Sample Paper CA Final – Paper 4: Corporate and Allied Laws (Old Course) May 2019 Examination provided by ICAI. The pattern of CA Final question paper would be 30% objective and 70% descriptive under the Old and New Schemes.

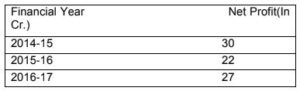

1. From the following information in respect of company ABC Ltd. Compute the amount the company is required to spend on account of Corporate Social Responsibility for the Financial Year 2017-2018:

(a) 26 Crore

(b) 52 Lacs

(c) 55 Lacs

(d) 26 Lacs

2. Mr. B, director of XRL Company from 2006. He got his DIN allotted to him on May 6, 2017. By what date he should have intimated his DIN to XRL Company?

(a) Before May 20, 2017

(b) Before June 6, 2017

(c) Before July 6, 2017

(d) Before August 6, 2017

3. Mr. Raman, is appointed as valuer in April, 2018 in ABC Ltd. He undertook the valuation of the assets of the company in 2018. In case Mr. Raman becomes interested in any property, stock etc of the company, he may be not be eligible to undertake valuation in such property of the company till:

(a) 2019

(b) 2020

(c) 2021

(d) He will never be appointed as Registered Valuer of ABC Ltd.

4. PQR Company give its assent to give guarantee to ABZ Company on the taking of loan from financial institution. According to the Companies Act, 2013, the said act should be approved by the Board of Directors. State the mode of approval adopted by the board of directors of PQR company-

(a) Board shall give approval for giving guarantee on the loan by simple majority

(b) Board shall give approval by passing circular resolution.

(c) Board shall give approval by passing resolution through special majority

(d) Board shall give unanimous approval.

5. Mr. X, a director of the company, intimated of his participation in the meeting scheduled on August, 2018. He declared his participation through electronic mode, in April 2017. State whether Mr. X is entitled to participate in the meeting to be conducted in August 2018 –

(a) Yes, intimation about such participation was made at the beginning of the calendar year

(b) No, because intimation was made in previous calendar year

(c) Yes, because company was intimated of its participation in the meeting.

(d) No, because valid period of declaration (i.e., 1 year) of his participation expired.

6. In compliance to the Companies Act, 2013, at least one woman director shall be on Board of such class or classes of companies as may be prescribed. Ms. Riya is keen to hold the office of woman director in a company. She has selected some companies in which there is a vacancy for the woman director. Advice Ms. Riya in selecting the companies which are mandatorily required to appoint a woman director:

(a) PQR Limited which is a unlisted company and having paid up share capital of 150 crore rupees as per the last date of latest audited financial statements.

(b) ABC Limited which is a listed company and having a turnover of 150 crore rupees as per the last date of latest audited financial statements.

(c) XYZ Limited which is a unlisted company and having a turnover of 350 crore rupees as per the last date of latest audited financial statements.

(d) Both in ABC Limited and XYZ Limited

7. A director of XYZ, a Pvt. Ltd. takes a loan from its company. Due to some reasons, he fails to repay the debt within the given time period. He request board of directors to give him time for repayment of debt. State which of the below statements is correct with respect to the exercise of the power in the given situation as per the Companies Act, 2013-

(a) Power to fix the time limit for repayment of any debt due from director can be exercised only by members by special resolution at a general meeting.

(b) Power to fix the time limit for repayment of any debt due from director can be exercised by Board of the company itself.

(c) Power to fix the time limit for repayment of any debt due from director can be exercised with the prior permission of the company in general meeting while taking debt.

(d) Board shall not exercise this power if the provision related to repayment of debt is contained in the articles of the company.

8. Under what circumstances the meeting of the creditors may be dispensed by the NCLT?

(a) if 70% of the creditors in value agree and confirm to the scheme by way of affidavit

(b) if 80% of the creditors in value agree and confirm to the scheme by way of affidavit

(c) if 90% of the creditors in value agree and confirm to the scheme by way of affidavit

(d) None of the above

9. When can an application be made to Tribunal for constitution of a winding up committee to assist and monitor the progress of liquidation proceedings by the Company Liquidator in carrying out the function?

