Interpretation of Tax Treaties – CA Final International Taxation

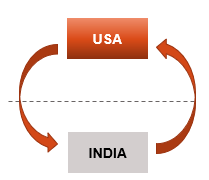

WHAT IS INTERNATIONAL TAX LAW

International tax law are the tax laws, which apply to tax income from activities, that takes place in two or more countries. Read more

DOUBLE TAXATION AND CONNECTING FACTORS

Taxability of a foreign entity /taxpayer, in any country depends upon the : –

- Residence of Taxpayer – Generally, resident are taxable on their global income, while the non resident maybe only taxable on certain income.

- Source of Income – Generally, income from sources within a country is taxable in that country, while income from sources outside the country is not taxable (unless the income is text based on the residential status).

Read more about Double taxation and Connecting Factors

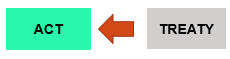

DEFINITION OF TREATY

Article 2 of Vienna Convention on Law of Treaties, 1969 defines “Treaty” as –

“Treaty” means an international agreement concluded between States in written form and governed by international law, whether embodied in a single instrument or in two or more related instruments and whatever its particular designation Read more

DEFINITION OF DOUBLE TAXATION AVOIDANCE AGREEMENT (“DTAA”)

Tax treaties , which are also called Double Tax Avoidance Agreements, or DTAAs, are agreements between two or more sovereign countries. The intention behind such agreement is to avoid double taxation for various forms of income which may be derived by residents of there states by arriving at an understanding as to how their residents will be taxed in respect of cross border transactions. DTAA may cover a range of taxes, including income taxes, inheritance taxes, or other taxes Read More

DIRECTIVE PRINCIPLES FOR INTERNATIONAL AGREEMENTS UNDER INDIAN CONSTITUTION

Article 51 of the Indian Constitution has set out some directive principles, which must be followed by the State, in the context of International agreements and relationships. This Article provides that the State shall endeavor to –

- Promote international peace and security;

- Maintain just and honorable relations amongst nations;

- Foster respect for international law and treaty obligations in the dealings of organized people with one another; and

- Encourage settlement of international disputes by arbitration.

In line with the principle outlined at point (c ) above, Section 90 of the Income Tax Act, 1961 authorize Central Government to enter into tax treaties with foreign Governments. Earlier, Central Board of Direct Taxes Circular 333 dated 02 April 1982 , and thereafter , the present Section 90 (2) provides that if an assessee is eligible to claim the benefits of the DTAA entered into by Central Government, the provisions of the Act shall be applicable only if they are more beneficial to the assessee. The intention of the Government is to clarify that tax treaties are intended to grant tax relief and override the domestic law provision, where they are more beneficial.

ROLE OF VIENNA CONVENTION IN APPLICATION AND INTERPRETATION OF TAX TREATIES

A Tax Treaty, is a part of international law. Accordingly, the interpretation of a Tax Treaty should also be based on principles and rules of interpretation applicable internationally . One such international convention, which is widely accepted to interpret tax Treaties is the Vienna Convention on Law of Treaties (codified in 1969). This Convention, was ratified by 114 Countries in April 2014. It provides the basic rules of interpretation of any international agreement , and since Tax Treaty is an international agreement, these principles are also applicable in Interpretation of Tax Treaties.

It applies only to written treaties between states and comprises of the following parts : –

- First Part – It defines the terms and scope of the agreement.

- Second Part – This part of the Convention, lays out the rules for the conclusion and adoption of treaties. It provides that there should be consent of parties to be bound by treaties , and the formulation of reservations whereby one or more parties may decline to be bound by one or more specific provisions of a treaty

- Third part – It deals with the application and interpretation of treaties.

- Fourth part – It discusses how the Treaties have to be modified or amended.

- Fifth Part – It deals with and provides grounds and rules for invalidating, terminating, or suspending treaties. It also includes provision which grants the International Court of Justice, jurisdiction over disputes arising from the application of those rules.

- The Final parts provides, what shall be the effect of the following on Treaties : –

- Changes of government within a Contracting State;

- Alterations in consular relations between states;

- Impact of hostilities between states, and rules for depositaries, ratification and registration.

India is not a signatory to this Convention. However, the Convention has a lot of persuasive value in interpretation of tax treaties even in Indian tax Courts, who have recognized and referred to principles in the Vienna Convention, to interpret Tax Treaties.

ARTICLES OF VIENNA CONVENTION PROVIDE FOR DETAILED RULES OF INTERPRETING

ARTICLE 31 – GENERAL RULE OF INTERPRETATION

ARTICLE 32 – SUPPLEMENTARY MEANS OF INTERPRETATION

ARTICLE 33 – INTERPRETATION OF TREATIES AUTHENTICATED IN TWO OR MORE LANGUAGES

ARTICLE 31 OF THE VIENNA CONVENTION – GENERAL RULE OF INTERPRETATION

Article 31(1) of the Vienna Convention provides that

“A Treaty shall be interpreted in good faith in accordance with the ordinary meaning to be given to terms of the Treaty in their context and in the light of its object and purpose.”

