Article 15 Vs Article 14

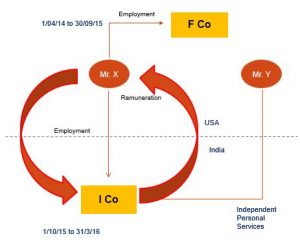

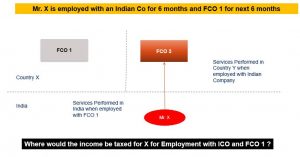

Mr. X’s remuneration from 01-04-14 to 30-09-15 shall be taxable in ?

Remuneration which is received from India for the period 1/10/15 to 31/3/2016 shall be taxable in ?

Mr. Y provided Independent Personal Services to ICO – These shall be taxable under which Article ?

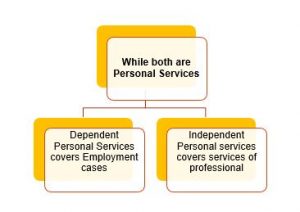

Dependent vs independent Personal Services

While both are Personal Services

- Dependent Personal Services covers Employment cases

- Independent Personal services covers services of professional

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

Salary deemed to accrue or arise in India – Section 9(1)(II) of the Act

Income which falls under the head “Salaries”, if it is earned in India.

Explanation.—For the removal of doubts, it is hereby declared that the income of the nature referred to in this clause payable for —

a)service rendered in India; and

b)the rest period or leave period which is preceded and succeeded by services rendered in India and

forms part of the service contract of employment, shall be regarded as income earned in India.

Exemption for Salary earned by a foreign citizen – Section 10(6)(vi)

remuneration received by him as an employee of a foreign enterprise for services rendered by him during his stay in India, provided the following conditions are fulfilled —

a.the foreign enterprise is not engaged in any trade or business in India ;

b.his stay in India does not exceed in the aggregate a period of ninety days in such previous year ; and

c.such remuneration is not liable to be deducted from the income of the employer chargeable under this Act ;

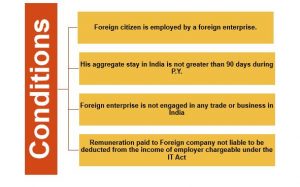

Exemption for Salary earned by a foreign citizen for services in India – Short stay exemption

Conditions

- Foreign citizen is employed by a foreign enterprise.

- His aggregate stay in India is not greater than 90 days during P.Y.

- Foreign enterprise is not engaged in any trade or business in India

- Remuneration paid to Foreign company not liable to be deducted from the income of employer chargeable under the IT Act

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

Article 15 (1) of the India US Treaty

Subject to the provisions of Articles 17 (Directors’ Fees), 18 (Income Earned by Entertainers and Athletes), 19 (Remuneration and Pensions in respect of Government Service), 20 (Private Pensions, Annuities, Alimony and Child Support), 21 (Payments received by Students and Apprentices) and 22 (Payments received by Professors, Teachers and Research Scholars),

salaries, wages and other similar remuneration

derived by a resident of a Contracting State

in respect of an employment shall be taxable only in that State

unless the employment is exercised in the other Contracting State.

If the employment is so exercised, such remuneration as is derived therefrom may be taxed in that other State

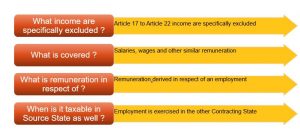

Article 15(1) – key characteristics

What income are specifically excluded ? – Article 17 to Article 22 income are specifically excluded

What is covered ? – Salaries, wages and other similar remuneration

What is remuneration in respect of ? – Remuneration derived in respect of an employment

When is it taxable in Source State as well ? – Employment is exercised in the other Contracting State

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

Questions

- What payments are covered within Article 15 ?

- What are Rights of India/ Treaty partner to tax income covered under this Article ?

- Who is Employer ?

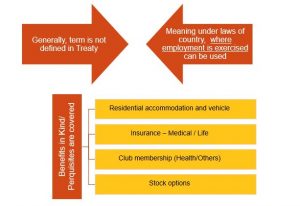

Salaries, wages & other similar remuneration

Generally, term is not defined in Treaty

Meaning under laws of country, where employment is exercised can be used

Benefits in Kind / Perquisites are covered

- Residential accommodation and vehicle

- Insurance – Medical / Life

- Club membership (Health/Others)

