current Assets of B Ltd. are Rs. 1,80,000 and the current ratio is 2 . Value of inventories is Rs. 45,000 . Calculate liquid ratio.

(a) 1.5 :1

(b) 2.5 :1

(c) 3 :1

(d) None of the above

Answer

Answer: (a) 1.5 :1

Explanation: Current Ratio = Current Assets/ Current Liabilities

2 = 1,80,000/(current liabilities)

Current liabilities = 90,000

Quick Ratio = Liquid Assets/Current Liabilities

= 1,35,000/90,000= 1.5

Working Notes:

Liquid Assets = Current Assets (-) Inventory

Liquid Assets = 180000 (-) 45000

Liquid Assets = 135000

28.Value of Inventory of J & Co. is Rs. 3,00,000 . Liquid Assets are Rs. 7,50,000. Quick Ratio is 1.25 . Calculate the current ratio .

(a) 0.5 :1

(b) 1.75 :1

c) 1.25 :1

(d) None of the above

Answer

Answer: (b) 1.75 :1

Explanation: Quick Ratio = Liquid Assets/Current Liabilities

1.25 = 7,50,000/(current liabilities)

Current liabilities = 6,00,000

Current Ratio = Current Assets/Current Liabilities

= 10,50,000/6,00,000= 1.75 : 1

Working Notes:

Current Assets = Liquid Assets + Inventory

= 750000 + 300000

= 1050000

29.Current Assets = Rs. 2,00,000 . Inventory = Rs. 50,000 . Prepaid Expenses = Rs. 30,000 . Working Capital = Rs. 1,40,000. Calculate Liquid Ratio.

(a) 4 :3

(b) 2 :1

(c) 5 :2

(d) None of the above

Answer

Answer: (b) 2 :1

Explanation: Liquid Assets = Current Assets (-) Inventory (-) Prepaid Expenses

Liquid Assets = 200000 (-) 50000 (-) 30000

Liquid Assets = 120000

Current Liabilities = 60000

Liquid Ratio = Liquid Assets/Current Liabilities

= 1,20,000/60,000= 2 : 1

Working Note 1 :

Current Liabilities = Current Assets (-) Working Capital

= 200000 (-) 140000

= 60000

30.The ratio of Current Assets (Rs. 75000 ) to Current Liabilities is 5 : 3. The firm is interested in maintaining a Current ratio of 4 : 3 by acquiring some Current Assets on credit. You are required to suggest the amount of Current Assets which must be acquired for this purpose.

(a) 45,000

(b) 20,000

(c) 45,000

(d) None of the above

Answer

Answer: (a) 45,000

Explanation: Current Ratio = Current Assets/Current Liabilities

5:3 = 75,000/(current liabilities)

Current liabilities = 45,000

Working note 1 :

Let x be the amount of current assets acquired on credit.

Current Ratio to be maintained= 4 : 3

4 : 3 = (75,000 + x)/(45,000 + x)

180000 + 4x = 225000 + 3x

4x-3x = 45000

1x = 45000

x = 45000

Accounting Ratios Class 12 MCQ Questions with Answers

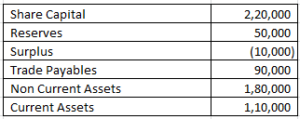

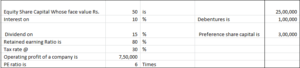

31.From the Following information calculate Equity Ratio:

(a) 1.3

(b) 2.6

(c) 4.6

(d) None of the above

Answer

Answer: (a) 1.3

Explanation: Equity Ratio = Shareholders’ Equity/Capital Employed

= 2,60,000/2,00,000= 1.3

Working note 1 :

Shareholders’ Equity = Share Capital + Reserves + Surplus

Shareholders’ Equity = 220000 + 50000 + -10000

Shareholders’ Equity = 260000

Capital employed = Non Current Assets + Current Assets (-) Trade Payables

Capital employed = 180000 + 110000 (-) 90000

Capital employed = 200000

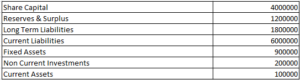

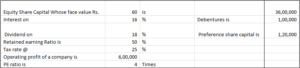

32.Compute Debt to Total Assets Ratio from the following information.

