Form 15CB is the Form, in which a CA, is required to provide the tax that should be deducted from specified payments to the non-resident , which is the subject matter of such certificate (Section 195(6)). Such form has to be obtained , before paying any sum to non-resident , whether or not the payment is chargeable to tax , and has to be filed online.

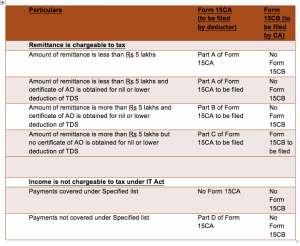

Relevant Factors to be considered in making decision on , which Part of Form 15CB needs to be filed are as under : –

- Whether remittance is chargeable to tax or is not chargeable to tax under IT Act ?

- Whether remittance is less than or more than Rs 5 lakhs ?

- Whether certificate of AO is obtained for nil or lower deduction of TDS ?

- Whether payments covered under Specified list ?

Once these items are identified, the Payor would be required to furnish form 15CA/15CB as per the following table : –

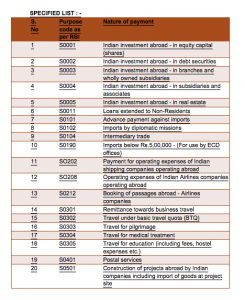

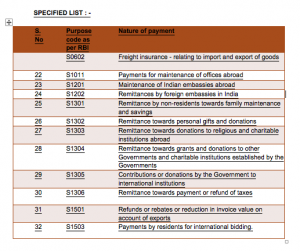

However, Form 15cb is not required to be obtained in the case of the following specified transactions : –