Section 2(1) “actionable claim” shall have the same meaning as assigned to it in section 3 of the Transfer of Property Act, 1882;

It must be noted that ‘Actionable claims’ is specifically included in the definition of goods. Transactions of actionable claims, other than lottery, betting & gambling shall be treated neither as a supply of goods nor a supply of services as per Para 6 of Schedule III of CGST Act, 2017.

Section 2(2) “address of delivery” means the address of the recipient of goods or services or both indicated on the tax invoice issued by a registered person for delivery of such goods or services or both;

“address of delivery’ is relevant to determine place of supply of goods (other than imports/exports).

Section 2(3) “address on record” means the address of the recipient as available in the records of the supplier;

This is relevant to determine place of supply. In case of supplies made by a registered person to an un-registered person (except in relation to those services where the place of supply has been specifically provided under the law) shall be the address on record available in the records of the supplier.

Section 2(4) “adjudicating authority” means any authority, appointed or authorised to pass any order or decision under this Act, but does not include the Central Board of Indirect Taxes and Customs, the Revisional Authority, the Authority for Advance Ruling, the Appellate Authority for Advance Ruling, the Appellate Authority the Appellate Tribunal and the Authority referred to in sub section (2) of section 171;

Section 2(5) “agent” means a person, including a factor, broker, commission agent, arhatia, del credere agent, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another;

Agent can work purely on commission basis. Even e-commerce companies like Flipkart, Amazon and Uber may be covered in some situations. But the relevance of being an agent is more pronounced while examining whether a transaction between a principal and agent is itself a supply under para 3, schedule I (Chapter 2 of this book). Very often, the word agent or agency is used without necessarily implying that the transaction is one of agency as understood under Indian Contract Act such as, recruitment agency, travel agency etc. Care must be taken to identify whether the parties intended to constitute an agency as understood in law and nothing less.

Section 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

The phrase “aggregate turnover” is widely used under the GST laws. Aggregate Turnover is an all-encompassing term covering all the supplies effected by a person having the same PAN. It specifically excludes:

- Inward supplies effected by a person which are liable to tax under reverse charge mechanism; and

- Various taxes under the GST law, Compensation cess.

Section 2(7) “agriculturist” means an individual or a Hindu Undivided Family who undertakes cultivation of land—

(a) by own labour, or

(b) by the labour of family, or

(c) by servants on wages payable in cash or kind or by hired labour under personal supervision or the personal supervision of any member of the family;

An individual/HUF undertaking cultivation of land which is not owned by him would be regarded as an agriculturist. Agriculturist providing taxable supplies need to confirm that the aggregate turnover is not exceeded when taking a decision not to register. Everyone who owns agricultural property will not ipso facto be eligible for exemption from registration because other taxable supplies may necessitate registration.

Section 2(8) “Appellate Authority” means an authority appointed or authorised to hear appeals as referred to in section

107;

Section 2(9) “Appellate Tribunal” means the Goods and Services Tax Appellate Tribunal constituted under section 109;

Section 2(11) “assessment” means determination of tax liability under this Act and includes self-assessment, re-assessment, provisional assessment, summary assessment and best judgment assessment;

Section 2(12) “associated enterprises” shall have the same meaning as assigned to it in section 92A of the Income-tax Act, 1961;

‘Associated enterprise’ is referred to only in the context of time of supply of services where the supplier is an associated enterprise (located outside India) of the recipient ( reverse charge attracted under sec 9(3)). It may be noted that in addition to associated enterprise, the Act also defines ‘related person’, the reference to which is made in the context of deemed supply (Schedule I) and valuation.