(a) Within two weeks from the date of passing of winding up order

(b) Within three weeks from the date of passing of winding up order

(c) Within four weeks from the date of passing of winding up order

(d) Within six weeks from the date of passing of winding up order

10. A Ltd, appointed Mr. A & Mr. B as directors of the Company, by passing of single resolution for election of these two. Later on it came in the notice of the Company that there might be some confusion regarding the compliance of the applicable provisions. State the correct statement in the light of the Companies Act, 2013 as to the an appointment and to the validity of acts of said appointed directors ?

(a) Void Appointment & acts of the directors are void ab-inito.

(b) Void Appointment & acts of the directors are valid until defect in the appointment is shown to the Company.

(c) Valid Appointment & so acts are also valid.

(d) Appointment is valid subject to ratification by shareholder in general meeting.

11. Mr. Mahesh returned from abroad, was left unspent with the foreign currency USD 1,000.This amount can be retained with him –

(a) for 60 days

(b) for 90 days

(c) for 120 days

(d) for 180 days

12. RAB Bank Limited, a banking company, has defaulted in the payment of dues to their catering contractor. Can the contractor, as an operational creditor initiate insolvency process against the bank-

(a) Yes, operational creditors are entitled

(b) No, financial service providers are excluded

(c) Yes, banking companies are covered under this code

(d) No, catering is an excluded service under the Code

13. The time line of 180 days for the Corporate Insolvency Resolution process commences from the

(a) Date of Debt

(b) Date of preferring the application

(c) Date of admission of application by NCLT

(d) 90 days after the debt is due

14. ABC and Co, the tax consultants of X Limited, for which an interim resolution professional – Mr A, has been appointed under the Corporate Insolvency resolution process has refused to furnish information to Mr A on the grounds of client confidentiality. Are they right

(a) Yes, they are right

(b) No, the Code provides powers to the IRP to access all information from various parties

(c) Partly right, they can do so only after consent of the directors

(d) Mr A is not right in even asking for this information

15. Operational creditors are entitled to receive notice of meetings of Committee of creditors if their aggregate dues are not less than …. % of the total debts of the corporate debtor

(a) 20%

(b) 10%

(c) 15%

(d) 5%

16. According to the Companies Act, 2013, the draft minutes of a Board meeting held through audio visual means shall be circulated among all the directors within ………. Of the meeting:

(a) 10 days

(b) 15 days

(c) 30 days

(d) One month

17. Minimum threshold prescribed for applicability of SARFAESI Act on NBFCs is –

(a) 1 crore

(b) 10 crore

(c) 100 crore

(d) 500 crore

18. Drug trafficking is a punishable offence in India. Suppose, Mr. X & Mr. Y, are involved in drug trafficking including imported drugs trafficking. Under which Act, Mr. X & Mr. Y can be prosecuted?

(a) Narcotic Drugs and Psychotropic Substances (NDPS) Act, 1985

(b) Prevention of Money Laundering Act, 2002

(c) Foreign Exchange Management Act, 1999

(d) Offences under the Unlawful Activities (Prevention) Act, 1967

19. Ruby Ltd. filed an application to the NCLT stating that corporate insolvency resolution process against him, cannot be completed within the 90 days under the fast track insolvency resolution process. Considering application and on being satisfied, NCLT ordered to extend the period of such process by 30 days. Later, again Ruby Ltd. initiated an application for further extension of time period of insolvency process by 15 days. Decide in the given situation, whether NCLT, can extend timelines by further 15 days.

(a) Yes, because extension of duration in toto, is not exceeding 45 days.

(b) Yes , depends of the facts , if it is justified , NCLT may extend the timelines.

(c) No, extension of the fast track insolvency resolution process shall not granted more than once.

(d) (a) & (b)

20. KDS Agro Pvt. Ltd., a newly incorporated company has not mentioned the names of first directors of the company in its Articles of Association. Referring the provisions of the Companies Act, 2013, who shall be deemed to be the first directors of the company?

(a) The members of the company shall be deemed to be the first directors of the company.

(b) The subscribers of the company shall be deemed to be the first directors.

(c) None shall be deemed to be the first directors of the company.

(d) The shareholders shall appoint first directors in the General Meeting.