The following are the characterstics of Article 31(1) of the Vienna Convention : –

- Treaty shall be interpreted in good faith ;

- When interpreting a Treaty, ordinary meaning should be given to terms of the Treaty , since it is an agreement and not a taxing statute;

- The ordinary meaning should consider the context in which such words are used. The context shall also comprise, of : –

- Agreement entered into between all parties while concluding Treaty;

- Any additional instrument, which is made by one party and accepted by the other party, in connection with conclusion of the Treaty.

- The interpretation should consider the object and purpose of entering into a Tax Treaty by the Contracting States.”

Additional factors taken into account for the interpretation of Treaties

Article 31(2) and 31(3) of the Vienna Convention, further provides that the following additional factors shall also be taken into account for the interpretation of Treaties, together with the context : –

- Any subsequent agreement between the parties regarding the interpretation or application of the Treaty ;

- Any subsequent practice in the application of the Treaty, which establishes the agreement of the parties regarding its interpretation;

- Any relevant rules of international law applicable to relation between the parties.

A special meaning shall be given to a term used in the Treaty, provided it is established that the parties intended to give such term that special message.

ARTICLE 32 OF THE VIENNA CONVENTION – SUPPLEMENTARY MEANS OF INTERPRETATION

While entering into a Tax Treaty, there is a lot of preparatory work that is done by all the States who enter into a Treaty. Further, certain circumstances (like Double Taxation) may be resulting in loss to such States, due to which they may enter into a Tax Treaty.

Since Article 31 provides general rules of interpretation, additional confirmation may be required to substantiate such interpretation. Article 32 provides that to confirm the meaning , which may result by application of Article 31, or in cases where application of Article 31 provides an ambiguous meaning or leads to absurd result, recourse can be taken to supplementary means of interpretation, which may include preparatory work of the Treaty and the circumstances of its conclusion.

ARTICLE 33 OF THE VIENNA CONVENTION – INTERPRETATION OF TREATIES AUTHENTICATED IN TWO OR MORE LANGUAGES

A Treaty is a contract between two or more countries, and it is likely that it may be entered into more than one languages. In such a case, the interpretation of the text in different language may result in different interpretation. The issue which may arise is , which language would be more authentic and carry more weight age in interpretation of the tax treaty. In such a case one has to follow the following rules :

- If a Treaty has been authenticated in two or more languages, the text is equally authoritative in each language. However, if the Treaty itself provides, or the parties agree , that in case of divergence of interpretation, a particular text shall prevail over the other text , then the interpretation based on such text shall prevail

- If the Treaty has been authenticated into a particular language, any version of the Treaty in a different language (other than wherein text was authenticated) shall be considered an authentic text, only if the Treaty so provides, or the parties so agree that’s such text in a different language would be considered as authentic.

- The terms of the Treaty are presumed to have the same meaning in each authentic text.

- Where a particular text does not prevail over the other text in terms of the specific provision of the Treaty, and the comparison of the two authentic texts discloses a difference in interpretation, which cannot be removed by application of provisions of Article 31 and 32, the meaning which best reconciles the texts, having regard to the object and purpose of the Treaty, shall be adopted.

INDIAN CONTEXT

In Indian context, where the Treaty is authenticated in two or more languages, both texts are generally considered equally authoritative. However, if the Treaty provides that a particular text shall prevail in case of divergence or the parties agree that a particular text shall prevail in case of divergence, that text shall prevail. Almost all Indian tax treaties invariably provide that both Hindi and English are authentic texts, but in case of divergence, generally it is provided that the text in English shall prevail.

EXAMPLE

Based on the following clauses of the Treaty, your advise is required on which text language shall prevail in case of divergence : –

A. India Mauritius Tax Treaty

DONE on this 24th day of August, 1982 at Port Louis on two original copies each in Hindi and English languages, both the texts being equally authentic. In case of divergence between the two texts, the English text shall be the operative one.

Solution

The Treaty is entered into two languages . The last line clearly indicates that in case of divergence between the two texts, the English text shall be the operative one. Hence English text shall prevail.

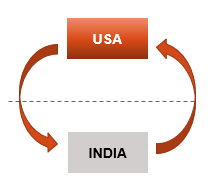

B. India USA Tax Treaty

DONE at New Delhi in duplicate, this 12th day of September, 1989, in the English and Hindi languages, both texts being equally authentic. In case of divergence between the two texts, the English text shall be the operative one.