Section 2(16) “Board” means the Central Board of Excise and Customs constituted under the Central Boards of Revenue Act, 1963;

(17) “Business” includes––

(a) any trade, commerce, manufacture, profession, vocation, adventure, wager or any other similar activity, whether or not it is for a pecuniary benefit;

(b) any activity or transaction in connection with or incidental or ancillary to sub-clause (a);

(c) any activity or transaction in the nature of sub-clause (a), whether or not there is volume, frequency, continuity or regularity of such transaction;

(d) supply or acquisition of goods including capital goods and services in connection with commencement or closure of business;

(e) provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members;

(f) admission, for a consideration, of persons to any premises;

(g) services supplied by a person as the holder of an office which has been accepted by him in the course or furtherance of his trade, profession or vocation;

(h) activities of a race club including by way of totalisator or a license to book maker or activities of a licensed book maker in such club; and

(i) any activity or transaction undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities;

The term business has been defined in an inclusive manner. This definition is very wide and covers all the transactions that were previously subjected to various taxes that are being subsumed in the GST Laws.

This definition of business is important since levy is on supplies undertaken in the course or

furtherance of business.

Profit motive is irrelevant. Thus, occasional transactions are subject to GST.

Incidental or ancillary activities taxable i.e. sale of used car, sale of scrap, sale of old machinery, sale of old furniture etc. is subject to GST, though normally the taxable person may not be in business of selling cars, furniture or machinery.

‘Wager’ is also included in the definition of business to impose GST on betting transactions; Government activities excluding sovereign functions are also subject to GST.

Clause (g) deals with services supplied by a holder of an office. Hence, if a practicing CA is appointed as an independent director of a company, it means that he accepts this office of directorship in the course or furtherance of his professional practice. Any service provided by him as an independent director to the company appointing him shall be regarded as business.

Section 2(19) “capital goods” means goods, the value of which is capitalised in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business;

An attempt has been made to align the meaning of capital goods to the generally accepted standards of accounting of what is considered as revenue and what as capital.

Section 2(20) “casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business;

Example, Mumbai registered taxable person participate in exhibition in ‘Delhi’.

The threshold limits for registration would not apply to casual taxable person and he would be required to obtain registration irrespective of his turnover.

Section 2(31) “consideration” in relation to the supply of goods or services or both includes––

(a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government;

(b) the monetary value of any act or forbearance, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government:

Provided that a deposit given in respect of the supply of goods or services or both shall not be considered as payment made for such supply unless the supplier applies such deposit as consideration for the said supply;

Non-refundable deposit will be part of consideration. Consideration is not the amount that the recipient pays but the amount that the supplier collects whether from the recipient or third Party. Clause (b) example:- (a) An amount paid as contractual penalty for non-supply of goods on timely basis could be treated as “monetary value of forbearance” and therefore, may be considered as consideration for applicability of GST. (b) Penalty charges on early termination of an agreement could be treated as “monetary value of any act” and therefore, may be considered as consideration.

Section 2(32) “continuous supply of goods” means a supply of goods which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, whether or not by means of a wire, cable, pipeline or other conduit, and for which the supplier invoices the recipient on a regular or periodic basis and includes supply of such goods as the Government may, subject to such conditions, as it may, by notification, specify;

Example: Open purchase orders with daily delivery schedule (Just In Time Approach) subject to acceptance tests only at the time of issue-for-production and understanding of fortnightly billing.

Section 2(33) “continuous supply of services” means a supply of services which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, for a period exceeding three months with periodic payment obligations and includes supply of such services as the Government may, subject to such conditions, as it may, by notification, specify;

Example: Licensing of software or brand names, renting of immovable property etc.

Section 2(34) “conveyance” includes a vessel, an aircraft and a vehicle;

Section 2(39) “deemed exports” means such supplies of goods as may be notified under section 147;

Section 2(42) “drawback” in relation to any goods manufactured in India and exported, means the rebate of duty, tax or cess chargeable on any imported inputs or on any domestic inputs or input services used in the manufacture of such goods;

The definition of Drawback is relevant when refund of Input Tax Credit is claimed. The law provides that refund of unutilized input tax credit will not be allowed if the supplier has availed drawback of such tax.