- Stock options

Place of Exercise

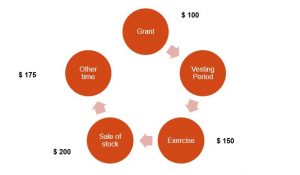

Different stages of Stock Option

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

Stock Option – Value increase taxable as Salary

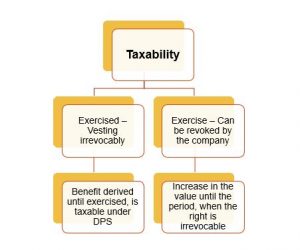

Taxability

(A) Exercised – Vesting irrevocably

(B) Exercise – Can be revoked by the company

(A) Exercised – Vesting irrevocably:-

Benefit derived until exercised, is taxable under DPS

(B) Exercise – Can be revoked by the company:-

Increase in the value until the period, when the right is irrevocable

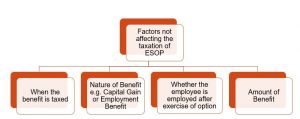

Factors not affecting the taxation of ESOP

- When the benefit is taxed

- Nature of Benefit e.g. Capital Gain or Employment Benefit

- Whether the employee is employed after exercise of option

- Amount of Benefit

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

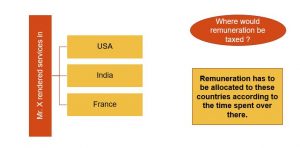

Employment exercised in several countries

Mr. X rendered services in

- USA

- India

- France

Where would remuneration be taxed?

Remuneration has to be allocated to these countries according to the time spent over there.

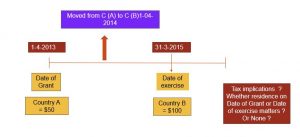

Bonus for services rendered & stock option exercise post leaving

Which date is important for taxing stock options

Article 15 (2) of the India us treaty

Notwithstanding the provisions of paragraph 1, remuneration derived by a resident of a Contracting State in respect of an employment exercised in the other Contracting State shall be taxable only in the first-mentioned State, if :

a) the recipient is present in the other State for a period or periods not exceeding in the aggregate 183 days in the relevant taxable year ;

b) the remuneration is paid by, or on behalf of, an employer who is not a resident of the other State ; and

c) the remuneration is not borne by a permanent establishment or a fixed base or a trade or business which the employer has in the other State.

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

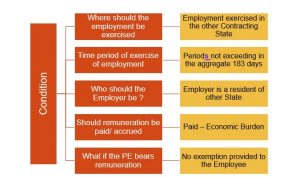

Analysis of Conditions for Article 15 (2)

Condition

- Where should the employment be exercised – Employment exercised in the other Contracting State

- Time period of exercise of employment – Periods not exceeding in the aggregate 183 days

- Who should the Employer be ? – Employer is a resident of other State

- Should remuneration be paid/ accrued – Paid – Economic Burden

- What if the PE bears remuneration – No exemption provided to the Employee

Period during relevant taxable year – variations

- Relevant Taxable Year

- 183 days in 12 month period

- Previous Year

- Fiscal Year – Source State

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

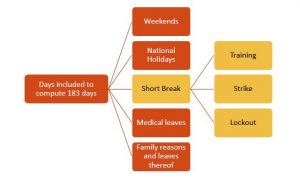

Days included to compute 183 days

a) Weekends

b) National Holidays

c) Short Break

d) Medical leaves

e) Family reasons and leaves thereof

c) Short Break

- Training

- Strike

- Lockout

Paid “by or on behalf”

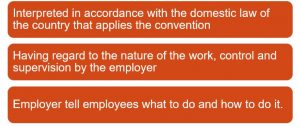

Meaning of Employer

- Interpreted in accordance with the domestic law of the country that applies the convention

- Having regard to the nature of the work, control and supervision by the employer

- Employer tell employees what to do and how to do it.

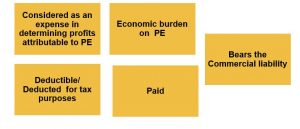

Borne by PE

- Considered as an expense in determining profits attributable to PE

- Deductible/ Deducted for tax purposes

- Economic burden on PE

- Paid

- Bears the Commercial liability

Click here to Enroll in Interpretation of Tax Treaty (DTAA) – International Taxation Course

Article 15 (3) of the India us treaty

Notwithstanding the preceding provisions of this Article,

remuneration derived

in respect of an employment exercised aboard a ship or aircraft operating in international traffic by an enterprise of a Contracting State

may be taxed in that State.

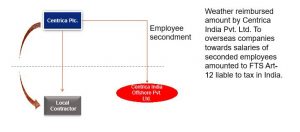

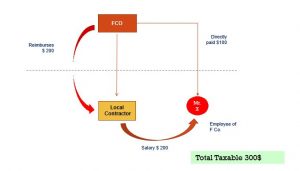

44 taxmann.com 300, Centrica India Offshore p Ltd.

Weather reimbursed amount by Centrica India Pvt. Ltd. To overseas companies towards salaries of seconded employees amounted to FTS Art- 12 liable to tax in India.