(a) 1.5 :1

(b) 6.5 :2

(c) 4.5 :1

(d) None of the above

Answer

Answer: (a) 1.5 :1

Explanation: Debt to Total Assets Ratio = Total Outside Liabilities/Total Assets

= 18,00,000/12,00,000= 1.5 : 1

Working note 1 :

Total Assets = Fixed Assets + Non Current Investments + Current Assets

Total Assets = 900000 + 200000 + 100000

Total Assets = 1200000

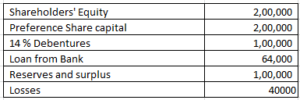

33.Compute Capital Gearing Ratio from the following information.

(a) 4.2 :1

(b) 3.4 :1

(c) 1.4 :1

(d) None of the above

Answer

Answer: (c) 1.4 :1

Explanation: Capital Gearing Ratio = Preference Share Capital + Dentures + Other/(Equity Share Capital + Reserves & Surplus)

= (2,00,000 + 1,00,000 + 60,000)/(2,00,000 + 1,00,000 – 40,000)

= 3,64,000/2,60,000= 1.4 : 1

34.Compute Proprietary ratio if equity share capital is Rs. 1,50,000; Preference Share Capital is Rs. 1,00,000; Capital Reserve is Rs. 60,000; Profit & Loss Balance is Rs. 40,000. The value of 6 % Debentures is Rs. 75,000 and 9 % Mortgage loan- Rs. 1,25,000. Value of Current Liabilities is Rs. 2,75,000 Non Current Assets is worth Rs. 55,000 Value of Current Assets is Rs. 45,000.

(a) 5.5

(b) 3.5

(c) 1.5

(d) None of the above

Answer

Answer: (b) 3.5

Explanation: Proprietary Ratio = Shareholders’ Funds/Total Assets

= 3,50,000/1,00,000= 3.5

Working note 1 :

Shareholders’ Funds = Equity share capital + Preference share capital + Capital reserve + Profit and loss balance

Shareholders’ Funds = 150000 + 100000 + 60000 + 40000

Shareholders’ Funds = 350000

Working note 2 :

Total Assets = Non current assets + Current assets

Total Assets = 55000 + 45000

Total Assets = 100000

35.Compute Interest Coverage ratio if equity share capital is Rs. 8,25,000; Preference Share Capital is Rs. 4,95,000; Capital Reserve is Rs. 2,47,500; Profit & Loss Balance is Rs. 4,12,500 . The Value of 15 % debentures is Rs. 1,50,000 and 10 % Mortgage loan of Rs. 3,00,000 .The value of Current Liabilities is Rs. 8,05,000. Non Current Assets is worth Rs. 16,50,000 and Value of Current Assets is Rs. 20,62,500.

(a) 7.6 times

(b) 5.6 times

(c) 4.6 times

(d) None of the above

Answer

Answer: (b) 5.6 times

Explanation: Interest Coverage Ratio = Net Profit before Interest and Tax/Fixed Interest charges

= 2,94,000/52,500= 5.6 times

Working Notes:

Interest on debenture = 15% x 150000

= 22500

Interest on loan = 10% x 300000

30000

Total interest charges = 52500

Accounting Ratios Class 12 MCQ Questions with Answers

36.Calculate profit before interest and tax from the following information. Profit after interest and tax 1,38,000. 18 % Debentures = 3,12,000. Tax @ 40 %.

(a) 2,30,000

(b) 2,86,160

(c) 5,16,160

(d) None of the above

Answer

Answer: (b) 2,86,160

Explanation: Profit before interest and tax = Profit before tax + Interest

Profit before interest and tax = 230000 + 56160

Profit before interest and tax = 286160

Profit before Tax = Profit after Tax (100/(1- tax rate))

= 1,38,000 (100/60) = 2,30,000

Interest = Rate of interest (x) Debentures

Interest = 18% (x) 312000

Interest = 56160

37.Calculate- Interest Coverage Ratio & Debt Service Coverage Ratio from the following information. Net Profit before interest and tax is Rs. 9,00,000. 15 % Long Term Debt 6,00,000 (Principal amount is repayable in 4 equal instalments).