Section 2(44) “electronic commerce” means the supply of goods or services or both, including digital products over digital or electronic network;

Section 2(45) “electronic commerce operator” means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce;

Section 2(47) “exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply;

Section 2(48) “existing law” means any law, notification, order, rule or regulation relating to levy and collection of duty or tax on goods or services or both passed or made before the commencement of this Act by Parliament or any Authority or person having the power to make such law, notification, order, rule or regulation;

This covers all the existing Central & State Laws, relating to levy of tax on goods or services like Central Excise Law, Service tax law, State VAT Laws etc. Therefore, laws that don’t levy tax or duty on goods or services i.e. the Indian Stamp Act, 1899 would not be covered here.

Section 2(49) “family” means, ––

(i) the spouse and children of the person, and

(ii) the parents, grand-parents, brothers and sisters of the person if they are wholly or mainly dependent on the said person;

Section 2(50) “fixed establishment” means a place (other than the registered place of business) which is characterized by a sufficient degree of permanence and suitable structure in terms of human and technical resources to supply services, or to receive and use services for its own needs;

Temporary presence of staff in a place by way of a short visit to a place or so doesn’t make that place a fixed establishment. The definition is relevant to determine where the taxable person should obtain GST registration in particular State.

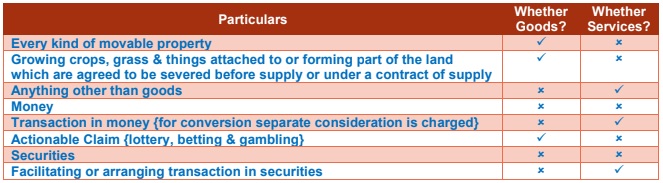

Section 2(52) “goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply;

Actionable claims are goods under GST. Intangibles like copyright and carbon credit would continue

to be covered under ‘goods.

The item must be such that it is capable of being bought or sold. This is the test of ‘Marketability’. The goods must be known in the market. Unless this test of marketability is satisfied, these will not be goods. This view, expressed in judgements. It was held that to become ‘goods’ an article must be something which can ordinarily come to market to be bought and sold.

Section 2(56) “India” means the territory of India as referred to in article 1 of the Constitution, its territorial waters, seabed and sub-soil underlying such waters, continental shelf, exclusive economic zone or any other maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976, and the air space above its territory and territorial waters;

Section 2(59) “input” means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business;

Section 2(60) “input service” means any service used or intended to be used by a supplier in the course or furtherance of business;

Section 2(61) “Input Service Distributor” means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office;

The law doesn’t provide any limit of offices to be registered as ISD.

Section 2(62) “input tax” in relation to a registered person, means the central tax, State tax, integrated tax or

Union territory tax charged on any supply of goods or services or both made to him and includes—

(a) the integrated goods and services tax charged on import of goods;

(b) the tax payable under the provisions of sub-sections (3) and (4) of section 9;

(c) the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

(d) the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

(e) the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services Tax Act, but does not include the tax paid under the composition levy;

Input tax also includes reverse charge.

Input credit of cess can only be utilised for discharging the liability on such cess.

Section 2(63) “input tax credit” means the credit of input tax;

Section 2(67) “inward supply” in relation to a person, shall mean receipt of goods or services or both whether by

purchase, acquisition or any other means with or without consideration;

Section 2(68) “job work” means any treatment or process undertaken by a person on goods belonging to another

Section 2(69) “local authority” means––

(a) a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

(b) a “Municipality” as defined in clause (e) of article 243P of the Constitution;

(c) a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any State Government with the control or management of a municipal or local fund;

(d) a Cantonment Board as defined in section 3 of the Cantonments Act, 2006;

(e) a Regional Council or a District Council constituted under the Sixth Schedule to the Constitution;

(f) a Development Board constituted under article 371 and article 371J of the Constitution; or

(g) a Regional Council constituted under article 371A of the Constitution;

Section 2(70) “location of the recipient of services” means, –

(a) where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; &

(d) in absence of such places, the location of the usual place of residence of the recipient;

Section 2(71) “location of the supplier of services” means, –

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;

Section 2(72) “manufacture” means processing of raw material or inputs in any manner that results in emergence of a new product having a distinct name, character and use and the term “manufacturer” shall be construed accordingly;

It is important for composition levy and maintenance of accounts. For deemed exports, one pre-condition is that the goods in question must be manufactured in India.