Solution

The Treaty is entered into two languages. The last line clearly indicates that in case of divergence between the two texts, the English text shall be the operative one. Hence English text shall prevail.

C. India China Tax Treaty

ONE in duplicate at New Delhi on this eighteenth day of July, one thousand nine hundred and ninety-four in the Hindi, Chinese and English languages, all three texts being equally authentic. In case of any divergence the English text shall prevail.

Solution

The Treaty is entered into three languages. The last line clearly indicates that in case of divergence between the two texts, the English text shall be the operative one. All three texts being equally authentic . Hence English text shall prevail.

D. India Canada Tax Treaty

DONE in duplicate at New Delhi this 11th day of January, 1996 in the English, French and Hindi languages, each version being equally authentic.

Solution

The Treaty is entered into three languages. The last line clearly indicates that all three texts being equally authentic .

ARTICLE 26 – PACTASUNTSERVANDA (IN GOOD FAITH) : –

PACTASUNTSERVANDA principle stresses that the clauses contained in contract are law between the parties, and non-fulfillment of respective obligations under the contract clauses is a breach of the pact.

Under this Article, every Treaty, which is in force (i.e, is valid between Contracting States), is binding upon the parties to the Treaty. During such period, it is mandatory for them to follow the Treaty, in good faith. Generally, the date of entry in force is as per Article 30 (Please refer Article 30 of the India USA Treaty).

ARTICLE 30

ENTRY INTO FORCE

- Each Contracting State shall notify the other Contracting State in writing, through diplomatic channels, upon the completion of their respective legal procedures to bring this Convention into force.

- The Convention shall enter into force on the date of the letter of such notifications and its provisions shall have effect : –

(a)

(i) in respect of taxes withheld at source, for amounts paid or credited on or after the first day of January next following the date on which the Convention enters into force;

(ii) in respect of other taxes, for taxable periods beginning on or after the first day of January next following the date on which the Convention enters into force; and

(b) in India, in respect of income arising in any taxable year beginning on or after the first day of April next following the calendar year in which the Convention enters into force.

ARTICLE 27 – INTERNAL LAW AND OBSERVANCE OF TREATIES : –

This article deals with the obligation of a contracting state, to meet its obligation under a treaty, in case there are any conflicts, between the Treaty and its domestic tax laws . A contracting state can not justify its failure to perform its obligations under a Treaty, merely on the ground that the provisions of its internal law are in conflict with the provision of the Treaty. The rule that a country has to perform its obligation under a treaty is applicable, even if the very act of entering into the Treaty was in violation of provision of internal law of that contracting state (Article 46).

In India, the provisions of Treaty, override the provisions of internal law (i.e, income Tax Act, 1961 . ” Section 90 (2) of the Income Tax Act, 1961 , specifically provides that provisions of domestic tax laws would be applied, only to the extent that day are more beneficial to the assessee. However in case the provision of the Treaty are more beneficial to the assessee, they shall apply even if the provision of the domestic law provide otherwise.

ARTICLE 28 – NON RETROACTIVITY OF TREATIES : –

As a general rule, every Treaty provides the date from which the provision of the Treaty would be applicable in each of the contracting states. For example, the India USA tax Treaty discussed above, provides as under : –

“in India, in respect of income arising in any taxable year beginning on or after the first day of April next following the calendar year in which the Convention enters into force.”

It provides the assessment year, for which Treaty is applicable in India.

Similarly the tax year for which it is applicable in US is also provided. There may be some time gap between these two provisions applicability.

Accordingly, the Treaty provisions, do not bind a party to a Treaty for any act or fact which took place before the date of the Entry into force of the Treaty with respect to that party.

However, this rule is subject to any different intention appearing from the Treaty or otherwise agreed to between parties.

ARTICLE 29 – TERRITORIAL SCOPE OF TREATIES : –

A Treaty is binding upon each party to a Treaty, in respect of its entire territory. However, if a different intention appears from the Treaty or is otherwise established, then the Treaty shall be applicable only in respect of that Territory of the contracting party.

For example, ARTICLE 3 – GENERAL DEFINITIONS – of the India USA Treaty provides for definition of India and USA as under : –

1

(a) the term “India” means the territory of India and includes the territorial sea and air space above it, as well as any other maritime zone in which India has sovereign rights, other rights and jurisdictions, according to the Indian law and in accordance with inter-national law ;

(b) the term “United States”, when used in a geographical sense means all the territory of the United States of America, including its territorial sea, in which the laws relating to United States tax are in force, and all the area beyond its territorial sea, including the sea bed and subsoil thereof, over which the United States has jurisdiction in accordance with international law and in which the laws relating to United States tax are in force ;

Thus, the Treaty would be applicable to all person who are resident of India and USA , who are covered under the aforesaid geographical area.