(a) 10 & 3.75 times

(b) 11 & 5.75 times

(c) 12 & 4.75 times

(d) None of the above

Answer

Answer: (a) 10 & 3.75 times

Explanation: Interest Coverage Ratio = Net Profit before Interest and Tax/ Fixed Interest charges

= 9,00,000/90,000= 10 times

Debt Service Coverage Ratio = Earning Available for Debt Services/(Interest + Installments)

= 9,00,000/(90,000 + 1,50,000)= 3.75 times

Working Notes:

1. Interest on Long Term Debt = 15 % x 600000

90000

38.Earnings before Interest & Taxes is Rs. 2,00,000 and Lease Payments is Rs. 1,50,000. Interest is Rs. 1,00,000. Compute Fixed Charges Coverage Ratio.

(a) 1.4 :1

(b) 2.8 :1

(c) 4.2 :2

(d) None of the above

Answer

Answer: (a) 1.4 :1

Explanation: Fixed Charges Coverage Ratio = EBIT + Fixed Charges Before Tax/( Interest + Fixed Charges Before Tax )

= (2,00,000 + 1,50,000)/(1,00,000 + 1,50,000)= 1.4 : 1

39.If Revenue from Operations of XYZ Ltd is Rs. 25,00,000; Cost of Revenue from Operations is Rs. 10,00,000; Selling Expense is Rs. 250000; Administrative Expenses is Rs. 2,00,000. Calculate- Gross Profit Ratio, Operating Ratio, Operating Profit Ratio.

(a) 60% ; 58% ; 42%

(b) 58% ; 42% ; 60%

(c) 60% ; 42% ; 58%

(d) None of the above

Answer

Answer: (a) 60% ; 58% ; 42%

Explanation: Gross Profit Ratio = Gross Profit x 100/ Revenue from Operations

= (15,00,000/25,00,000)x100 = 60%

Operating Profit Ratio = Operating Cost x 100/Net Revenue from Operations

= (14,50,000/25,00,000)x100 = 58%

Operating Profit Ratio = 100 (-) Operating Ratio

Operating Profit Ratio = 100 (-) 58

Operating Profit Ratio = 42 %

Working Notes:

1. Gross Profit = Revenue from Operations (-) Cost of Revenue from Operations

Gross Profit = 2500000 (-) 1000000

Gross Profit = 1500000

2. Operating Cost = Cost of Revenue from Operations + Selling Expenses + Administrative Expenses

3. Operating Cost = 1000000 + 250000 + 200000

4. Operating Cost = 1450000

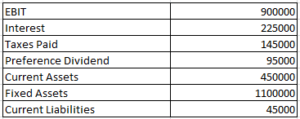

40.Calculate Return on Assets & Return on Capital Employed on the basis of the following information.

(a) 48.59 % and 49.95 %

(b) 45.59 % and 46.95 %

(c) 49.59 % and 51.95 %

(d) None of the above

Answer

Answer: (b) 45.59 % and 46.95 %

Explanation: Return on Assets = EBIT x (1- tax) x 100/Total Assets

= (9,00,000/15,50,000)x 0.785 x 100 = 45.59%

Return on Capital Employed = EBIT x (1- tax) x 100/Capital Employed

= (9,00,000/15,05,000)x 0.785 x 100 = 46.95%

Working Notes:

EBT = EBIT (-) Interest

EBT = 900000 (-) 225000

EBT = 675000

Tax Rate= (Tax Rate x 100)/EBT

= (1,45,000/6,75,000)x 100

Tax Rate = 21.4814814814815 %

Tax Rate = 21.4814814814815%

2. Total Assets = 1550000

3. Capital Employed = 1505000

Accounting Ratios Class 12 MCQ Questions with Answers

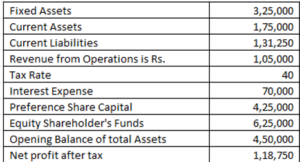

41.From the following information calculate return on total assets.

