Safe Harbour Rules – In this Article, we would discuss about Safe Harbour Rules under the Indian Transfer Pricing Regulations. Transfer Pricing involves lot of dispute amongst taxpayers and tax authorities, on how much should be the margins/ what should be the ALP .

“Safe harbour” is a mechanism to reduce litigation, and implies circumstances under which, the tax authorities shall accept the Transfer Price declared by the taxpayer. These rules provides minimum operating margins in relation to an operating expense, which a taxpayer is expected to earn from certain international transactions. If that will be acceptable to the tax authorities.

“Safe harbour Rules generally contain the following : –

-

- Sector in which the assessee operates;

- Turnover for which they are covered;

- Margin that should be earned by them to be eligible for Safe Harbour Rules

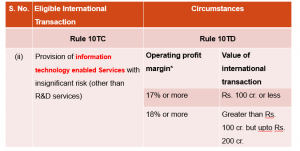

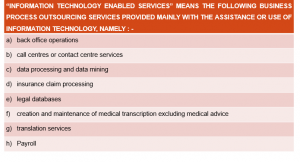

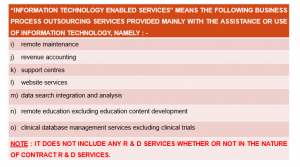

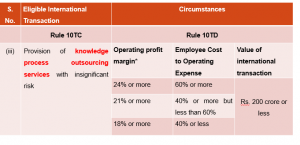

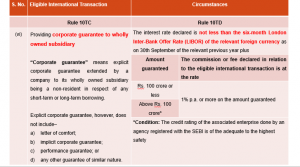

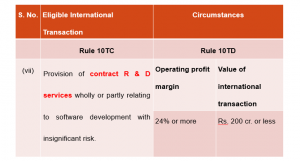

The transfer price declared by assessee shall be accepted by tax authorities if it is in accordance with the followings circumstances: –

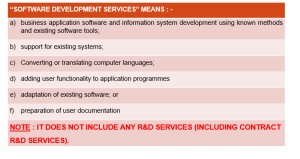

SOFTWARE DEVELOPMENT SERVICES

INFORMATION TECHNOLOGY ENABLED SERVICES

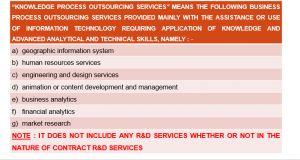

KNOWLEDGE PROCESS OUTSOURCING SERVICES

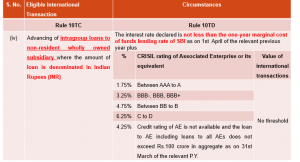

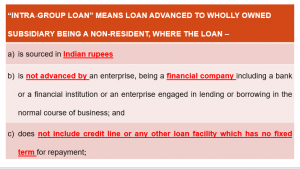

INTRAGROUP LOANS TO NON-RESIDENT WOS IN INDIAN CURRENCY

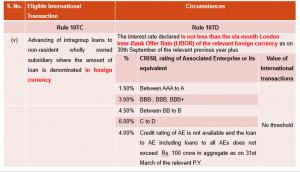

INTRAGROUP LOANS TO NON-RESIDENT WOS IN FOREIGN CURRENCY

FOR INTERNATIONAL TRANSACTION

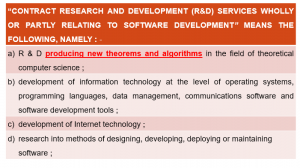

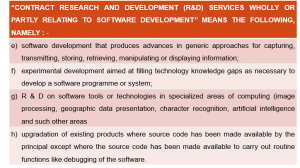

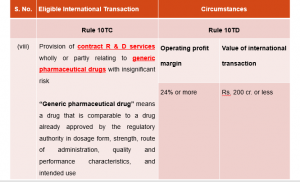

CONTRACT R & D SERVICES

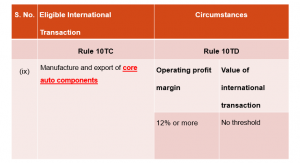

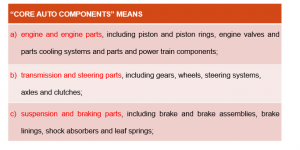

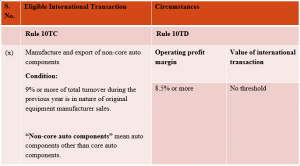

CORE AUTO COMPONENTS

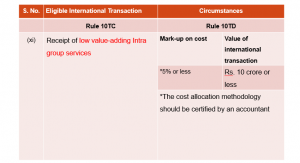

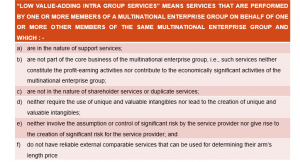

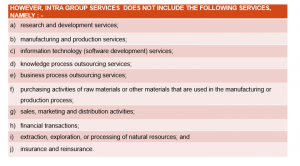

LOW VALUE-ADDING INTRA GROUP SERVICES