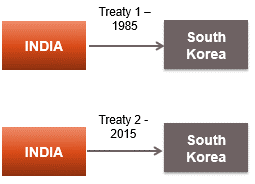

ARTICLE 30 OF THE VIENNA CONVENTION – APPLICATION OF SUCCESSIVE TREATIES RELATING TO THE SAME SUBJECT MATTER – CHANGE DIAGRAM KOREA

Generally, a Treaty once entered into between parties remains and force unless it is mutually cancelled. However over a period of time, and with change in circumstances and economic conditions, there may be a need to revise the Treaty. In such a case, the question that arises is, once a new treaty is entered into, what would be the relevance of the old Treaty ? In such a case where parties enter into successive treaties, relating to the same subject-matter, their rights and obligations shall be determined in accordance with the following paragraphs (Subject to Article 103 of the Charter of the United Nations).

- Treaty specifies it is subject to another Treaty

When a Treaty specifies, that it is subject to, an earlier or later Treaty, the provisions of the earlier or later Treaty shall prevail.

- Treaty specifies it should not to be considered as incompatible with another Treaty

When a Treaty specifies, that it should not to be considered as incompatible with, an earlier or later Treaty, the provisions of the earlier or later Treaty shall prevail.

- All common parties to both Treaty – Earlier Treaty is not terminated

When all the parties to the earlier Treaty, are also parties to the later Treaty, but earlier Treaty is not terminated or suspended in operation under Article 59, the earlier Treaty applies only to the extent that its provisions are compatible with those of the later Treaty.

- All parties not common in both Treaty – Earlier Treaty is not terminated

When the parties to the later Treaty do not include all the parties to the earlier one, the relationship between various parties would be governed as under : –

- For States who are Party to Both treaties – Same rule applies as Bullet 2 above;

- Between a State party to both treaties and a State party to only one of the treaties – The Treaty to which both States are parties, governs their mutual rights and obligations.

WHERE TREATY ARE SUBJECT TO OTHER TAX TREATIES ENTERED LATER

Sometimes parties to the Treaty, subject themselves to provisions of other tax treaties that may be entered at a later date. This implies, that if the provision of the later Treaty are more beneficial then the provision of the Treaty entered into between two countries, the beneficial provisions of the subsequent Treaty would override, the provisions of the Tax treaty between two contractor States.

For example Most Favored Nation (“MFN” Clause) in the protocol on Indian DTA with France – [Refer Paragraph 15 of this chapter for detailed discussion on MFN clause]

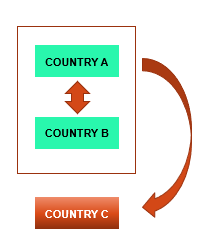

ARTICLE 34 – GENERAL RULE REGARDING THIRD STATES

A Treaty is an agreement between the states who enter into such Treaty. It does not create either obligations or rights for a third State without its consent.

For example, if India and USA enters into a tax treaty, a resident of UK cannot claim the benefit under India USA treaty.

Practically in such cases, it is seen that, the residents of third country, incorporate shell companies to claim the benefit of tax treaty. This is also known as Treaty shopping.

ARTICLE 42 – VALIDITY AND CONTINUANCE IN FORCE OF TREATIES

There may be situations, where one, or more than one parties, who have entered into a tax treaty may no longer want to be bound by the provision of such Treaty. In such a case, one needs to look at the provision of the relevant treaty, to find out if it contains any provisions relating to the termination of a Treaty, its denunciation or the withdrawal of a party ,

or its suspension . Such an act, may take place only as a result of the application of the provisions of the Treaty or of the Convention. Generally, all comprehensive DTAA contains an article relating to termination of the tax treaty, mostly ARTICLE 31 – TERMINATION, governs the provision and procedure of termination of Indian Treaties. For example, Article 31, of the India USA Treaty provides as under :-

ARTICLE 31

TERMINATION

This Convention shall remain in force indefinitely but either of the Contracting States may, on or before the thirtieth day of June in any calendar year beginning after the expiration of a period of five years from the date of the entry into force of the Convention, give the other Contracting State through diplomatic channels, written notice of termination and, in such event, this Convention shall cease to have effect :

(a)

(i) in respect of taxes withheld at source, for amounts paid or credited on or after the first day of January next following the calendar year in which the notice of termination is given; and

(ii) in respect of other taxes, for taxable periods beginning on or after the first day of January next following the calendar year in which the notice of termination is given; and

(b) in India, in respect of income arising in any taxable year beginning on or after the first day of April next following the calendar year in which the notice of termination is given.

This article provides both the manner of serving a notice of termination of tax treaty, and the period starting which, the termination shall take effect in either of the contractor state, both in respect of deduction of tax and taxability of income.

