How to File Form 15CA -CB

Step-by-step procedure to file form 15CB

Step 1 :-

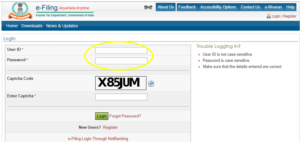

Log in to www.incometaxindiaefiling.gov.in with CA login and click on the button “login here”

Step 2 :-

Enter User ID , password and captcha in order to login

Step 3 :-

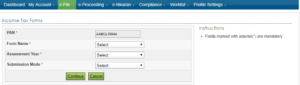

Insert User ID , PAN of the assessee for whom Form 15CB needs to be filed and PAN of the CA

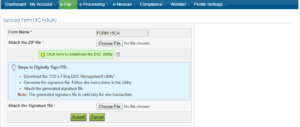

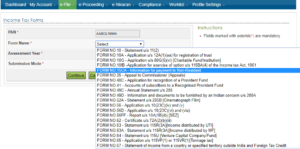

Step 4 :- In the button “Form Name” choose Form 15CB from the list of available

Step 5 :- Select the submission mode

Step 5 :-

Select the filing type as original

Step 6 :-

Attach the xml file of Form 15CB , attach DSC and click on the submit button

How to File Form 15CA -CB

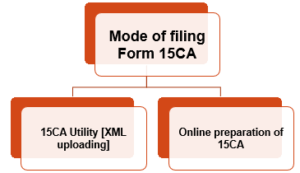

Mode of filing form 15CA

Step by step procedure to file form 15CA via utility

Step 1 :- We can login www.incometaxindiaefiling.gov.in by clicking on the button “Login Here”

Step 2 :- We need to enter user Id , password and captcha in order to login e-filing website

Step 3 :- We need to click on the button of “e-file” and select option of “upload Form 15CA (Bulk)”

Step 4 :- We need to attach the XML file of Form 15CA and digital signature file of the authorised person of the deductor company and click on the submit button

Step-by-step procedure to Prepare and submit form 15CA Online

Step 1 :- We can login www.incometaxindiaefiling.gov.in by clicking on the button “Login Here”

Step 2 :- We need to enter user Id , password and captcha in order to login e-filing website

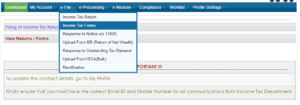

Step 3 :- We need to click on the button of “e-file” and select option of “Income Tax Forms”

Step 4 :- After we click on the button of “Income Tax Forms” this page will appear

Step 6 :-

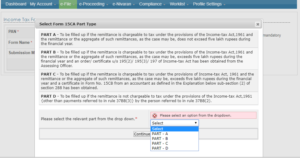

Click on the button of “Submission Mode” and select “Prepare and Submit Online“ and then click on the continue button

Step 7 :- Select Part A /B /C /D whichever is applicable , press continue button and then prepare that Part of Form 15CA online

Revision / withdrawal of Form 15CA / 15CB in case of error

REVISION OF FORM 15CB

- There may be error in Form 15CB which is identified by Chartered Accountant after filing like, wrong calculation of withholding tax, application of wrong rate of withholding tax, etc.

- There is no provision under the law to remove any error in Form 15CB by revising / withdrawing that Form .

- In such a case , the Chartered Accountant is required to issue new certificate in Form 15CB which reflects the correct position .

REVISION OF FORM 15CA

- There may be some error in Form 15CA which is identified by Chartered Accountant or the Bank before processing of payment to non-resident like, error in mentioning proposed date of remittance or error in selecting the relevant Part of Form 15CA or error in Form 15CB due to which Form 15CA need to be changed .

- In such a case , there is option in e-filing portal to withdraw Form 15CA within 7 working days of its submission . Thereafter , deductor is required to submit the new Form 15CA reflecting the correct position .