(a) 20%

(b) 35%

(c) 25%

(d) None of the above

Answer

Answer: (c) 25%

Explanation: Return on Assets = Net Profit after tax x 100/Average Total Assets

= (1,18,750/4,75,000)x100 = 25%

Working note 1 :

Value of total assets at the end = Fixed Assets + Current Assets

= 325000 + 175000

= 500000

Average Total Assets = (opening assets + closing assets)/2

= (4,50,000 + 5,00,000)/2= 4,75,000

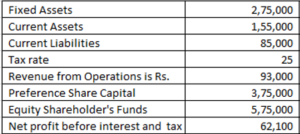

42.Calculate return on capital employed from the following information.

Calculate return on equity from the following information.

(a) 13%

(b) 28%

(c) 18%

(d) None of the above

Answer

Answer: (c) 18%

Explanation: Return on Capital Employed = Net Profit before Interest and Tax x 100/Capital Employed

= 62,100/3,45,000x 100 = 18%

Working note 1 :

Capital employed = Fixed Assets + Current Assets (-) Current Liabilities

Capital employed = 275000 + 155000 (-) 85000

Capital employed = 345000

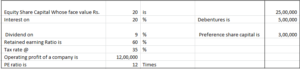

43. On the basis of the following data calculate earning per share:

(a) 1.24

(b) 3.24

(c) 5.24

(d) None of the above

Answer

Answer: (a) 1.24

Explanation: EBIT = 1200000

Less: Interest on Debentures = 500000

EBT = 700000

Less: Tax = 245000

EAT = 455000

Less: Preference Dividend = 300000

Earnings for Equity Shareholders = 155000

Less: Retained Earnings = 93000

Dividend Paid = 62000

EPS= Earning Available for Equity Shareholders/No. of Equity Shares

= 1,55,000/1,25,000= 1.24 per share

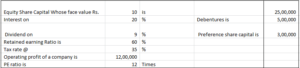

44.On the basis of the following data calculate market price per share:

(a) 7.44

(b) 3.72

(c) 8.6

(d) None of the above

Answer

Answer: (a) 7.44

Explanation: EBIT = 1200000

Less: Interest on Debentures = 500000

EBT = 700000

Less: Tax = 245000

EAT = 455000

Less: Preference Dividend = 300000

Earnings for Equity Shareholders = 155000

Less: Retained Earnings = 93000

Dividend Paid = 62000

EPS= Earning Available for Equity Shareholders/No. of Equity Shares

= 1,55,000/2,50,000= 0.62 per share

Market price per share = PE Ratio x EPS

Market price per share = 12 x 0.62

Market price per share = 7.44

45. On the basis of the following data calculate dividend per share:

(a) 0.62

(b) 2.62

(c) 4.62

(d) None of the above

Answer

Answer: (a) 0.62

Explanation: EBIT = 750000

Less: Interest on Debentures = 100000

EBT = 650000

Less: Tax = 195000

EAT = 455000

Less: Preference Dividend = 300000

Earnings for Equity Shareholders = 155000

Less: Retained Earnings = 124000

Dividend Paid = 31000

EPS= Earning Available for Equity Shareholders/No. of Equity Shares

= 1,55,000/50,000= 3.1 per share

DPS= Dividend Paid/No. of Equity Shares

= 31,000/50,000= 0.62 per share

46. On the basis of the following data calculate Dividend Payout Ratio

(a) 50%

(b) 52%

(c) 54%

(d) None of the above

Answer

Answer: (a) 50%

Explanation: EBIT = 600000

Less: Interest on Debentures = 100000

EBT = 500000

Less: Tax = 125000

EAT = 375000

Less: Preference Dividend = 120000

Earnings for Equity Shareholders = 255000

Less: Retained Earnings = 127500

Dividend Paid = 127500

EPS= Earning Available for Equity Shareholders/No. of Equity Shares

= 2,55,000/60,000= 4.25 per share

Dividend per share = 1,27,500/60,000= 2.125

Dividend Payout Ratio = Dividend per Share/Earning per Share

= 2.125/4.25= 50%