ARTICLE 46 – PROVISIONS OF INTERNAL LAW REGARDING COMPETENCE TO CONCLUDE TREATIES

A State , which under its internal law , was not competent to conclude treaty, cannot conclude that a Treaty is invalid. However, this is subject to the exception when : –

- Violation was manifest, i.e, it was very clear or obvious; and

- Violation concerned a rule of internal law of fundamental importance of such State.

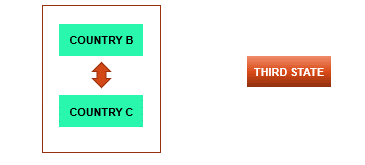

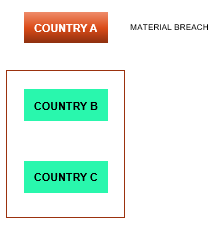

ARTICLE 60 – TERMINATION OR SUSPENSION OF THE OPERATION OF A TREATY AS A CONSEQUENCE OF A BREACH

If there is a material breach of a Bilateral Treaty by one of the parties to the Treaty, other party can invoke such breach as a ground for terminating/ suspending the operation of the whole or part of the Treaty. For this purpose, a material breach of a Treaty, could be :

- Repudiation of the Treaty not sanctioned by the Convention ; or

- Violation of a provision , which is essential to the object or purpose of the Treaty.

ARTICLE 60 – TERMINATION OR SUSPENSION OF THE OPERATION OF A TREATY

Right of the other Party in case of a Material breach –

The following are the rights of the parties affected by the breach. However, such provisions are subject to any provision in the Treaty , applicable in the event of a breach.

For the purpose of understanding these provisions let us say there are three parties to the transaction (Generally, in case of tax treaties there are only two parties)

Party committing the breach – PB

Party affected by the breach – PA

Party not affected by the breach – PNA

- PARTY SPECIALLY AFFECTED BY THE BREACH

Party specially affected by the breach (PA) can suspend operation of the whole are part of the Treaty, between itself and the Party committing the breach (PB);

- PARTY OTHER THAN DEFAULTING PARTY – UNANIMOUS DECISION

Other parties (PA + PNA), by unanimous agreement, can suspend the operation of whole are part of the Treaty or may terminate it . Such suspension or termination can be : –

a) In relations amongst themselves (PA + PNA) and the Defaulting State (PB) ; or

b) Between all the parties (PA+PNA+PB);

- PARTY OTHER THAN DEFAULTING PARTY – INDIVIDUAL DECISION

Any party other than the defaulting State , can invoke the breach by one of the parties, to suspend operation of the entire Treaty or part of the Treaty with respect to itself, if such a breach radically changes their position with respect to further performance of their obligations under the Treaty.

ARTICLE 61 – SUPERVENING IMPOSSIBILITY OF PERFORMANCE

In certain cases, there may be certain situations, which could either be of a temporary nature or permanent nature, which makes it impossible for the party to the Treaty, to perform their obligations under the Treaty.

If the impossibility of performing provision of a Treaty is of a temporary nature, it may be invoked only as a ground for suspending the operations of the Treaty.

However, if the impossibility of performance is due to permanent destruction of an essential object of Treaty required for Treaty execution, a party to the Treaty may invoke it as a ground for terminating or withdrawing from the Treaty. However, such termination can be invoked only if such impossibility is not arising due to that party’s breach of obligation , either under the Treaty , or any other international obligation .

ARTICLE 62 – FUNDAMENTAL CHANGE OF CIRCUMSTANCES

A fundamental change of circumstances, which was not foreseen by the parties (vis a vis those existing at the time of the conclusion of a Treaty), may not be invoked as a ground for terminating a Treaty , or withdrawing from the Treaty unless –

- The existence of those circumstances constituted an essential basis of the consent of the parties to be bound by the Treaty; and

- The change radically transforms the extent of obligations still to be performed under the Treaty.

ARTICLE 63 – SEVERANCE OF DIPLOMATIC OR CONSULAR RELATIONS

The severance of diplomatic or consular relations between parties to a Treaty, does not affect the legal relations established between them by the Treaty. However, this is subject to the exception where existence of such relations, is indispensable for the application of Treaty.

ARTICLE 64 – EMERGENCE OF NEW PEREMPTORY NORM OF GENERAL INTERNATIONAL LAW

If a new peremptory norm of general international law emerges, any existing Treaty which is in conflict with that norm becomes void and stands terminated.

A peremptory norm is a fundamental principle of international law, which is accepted by the international community of states, as a norm from which no deviation is permitted.

INDIAN JUDICIARY ON PRINCIPLES OF INTERPRETATION IN VIENNA CONVENTION

OECD Model Commentary

OECD Model Commentary has been widely used in interpretation of tax treaties in India. So, whenever there is any ambiguity in interpretation of tax treaty, it may be resolved with the help of OECD Model Commentary. Lets look at the importance of OECD commentary on the basis of certain judicial precedents.