Section 2(73) “market value” shall mean the full amount which a recipient of a supply is required to pay in order to obtain the goods or services or both of like kind and quality at or about the same time and at the same commercial level where the recipient and the supplier are not related;

Section 2(75) “money” means the Indian legal tender or any foreign currency, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any other instrument recognised by the Reserve Bank of India when used as a consideration to settle an obligation or exchange with Indian legal tender of another denomination but shall not include any currency that is held for its numismatic value;

Money is out of the scope of taxation under GST. Supply of currency held for its numismatic values will be liable to GST.

Section 2(77) “non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India;

The law had not defined the word ‘occasionally’.

Section 2(78) “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act;

It includes petroleum products, alcoholic liquor for human consumptions.

Section 2(79) “non-taxable territory” means the territory which is outside the taxable territory;

Section 2(80) “notification” means a notification published in the Official Gazette and the expressions “notify” and “notified” shall be construed accordingly;

Section 2(81) “other territory” includes territories other than those comprising in a State and those referred to in sub-clauses (a) to (e) of clause (114);

Section 2(82) “output tax” in relation to a taxable person, means the tax chargeable under this Act on taxable supply of goods or services or both made by him or by his agent but excludes tax payable by him on reverse charge basis;

Section 2(83) “outward supply” in relation to a taxable person, means supply of goods or services or both, whether by sale, transfer, barter, exchange, licence, rental, lease or disposal or any other mode, made or agreed to be made by such person in the course or furtherance of business;

The phrase ‘outward supply’ can be applied to a supply only when such supply is made in the course or furtherance of business i.e. business assets are put to personal use. In such a case, even the transaction is deemed to be a supply (made without consideration), it can’t be treated as an ‘outward supply’, since the application of the business asset for personal use was neither in the course nor furtherance of business.

Supplies not qualifying as outward supplies would also be included for the purpose of computing the

‘aggregate turnover’.

Details of supplies on which tax is payable, but which do not amount to ‘outward supplier’ would also have to be declared in the return for outward supplies (GSTR-1)

Section 2(84) “person” includes—

(a) an individual;

(b) a Hindu Undivided Family;

(c) a company;

(d) a firm;

(e) a Limited Liability Partnership;

(f) an association of persons or a body of individuals, whether incorporated or not, in India or outside India;

(g) any corporation established by or under any Central Act, State Act or Provincial Act or a Government company as defined in clause (45) of section 2 of the Companies Act, 2013;

(h) anybody corporate incorporated by or under the laws of a country outside India;

(i) a co-operative society registered under any law relating to co-operative societies;

(j) a local authority;

(k) Central Government or a State Government;

(l) society as defined under the Societies Registration Act, 1860;

(m) trust; and

(n) every artificial juridical person, not falling within any of the above;

Section 2(85) “place of business” includes––

(a) a place from where the business is ordinarily carried on, and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies or receives goods or services or both; or

(b) a place where a taxable person maintains his books of account; or

(c) a place where a taxable person is engaged in business through an agent, by whatever name called;

Section 2(86) “place of supply” means the place of supply as referred to in Chapter V of the Integrated Goods and Services Tax Act;

Section 2(88) “principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods or services or both;

Section 2(89) “principal place of business” means the place of business specified as the principal place of business in the certificate of registration;

Section 2(92) “Quarter” shall mean a period comprising three consecutive calendar months, ending on the last day of March, June, September and December of a calendar year.