- In case of CIT v. Vishakhapatnam Port Trust [1983] 15 Taxman 72 (AP), the Andhra Pradesh High Court observed that “the OECD provided its own commentaries on the technical expressions and the clauses in the Model Convention.

- In case of Credit Lyonnais v. DCIT (2005) 94 ITD 401 (Mum), the Mumbai ITAT held that both UN and OECD Model Commentaries are a great help in interpretation of tax treaties.

- In case of Sonata Information Technology Ltd. v. ACIT (2006) 103 ITD 324 (Bangalore), it was held that the Model Commentaries give the authoritative interpretation of the provisions of DTAAs.

- In the following cases, the Courts have considered the OECD commentary / OECD Model as a useful guide to interpret various provisions of tax treaties :-

-

- Union of India v. Azadi Bachao Andolan [2003] 132 Taxman 373 (SC)

- Metchem Canada Inc. v. Deputy Commissioner of Income-tax [2006] 100 ITD 251 (MUM.)

- Graphite India Ltd. v. Deputy Commissioner of Income-tax [2003] 86 ITD 384 (KOL.)

- Director of Income-tax (International Taxation) v. Balaji Shipping UK Ltd. [2012] 24 taxmann.com 229 (Bombay)

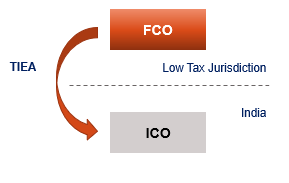

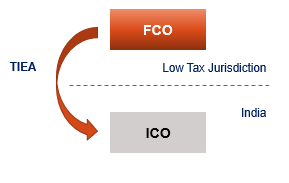

AGREEMENT ON EXCHANGE OF INFORMATION ON TAX MATTERS OR TAX INFORMATION AND EXCHANGE AGREEMENT (TIEA)

Background

In order to tackle cases of tax avoidance/ tax evasion by non-residents, the source country where the income arises, need to exercise jurisdiction on the taxpayer. However, such ability is seriously restricted, due to lack of information about such taxpayers, who may not have a physical presence in the source country. In such cases, if there are mechanisms through which information can be exchanged between the source country and the country of residence of the taxpayer, such cases of tax avoidance/ tax evasion by non-residents can be avoided.

“Lack of effective exchange of information” has been one of the key components in determining harmful tax practices”.

The OECD Global Forum Working Group, has developed ‘Agreement on Exchange of Information on Tax Matters’ as a legal instrument that could be used to establish effective exchange of information.

The Agreement is presented as : –

- Multilateral instrument ; and

- Model of bilateral treaties or agreements.

TIEA TO PROMOTE INTERNATIONAL CO-OPERATION

TIEA, is not a Tax Treaty, but an agreement between two jurisdictions for exchange of information covered therein and validly requested by the other jurisdiction. The key features of TIEA are as under : –

- TIEA are used for obtaining information from countries with no taxes, or low taxes on income or profits, wherein DTAA may not be appropriate given that there is no double taxation;

- TIEAs are overall, much narrower in scope than DTAAs and do not deal extensively on taxation of income ;

- TIEAs are more detailed on of exchange of information than DTAAs, and specify the rules and procedures for how such information is to be exchanged.

INDIA’S TAX INFORMATION EXCHANGE AGREEMENT (TIEAS)

India has completed negotiations/entered into TIEAs with Bahamas, Bermuda, British Virgin Islands, Cayman Islands, Jersey, Monaco, Saint Kitts & Nevis, Argentina, and Marshall Islands, to facilitate greater exchange of information.

Contents of TIEA

Indian TIEA with Isle of Man would provide : –

- Banking and ownership information on companies ;

- Exchange of past information in criminal tax matters.

- Any information shared under TIEA has to be treated as secret, and can be disclosed only to specified persons or tax authorities concerned with determination of tax appeal.

- The party from whom information has been requested (Requested party) has to provide requested information, even though other party may not need such information for its own tax purposes.

INTERPRETATION OF TREATIES

There are two views on the interpretation of tax Treaties. Different countries may follow either of these rules for interpretation of tax treaties. The classification of interpretation into these rules depends on the following factors : –

- Whether DTAA overrides domestic law ?

- Whether International Law and National Law are part of the same system of Law ?

Read more about two views on interpretation of tax treaties

INTERPRETATION OF TREATIES – TREATY OVER DOMESTIC LAW

Generally, the provision of domestic tax laws of a country, deals with the taxation of various types of income. If such country has entered into a tax treaty with another country, such a tax treaty may also deal with taxation of some or all the incomes which are taxable under the domestic tax laws. The issue which arises is, if the provision of these two laws are different, which one of the two can be opted for by the taxpayer ?

Section 90(2) of Income Tax Act, 1961, provides that the provision of DTAA shall override the provisions of domestic tax law. The following situation can arise in this case : –

Provisions of the IT Act are more beneficial

In case the provision of the IT Act are more beneficial, compared to the provisions of a Tax treaty, the taxpayer can opt to be taxed as per the provision of the IT Act. It is a well – accepted position of law that if the Act, does not impose any liability to tax, tax authorities cannot resort to DTAA to impose tax liability. For example, payment of royalty earned by a non resident are liable for tax @ 10% under the provisions of the Income Tax Act 1961, a higher tax of 15% cannot be applied under the India Singapore tax treaty.

Provisions of the Treaty are more beneficial

In case the provisions of Tax treaty are more beneficial, and there is a conflict between the provisions of the domestic law vis-à-vis Treaty, the provisions of the Treaty shall prevail. The taxpayer can opt to be taxed as per the provision of the tax treaty , provided he satisfies the eligibility criteria to be entitled to the beneficial provision of such Treaty.

For example, payment of fee for technical services earned by a non resident are liable for tax @ 10% under the provisions of the Income Tax Act 1961. However, if the payment is exempt from tax under the India USA tax treaty, since it does not make available Technical Services to an Indian company, the tax authorities cannot levy tax based on the provisions of the Income Tax Act 1961.

EXCEPTION – GAAR : –

However, the rules that the beneficial provision of Treaty shall override the provision of the Income Tax Act 1961 are subject to one exception. In case, any transaction or arrangement, is covered under General Anti-Avoidance Rules (GAAR), Section 90(2A) of the Income Tax Act provides that such provisions, which are a part of the Income Tax Act, shall apply to the assessee, even if such provisions are not beneficial to him. In view of this, even if there are certain beneficial provision in respect of such transaction in the tax treaty, such beneficial provision will not be available to the taxpayer.

INTERNATIONAL TAX CONFLICTS AND DOUBLE TAXATION – INTRODUCTION

DOUBLE TAXATION : –

Certain transactions and structures may trigger the tax laws of the two countries , resulting in taxation in both these countries.

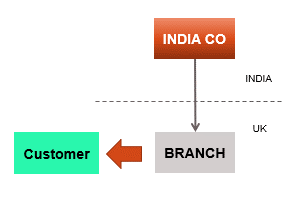

Let us take an example : –

INDIA CO. has set up a branch in United Kingdom (UK) to carry on trading activities, and earns certain profits from such trading. This transaction of the branch will trigger provisions of Income Tax law in UK being the source country. However, since branch is an extension of the Indian company which is a tax resident in India. Profit arising from such transaction of the UK branch would also be liable to tax in India. Since India has signed a tax treaty with UK, Indian company, would be eligible for relief from double taxation as per relevant provisions of the Income Tax Act, 1961 read with the applicable treaty provisions.

REASON FOR CONFLICTS IN INTERNATIONAL TAXATION

Conflicts in the international taxation arise, when tax laws of two or more countries have certain gaps which leads to interpretation of the laws in such a manner, that the taxpayers may be taxed more than once.

INCOME CLASSIFICATION CONFLICT : –

Classification conflict arises when the same income is classified differently in two countries.

For example : –

Country X , the country of Source, may treat a particular income as interest and provide tax deduction on such interest, whereas its counterpart, say Country Y, may not tax it considering it as dividend.

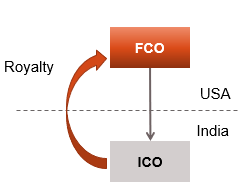

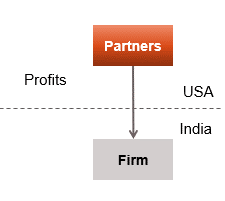

TAXABILITY OF AN ENTITY : –

Conflict can also arise, when one country treats a legal entity as a transparent entity for tax purposes while the other country consider it as a tax payer.

Country X (say USA) may consider partnership firm as a transparent entity, whereby its partners are taxed on profits of the firm in proportion to their share of profits, and the firm is not liable to tax. However, its counterpart Country Y (India) considers a partnership entity as an opaque entity and tax is levied on the firm whereas its partners are exempt from taxation.

In such a case, if an Indian firm earns some profits in India, it would be liable to pay taxes in India on such income and its partners would be exempt from taxation in India. However, since USA considers partnership as a transparent entity, the profit of such Indian partnership would be taxed in the hands of the partners for US tax purposes. Thus a conflict has arisen, since US treats a partnership firm as a transparent entity for tax purposes while India, considers it as a tax payer.