Section 2(93) “recipient” of supply of goods or services or both, means—

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is

rendered, and any reference to a person to whom a supply is made shall be construed as a reference to the recipient

of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;

Section 2(94) “registered person” means a person who is registered under section 25 but does not include a

person having a Unique Identity Number;

Section 2(96) “removal’’ in relation to goods, means—

(a) despatch of the goods for delivery by the supplier thereof or by any other person acting on behalf of such supplier; or

(b) collection of the goods by the recipient thereof or by any other person acting on behalf of such recipient;

Section 2(98) “reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act;

Section 2(101) “securities” shall have the same meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956;

Securities such as shares, scrips, stocks, bonds, debentures, debenture stock are neither treated as goods nor as services, by way of a specific exclusion in the respective definitions. ITC is not available for transactions in securities.

Section 2(102) “services” means anything other than goods, money & securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged;

Explanation.– For the removal of doubts, it is hereby clarified that the expression “services” includes facilitating or arranging transactions in securities;

Though definition of ‘service’ can cover even immovable property, sale of land and sale of completed building has been excluded from definition of goods or services.

The definition of ‘service’ is so broad that practically sky is the limit for imposing any tax by Union or State Governments.

Securities were excluded from the definition of both goodsand services. But it is to clarify that though securities are excluded from definition of services but transaction in securities will be included.

Although industry is already charging GST on these transaction.

Section 2(103) “State” includes a Union territory with Legislature; Delhi & Puducherry are states since they have legislature although they are Union Territory.

Section 2(105) “supplier” in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied;

Section 2(107) “taxable person” means a person who is registered or liable to be registered under section 22 or section 24;

Section 2(108) “taxable supply” means a supply of goods or services or both which is leviable to tax under this Act;

Section 2(109) “taxable territory” means the territory to which the provisions of this Act apply;

Section 2(112) “turnover in State” or “turnover in Union territory” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis) and exempt supplies made within a State or Union territory by a taxable person, exports of goods or services or both and inter-State supplies of goods or services or both made from the State or Union territory by the said taxable person but excludes central tax, State tax, Union territory tax, integrated tax and cess;

The ‘turnover in state’ (including UT) is a reproduction of the expression ‘aggregate turnover’, but for the fact that ‘turnover in state’ is restricted to the turnover of a taxable person, whereas aggregate turnover is PAN-based (i.e., turnover of all taxable persons having the same PAN, across States). It is important term for ‘composition scheme’ & for ‘ISD’.

Section 2(113) “usual place of residence” means––

(a) in case of an individual, the place where he ordinarily resides;

(b) in other cases, the place where the person is incorporated or otherwise legally constituted;

Section 2(114) “Union territory” means the territory of—

(a) the Andaman and Nicobar Islands;

(b) Lakshadweep;

(c) Dadra and Nagar Haveli;

(d) Daman and Diu;

(e) Chandigarh; and

(f) other territory.

Explanation. -For the purposes of this Act, each of the territories specified in sub-clauses (a) to (f) shall be considered to be a separate Union territory;

Section 2(117) “valid return” means a return furnished under sub-section (1) of section 39 on which self- assessed tax has been paid in full;

Section 2(118) “voucher” means an instrument where there is an obligation to accept it as consideration or part consideration for a supply of goods or services or both and where the goods or services or both to be supplied or the identities of their potential suppliers are either indicated on the instrument itself or in related documentation, including the terms and conditions of use of such instrument;

Loyalty points credited to digital wallet is not supply of vouchers as no consideration is paid for the same.

It is only a form of discount which can be availed in future transaction. It is the form of actionable claim.

Section 2(119) “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfers of property in goods (whether as goods or in some other form) is involved in the execution of such contract;

This is limited to immovable property but contract must include transfer of property. A contract in relation to movable property, however would be treated as a ‘composite supply’ of goods or services depending on the principal supply.

Contributed by CA Amit Jain