CONFLICTS DUE TO DIFFERENCE IN TAX SYSTEM : –

While some countries (like Hong Kong and Singapore follow territorial tax system, wherein tax is levied only on income from a source inside the country, certain other countries may follow a worldwide system of taxation, where the Global income of the resident is liable to tax in India.

In such a case, if an Indian resident derive some income in Singapore, it would be taxable in Singapore due to the territorial system of taxation. However, since India taxes the global income of it’s tax resident, such income would also be liable for taxation in India.

BASIC PRINCIPLES OF INTREPRETATION OF A TREATY

If words used in a Treaty are clear or unambiguous, different rules for interpretation are not required. However where terms or words used in treaties are ambiguous, vague or are prone to different meanings, one need to resort to rules for interpretation.

CUSTOMARY INTERNATIONAL LAW OF TREATY INTERPRETATION –

Prior to the Vienna Convention, tax treaties were interpreted according to the customary international law. Some important principles, of Customary International law , which are used in interpretation of tax treaties are as under : –

OBJECTIVE INTERPRETATION :

Words and phrases used in the Tax Treaty are firstly to be interpreted according to their plain and natural meaning (grammatical interpretation).

However, the grammatical interpretation should not be adopted where such interpretation: –

- Results in an absurd result of interpretation ;

- Results in an interpretation which has inconsistency with other portions of the Treaty,

- Results in an interpretation which is clearly beyond the intention of the parties who entered into the Treaty.

SUBJECTIVE INTERPRETATION : –

In such a case , the Terms of a treaty, are interpreted according to the common intention of the contracting parties at the time of entering into the treaty. Such , common intention can be gathered, from the words used in the treaty and the context of the Treaty. In Indian context, in the case of Abdul Razak A. Meman’s [2005] 276 ITR 306, the Authority for Advance Rulings relied on the speeches delivered by the Finance Ministers of India as well as UAE, to arrive at the intention of parties in signing the India-UAE Tax Treaty.

PURPOSIVE INTERPRETATION: –

Purposive interpretation, requires interpretation of Terms of a treaty in a manner which facilitates the attainment of the aims and objectives of the treaty.

In case of Union of India v. Azadi Bachao Andolan 263 ITR 706, the Hon’ble Supreme Court of India accepted the application of Purposive interpretation and observed as under

“the principles adopted for interpretation of treaties are not the same as those in interpretation of statutory legislation. The interpretation of provisions of an international treaty, including one for double taxation relief, is that the treaties are entered into at a political level and have several considerations as their bases.”

THE PRINCIPLE OF EFFECTIVENESS : –

This principle requires that the Treaty should be interpreted in a manner, which on the whole, will render the treaty most effective and useful. If a particular interpretation yields effective result for one or more part of the Treaty, but renders other parts ineffective/non operational, such interpretation should be avoided.

PRINCIPLE OF CONTEMPORANEA EXPOSITIO : –

A treaty’s terms should to be interpreted on the basis of their meaning , at the time the treaty was concluded. This principle was considered by the AAR in the case of Abdul Razak A. Meman’s [2005] 276 ITR 306, wherein the AAR observed that while interpreting treaties, regard should be had to material contemporanea exposition.

LIBERAL CONSTRUCTION : It is a general principle of construction with respect to treaties that they shall be liberally construed , so as to carry out the apparent intention of the parties.

In John N. Gladden v. Her Majesty the Queen, the Federal Court, observed that “Contrary to an ordinary taxing statute, a tax treaty or convention must be given a liberal interpretation with a view to implementing the true intentions of the parties. A literal or legalistic interpretation must be avoided when the basic object of the treaty might be defeated or frustrated in so far as the particular item under consideration is concerned.”

CUSTOMARY INTERNATIONAL LAW OF TREATY INTERPRETATION

- TREATY AS A WHOLE – INTEGRATED APPROACH : – A treaty should be construed as a whole , and provision should not be considered in isolation . In interpreting Treaty, effect should be given to each word . Every word should be tried to be construed in the same manner wherever it occurs.

- REASONABLENESS AND CONSISTENCY : – Treaties should be given an interpretation in which the reasonable meaning of words and phrases is preferred, and in which a consistent meaning is given to different portions of the instrument.

EXTRINSIC AIDS TO INTERPRETATION OF A TAX TREATY

There are several extrinsic material used in interpretation of tax treaties including the following : –

- Interpretative Protocols, Resolutions and Committee Reports, on agreed interpretations;

- Subsequent agreement between parties regarding the interpretation of the treaty (Article 31(3) of the VCLT )

- Subsequent conduct of the state parties, as evidence of the intention of the parties;

- Other treaties, which relate to the same subject matter, in case of doubt on interpretation of particular provisions of the Treaty

Read more on Extrinsic Aids to Interpretation of a Tax Treaty